Avant Reviews – Get All of the Facts Before Using Avant

If you are looking for a personal loan for any reason, there are a few avenues that can get you to your financial goal, but you should consider all of the benefits and drawbacks before you make the plunge.

In this Avant loan reviews article, AdvisoryHQ provides information that will allow you to decide whether an Avant personal loan could be the right choice for you, especially based on your credit score or history.

Are you seeking a loan provider that offers personal loans with no credit, instant loans for bad credit or a wide variation of loan types and rates for all types of credit scores? If so, then this detailed “Avant reviews” article and Avant personal loans overview will be of great interest.

Avant Loan Reviews

As referenced above, Avant provides a wide range of different loan programs for those with no credit, bad credit or improving credit. Even those with great and excellent credit scores can also use Avant for instant loan situations – at a great rate.

Image Source: BigStock

Here’s an overview of some of Avant’s top rated features:

Avant Loans Allow You to Build Credit

With each payment you make to pay down your loan at Avant, your progress is reported to each of the 3 major credit reporting bureaus, and you can use this to help you build credit as you repay your loan.

Avant Loans Have No Prepayment Fees

Perhaps the most frustrating thing about loans (aside from interest rates!) is prepayment fees. These fees are meant to deter individuals from paying off their balance early, which reduces the profit a credit company makes from the interest.

Loans from Avant come with no prepayment fees. If you save up the money to pay off your Avant loan in full, you do not have to worry about paying anything other than the balance owing. This feature, in conjunction with Avant’s commitment to reporting your payments to the credit bureaus, validates their claim that they want to help customers build credit and be financially responsible.

Avant Personal Loans for Those with Bad Credit or No Credit

If you have a few bumps on your credit report that may be keeping you from making financial headway in most traditional situations, you can still confidently apply for a loan from Avant. It has the most lax credit requirements in the industry, so your chances of getting approved with less-than-perfect credit are still good.

Avant Loans Have Relatively Low Interest Rates

You stand to save a good deal with Avant’s available lowest interest rates among the best of lenders of its kind.

Superior Customer Service

If you read any other Avant reviews, you’ll see an overwhelming trend of great customer service. Even in the event of a problem, people still stop to mention that they received good customer service regardless. Having a reasonable and understandable voice on the phone when you are dealing with money, bank accounts, and personal information is important!

Image Source: Avant

Avant Reviews – History of Avant

Although it has built up a substantial reputation already, Avant (formerly Avant Credit) is fairly new on the scene. It began operations in 2012 and is a Chicago-based company with branches in Chicago, Los Angeles, and London.

Its self-proclaimed mission is “to lower the barriers and costs of borrowing.”

You can see from the firm’s About Us page that it strongly believes in a business model that is “people centered.” It states that “laughter, snack munching, and tech-chats are just a few things you’ll hear in our office.”

Here are some of the other things that it offers its employees:

Image Source: About Avant

From what we can see, Avant might just be a company that cares about its employees and consumers and wants to build a mutually-beneficial relationship with both. Thumbs up!

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Who Will Qualify for an Avant Loan?

As we’ve mentioned already, Avant touts some of the lowest credit and income requirements out there. It seems to make the process as easy as possible for potential borrowers. If your credit score is somewhere around 580, you can get qualified, and Avant’s expert team of representatives can usually help you find the best way to do it.

Types of Avant Loans (Avant Loan Reviews)

Avant offers financing for a variety of unsecured loans, from everyday needs to once-in-a-lifetime purchases. You can get a loan anywhere from $2,000–$35,000. The type of loan you get doesn’t affect your approval or your interest rate, so don’t let that be a worry. Here are some examples of the types of loans offered by Avant:

- Avant Debt Consolidation Loans: Are you lost in a sea of multiple credit cards? Consolidate all of your debt for one simple monthly payment, and enjoy the relief of not having to juggle multiple accounts. Fixed annual percentage rates (APR) are low, so you can save money and time.

- Avant Home Improvement Loans: Whether you are looking to remodel your kitchen, buy new furniture or build an addition onto your house, Avant offers convenient home improvement loans for all types of home improvement projects. No refinancing of your mortgage is needed.

- Avant Emergency Loans: You never know when life might throw you for a loop. An unexpected emergency can be stressful enough; don’t let a lack of finances put even more weight on your shoulders. You can rely on Avant’s emergency loans to help you during a tough time. It offers loans for things like auto repairs, medical bills, out-of-town trips, and replacing lost valuables, to name a few.

Avant Loan Interest Rates

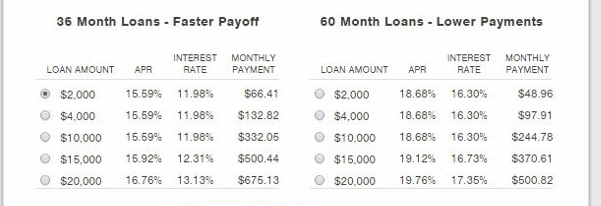

Your APR (annual percentage rate) is based on your credit score and financial history, along with your current income.

Avant loan rates vary from a 9.95% APR on the low end all the way to 35.99% on the high end.

Avant Loan Terms

Avant offers extremely convenient loan terms starting at 24 months and going all the way up to 60 months. When you apply, you will be presented with a variety of loan amounts and terms to choose from. Make your decision based on what you can truly afford and how quickly you want to pay off your loan.

As you can see below, a 36-month term will allow you to pay off your loan quicker, but if you cannot afford the higher payments, a 60-month term will help you maintain lower payments for the longevity of your loan.

Image Source: Avant

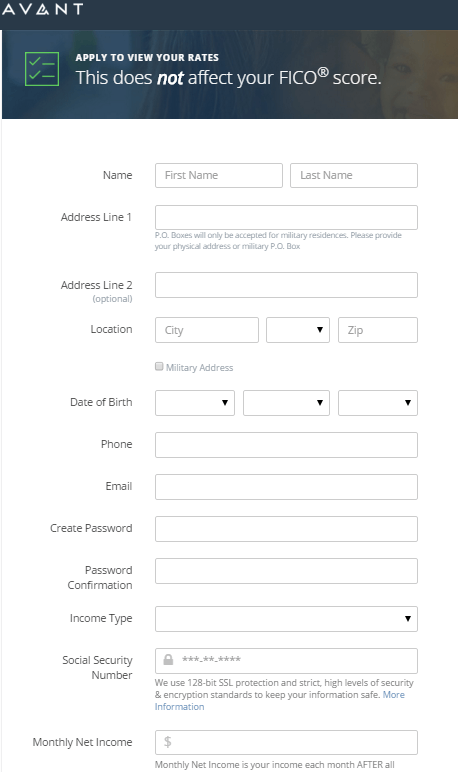

How to Apply for an Avant Loan

Applying for an Avant personal loan is an extremely simple process! Its initial application takes minutes and only asks for basic information, such as your name, address, telephone number, and date of birth. Once you do this, you’ll be given a personalized loan rate and several loan options.

If you decide to go ahead with the process, you’ll choose the loan that best fits you (as discussed above), and you will then have to provide more sensitive information, like your Social Security number, employment information, and bank account information.

Image Source: Avant Loan

Avant boasts a “24 hour application,” but, honestly, this not a relevant time period as each application is different, and it can take much longer to verify information from borrower to borrower. While it is possible to have your loan within a day, I believe that the point Avant is trying to make is that you can get a loan fast.

On the quick end of things, you can expect to have money in your account within 1–2 days. Sometimes, it can take up to 3–4 days or more.

Another great thing about the application process with Avant is that applying to view a personalized rate doesn’t affect your FICO credit score like most other loan inquiries would! So, you can safely look into Avant’s rates for yourself without worrying about any penalties or commitments.

A Look at Avant’s Privacy and Security

Your online security is critical. Does Avant offer proper online safety and security measures to keep your money and your information safe? Well, sort of. Read on to learn about Avant’s privacy practices and how this may affect you!

FDIC-Insured

All loans made through Avant are financed by WebBank, a Utah-chartered industrial bank who is an FDIC member. The FDIC insures each depositor for up to $250,000. Since the highest amount that you can borrow from Avant is $35,000, this means that all of your transactions are completely insured.

Data Encryption

Avant also uses state-of-the-art, 128-bit SSL data encryption technology and strict, high levels of security to keep your most valuable information safe and out of the wrong hands.

Norton-Secured

Avant is powered by Norton Security, a leading malware protection and removal provider. You can browse safely without worrying about viruses or malware infecting your computer.

Selling Your Information

Both Avant and its banking partner, WebBank, share and sell your personal information, even after you are no longer a customer. This can be somewhat concerning, especially in today’s world of super-hackers that can get into a database with ease.

Avant claims that it needs to share your personal information in order to run its everyday business. You can read more about this on Avant’s Privacy Policies page. If privacy is an issue for you, Avant may not be the best choice, and you may want to finance your loan through a different lender.

Free Wealth & Finance Software - Get Yours Now ►

A Final Review of Avant Loans

In a market ripe with banks and lenders wanting you to sign up for super-high interest loans that require near-perfect credit to secure, Avant looks at lending a little bit differently. It seems to take a more human approach, lessening its credit requirements, and offering potentially low interest rates for qualified borrowers.

No loan comes without strings attached, however. If you miss a payment or get behind, Avant can slap you with a few ugly $25 fees, and it can even reserve the right to report you to a collections agency rather quickly.

Also, keep in mind its information sharing policy (as noted above) if you decide that an Avant Loan is right for you.

When you weigh the pros and cons presented in this Avant Loan Review, it still seems like a really great option, and it should certainly remain on your list when you are in need of a personal loan.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.