Review: 6 Tips On Finding and Selecting the Best Budgeting App & A List of 10 Best Apps

If you need personal finance help, one of the most important things you will ever do to take control of your financial future is to create a budget.

Gone are the days of sitting down with a legal pad and writing out a budget at the kitchen table. In 2016, there are tons of easy-to-use budgeting apps that will help you do just that.

Once you have created a budget, many of the best budgeting apps will also help you track your spending, so you can make sure you are not overspending in any category.

You can set financial goals and even monitor your saving and investing habits. Finding the best budgeting app can be a life-changer and can help people have more healthy relationships.

So we will share some tips with you on what to look for to find the best budgeting app for you. Not everyone is the same, and with the range of mobile finance apps available, you should be able to find one that fits your needs perfectly.

HomeBudget Expense Management Software

We will examine six key areas for you to check out when deciding on which paid or free personal finance software to use.

You will want to think about:

- Compatibility

- Feature set

- Cost

- Customer reviews

- Company reputation

- Testing

See Also: Ways Negative Interest Rates Will Impact You (Review)

Compatibility

Most of the best budgeting apps today are available on iOS, so they can be used with all of your Apple products, like your iPhone and iPad. Many of the best budgeting apps are also available on the Android platform.

Many popular budgeting apps have web apps as well. For example, Mint and YNAB (You Need a Budget) allow users to log on to their sites and access their budgets using a computer.

So, think about when you might use your budgeting app. Is accessing the app when you are out shopping important to you? Is it easier for you to work on your budget at your home computer with your spouse? If you need some of these functions, you can filter out a personal app that might not be right for you.

If one of the best budgeting apps is only available on iOS, but you own an Android device…well, you can take that off your list of possibilities.

Here is a list of ten of the most popular and best budgeting apps available, and which platforms they are supported on:

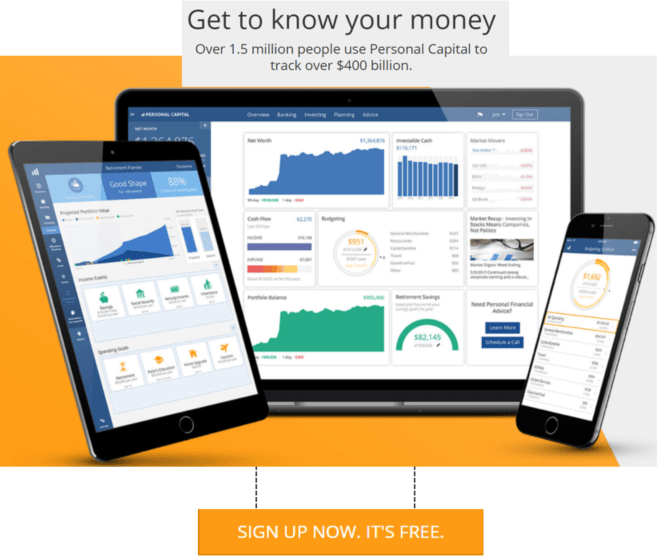

- Personal Capital (Best free money management app)

- Mint.com (Android, iOS, Web)

- HomeBudget App with Sync (Android, iOS, Mac OS X, Windows)

- YNAB (Android, iOS, Web)

- Prosper Daily (Android, iOS)

- PocketGuard (Android, iOS)

- Spendbook (iOS)

- Wally (Android, iOS)

- Level Money (Android, iOS)

- Spendee (Android, iOS)

As you can see, most mobile finance apps now support both Android and iOS. If you need additional platform functionality, there are very good options for you too.

Feature Set

Next, you will need to look at the features offered by the budgeting apps you are considering using. Does it do what you need it to?

If you click on the links above and get a feel for each budgeting software, you will find that one may strike you as looking better. User interface may seem like a small feature, but it is actually very important in choosing the best budgeting app for yourself. If you don’t like the look of the app, you will use it less.

And if you find that a key function is missing from the app, it will not be useful to you at all.

Tips for Finding Best Budgeting Apps

Many of the best budgeting apps offer the “envelope system,” which helps you by placing a certain amount of money in a virtual envelope. This is based on the real-world budgeting practice of placing cash in envelopes marked with the purpose of that cash for the month.

For instance, under the envelope system, if you budgeted $300 this month for groceries, you will place $300 in an envelope marked “groceries.”

When you get to the checkout line, you use the money from that envelope to purchase groceries. If you run out of money in an envelope, you must either adjust your budget or come up with ways to not spend any more in that category for the month. This feature gives people a lot of personal finance help. It is a discipline that many find useful, especially in the early months of living with a budget.

So, look into the app you are considering and make sure it has the features you need as well as an easy-to-use interface that will be acceptable to you.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Cost

This is a big one. As all of the best budgeting apps are owned by companies that need to turn a profit, you must understand that they need to earn revenue somehow. For many, this means charging an upfront price or charging a monthly subscription fee to use their service.

Some of the best budgeting apps do not charge, and free personal finance software companies support their product by selling in-app advertisements about credit card offers, loans, or other (usually financial) products.

Now, the word “free” sounds great, but some users may find ads to be distracting or annoying, and others might be too tempted by offers like rewards on credit cards, which could actually derail their financial discipline.

Some of the best budgeting apps are considered “freemium.” This means that most of the features are available on the free version of the app, but the company will charge an additional fee for more advanced features, like live-syncing with your bank or investment accounts.

Again, users will differ in their needs here. But just remember, when using the best apps for budgeting, you will pay for it somehow. A few additional dollars per month may make a whole lot of sense to you, and this psychological trigger might encourage you to use the software more efficiently. Using the software and staying on budget will save you a ton of headaches and help you on your way to a healthy financial future.

These are the current costs of some of the best budgeting apps mentioned above:

- Personal Capital (Best free money management app)

- Mint.com (Free)

- HomeBudget App with Sync ($2.99 and up, depending on the platform)

- YNAB ($5 per month)

- Prosper Daily (Freemium, add $9.99 per month for additional identity theft and fraud protection)

- PocketGuard (Free)

- Spendbook ($1.99)

- Wally (Free)

- Level Money (Free)

- Spendee (Freemium)

- IOU ($2.99)

Related: The Frugal Entrepreneur: Tips for Starting Your Own Business with No Money

Read About Personal Capital – A Top Free Finance Tool

Customer Reviews

This is where the Internet shines. You can and should read through pages of reviews from real users in the Apple iTunes Store or the Google Play Store, which is likely where you will download the best apps for budgeting.

Now, some companies have been known to pay for positive reviews, so it may take you some time to find a poor review. Pay the most attention to the mediocre reviews, the two- or three-star reviews: this is where real people with interesting opinions open up about what the app did well and where the app fell short.

Don’t just go with the app with the highest star rating, since that may not reflect the best budgeting app for you personally. For instance, you may find that a person rated an app two stars because the colors are not customizable.

If you don’t care what colors the app uses, but all the features they mentioned were just what you were looking for, then you can disregard the negative points of that review.

While it might not be a large purchase for you in terms of dollars spent, your choice of personal app for budgeting could be a massive shift in your journey toward financial health.

Be picky, and be thorough. Take an evening to sift through all your options, and do your research to see which app lines up best with your specific needs.

Company Reputation

This can be a bit tricky, as it impacts the best budgeting apps on a few different fronts. Security is clearly important in this type of software. You do not want your sensitive financial information hacked, and you want your login and passwords to be well-protected.

If you use one of the bigger mobile finance apps, like Mint.com, your information may be targeted by hackers looking to make a big score, due to the fact that there are so many users on Mint.

On the other hand, if you go with a company that makes one of the best apps for budgeting, but is really just one software developer in a basement somewhere, you may not feel comfortable letting this company into your financials. You may not be sure that they have your best interests in mind, or that they have the necessary expertise to keep your information secure.

Another aspect of this is regular updates. Even the best app for budgeting needs to be updated regularly in order to stay up-to-date with security changes and to make sure all bugs are fixed. Bugs happen, even in the best budgeting apps, but it is the regular updates that can tell you whether your company is helping you out.

If you go to the download page of your app store and notice that the app hasn’t been updated in over a year, the software is likely not being actively supported at this time by the software company and is probably not going to be the best app for budgeting.

This lack of updates can leave security holes in the software and can also mean you will be dealing with more bugs as you use it in your daily life.

After inputting all of your information and building history in the best budgeting app for you for a few months, there is nothing more frustrating than having to ditch your app because the developer stopped supporting it.

This may be okay if you are buying a game for 99¢, but make sure you trust the app developer that you use for your personal mobile finance app.

Popular Article: Top Best Financial Goals to Set in This Year (Examples of Short & Long-Term Financial Goals)

Try It Out!

The last, and perhaps most obvious tip is just to try it out!

If you think an app could be the best budgeting app for you, just give it a shot! Even if it costs a couple of bucks to demo for a month, you don’t have to make any permanent decisions. If you find the app is missing a feature that you definitely need, then you can look to alternatives.

You can always switch to a different app that more suitably meets your needs and gives you more personal finance help.

And don’t worry about spending too much money trying out the best budgeting apps. If you spend an extra $15 trying out 4-5 apps before you find the one you like, then so be it.

It will be more than worth it in the long run if you find the best budgeting app for yourself and your family.

Conclusion

When looking to find for the best budgeting app, make sure to dedicate enough time to the search, and don’t settle for something you’re not 100% happy with.

In today’s app market, there are literally dozens of viable budgeting app options that can offer personal finance help. There is no reason that you won’t be able to find exactly what you’re looking for and the best app for budgeting.

Try to enjoy the process. If you can make budgeting fun, it will help you stick to your personal finance goals. When creating your monthly budget, grab a glass of wine or a great cup of tea, and enjoy taking control of your own financial destiny.

And remember — after all the research is over, the best budgeting app is the one you actually use.

Best FREE Finance & Money Management Software

Image Sources:

- http://www.anishu.com/

- http://www.bigstockphoto.com/image-93414998/stock-photo-side-view-of-a-man-s-hands-using-smart-phone-in-interior-at-his-coworking-place-using-technology

- https://www.personalcapital.com

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.