A Brief Overview of Auto Loan Payment Calculators

Buying the right car can be tricky, but paying for it is another story. Thankfully, there are plenty of auto loan payoff calculators to help you understand your options.

While we all would love to buy our dream car outright, the reality is that many people must take out an auto loan that could take years to pay off. Luckily, there’s an upside: by paying a loan on time every month, our credit scores increase, which will ultimately help us qualify for credit cards and other loans in the future.

Therefore, having an auto loan is not necessarily a bad thing. It is, however, something you will want to pay off quickly. This is where a good auto loan payment calculator comes into play.

Auto loan payoff calculators will show you how much money you can save in the long run by simply increasing your monthly payments. If you find that you can afford to pay more each month, an auto loan calculator with tax will calculate your savings and help you adjust your payments to the appropriate amount.

Keep in mind that auto loans come with interest rates. The bigger your loan, the more you will be affected by these interest rates. Auto loan payment calculators are the best way of showing you exactly how to reduce your loan so the interest rates do not control your finances.

Image source: Pexels

Throughout this review, we will answer several of the most commonly asked questions concerning auto loan payment calculators, including:

- Which auto loan payment calculator is right for me?

- How do I interpret the results of a car auto loan calculator?

- Are all auto loan payoff calculators the same?

Since our goal throughout this article is to discuss the differences among several auto loan payoff calculators, you can assume the answer to the last question is no. However, we will show you why you might want to rely on one auto loan payoff calculator and not another.

Understanding how to use an auto loan early payoff calculator is helpful for just about everyone, regardless of whether you have purchased a car.

If you think you will buy a vehicle in the future, this article is right for you. The same goes for those who have already been paying auto loans for years. It is never too late or too early to see how a car loan early payoff calculator will affect your finances.

We will begin by comparing and contrasting three auto loan payment calculators before analyzing each on an individual basis. Read on for some of our recommendations.

See Also: Best Loan Payoff Calculators | Guide | How to Find the Best Loan Payoff Calculators

Comparison Review List

While there are many auto loan payment calculators to choose from, the three we will focus on throughout this article include:

For a side-by-side comparison of these three early auto loan payoff calculators, keep reading. For those of you who want to focus specifically on just one of the calculators, feel free to navigate directly to our reviews featured later in this article.

High Level Comparison Table

Auto Loan Payment Calculators | Usability | Specificity of Readings |

Easy | Specific | |

Very Easy | General | |

Moderate | Very Specific |

Auto Loan Payoff Calculators: A Closer Look

The table above may not give you much information about the three auto loan early payoff calculators we will discuss, but there is a correlation between a calculator’s usability and the precision of its readings that we would like to examine.

One thing to consider when choosing an auto loan calculator with tax is how much effort you want to put into understanding your options. If you simply want to approximate how much more money you should spend each month, you can use a car loan early payoff calculator that does not require a lot of specific information.

By simply entering your loan amount, the interest rate, and your loan balance, a very basic auto loan payment calculator will give you a decent understanding of your future payments.

If you want to be able to calculate the exact amount, to the cent, that you will have to spend in order to fit within a particular budget, however, you will need an auto loan calculator with tax that accounts for every aspect of your loan.

Essentially, that is our methodology for the table. As we mentioned, the CalcXML early auto loan payoff calculator is the easiest to use, but it does not give a very specific reading. Overall, the more basic the car loan payoff calculator is, the less accurate it may be for your particular situation.

However, this may be exactly what you are looking for. The only way to truly know is by getting a better sense of how an auto loan calculator with tax works. We will begin with an analysis of the Bankrate® auto loan payment calculator.

Don’t Miss: Best FD Interest Calculators | Guide | How to Find and Use the Top Fixed Deposit Calculators

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Bankrate® Auto Loan Calculator with Tax

Image Source: Bankrate®

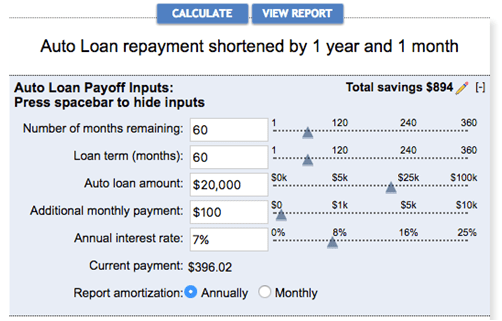

The first auto loan calculator with tax we will analyze is featured on the Bankrate® website. If you are looking for an easy-to-use car loan payoff calculator that accurately explains your savings, this is the one for you.

As you will see, auto loan payoff calculators vary greatly in the amount of information they require. Here, you will be asked for the balance of your loan, the number of months you were given to pay it off, the months you have remaining, and the annual interest rate. Once you have entered this information, you will then have the option of adjusting the additional monthly payments you are willing to spend.

All of this information should be written directly on your loan or the paperwork you receive each month. It is for this reason that we find this car auto loan calculator to be one of the best. As long as you have some basic information, you can get an accurate reading of your auto loan.

Another reason this auto loan payoff calculator is a good fit for many car buyers is that it allows anyone with an auto loan to use it. Whether you have started to pay off your loan or not, this auto loan payment calculator will adjust to your current situation.

Simply enter the number of months in which your loan must be paid off and the number of months you have remaining. If they are one and the same, the car auto loan calculator will register your information accurately. This will also be true if they are not the same.

Once you have entered all of the necessary information, the early auto loan payoff calculator will then calculate your current payment. It does this by looking at the amount of your loan and the term of your loan. Therefore, you will not have to enter this information.

As long as this information is correct, proceed by entering the additional payment you can afford each month. You can do this by moving the triangles from side to side (see the image above) or simply by entering a number into the table. Either way, the car loan early payoff calculator will process the new information.

Once all of the information has been registered, you will instantly be shown how much money you can save. The auto loan payoff calculator will present its findings to you in the upper left hand section. If you have a specific goal in mind, simply adjust the additional payment amount to reach the desired savings.

The beauty of this auto loan calculator with tax is that it presents the information you want instantly. You do not have to click enter and be redirected to a new page. Your calculations will appear on the same page you entered the information.

Beneath the auto loan early payoff calculator, you will find a graph that shows the amount of time it will take you to pay off your loan given the additional monthly payments. The higher your additional payments, the less time it will take to pay off your loan.

That being said, if the main reason you use an auto loan calculator with tax is to see how long it will take you to pay off your loan, this is not the best calculator out there. The graph is not as easy to read as one that simply shows you a number.

But if you want an accurate representation of your total savings, do not skip past this auto loan payment calculator. The information that you are required to enter is minimal and the readings are instant. What could be better than that?

Related: Best Credit Card Interest Calculators | Guide | How to Find and Use the Best Interest Calculators

The CalcXML Auto Loan Calculator with Tax

Image Source: CalcXML

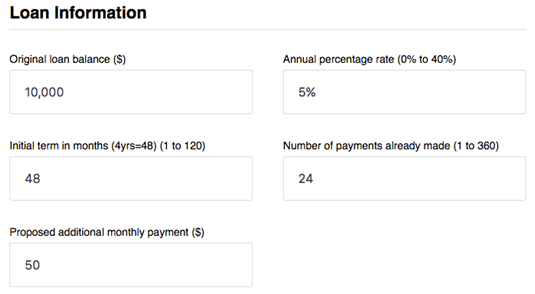

The second auto loan payoff calculator we will analyze is by CalcXML. Our analysis here will be the shortest of our three auto loan payment calculator reviews because it is one of the easiest calculators you can use.

The information you enter into this car loan payoff calculator is the same as the one mentioned above, but we consider this to be the easiest because your readings come out in the simplest way possible. Once you click “calculate” at the bottom of the screen, you will be redirected to a new page with the information you need.

A “Results” page will give you a few of the most important numbers concerning your loan as well as a single sentence describing your financial situation. This sentence will tell you how much money you can save and how much sooner you will own your vehicle given the increased payments.

With this in mind, the auto loan early payoff calculator presented here is easy to use and gives a basic sense of your savings. It does not get much more straightforward than that.

At the same time, your results will not be especially accurate when using this car loan payoff calculator.

For instance, many people want to know which month and year they can finish paying off their loan. The results shown in this car loan early payoff calculator will simply tell you an approximation, such as “0.4 years sooner.”

Additionally, you will have to navigate between the results page and the early auto loan payoff calculator page when adjusting the amount you want to spend.

This may seem like more of a hassle than its worth, but if your main goal is to get a close estimate of your savings, this auto loan payment calculator will give you the results you need.

Popular Article: Top Best American Express Card Offers & Benefits |Ranking | Compare Top AMEX Card Offers

The U.S. Bank Auto Loan Calculator with Tax

Image Source: U.S. Bank

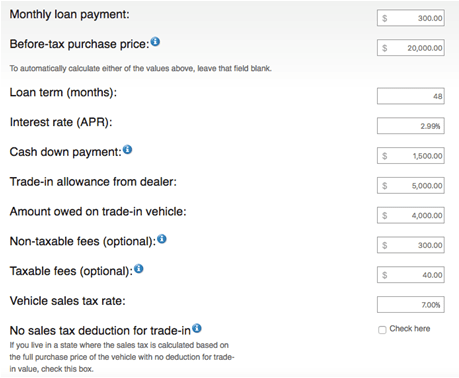

The final auto loan payoff calculator we will discuss in this review is featured on the U.S. Bank website. In many ways, this is the first example of an auto loan calculator with trade in and payoff that we have featured.

We can call this an auto loan calculator with trade in and payoff because there is so much more information you can enter into this calculator, including your trade-in value. This could be helpful for many reasons. For instance, if you still owe money on your trade-in vehicle, you can add this to your current loan.

But just because an auto loan calculator with trade-in and payoff is the most comprehensive, doesn’t mean it is right for everyone. Some of the information the auto loan payoff calculator wants you to enter may confuse many of its users. Anyone who enters inaccurate information will be presented with inaccurate calculations.

With that being said, however, this auto loan calculator with tax takes into account trade-in allowances, non-taxable fees, taxable fees, sales tax, and others. This will be very valuable information for anyone looking to get the most accurate readings possible.

If you must pay off your auto loan by a particular date, this auto loan payment calculator may be your best bet. Since it accounts for so many different aspects of an auto loan, you will know exactly how tax and trade-in values affect your timeline.

Additionally, when you enter your information, the car loan payoff calculator directs you to a page with a detailed explanation of your payments. You will not only see how much time and money you are saving; you are given alternate scenarios if you adjusted your payments again.

The readings here are good for all different types of learners. Information from this car loan early payoff calculator is presented in graphs, written descriptions, charts, and numbers. Anyone with a keen eye for financial savings will be able to look through the calculations and determine exactly how to approach the auto loan.

Again, this information could overwhelm some people. But which auto loan payoff calculator you choose is up to you. It will all depend on how many different calculations you need.

Read More: Air Force vs. Guard vs. Navy Retirement Calculators | Comparison Reviews

Conclusion: Which Auto Loan Payment Calculator Is Right for You?

As we mentioned at the beginning of this article, one of the most frequently asked questions is, “Which auto loan payment calculator is right for me?” The answer, of course, is that it depends on what you want from an early auto loan payoff calculator.

If you are curious to see how much money you can save, any auto loan payment calculator will do the trick as long as you enter accurate information. All auto loan payment calculators will give you an overview of how much you can save and how much faster you will pay it off.

If you want to use an auto loan payoff calculator to clearly and accurately keep track of your future financial standing, you will want to use one that is a little more complicated. Many auto loans are affected by sales tax, trade-in values, taxable fees, and more. As long as you can enter all of the information correctly, auto loan payoff calculators like these will give you the information you need.

Try using the three car loan payoff calculators we reviewed, but don’t be afraid to look for others. There are countless calculators available on the web, and there is no harm in weighing your options.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.