2018 RANKING & REVIEWS

TOP RANKING BANKS FOR MILLENNIALS

Intro: Which Bank is the Best for Millennial Banking?

Exploring the relationship between Millennials and banking often means looking at what sets one financial institution apart from another.

After all, selecting which bank is best for your unique financial needs is the most reliable way to ensure that your money is truly in good hands—especially while you’re still young.

Despite the importance of finding the best banks for Millennials, many are still searching for an effective, rewarding, and distinctive banking experience.

In fact, 53 percent of Millennials “don’t think that their bank offers anything unique.” As the largest living generation of over 83 million people, there is a huge percentage of complacent Millennial bankers waiting to find top-notch Millennial banks.

When it comes to choosing the best bank for you, it’s important to make sure that you find the unique features, affordable fees, and financial tools that will help you reach your financial goals.

If you’re part of the percentage that doesn’t see anything special with your bank—and you’re ready for a change—this article was written to help you decide which bank is best for you.

Award Emblem: Top 5 Best Millennial Banks

AdvisoryHQ’s List of the Top 5 Best Banks for Millennials

List is sorted alphabetically (click any of the banking firm names below to go directly to the detailed review section for that Millennial bank).

Top 5 Best Banks for Millennials | Brief Comparison & Ranking

Best Millennial Banks | Highlighted Features |

| Ally Bank | Fee-free, interest-bearing Ally savings account and checking account |

| Aspiration | Flexible, value-based approach to Millennial banking and investments |

| Bank of Internet USA | Access to free online account management through FinanceWorks™ |

| Capital One | Dynamic online and mobile banking tools |

| Simple | All-in-one online interface for banking and budgeting |

Table: Top 5 Best Banks for Millennials | Above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Makes a Great Millennial Bank?

Uncovering the best Millennial banking depends on looking at what Millennials value.

Of course, not all Millennials value the same banking tools, but there are a few specific features that make some banks particularly beneficial for Millennial banking.

When it comes to Millennial banking, here’s a look at the types of banking features that Millennials value:

Best Mobile Bank Apps

This is the first generation to have constant access to the Internet across a wide variety of devices, making accessibility a key part of banking for Millennials.

In fact, the ABA reports that Millennials are three times more likely to sign up for a new bank account with their phone instead of doing it in person. This is actually a good thing—as Jennifer Calonia of Forbes rightly points out,

This kind of accessibility provides a new level of engagement between millennials and their money, which can only help inform and improve their financial decisions.

As a result, the best banks for Millennials will provide intuitive, multi-functional mobile apps to make banking for Millennials accessible, convenient, and efficient.

In some cases, the best mobile bank apps will also include budgeting and goal-setting features, like the Simple Bank app.

Low or Transparent Fee Structure

With plenty of debt stacking up, it’s no wonder that Millennial bankers are getting tired of excess fees. In fact, a 2015 Accenture survey found that high banking fees was a primary source of dissatisfaction for Millennials.

If you are looking for the best banks for Millennials, you’ll want to look for a Millennial bank that eliminates fees wherever possible.

Banks with no account maintenance fees, zero minimum balance penalties, and low overdraft fees are likely to be the best banks for Millennials.

Although it may be impossible to eliminate all Millennial bank fees, the best Millennial banking institutions will, at the very least, have a transparent fee structure.

Flexible Requirements

Whether you’re opening a checking, savings, or investment account, having flexible requirements is important for Millennial banking. This can include anything from opening account deposits to minimum account balance requirements.

The best banks for Millennials make their services accessible, and strive to provide flexible requirements to ensure that account holders can access their funds when they need them.

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Banks for Millennials

Below, please find a detailed review of each bank on our list of best banks for Millennials. We have highlighted some of the factors that allowed these Millennial banks to score so high in our selection ranking.

See Also: Best Banks for Bad Credit | Ranking & Review

Ally Bank Review

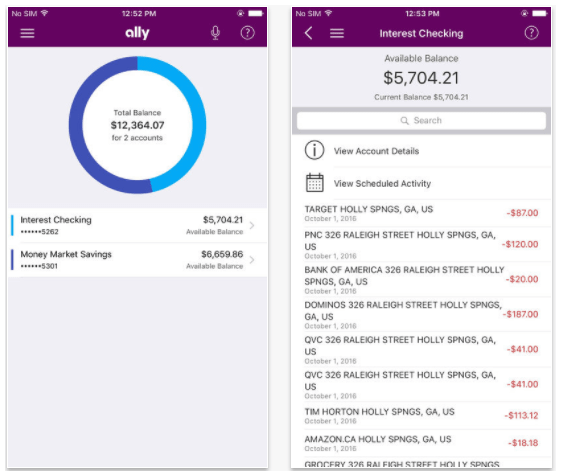

Once you start looking for the best banks for Millennials, Ally Bank is guaranteed to be one of the first results. Recently, Ally was named “Best Internet Bank” and “Best Bank for Millennials” by Kiplinger’s Personal Finance Magazine in 2017.

With over 71 billion in customer deposits, Ally provides an award-winning online banking experience that continues to attract Millennial bankers across the globe.

What stands out about Ally is their commitment to fee-free banking, which consistently ranks Ally among top Millennial banks. Their online checking account comes with zero fees for account maintenance, ACH transfers, debit card use, and check disbursement.

Overdraft transfers from an Ally savings account are even provided free of charge, making Ally one of the best Millennial banks.

Their basic checking and Ally savings accounts both come with low fees and opportunities to earn interest (0.10-0.60 percent and 1.20 percent, respectively), making Ally a best bank for Millennials that want to start growing their savings.

With an emphasis on affordable and accessible banking, Ally is one of the best banks for Millennials to consider this year.

As an online-only bank, Ally also has one of the best mobile bank apps, available on Google Play and iTunes.

As an online-only bank, however, potential account holders should know that cash cannot be deposited into an Ally savings account or checking account. This best bank for Millennials only accepts deposits via remote check deposit, direct deposit, online transfers, wire transfers, and by mail.

Don’t Miss: Best Kentucky Banks | Ranking | Top banks in Kentucky

Aspiration Review

Aspiration offers a unique, refreshing take on improving the Millennial banking experience.

While their financial products are limited, they are a great fit for young investors or those looking for an affordable high-yield checking account.

Their signature offering, the high-yield checking Summit Account, offers between 0.25 and 1.00 percent APY with a keen focus on affordability. As a best bank for Millennials, there are no monthly service fees and no requirements for monthly deposits or balances.

Additionally, this Millennial bank charges zero fees for ATM withdrawals, both domestic and overseas, which is great news for Millennial bankers who love to travel.

Their investment products also come with a commitment to a fair fee structure. Each account holder can set their own fee structure (even if it’s zero), and Aspiration will even donate to charity based on your chosen fee amount.

It’s not often that banking for Millennials is so flexible, making Aspiration a best bank for Millennials that want better control over their banking terms.

However, it is important to note that Millennial bankers will need to have another bank or credit union account already established to sign up with Aspiration, since funding can only be accomplished through online transfers.

Related: Best Private Banks | Ranking | Top Private Wealth Management Banks

Bank of Internet USA Review

As Millennial banking with online-only banks continues to increase in popularity, Bank of Internet USA (BOFI USA) is thriving.

Since their founding in 1999, BOFI USA has received plenty of accolades from various financial experts, highlighting this Millennial bank as one of the best online banks on the market.

Most recently, BOFI USA was listed as a “Do-It-All Online Bank” by Kiplinger’s Personal Finance Magazine in 2017.

As a top Millennial bank, BOFI USA does a great job at offering variety and flexibility. For example, Millennial banking customers can choose from six checking accounts ranging from interest-bearing, cash back rewards, and basic checking.

One unique checking account is the Cash Back Checking, which provides up to 1 percent cash back on purchases and Purchase Rewards when shopping with participating stores.

It’s a creative way to provide increased value for Millennial bankers, and it’s a great example of the focus that BOFI USA puts on providing as many benefits as possible.

Millennial bank account holders can also take advantage of a range of free online tools, including:

- Access to FinanceWorks™ to create and manage financial goals

- Use of Popmoney® to send, request, and receive payments

- Mobile Deposit for checks

- Online Bill Pay

- 24/7 access through the best mobile bank apps

As with many online banks, BOFI USA does not accept cash deposits outside of their San Diego branch location. For Millennial banking customers outside of the area, the only way to deposit cash is to use the register at participating retailers and drugstores.

Popular Article: Best Banks in Minnesota (Ranking & Review)

Capital One Review

As a globally recognized financial institution, Capital One offers a wide range of financial products, including credit cards, mortgages, and basic banking services.

What makes Capital One a great Millennial bank to consider are their 360 Savings® and 360 Checking® accounts. Both can be conveniently opened and managed completely online.

The 360 Savings® account has no fees, no minimum balance requirements, and all deposits earn 0.75 percent APY. Similarly, the 360 Checking account has no fees or minimum balance requirements, and even yields 0.20-0.90 percent APY.

While the APY rates are relatively low, it’s worth mentioning that Capital One does not have minimum balance requirements—a fact which makes this Millennial bank stand out among competing national banks.

As one of the best banks for Millennials, Capital One also has a ton of online and mobile tools to provide on-the-go account management, including:

- Zelle℠ lets you send money securely to anyone

- Text and email alerts keep you updated on your account activity

- Pay bills with Online Bill Pay

- Free access to CreditWise® to monitor your credit score

- Easily deposit checks by taking a picture with Mobile Check Deposit

- Capital One Wallet℠ helps keep track of purchases in real-time

- Enhanced Transactions shows a detailed look at each purchase, including merchant names, addresses, item descriptions, and more

With enhanced mobile access, dynamic online tools, and fee-free accounts, Capital One offers convenient and efficient banking for Millennials.

Read More: Best Bank for Auto Loans | Finding the Best Banks to Get an Auto Loan or Car Refinance

Free Wealth & Finance Software - Get Yours Now ►

Simple Review

Simple is an online-only bank for Millennials that aims to reinvent the banking process, inviting account holders to “Save easily. Bank beautifully.”

With a clean, eye-catching interface, Simple acts as an all-in-one banking and budgeting tool to help users save and spend smarter.

Rather than downloading separate apps for budgeting and banking, Simple makes Millennial banking easy with an array of user-friendly features and budgeting tools available via web browser or the Simple Bank app.

Users can create Goals for expenses or future purchases through the Simple Bank app, while Trackable Spending generates detailed reports on spending habits and transaction labelling through photos, notes, and hashtags.

Safe-to-Spend® takes your total balance and subtracts any savings goals and upcoming bills to provide a quick snapshot of how much money you can safely spend. For those that struggle with overspending, Safe-to-Spend is a great Millennial banking tool.

It’s rare to find these types of budgeting features built directly into a banking app, which certainly makes Simple one of the best mobile bank apps in terms of multi-purpose functionality.

As a best bank for Millennials, Simple offers the best of both worlds—fee-free banking combined with goal-oriented saving, real-time budgeting, and an intuitive Simple Bank app.

Related: Best Banks in Missouri (Ranking & Reviews)

Conclusion: Which Bank is the Best Option for Millennial Banking?

With high student loan debt and lower income than previous generations, banking for Millennials can be challenging, both for Millennials and the banks trying desperately to keep them.

Luckily, many banks are starting to recognize the importance of Millennial banking, providing enhanced services and better account access to provide the best banking for Millennials.

Ultimately, choosing between the best banks for Millennials will come down to identifying and defining your unique financial goals.

Are you looking for an affordable high-yield checking account or investment options that won’t break the bank? If so, Aspiration, Ally, or Capital One may be the best Millennial bank for you.

If you want the best mobile bank apps for budgeting and account management, you might find that Simple or Bank of Internet USA will provide the best Millennial banking experience.

Make sure to compare a few of the top Millennial banks to ensure that you find your own best bank for Millennials that aligns with your personal financial needs.

Image sources:

- https://www.pexels.com/photo/blur-close-up-depth-of-field-device-407237/

- https://itunes.apple.com/us/app/ally-mobile/id514374715?mt=8

- https://www.aspiration.com/

- https://www.simple.com/features/safe-to-spend

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.