2017 RANKING & REVIEWS

TOP RANKING BEST BALANCE TRANSFER CREDIT CARDS

Smart Money Secrets | The 6 Best Balance Transfer Cards to Use

There is a little-known secret that several smart money experts use to pay off debt faster, which is finding the best credit cards for balance transfers.

Most people open a credit card account for the ability to charge things on credit, but don’t realize that you can save a lot in interest charges by using balance transfer cards to get a much better rate on debts you already owe to other credit card or loan issuers.

A credit card balance transfer allows you to transfer the amount you owe on a credit card or loan to another card with a lower annual percentage rate, or APR, which can save you a good deal of money in interest, especially if the new credit cards for balance transfers offer a 0% APR for a limited time.

Award Emblem: Top 6 Best Balance Transfer Credit Cards

You can save hundreds of dollars in interest just from transferring your existing debt to the best credit card for balance transfers, helping you get ahead and pay off your debit for less than you originally bargained for. When you compare balance transfer credit cards, you may be surprised at the other deals you can find, including rewards points and similar perks.

In our 2017 Ranking and Reviews for Best Card for Balance Transfer we will review six of the best balance transfer credit cards to use when you want to reduce the overall debt you owe by transferring high-interest debt to the best credit card to transfer balance of your debt to. We will go over the introductory APRs, any annual fees, and compare credit cards balance transfer rates.

AdvisoryHQ’s List of the Top 6 Best Balance Transfer Cards

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- BB&T Bright® Card

- PenFed Platinum Rewards VISA Signature® Card

- PNC CORE℠ Visa®

- Security Service Power Rewards MasterCard®

- U.S. Bank Platinum Visa® Card

- Visa Titanium Signature Rewards

Top 6 Best Credit Cards for Balance Transfers | Brief Comparison & Ranking

Credit Card Names | Balance Transfer APR Intro Rate | Balance Transfer APR After Intro | Annual Fee |

| BB&T Bright® Card | 0% for | 8.40%- | None |

| PenFed Platinum Rewards VISA Signature® Card | 0% for | 10.24%- | None |

| PNC CORE℠ Visa® | 0% for | 10.24%- | None |

| Security Service Power Rewards MasterCard® | None | 7.90% to 9.90% | None |

| U.S. Bank Platinum Visa® Card | 0% for | 10.24%- | None |

| Visa Titanium Signature Rewards | 0% for | 5.99%- | $59 |

What’s the Benefit of Best Balance Transfer Credit Cards?

Most people will typically read past the balance transfer information on a credit card application, but in reality if you have debt from a loan or high-interest credit card, then using balance transfer credit cards to pay back the debt at a much lower interest rate can save you quite a bit over the life of the payback period.

As an example of what you can save by doing a credit card balance transfer, let’s assume you had a credit card debt of $7,000 at a rate of 18% interest and made a payment of $200 per month. Using a credit card calculator, it could be about 4 years and 2 months to pay off that debt, and you’d pay about $3,000 in interest.

If you transferred your balance to one of the balance transfer cards that offers 0% interest for the first 15 months and 18% interest after that, and you made a payment of $200 per month, you’d pay off the debt in about 3 years and 3 months, paying only about $791.31 in interest, saving more than $2,200 in interest charges.

See Also: Best Starter, First, Beginner Credit Cards for Beginners | Ranking | Good First Credit Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do You Use a Best Credit Card for Balance Transfers?

It’s not as complicated as you may think to use one of the best balance transfer cards to transfer debt. Many have an online option to do a balance transfer while others will require a call. But you are basically paying off a higher interest debt with one of the lower interest best credit cards for balance transfers in order to save money on the interest paid on the debt.

Image Source: Pixabay

Important considerations when doing a credit card balance transfer:

- Any balance transfer fees involved

- The difference in APR and any introductory 0% APR period

- What you can afford to pay as a monthly payment

- Make sure your new card issuers know you’re initiating balance transfer credit cards

- The APR rate after the introductory period

- If consolidating debt makes your life easier

- The credit limit on the new best credit card for balance transfers you’ve secured

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Don’t Miss: Best Credit Cards to Build Credit | Ranking & Reviews | Credit Cards for Building Credit

Detailed Review—Top Ranking Best Balance Transfer Credit Cards

Below, please find the detailed review of each credit card on our list of best balance transfer cards. We have highlighted some of the factors that allowed these best credit cards for balance transfers to score so high in our selection ranking.

BB&T Bright® Card Review

This card is issued by BB&T and was chosen as one of the best balance transfer credit cards because of the 0% APR offered for 15 months, followed by fairly low variable APRs ranging from 8.40% to 17.40%, which is valid for balance transfers. The zero and low interest make a credit card balance transfer with this card one that could save you a lot of money if you’re paying higher interest on another card or a loan.

When you compare offers that would make good balance transfer credit cards, BB&T’s website confirms this card has the lowest annual percentage rate of the credit cards that they offer. When doing a credit card balance transfer, there is a fee of 3% for each transfer with a $10 minimum.

The BB&T Bright® Card has some other features that you will want to review when you compare balance transfer credit cards and which could be of benefit to you.

Best Balance Transfer Cards Features:

- Zero liability on unauthorized purchases

- Warranty manager service and purchase security

- Travel and emergency assistance services

- Travel accident insurance

- No annual fee

Considerations When You Compare Credit Cards Balance Transfer Details:

- 0% APR for 15 months

- 8.40%–17.40% variable APR after intro period

- 3% balance transfer fee ($10 minimum)

- Type of credit needed to get card is from fair to excellent

You can apply for a BB&T Bright® card here.

PenFed Platinum Rewards Visa Signature® Card Review

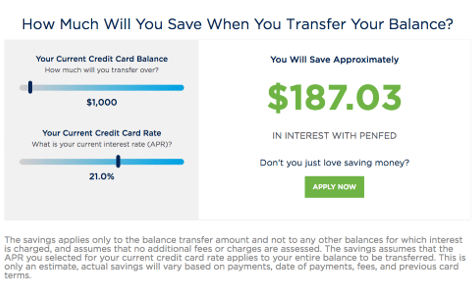

This card is issued by PenFed Credit Union and was chosen as one of the best balance transfer credit cards because of the 0% APR offered for 12 months on balance transfers, followed by fairly low variable APRs ranging from 10.24% to 17.99%. Their website has a nice “estimate my savings” tool to see how much you can save in the balance transfer cards area of the page.

Source: PenFed Credit Cards for Balance Transfers

When you compare balance transfer credit cards, this one has a popular added benefit of earning rewards points. A consideration of banking or securing a credit card from PenFed is that you need to review their list of eligible organizations to see if you qualify as a member. When doing a credit card balance transfer, there is a fee of 3% for each transfer with no minimum.

The PenFed Platinum Rewards Visa Signature® Card has a few other features that may make it more interesting to you when you compare balance transfer credit cards.

Best Balance Transfer Cards Features:

- Earn rewards points

- No foreign transaction fees

- Complimentary 24/7 concierge service

- Special retailer savings and discounts

- No annual fee

Considerations When You Compare Credit Cards Balance Transfer Details:

- 0% APR for 12 months

- 10.24%–17.99% variable APR after intro period

- 3% balance transfer fee

- You need to qualify as a member of PenFed Credit Union

You can apply for a PenFed Platinum Rewards Visa Signature® card here.

Related: Best 0 APR Credit Cards | Ranking | Top Credit Cards with 0 APR Offers (Reviews)

PNC CORE℠ Visa® Card Review

This card is issued by PNC and was chosen as one of the best balance transfer credit cards because of the 0% APR offered for 15 months followed by somewhat low variable APRs ranging from 10.24% to 20.24%. These two factors help make this a best card for balance transfer, especially if you plan to pay most of the balance by the first 15 months.

When you review credit cards for balance transfers, this one offers a $100 cash bonus after you make $1,000 or more in net purchases during the first three billing cycles. When you do a credit card balance transfer with this card, there is a fee of 3% for each transfer with a $5 minimum for the first 90 days, and after that it is 4% with a $5 minimum.

The PNC CORE℠ Visa® Card has a few other features that you may want to review when you compare balance transfer credit cards.

Best Balance Transfer Cards Features:

- Fraud protection and monitoring

- Lowest introductory rate on balance transfer

- No annual fee

Considerations When You Compare Credit Cards Balance Transfer Details:

- 0% APR for 15 months

- 10.24%–20.24% variable APR after intro period

- 3% balance transfer fee ($5 minimum) for 90 days, 4% after that

- Type of credit needed to get card is from fair to excellent

You can apply for a PNC CORE℠ Visa® Card here.

Security Service Power Rewards MasterCard® Review

This card is issued by Security Service Federal Credit Union and was chosen as a best credit card to transfer balance amounts because it has no fee for balance transfers and a although they don’t have any 0% APR period, they do have a fairly low APR for balance transfer credit cards of 7.90% to 9.90%.

Source: Security Service Best Credit Card to Transfer Balance

You do need to qualify as a member in order to apply for one of their balance transfer cards. You can find a list of qualifying details here. They are one of the few credit cards for balance transfers that actually have a lower rate for balance transfers than they do for purchases.

The Security Service Power Rewards MasterCard® has extra features that you’ll want to take a look at when you compare balance transfer credit cards and which could be of benefit to you.

Best Balance Transfer Cards Features:

- Rewards points

- No cash advance fee

- Personalize your card with an image

- 60-day price protection

- Identity theft resolution services

- Zero liability protection

- Extended warranty

- Entertainment discounts

- No annual fee

Considerations When You Compare Credit Cards Balance Transfer Details:

- 7.90%–9.90% variable APR

- No balance transfer fee

- You need to qualify to be a member

You can apply for a Security Service Power Rewards MasterCard® here.

Popular Article: Top Capital One Credit Cards | Ranking | Compare Best Capital One Credit Card Offers & Promotions (Reviews)

Free Wealth & Finance Software - Get Yours Now ►

U.S. Bank Platinum Visa® Card Review

This card is issued by U.S. Bank and was chosen as one of the best balance transfer credit cards because of its 0% APR offered for 12 months on purchases and balance transfers followed by variable APRs ranging from 10.24% to 21.24%.

Source: Andrews FCU Best Credit Cards for Balance Transfers

When you are looking for the best card for balance transfer options, this one is from a main bank that doesn’t have the same qualifications needed for a credit union, so it can be easier to secure. The fee is similar to other best credit cards for balance transfers at 3% with a $5 minimum.

When reviewing the U.S. Bank Platinum Visa® Card, you may find that it has some other features that make it the best credit card for balance transfers for your needs.

Best Balance Transfer Cards Features:

- Choose your own payment date

- Easy access with more than 1,000,000 ATMs worldwide

- Auto pay

- Fraud protection

- Overdraft protection

- No annual fee

Considerations When You Compare the Best Credit Card to Transfer Balance Details:

- 0% APR for 12 months

- 10.24%–21.24% variable APR after intro period

- 3% balance transfer fee ($5 minimum)

- Type of credit needed to get card is from fair to excellent

You can apply for a U.S. Bank Platinum Visa® Card here.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Visa Titanium Signature Rewards Card Review

This card is issued by Andrews Federal Credit Union and was chosen as one of the best credit cards for balance transfers because it offers 0% APR for 12 months on balance transfers followed by fairly low variable APRs ranging from 5.99% to 18.00%.

When you look for the best credit card for balance transfers, this one offers a lower balance transfer fee than most others, at only 1.50%, others are at 3.0% or more. Due to their connection with the American Consumer Council, they have more ability to qualify as a member than other government-based credit unions.

The Visa Titanium Signature Rewards Card offered by Andrews Federal Credit Union has a few other features that you may want to review when you compare the best credit cards for balance transfers.

Best Balance Transfer Cards Features:

- Rewards points

- No foreign transaction fees

- Annual fee waived first year, $59/year after that

Considerations When You Compare Best Credit Cards for Balance Transfers Details:

- 0% APR for 12 months

- 5.99%–18.00% variable APR after intro period

- 1.5% balance transfer fee

- Need to qualify for credit union membership

Conclusion—Top 6 Best Credit Card for Balance Transfers

If you are dealing with a high-interest debt from a credit card or loan, then securing one of the best balance transfer credit cards can save you quite a bit in interest charges and help you pay off your debt faster. Many people think they are locked into a particular interest rate with credit card debt, but a credit card balance transfer can completely change your financial outlook for that debt.

Some of the factors you’ll want to consider when you review the best balance transfer credit cards is how soon you think you may pay off the debt.

If you plan to pay it off sooner, then the balance transfer credit cards with the 0% introductory rates will be of most interest to you. If you think you may need more time than 12 or 15 months, then you’ll want to consider the variable APR that kicks in after the introductory rate and pick the lowest one.

We hope that our 2017 Ranking and Reviews for the Best Credit Card for Balance Transfers is a great reference when you’re considering balance transfer credit cards and how to save a bit on the debt you already have. If you choose wisely, then the best balance transfer credit cards you can find could have a positive impact on your financial health that helps you reach your goals sooner than you planned.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.