2017 RANKING & REVIEWS

TOP RANKING BEST CARD READERS

Finding the Best Card Readers

Once, cash was king. For a very long time cash was the most common way for merchants and customers to conduct their business.

But, in the past few decades a new king has arrived: the credit card. Credit card processing is much more technical than what was once an exchange of a few bills or coins.

Award Emblem: Top 6 Best Card Readers

In order for a business to accept credit cards, particular pieces of hardware are necessary.

To stay competitive today, a business of any size is likely to need the best card reader possible. There are a variety of card readers available, but finding the right one can be tricky. Many people are often faced with questions like:

- Do all card readers accept the same kinds of cards?

- How much does it cost to maintain a card reader?

- What kinds of features can I expect?

To answer these questions and more, the following reviews will lay out the best card readers for inspection. These options offer a wide range of rates, services, and features. Armed with the best information, you can weigh the needs of your business and choose from the best card readers available.

See Also: Top Credit Card Sign-Up Bonus Offers | Ranking | Best Sign-Up Bonus Credit Cards Reviews

AdvisoryHQ’s List of the Top 6 Best Card Readers

List is sorted alphabetically (click any of the best card reader names below to go directly to the detailed review section for that card card reader):

Image Source: Pixabay

Top 6 Best Card Readers | Brief Comparison & Ranking

Card Reader Names | Monthly Fee | Free Card Reader Option | Rates |

| Capital One® Spark Pay® | Pro plan $19.00Go Plan $0 | Yes | Pro plan between 1.99% and 2.80%. Go Plan between 2.65% and 3.70%; $0.05 per transaction |

| cartwheel register® | None | No | 2.6% and $0.24 per transaction |

| Moolah | $14.95 | Yes | 2.79% and $0.29 per transaction |

| Pay Pal Here | None | Yes | 2.7% per U.S.-based transaction |

| QuickBooks GoPayment | Pay-as-you-go plan $0 Monthly plan $19.95 | Yes | Pay-as-you-go plan 2.40% per swipe/dip, 3.40% per keyed transaction. Monthly Plan-1.6% per swipe/dip, 3.2% per keyed transaction. Additional $0.25 per transaction of any kind |

| Square | None | Yes | 2.75% per swipe, dip, or tap and 3.5% and $0.15 per keyed transaction |

How Do Card Readers Work?

A card reader is a device used to transfer a cardholder’s information to a data processor. This allows funds to be pulled from the cardholder’s account and transferred to the merchant.

Traditionally, a card reader needs to be connected to the internet or a phone line to send this data, but often a mobile device or computer can be substituted.

What Is a Merchant Account?

Merchant accounts are used to move funds from a customer’s credit card account to a business. Merchant accounts are often held by processing companies or banks. These institutions will use the merchant account to hold funds on behalf of the business owner and deposit them into the business owner’s account upon request.

What Kinds of Cards Can a Card Reader Process?

Several different kinds of credit cards are used by customers. Traditional cards with magnetic strips must be swiped through a card reader in order to be read. Newer cards with chip technology have more complex encryption and must be dipped or inserted into the reader.

Some credit cards are contactless and only need to be tapped on or waved in front of the machine. Finally, some customers choose to use mobile payment applications like Apple Pay that do not require a card at all.

For these, customers must wave or tap their smart phone before the processor in order for payment information to be accessed.

What Is a POS system?

A POS, or point-of-sale, system refers to a fully functional, stationary check-out terminal. This often involves a card reader, cash drawer, receipt printer, and monitor of some kind. In contrast, a reader is simply the machine that collects credit card information.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Don’t Miss: Top Chase Credit Cards | Ranking | Compare Best JPMorgan Chase Offers and Rewards

Detailed Review – Top Ranking Best Card Readers

Below, please find the detailed review of each card on our list of best card readers. We have highlighted some of the factors that allowed these payment card readers to score so highly in our selection ranking.

Capital One® Spark Pay® Review

Capital One® Spark Pay® offers customers a great solution for all of their magnetic card reader needs. Customers are offered a free card reader and supportive app when they sign up for an account with no monthly obligation. Business owners can choose from a variety of plans and reader options to fit their needs.

The Pro Plan costs $19.00 a month and $0.05 per transaction. Business owners will be charged different transaction fees depending on the type of card used:

- 1.99%-Visa

- 1.99%-Master Card

- 1.99%-Discover

- 2.80%-American Express

- 2.80%-keyed transactions

The Go Plan is slightly more flexible and costs $0 a month with a $0.05 charge per transaction. Though there is no monthly fee for this payment card reader plan, business owners will have slightly higher transaction fees:

- 2.65%-Visa

- 2.65%-Mastercard

- 2.65%-Discover

- 3.70%-American Express

- 3.70%-keyed transactions

Features

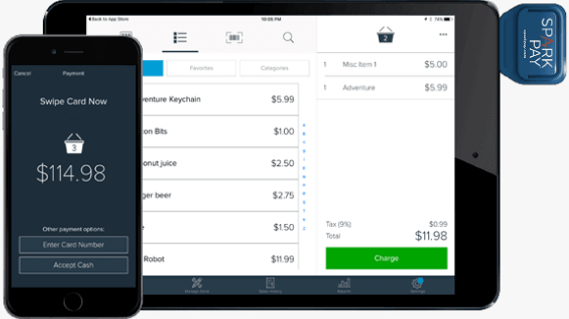

Both payment card reader plans include a free Spark Pay mobile reader. This free card reader can turn a smart phone or tablet into a portable card reader.

Business owners can simply download the app, plug in the reader, and start accepting payments through their new swipe card reader.

Image Source: Spark Pay

Business owners can also choose from a variety of more complex payment card readers. Customers can build a digital register that includes a card reader, cash drawer, and receipt printer to create a fully functional point-of-sale system.

Business owners can also purchase magnetic card reader payment terminals. These are capable of accepting a range of payment options like cards, Apple Pay, or Google Wallet. Register and card reader prices range from $99-$1,099.

These plans all include online support. This support allows business owners to monitor the flow of their business, track payment activity, and monitor their account.

Business owners can also customize the receipts generated from magnetic card reader transactions for better brand identity.

In early December 2017, Capital One shared the difficult business decision to end the brand’s Spark Pay payment card processing product suite as of January 31, 2018. As such, customers are no longer able to accept credit or debit payments through Spark Pay Mobile, Payment Terminal and Virtual Terminal solutions.

cartwheel register® Review

cartwheel register® is an app that turns any smart phone or tablet into a portable card reader. This app allows business owners to use the smart phone or tablet camera to scan any major credit card and accept payments easily.

This register system does not include any hardware or external magnetic card reader.

Image Source: cartwheel register

This credit, debit, or bank card reader system has a universal fee for all transactions of 2.6% and $0.24 per transaction. Business owners will pay the same amount regardless of the kind of card being scanned. There is no monthly fee or obligation with this system.

Features

As an app, this card reader for phones or tablets comes equipped with a number of useful features. This card reader system can act as a merchandise scanner. It records transactions and the movement of merchandise to help business owners keep track of inventory and sales averages.

This portable card reader system can also sync with a Quickbooks Online account to help track sales. Business owners can choose to receive daily and monthly sales analysis emails and can easily track their averages.

This is more than a magnetic card reader system. This register can accept and record cash payments and refund partial or entire transactions. Because this system records each transaction, business owners can access their entire sales history and can access email receipts for all past sales.

Related: Chase vs. Capital One Secured Credit Card Review | Which Card Is Best? Secured Card Reviews

Moolah Review

Moolah is a swipe card reader and processor service that provides businesses with the support needed to easily accept customers’ payments.

Each account includes a free card reader and a magnetic card reader support system.

The support system and card reader price is $14.95 a month plus 2.79% and $0.29 per transaction. This card reader price is universal no matter which kinds of cards are being processed. Special pricing is available for businesses that process more than $50,000 each month.

Image Source: Moolah

Features

The Moolah magnetic card reader works with mobile devices like smartphones or tablets to turn them into portable card readers. Business owners are also able to process in-app payments like Apple Pay through their Moolah account.

The Moolah magnetic card reader system has a number of great features, like:

- A merchant account for each business

- Quick two-day funding

- No termination or setup fees

- An Authorize.net Gateway

- 24/7 support

- Able to work with a number of third-party systems

- Syncs with existing QuickBooks accounts

This swipe card reader system also offers a free point-of-sale app for retail and restaurant use. This app allows business owners to scan barcodes , process both cash and credit payments, and choose from print or email receipts.

Pay Pal Here Review

Pay Pal Here offers business owners credit and debit card reader devices for the price of 2.7% for each U.S.-based transaction. Additionally, card reader prices for keyed transactions are 3.5% and $0.15, 2.9% and $0.30 to invoice, and 1% for cross-border transfers.

Business owners can choose from two credit or bank card readers. The first is the mobile card reader, which connects to a smartphone or tablet to create a magnetic card reader. Business owners will receive their first mobile card reader for free but will be charged $14.99 for each additional reader.

The second swipe card reader available is the Chip Card Reader. This can process swipes, insertions, contactless cards, and Apple Pay. This swipe card reader can connect to a smartphone or tablet through a Bluetooth signal and costs $149.00.

Image Source: Pay Pal

Image Source: Pay Pal

Features

Both swipe card reader options can accept Visa, MasterCard, American Express, and Discover. Both swipe card readers can also be synced with the Pay Pal Here app. The app offers additional services like features to assist with inventory management and sales reports.

Business owners can also use the systems provided with the swipe card readers to send invoices or record cash and check transactions. Business owners can also enjoy added freedom with:

- No contract or commitment

- No monthly payment

- No set-up or cancellation fees

Popular Article: Finding the Best Reloadable Debit Cards with No Fees | Guide

QuickBooks GoPayment Review

QuickBooks GoPayment offers business owners two payment plans for their card swipe reader system. The pay-as-you-go plan costs $0 a month. However, business owners will be charged 2.40% for every swiped or dipped transaction, 3.40% for every keyed transaction, and an additional $0.25 for every transaction.

Business owners can also choose the monthly plan. This option charges $19.95 a month for the card swipe reader services. Business owners must also pay a slightly lower 1.6% for each swiped or dipped transaction, 3.2% for each keyed transaction, and an extra $0.25 per transaction of any kind.

Both plans offer customers a free card swipe reader that can be connected to mobile devices like a smartphone or tablet. This card swipe reader works through an app that is available for iPhone, iPad, or Android devices and can accept credit and debit cards of any kind.

Features

This credit and debit card reader system can record all card, cash, and check transactions. It can then sync the magnetic card reader information to a QuickBooks account to make business management simple.

This debit card reader system offers business owners the option to process transactions through photos of customer credit card information. Customers can also sign for their transactions directly on the mobile device being used and it will be recorded by the GoPayment app.

Receipts for credit or bank card reader transactions can be sent through email or text. Business owners have the added option to customize their receipts to include special information or company logos.

This system is more than just a card reader for phones or tablets. This credit or debit card reader system is compatible with Intuit Point of Sale products. Business owners can purchase customizable iPad or desktop register systems for a more traditional point-of-sale counter top set up.

Free Wealth & Finance Software - Get Yours Now ►

Square Review

Square offers business owners a free card reader and access to the Square Register app with each account. This option has no monthly fee but charges 2.75% for each swipe, dip, or tap transaction. Business owners will also be charged 3.5% and $0.15 for each keyed in transaction.

Features

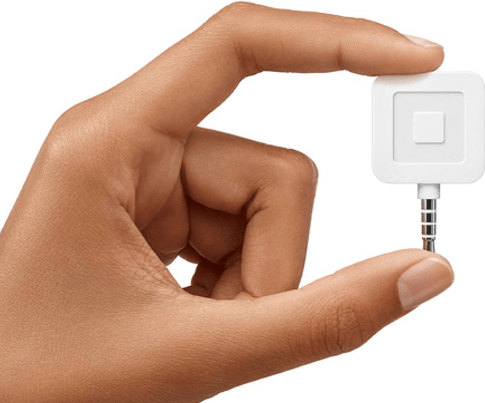

This is a card reader for phones or tablets and can connect directly with iOS or Android devices through the headset jack. This card reader for phones or tablets is able to process cards, cash, checks, and gift cards with the help of the free app and does not require an internet connection to function.

Image Source: Square

The processing app records all transactions and can offer business owners sale reports and analysis, as well as inventory records. When paired with a printer, it can produce either printed or digital receipts. This app also enables customers to sign for their purchase directly on the mobile device being used.

This card reader for phones or tablets offers a number of attractive features, like:

- Uniform fees for all major cards

- Funds deposited in one or two business days

- Instant deposits available

- Chargeback protection

- Payment dispute assistance

Along with this portable card reader, business owners can also purchase the Square contactless chip reader to process both Apple Pay and chip cards for $49. Businesses in need of a more traditional top-of-counter register option can also purchase a Square Stand for $99.

Read More: Capital One vs Citi® Secured MasterCard® | Comparison, Reviews, and Tools | Tips

Conclusion- Top 6 Best Card Readers

Each of the best card readers is designed to help businesses and business owners in a slightly different way.

Because every business offers their customers something unique, each will have different needs as far as credit card processing is concerned. Though some payment card readers will be more helpful than others, each offers something beneficial to the right client.

To find the best card readers for your business needs, keep in mind the highlights from our comparison:

- Capital One® Spark Pay®: Point-of-sale register and swipe card reader options

- cartwheel register®: No external swipe card reader

- Moolah: Uniform pricing

- Pay Pal Here: Multiple swipe card reader options

- QuickBooks GoPayment: Multiple payment plans and lowest pay-as-you-go percentages

- Square: Does not require constant internet connection

To choose the most useful credit or bank card reader for your business, it is crucial to consider your business needs.

For example, a small retail establishment might not benefit from a system built to accommodate tips, and a business that deals with a high volume of cash and card payments will need a system that can help with that need. With the information provided in our comparison, you can weigh the best aspects of each option against their potential drawbacks to find the best card readers for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.