2017 RANKING & REVIEWS

TOP RANKING BEST BUSINESS CREDIT CARDS FOR NEW BUSINESS

Introduction: The Best Business Credit Cards for a New Business

Starting your own business comes with a whole host of twists and turns. There will be good days and bad days, and on the worst days, you may find yourself wishing your credit were good enough to apply for one more loan from the bank. Credit cards for new businesses are a great way to gain access to needed credit for your entrepreneurial spirit. Starter business credit cards can help you weather even the worst moments of life as a business owner.

Award Emblem: Top 6 Best Business Credit Cards For New Business

Many banks are reluctant to lend money to new businesses that haven’t proven themselves as financially successful or sustainable. The best credit card for a new business, however, can be issued by any number of banks and can give your company access to a much needed credit line even when the banks turn you down.

In this brief article, AdvisoryHQ will review the best business credit cards for new businesses. We’ll begin by looking at why you should consider new business credit cards for startups before offering a comparative chart of the top six best startup business credit cards.

In our FAQ section, we’ll look at who benefits from the best business credit cards for startups as well what features to search for in business credit cards for new businesses. Finally, we will offer a complete review of six of the top starter business credit cards.

Why You Should Consider New Business Credit Cards for Startups

Let’s imagine that you’re a small restaurant owner who just opened a small hamburger joint on Main Street. The bank gave you a 10-year, $100,000 loan for startup costs including equipment, purchase of a locale, and other large purchases.

You have everything you need to start up your business, but the money from your loan is gone. During the first months, you’ve been struggling to get customers in the door. Since the bank won’t give you another loan, you decide to apply for a best credit card for a new business.

Image source: Pixabay

With your small business start up credit card, you’re able to access a revolving line of credit that doesn’t require any collateral and that might be interest-free if you pay off your loan in full each month. Business credit cards for new business with no credit are often a great option for startups that need access to fast credit and don’t want to go to the banks.

Credit cards for a startup business also are a great way to help new business owners get through the unpredictable beginning months of beginning their own company. According to Investopedia.com, “a credit card can provide business owners with a much-needed financial ‘cushion’ when accounts receivables are behind or sales are slow and the business is short on cash.”

See Also: Top Credit Cards with No Annual Fee | Ranking & Reviews | Best No Annual Fee Credit Cards

AdvisoryHQ’s List of the Top 6 Best Business Credit Cards for Startups

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- Blue for Business® Credit Card

- Cash Rewards for Business MasterCard®

- Ink Cash® Business Credit Card

- Fifth Third Business Rewards Credit Card

- TD Business Solutions Visa Signature® Credit Card

- Wells Fargo Business Platinum Credit Card

Top 6 Best Business Credit Cards for Startups| Brief Comparison & Ranking

Small Business Start Up Credit Card Names | % or Low Intro APR Offer? | Intro Duration | Annual Fee |

| Blue for Business® Credit Card | 0% | 9 months | None |

| Cash Rewards for Business MasterCard® | 0% | 9 months | None |

| Ink Cash® Business Credit Card | 0% | 12 months | None |

| Fifth Third Business Rewards Credit Card | 0% | 9 months | None |

| TD Business Solutions Visa Signature® Credit Card | None offered | None offered | None |

| Wells Fargo Business Platinum Credit Card | None offered | None offered | $50 |

Table: Top 6 Best Startup Business Credit Cards | Above list is sorted alphabetically

Who Benefits from Credit Cards for Startup Business?

Unless you have a large amount of savings, credit cards for new businesses are often the best way to finance the everyday dealings of your startup company.

Obviously, your line of credit isn’t going to be large enough to help you purchase a $100,000 machine that your business needs, but it can help you get through slow business times.

People who do lots of their business online also benefit from the best business credit cards for a new business. Having a small business start up credit card can make it easy for your as a business owner to purchase needed materials from online vendors and to make any other online transactions.

Furthermore, for small business owners who are trying to run their own accounting books, business credit cards for new business with no credit also usually offer some sort of financial bookkeeping service.

Besides receiving a monthly statement that offers clear information on your expenses, the best startup business credit cards also usually offer complimentary online money management tools and a year-end account summary — which can come in handy for tax season.

Don’t Miss: Best 0 Balance Transfer Credit Cards | Ranking & Reviews | 0 APR Credit Card Balance Transfer Fee

What to Look for in the Best Small Business Credit Card for New Business

When searching for new business credit cards for startups, it is important to understand that not all of best business credit cards for startups offer the same terms and conditions. The most important feature to consider in the best business credit cards for a new business is the APR they charge for purchases.

While you may plan on paying off your balance in full each month, the financial vulnerability that comes with running your own business may leave you with an outstanding balance on the best credit card for a new business that you use. Finding new business credit cards for startups with a low APR can save your new business hundreds of dollars in interest payments.

Furthermore, if you’re not an accounting guru, you should choose business credit cards for new businesses that also offer some sort of free financial bookkeeping service.

This free perk offered by a number of the best business credit cards for a new business is an easy way to keep better control of your expenses, especially if you use the best business credit cards for startups for your everyday business purchases.

Lastly, the best new business credit cards for startups should also allow you as a business owner to have multiple cards all linked to one business account. The most successful business owners are those who find trusted employees and delegate tasks and responsibilities to them. Finding the best business credit cards for startups can help you with that task.

According to MarketWatch.com, the best business credit cards for startups should allow you to:

“issue individual cards to each employee and link them to your business account. On your billing statement, the transactions will be itemized and divided based on each employee’s individual purchases. Not only does this make it easier to view, but if any employees are big spenders you will catch it fast.”

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Business Credit Cards for New Business

Below, please find the detailed review of each credit card on our list of business credit cards for new businesses. We have highlighted some of the factors that allowed these business credit cards for new business with no credit to score so highly in our selection ranking.

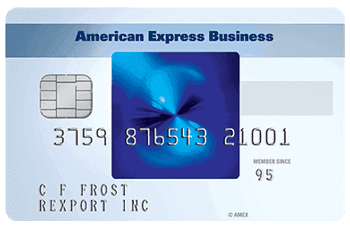

Blue for Business® Credit Card Review

The American Express Blue for Business® Credit Card is one of the top credit cards for a startup business that you can find.

With this small business start up credit card you can benefit from an introductory 0% APR for nine months. After that, your APR will still be somewhere between 11.49% and 19.49%, depending on your credit score.

Source: Blue for Business® Credit Card

Furthermore, among the best business credit cards for a new business, the American Express Blue for Business card gives you access to OPEN forum, an online community where business leaders around the country offer free advice about how to run a successful business.

Cash Rewards for Business MasterCard® Review

If you’re looking for new business credit cards for startups and also want a quality rewards program to accompany your everyday use of the card, the Bank of America Cash Rewards for Business MasterCard® is a great option.

Among the best business credit cards for startups, the Bank of America card comes with one of the best rewards programs in the industry. You can earn up to 3% cash back on business purchases at gas stations or office supply stores. If your small business requires lots of driving hours, you can earn major cash back by using this best credit card for a new business.

Furthermore, you can also earn a $200 statement credit offer by making $500 of purchases in the first 60 days of having the card. This is one of the top bonuses offered by new business credit cards for startups. Furthermore, this best small business credit card for a new business comes with no annual fee and an introductory 0% APR for nine months.

Popular Article: Best Credit Cards to Have | Guide | What is the Best Easy to Get Credit Card to Apply For?

Ink Cash® Business Credit Card Review

Chase Ink Cash® Business Credit Card is another of the best business credit cards for a new business. You can earn 5% cash back on the first $25,000 spent on purchases for cell phone, landline, internet, and cable TV services. For a new business, you’re effectively getting a 5% discount on your office expenses when you choose this best small business credit card for a new business.

Source: Chase Ink Cash® Business Credit Card

Furthermore, among the best business credit cards for startups, the Chase Ink Cash card offers you employee cards at no additional cost, zero annual fee, and an introductory 0% APR for 12 months. For starter business credit cards, the duration of the introductory APR is longer than other competitors.

Fifth Third Business Rewards Credit Card Review

The Fifth Third Business Credit Card is another of the best business credit cards for a new business. With this best small business credit card for a new business, you also will benefit from a quality rewards program, no annual fee, an introductory 0% APR for nine months, and a regular APR between 11.24% and 22.24%.

Source: Fifth Third Business Credit Card

Furthermore, this is one of the few new business credit cards for startups that also offers you free employee credit cards and other money management tools that will help you better keep track of your business’s cash flow.

TD Business Solutions Visa Signature® Credit Card Review

TD Bank may not be the most well-known bank on the market, but they also offer one of the best business credit cards for a new business.

The TD Business Solutions Visa Signature® credit card has no annual fee and also has a 0% introductory APR for balance transfers. If you want to switch to a lower APR credit card without paying a high transfer balance fee, this best small business credit card for a new business is for you.

Source: TD Business Solutions Visa Signature®

While the rewards program with this best small business credit card for a new business only offers 1 point for every dollar spent, there is no cap on the rewards you can earn. While other new business credit cards for startups offer more points per dollar spent, they often cap the rewards at a certain dollar amount.

If you spend thousands of dollars every month in business expenses, this best small business credit card for a new business will earn you quality rewards no matter how much you spend.

Read More: Best Credit Cards for People with No Credit History | Ranking and Reviews

Free Wealth & Finance Software - Get Yours Now ►

Wells Fargo Business Platinum Credit Card Review

Among the best business credit cards for startups, the Wells Fargo Business Platinum credit card is another quality option. Many credit cards for new businesses come with restrictions on the number of free employee cards. This best small business credit card for a new business, however, allows you to have up to 99 employee cards for no extra fee.

Furthermore, there is no foreign transaction fee on this card, which makes it a great choice for people whose business takes them outside of the United States often. You can also get free spending reports with this best business credit card for a new business and enjoy online banking and bill pay options.

Conclusion – Top 6 New Business Credit Cards for Startups

Finding the best business credit cards for startups is an important part of any business venture. If you’re having trouble getting a loan from the bank and need quick access to a revolving credit line that you can control, new business credit cards for startups are a great option for you and your business.

Furthermore, since so many different best business credit cards for startups also offer quality perks and rewards programs, your business can benefit from free cash back as well.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.