Guide to the Best Auto Loan Rates

If you want to purchase a new car, you probably aren’t going to be paying cash. Whether it’s because you don’t have enough money in your reserve for new wheels or you just don’t want to part with it, you’ll want to make sure you’re getting the best auto loan rates possible.

How do you know if you’re being given the lowest auto loan rates in town or if someone is trying to pull the wool over your eyes?

We want you to be aware of the current auto loan rates, so AdvisoryHQ has crafted this comprehensive guide to the best car loan rates. You should know how to find the best car loan rates for used and new cars in every situation.

Image Source: Pexels

Image Source: Pexels

Make sure you read these tips before you head to the dealership to browse. You’ll want to be armed with this information before you get pressured into any financing options.

See Also: How to Refinance Auto Loans with Bad Credit | This Year’s Guide | Bad Credit Auto Refinance

Check Your Credit

Chances are, you’re tired of hearing how important your credit score is when it comes to receiving a loan and qualifying for low auto loan interest rates. Unfortunately, it’s still true, especially when it comes to finding the right car loan interest rate.

Credit scores will play a big role in how trustworthy you appear, so the higher your credit score is, the lower you’ll find auto loan rates.

If you have poor credit, it doesn’t mean that there’s no hope for you to discover car loan rates that you can afford. There are plenty of companies that specialize in offering used car loan rates specifically to individuals who have low or no credit.

However, you probably want to be aware of these tips for making improvements. It may allow you to refinance and find more favorable auto loan interest rates in the future.

You should already be well acquainted with your credit report, taking a close look to make sure that everything is accurate at least once a year. The benefit to this is that the service is absolutely free through AnnualCreditReport.com. Taking care of blemishes or errors on an annual basis can help to shield you from identity theft and keep your credit score sparkling.

From here, you can get a better idea of your credit score through free sites such as Credit Karma.

They will give you a version of your credit score (different from the FICO score used by most lenders, but similar enough to give you a general idea) along with suggestions and recommendations for how to make improvements.

Keep in mind that resolving debt and paying your bills on time are all key factors for determining your credit score, and they boost your odds of receiving the lowest auto loan rates.

If these are areas where you’re currently struggling, making them a priority can help you to raise your credit score and find the lowest auto loan rates based on current auto loan rates.

Work hard to improve your credit score but understand that it isn’t an overnight process. This one simple action can help you get a better idea of the current auto loan rates for customers deemed more trustworthy by lenders.

Don’t Miss: Online Auto Loans: How to Find the Best Car Loans Online | This Year’s Guide

Separate Yourself from the Dealership

It might seem convenient to spend an afternoon strolling around the dealership, browsing through all of the new and used vehicles.

However, when you stumble onto one that you absolutely have to have, will you still be concerned with the used car loan interest rate or getting the best car loan rates for a new vehicle?

Most people only have their eyes on the prize at this point and are more likely to sign on the dotted line for a loan that doesn’t feature the best auto loan rates possible.

Being prequalified for the best car loan rates in advance of finding and negotiating a deal on a new-to-you car gives you flexibility and power to know that you’re getting the best deal during the negotiation. You should already be aware of what the lowest auto loan rates available are.

While you may occasionally find that the lowest auto loan rates are available through your preferred dealership, it’s not at all uncommon to find them significantly lower on your own.

Experts recommend checking first with online banks and local credit unions. According to the associate finance editor for the Consumer Reports Money Advisor, online banks are typically able to offer the best auto loan rates.

Because they do not have to maintain brick-and-mortar locations, their overhead is significantly lower and they can pass those savings along to customers in the form of the lowest auto loan rates compared to other current auto loan rates.

Banks and credit unions both offer lower new and used auto loan rates than you may find at a dealership, but local credit unions will still likely come out ahead. You may see a difference of approximately 1 to 1.5 percent lower car loan rates from credit unions.

Doing the research from the comfort of your own home or through other avenues apart from the dealership helps you to avoid common sales tactics that can cost you money in the long run, according to experts.

Often, dealerships will mix up the cost of the vehicle and tie it into financing promotions with lower current auto loan rates. By taking this out of the equation, you are in a much better position to receive the best car loan rates.

Related: Finding the Best Auto Loan Companies and Auto Lenders | This Year’s Guide

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

You’ll have a better idea of what the current auto loan rates are if you spend some time shopping around before making a commitment to one specific lender. Many individuals are cautious of damaging their ultra-important credit score by allowing too many inquiries while shopping for the best auto loan rates.

This avoidance can lead you to believe that you’re getting the best auto loan rates possible when that may not really be true.

Many people don’t realize that you are granted a brief period of time in order to “window shop” for the best auto loan rates before you’ll begin to damage your credit score. In most instances, lenders will only do soft pulls, which do not harm your overall borrowing ability.

Generally speaking, you are usually granted a two-week window in order to research your new or used auto loan rates.

Not sure where to start shopping? Depending on your credit score, you may want to consider a few of these options:

- Carvana: Carvana is ideal for individuals who have a less than stellar credit score, as they accept scores as low as 300. While, it does offer some of the best auto loan rates for users in this category, you must purchase cars through their website.

- My Auto Loan: For just a slightly higher credit score of 475, MyAutoLoan.com can give you preapproval for up to four offers (with multiple hard credit inquiries). According to The Simple Dollar, this is a great option for first-time car buyers due to the immense amount of information and advice they offer.

Source: MyAutoloan

- LightStream: Individuals with great credit can utilize this smaller offshoot of SunTrust Bank, but qualifying is more difficult with this company than it is for some lenders that don’t have such stringent requirements. That being said, you are likely to find some of the lowest auto loan rates through this company compared to others.

- Lending Tree: Lending Tree is a great option to be able to compare auto loan rates side-by-side in just a few clicks. Enter your basic information and Lending Tree will provide you with offers from various lenders.

If you’re applying for car loan rates online, you should also be able to receive preapproval, which gives you more peace of mind when you show up at the dealership. You already know that you’re receiving a specific used car loan interest rate, and you can be confident that it’s one of the best auto loan rates available because you’ve done your research.

Consider Short-Term Loans

You may find your monthly payment shrinking during each volley of the negotiation process. It can be tempting to think that they are just providing you with a lower used car loan interest rate when the reality is that they are just altering the length of your loan.

As your loan becomes longer, you tend to pay more in interest over the lifetime of the loan, even with the lowest current auto loan rates.

Even with low current auto loan rates, the longer your loan is open, the more expense you could be racking up with your auto loan rates.

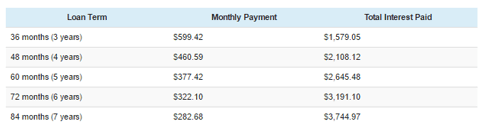

In the table below, you can see the difference in the monthly payment (significantly lower for each 12 month increase in the loan term) as the total interest paid increases drastically for the same time period.

Source: Best Auto Loans

Consider inquiring about short-term loans if you can afford the slightly higher monthly payment. Opting for a loan that is slightly shorter in length can often mean receiving the best car loan rates as well. Auto loan interest rates are usually lower for short-term loans than they are for their long-term counterparts.

You will spend less on your interest rates over the course of your loan and you can free up extra money in your monthly budget sooner by opting for a lower car loan interest rate and a shorter loan term. This is something to strongly consider if you can afford it.

Popular Article: How to Get a Credit Union Car Loan |Guide | Best Credit Unions for Car Loans

New Cars Offer Lower Interest

A new car loses a significant portion of its value the instant you drive it off the lot. Many people seek out used cars simply because they are the better value for the money.

They may have been pre-owned, but you can rest assured that you are probably getting more car for your money due to the lower sticker price. Unfortunately, you won’t usually find the best car loan rates when it comes to comparing used car loan rates.

When should you consider choosing a new car over a used car? If both of the vehicles you’re considering clock in around the same price, the new car will likely offer you the lowest auto loan rates and will provide you with the best deal overall. This may seem unlikely, but it could be the difference between looking at an average sedan that is brand new for the year and an older model of a luxury vehicle.

Warnings on Contingent Financing

When you leave the dealership with your new vehicle, there are two magic words you should be looking for: conditional and contingent. If your paperwork has these terms listed on your financing, you may want to consider walking away from the deal as quickly as possible. What’s listed as the current auto loan rates may not be the same in days to come.

Contingent or conditional financing means that your auto loan has yet to be finalized. This may not necessarily sound like a bad thing until you consider the implications for you. The dealership or lender could come back to you requesting an additional down payment or, even more common, higher car loan rates.

Since the car is already in your possession, it becomes difficult to untangle yourself from these sneaky schemes. Your car loan interest rate has fluctuated and it’s no longer one of the best auto loan rates available, but you feel stuck exactly where you are.

Be sure to keep an eye out for any deals that label your financing as contingent or conditional. It’s a sign that you might be receiving the best car loan rates right now but they won’t remain at those current auto loan rates for much longer. You’ll be saddled with less than favorable terms throughout the remainder of your loan if you can’t find a way to walk away.

Conclusion

Getting the best car loan interest rate is as simple as doing your homework. The best car loan rates will vary depending on your location, depending on the day, and even depending on whether you’re interested in new or used car loan rates. With so much fluctuation in the market, it’s hard to identify whether you’re receiving the lowest auto loan rates.

Don’t forget to shop around and check with more than one location. Start with online lenders from the comfort of your own home and then move on to banks and credit unions in your area.

You’re certain to find a loan that offers the best auto loan rates for your situation and financing needs.

Head to the dealership armed with your knowledge and loan preapproval for the lowest auto loan rates possible. This sets you up for success when it comes time to drive your brand new vehicle for the very first time.

Read More: Best Auto Refinance Companies | How to Find the Best Place to Refinance a Car

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.