2018 RANKING & REVIEWS

TOP RANKING BANKS AND CREDIT UNIONS IN VIRGINIA BEACH

Find the Best Rates in Town at These Top 6 Credit Unions & Banks in Virginia Beach (& 1 to Avoid)

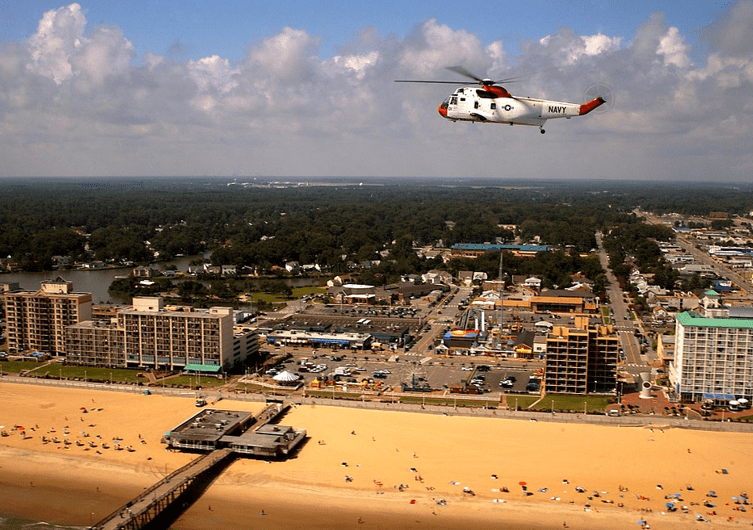

Hosting the East Coast Surfing Championships and holding the Guinness World Record for the longest pleasure beach, are just two of the claims to fame of Virginia Beach, VA. But just because this is a resort town, doesn’t mean people aren’t on the lookout for great places to bank.

Saving money on loan interest and getting generous savings rates lead to a healthy financial future. So, we looked for the Virginia Beach banks and credit unions that have great service and can save you lots of money.

When considering a new bank in Virginia Beach, it’s important to know the nearby towns, as several that are just minutes away. When looking to open a new account, you’ll also want to consider banks in Norfolk, VA or a Hampton Roads credit union.

Award Emblem: Top 6 Credit Unions & Banks in Virginia Beach

Have you been wondering about the differences between a Virginia Beach credit union and a bank in Virginia Beach? Why do credit unions seem to offer lower loan rates? We’ll cover that in our FAQ.

Let’s get started with a quick summary of the best credit unions and banks in Virginia Beach, VA, then we’ll get into details about the rates they offer and what makes each one a great option.

Top 6 Best Virginia Beach Credit Unions & Banks (& 1 to Avoid) | Brief Comparison & Ranking

| Top Bank or Credit Union in Virginia Beach | 2018 Ratings |

| Chartway Federal Credit Union | 5 |

| Dollar Bank | 5 |

| TowneBank | 5 |

| ABNB Federal Credit Union | 3 |

| BayPort Credit Union | 3 |

| Xenith Bank (formerly Bank of Hampton Roads) | 3 |

| Beach Municipal Federal Credit Union | 1 |

Table: Top 6 Credit Unions & Banks in Virginia Beach (& 1 to Avoid) | Above list is sorted by rating

FAQ: AdvisoryHQ Review of the Top Virginia Beach Banks | What’s the Difference Between Credit Unions & Banks in Virginia Beach?

If you’ve always had your accounts at banks, then you may be missing out on lower interest rates and other perks offered by Virginia Beach credit unions.

Over the years, credit unions have worked to compete with banks, opening membership requirements and offering similar products and services. Today, it’s difficult to tell the difference between them.

Here are a few ways that a bank and credit union in Virginia Beach are different:

- Banks are for-profit, credit unions non-profit

- You have to meet membership eligibility requirements with credit unions

- Banks don’t have membership requirements, anyone can open an account

- Depositor accounts at banks are insured by FDIC, at credit unions by NCUA

- Credit unions often have more freedom to offer lower loan rates and higher savings interest rates

- Private banks, without shareholders, also have more freedom with interest rates

- Credit unions return profits back to their account holders

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed AdvisoryHQ Review | Top Ranking Best Virginia Beach Credit Unions & Banks (& 1 to Avoid)

Below, please find a detailed review of each firm on our list of top banks & credit unions in Virginia Beach. We have highlighted some of the factors that allowed these Virginia Beach credit unions and banks to score so highly in our selection ranking

Click on any of the names below to go directly to the review section for that firm.

- Chartway Federal Credit Union

- Dollar Bank

- TowneBank

- ABNB Federal Credit Union

- Bayport Credit Union

- Xenith Bank (formerly Bank of Hampton Roads)

- Beach Municipal Federal Credit Union

See Also: San Francisco’s Best Banks & Credit Unions (& Banks to Avoid) | Ranking

Chartway Federal Credit Union Review

If you’re looking for credit unions or banks in Norfolk, VA or Virginia Beach, this next one is bound to be at the top of the search results. Chartway Federal Credit Union was started in 1959 with just $35 by workers at the Norfolk Naval Air Station.

Today, they have nearly 50 branches spanning Virginia, Utah, and Texas. Anyone that lives, works, worships or attends school in one of their branch areas can join.

Below are the highlights that make Chartway Federal Credit Union stand out on this 2018 ranking of the best credit unions and banks in Virginia Beach.

Benefits of Chartway Federal Credit Union in Virginia Beach at a Glance:

- 16 branch locations in Virginia Beach, VA & surrounding areas

- Home equity loans starting at 4.50% APR

- Credit cards starting at 8.99% APR

- Auto loan rates as low as 1.69% APR

- Better Business Bureau (BBB) A+ rating

Super Low Auto Loan Rates

Chartway is one of the Virginia Beach credit unions that has one of the lowest starting rates we’ve seen anywhere for auto loans. They offer a rock bottom 1.69% APR rate if you qualify. This is also one of the credit unions and banks in Virginia Beach, VA that has a fast approval process and no payment for up to 45 days after signing.

Rating Summary

Although Chartway Federal Credit Union has a few mixed reviews online, overall members say they’re treated like family and go to them for great CD rates and more. We rated them a 5 on our list of the top credit unions and banks in Norfolk, VA and the Virginia Beach area.

They offer attractive promotions, like $50 just for opening an account. This is also one of the Virginia Beach credit unions that gives back to the community through support of charitable organizations. Their ties to the military also make them a great VA Beach credit union for service members and their families.

Don’t Miss: Best Credit Unions & Banks in New York City (+ 2 to Avoid) | Ranking

Dollar Bank Review

This next bank in Virginia Beach is the largest independent mutual bank in the U.S. While Dollar Bank has only been in Virginia for a few years, it’s been serving Pennsylvania and Ohio residents since 1855. Because it’s an independent bank, it has no shareholders and more flexibility on the rates it offers.

Below are the highlights that make Dollar Bank stand out on this 2018 ranking of the best credit unions and banks in Virginia Beach.

Benefits of Dollar Bank in Virginia Beach at a Glance:

- 4 branch locations in Virginia Beach, VA & surrounding areas

- Home equity loans starting at 3.99% APR

- Rewards card with 1.25% cash back

- Savings account with 1.00% APY

- Better Business Bureau (BBB) A+ rating

Rate Discounts with “Everything Banking”

When you open an Everything checking or savings account with Dollar Bank, you can get some great rate discounts from bundling. Save ¼% off of loan interest, get $500 off mortgage closing costs, and enjoy higher preferred rates on Dollar Bank Certificates of Deposit.

Rating Summary

Great interest rates, low fees, and easy banking are reasons customers give this bank in Virginia Beach, VA high marks. A few negative reviews noted waiting for deposit availability. By far people say working with Dollar Bank is “fantastic,” and we rated them a 5 on our listing of the top Virginia Beach credit unions and banks.

Their recent expansion into the Virginia Beach and Hampton Roads area shows that they are growing. They also have stayed an independent bank, allowing them a similar freedom to set savings and loan rates as a credit union in Virginia Beach.

If you like Virginia Beach banks with a rich history yet still keep up with the times, you’ll definitely want to take a look at Dollar Bank.

TowneBank Review

TowneBank was started in a two-car garage in Portsmouth, Virginia and opened their first three branches in the spring of 1999. This is one of the regional banks in Virginia Beach that’s continued to grow. They have 37 banking offices and are one of the largest banks headquartered in the state of Virginia.

Below are the highlights that make TowneBank stand out on this 2018 ranking of the best credit unions and banks in Virginia Beach.

Benefits of TowneBank in Virginia Beach at a Glance:

- 15 branch locations in Virginia Beach, VA & surrounding areas

- Auto loans starting at 3.5% APR

- 23-month CDs with 1.40% APY and option to raise your rate

- Short-term personal loans starting at 4.75% APY

- Better Business Bureau (BBB) A+ rating

Multiple Rewards Card Options

If you use credit card rewards for travel or extra cash when you need it, this is one of the banks in Norfolk, VA and Virginia Beach that gives you plenty of options. You can choose from six different credit cards that give you cash back, offer travel rewards points, or help build your credit.

Rating Summary

TowneBank scored a 5 on our rankingof the best Virginia Beach credit unions and banks. They get high review scores from customers that mention the fast customer service. The only negative we found was one particular branch with long drive-thru lines. One reviewer called TowneBank the “Cadillac” of Hampton Roads area banks.

They provide both robust personal and business banking services and are proud community supporters, being started right in the heart of the Hampton Roads and Virginia Beach area. If you like Virginia Beach credit unions and banks with a great reputation, this is one to definitely check out.

Related: Best Credit Unions & Banks in Los Angeles (& 1 to Avoid) | Ranking

ABNB Federal Credit Union Review

ABNB Federal Credit Union is focused on saving people money. They’re fairly young, starting in 2011, but have helped people save over $48 million by refinancing to lower interest rates.

They’re a Virginia Beach and Hampton Roads credit union, anyone in the Greater Hampton Roads area or in NE North Carolina can join.

Below are the highlights that make ABNB Federal Credit Union stand out on this 2018 ranking of the best credit unions and banks in Virginia Beach.

Benefits of ABNB Federal Credit Union in Virginia Beach at a Glance:

- 15 branch locations in Virginia Beach, VA & surrounding areas

- Transfer credit card balances for 1.99% APR for 6 months

- Interest checking with up to 2.00% APY

- Auto loan rates as low as 2.55% APR

- Better Business Bureau (BBB) A+ rating

Free High Interest Checking

If you’re looking to save any way that you can with what you have, then Virginia Beach credit union’s Kasasa Cash® checking account is a great way to do that. There’s no monthly service fee, nationwide ATM fee refunds, and you earn 2.00% APY on balances up to $10,000. There are also other perks like unlimited check writing.

Rating Summary

Members that give ABNB Federal Credit Union high marks, praising them for kind and friendly customer service and willingness to help repair bad credit. Negative reviews mention high overdraft fees and long phone customer service wait times.

We rated this Virginia Beach and Hampton Roads credit union a high 3 on our ranking of the best credit unions and banks in Virginia Beach, VA. They have some of the best rates around, but members do give them mixed reviews.

If you’re looking to build or repair bad credit, many members say this is a wonderful Virginia Beach credit union to work with and the staff really cares.

BayPort Credit Union Review

BayPort Credit Union began in 1928 when Newport News Shipbuilding and Dry Dock Co. employees pooled their resources. Today, this credit union in Virginia Beach has over 103,000 members and serves residents of multiple cities and counties in the Tidewater and Hampton Roads, Virginia area.

Below are the highlights that make BayPort Credit Union stand out on this 2018 ranking of the best credit unions and banks in Virginia Beach.

Benefits of BayPort Credit Union in Virginia Beach at a Glance:

- 7 branch locations in Virginia Beach, VA & surrounding areas

- Fast Start Savings account with 5.00% APY

- Credit cards starting at 8.24% APR

- Auto loan rates as low as 2.54% APR

- Better Business Bureau (BBB) C- rating

Multiple Ways to Save

This is one of the Virginia Beach banks and credit unions that knows good savings habits start young. For members under 25-years old, they offer their Fast Start Savings with 5.00% APY for balances up to $500. But even if you’re over 25, you can still grow that nest egg with a regular savings or vacation club account at 0.15%-0.25% APY.

Rating Summary

BayPort Credit Union has a few mixed reviews, some members love their excellent customer service and have been with them for a decade or more, while others don’t find them quite as helpful. We did review their C- rating at the BBB, but saw only three complaints, and just one unanswered, so they could easily raise that rating.

This Virginia Beach credit union scored a 3 on our ranking of the top credit unions and banks in Virginia Beach. They offer some great loan rates as well as supercharged savings accounts. They also have robust offerings, which include auto, home, and life insurance and investment services.

Popular Article: San Antonio’s Best Banks & Credit Unions for Great Service | Ranking

Free Wealth & Finance Software - Get Yours Now ►

Xenith Bank Review

If you’re searching for the Bank of Hampton Roads, Xenith Bank is going to come up due to a merger a few years ago. Xenith Bank is a division of Union Bank & Trust of Richmond, Virginia, which has 148 branches across Virginia, North Carolina, and Maryland.

Below are the highlights that make Xenith Bank (formerly Bank of Hampton Roads) stand out on this 2018 ranking of the best credit unions and banks in Virginia Beach.

Benefits of Xenith Bank in Virginia Beach at a Glance:

- 15 branch locations in Virginia Beach, VA & surrounding areas

- Debit card points rewards program

- 13-month CDs with 1.55% APY

- Free checking account options

- Better Business Bureau (BBB) A+ rating

Personal and Business Investment Options

Besides the attractive CD rates of 1.55% to 1.86% for a 13 or 30-month CD, Xenith Bank offers a number of business and personal investment products. From Coverdell education savings accounts to Simplified Employee Pension (SEP) IRAs, this is one of the banks in Virginia Beach, VA geared towards growing your money.

Rating Summary

We rated Xenith Bank (formerly Bank of Hampton Roads) a 3 on our listing of the top Virginia Beach credit unions and banks. They don’t have many reviews online, so the few there are mixed. The only thing holding them back from a higher score was the lack of transparency on their website for their loan rates.

This is another of the banks in Virginia Beach that looks to be expanding through mergers and acquisitions, so more branches in the region could be on the horizon. They offer similar options to larger banks in VA Beach, including mobile and online banking.

Beach Municipal Federal Credit Union Review

Now we’re going to reveal the credit union in Virginia Beach that you may want to avoid until they get a little larger. Beach Municipal Federal Credit Union has both a lack of online reviews and of dedicated locations in the area, with just two branches.

Below are some of the improvements we feel would help Beach Municipal Federal Credit Union move up on a future ranking of top Virginia Beach credit unions and banks.

Expand Locations and Membership

One reason this credit union in Virginia Beach, VA might have just two locations is that their membership eligibility is more restrictive than others. You need to be an employee or volunteer for the City of Virginia Beach, or a family member, to join. If they expanded their membership to all residents of the city, that would be a positive step towards attracting more members.

Rating Summary

As a credit union in Virginia Beach that you may want to avoid, we rated Beach Municipal Federal Credit Union a 1 in our ranking of Virginia Beach banks and credit unions.

On the plus side, they are part of the CO-OP network of shared branches, giving their members the ability to use other credit unions and ATMs in the network. If they promoted happy members to give online reviews and expanded their footprint in the area, it would go a long way towards improving their overall ranking.

Read More: Best Credit Unions & Banks in Jacksonville, FL (& 1 to Avoid) | Ranking

Conclusion – Top 6 Best Credit Unions & Banks in Virginia Beach with Great Rates (& 1 to Avoid)

A few percentage points off on a loan or added to a savings plan can make a world of difference. If you’re not sure you’re getting the best deal out there, you may want to check out one of these top Virginia Beach credit unions and banks.

Even if you’re completely happy with the checking or saving accounts you have now, there’s no reason you can’t get a loan or CD with a different bank in Virginia Beach, Virginia that offers a money saving deal. Shop smart and take advantage of competing interest rates and you can come out richer in the end.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/virginia-beach-town-city-buildings-81260/

- https://pixabay.com/en/bicycle-riders-riding-cycling-2071825/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.