2017 RANKING & REVIEWS

WHAT’S A CHARGE CARD AND THE BEST CHARGE CARDS?

Intro: What Are the Differences Between Charge Cards and Credit Cards?

Sometimes the phrases credit card and charge card are used interchangeably; in reality, there are key differences between charge cards and credit cards.

These differences often leave consumers wondering whether a charge card or credit card is right for their needs. Many consumers are still wondering, “What’s a charge card?”

Before delving into the specifics of the best charge cards for individuals and the best business charge cards, it can be helpful to have a general understanding of the significant differences between each to start the explanation of just what’s a charge card.

Award Emblem: Top 6 Best Charge Cards & Best Business Charge Cards

To begin, the primary difference between a charge card and a credit card is the fact that the charge card has no limit. While this can seem like a great benefit of a charge card, the other difference between a charge card and a credit card is that a charge card’s balance has to be paid at the end of each month or billing cycle.

If the cardholder doesn’t pay the charge card balance as agreed, there is a significant penalty charged, which would be quite a bit higher than the annual interest rate for a credit card.

The following ranking of the best charge cards for consumers and the best business charge cards not only covers the top six specific cards; it also provides more information about the features of personal charge cards and business charge cards to help people make the most informed possible decision.

It should be noted that while this review doesn’t include store charge cards, these are also a popular category for many consumers. A store charge card will typically give the cardholder an opportunity to earn rewards for spending at the store, as long as they pay their balance in full each month.

See Also: Top Best Credit Cards with No Balance Transfer Fee (15–21 Months with Zero Balance Fees)

AdvisoryHQ’s List of the Top 6 Best Charge Cards and Best Business Charge Cards

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- American Express® Gold Card

- American Express® Green Card

- Platinum Card® from American Express

- Premier Rewards Gold Card from American Express

- The Enhanced Business Platinum Card® From American Express OPEN

- The Plum Card® from American Express OPEN

Top 6 Charge Cards| Brief Comparison

Credit Card Name | Introductory Rewards Bonus | Annual Fee | Intro Annual Fee |

| American Express® Gold Card | 25,000 points with $1,000 spending in the first three months | $160 | $0 (1st Year) |

| American Express® Green Card | 25,000 points with $1,000 in spending in the first three months | $95 | $0 (1st Year) |

| Platinum Card® from American Express | 75,000 points with $5,000 in spending in the first three months | $450 | $0 (1st Year) |

| Premier Rewards Gold Card from American Express | 50,000 points with $2,000 in spending in the first three months | $195 | $0 (1st Year) |

| The Enhanced Business Platinum Card® From American Express OPEN | 100,000 points with $15,000 in spending in the first three months | $450 | No Offer |

| The Plum Card® from American Express OPEN | $200 statement credit with $10,000 in spending in the first three months | $250 | $0 (1st Year) |

Table: Top 6 Best Charge Cards | Above list is sorted alphabetically

What Are the Benefits of a Charge Card?

Many consumers wonder what the benefits of a charge card are once they have an understand of what’s a charge card. They also wonder whether or not a charge credit card is the right option for them.

One of the biggest benefits of a charge card over a traditional credit card is the fact that there is no limit. This can be good for consumers who spend a lot of money each month or make big purchases with their charge card.

The fact that they have no limit is also one of the primary reasons business charge cards can be so advantageous for companies. They offer a lot of flexibility regarding cash flow and spending power, which is something many companies are looking for when they choose charge credit cards.

Though charge cards have no limit, that doesn’t necessarily mean the charge card credit card offers completely unlimited spending. Instead, the amount the consumer or business can spend evolves based on the card company’s perception of how much they’re able to pay back. For example, with business charge cards, the company might be able to spend more one month, but if they have issues in paying off the balance that month, their spending power might be decreased.

Another one of the chief benefits of a charge card that you will learn about when exploring what’s a charge card is the fact there is no interest since the balance of charge credit cards is paid off each month.

Finally, when comparing a charge card or a credit card, you should note that there are some specific benefits of a charge card, like its enticing rewards offers. Typically, the rewards programs available from the best business charge cards and consumer charge cards are provided at a higher level than what’s seen with regular credit cards.

Are There Disadvantages to a Charge Credit Card?

After seeing the benefits of a charge card and the advantages of the best business charge cards, you may be wondering whether or not there are any downsides to charge cards. The short answer is yes, there can be, but these really depend on the consumer.

Whether it’s store charge cards, business charge cards, or just a regular consumer charge card, if the balance isn’t paid off at the end of each month or billing cycle, there can be a very high late-payment fee. It’s somewhat similar to a bank overdraft fee, and if you’re consistently not making payments on time or in full, this can add up to be a lot of money each year.

While there can be a lot of flexibility regarding usage or spending with store charge cards, business charge cards, and regular charge cards, there isn’t so much flexibility when it comes to payment options.

If you’ve spent a lot in a month, you need to be prepared to then write a big check to pay that amount off. Charge cards are designed to help consumers avoid revolving debt, but this only works if you really do have the capability to pay off your balance.

Also, the best business charge cards and consumer charge cards tend to have higher annual fees than regular credit cards. This is often because they also offer some of the most high-level perks and rewards that you’ll see when you compare a charge card or credit card.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Charge Cards and Best Business Charge Cards

Below, please find the detailed review of each card on our list of charge credit cards. We have highlighted some of the factors that allowed these best charge cards to score so well in our selection ranking.

American Express® Gold Card Review

The American Express® Gold Card is a rewards charge card designed to offer special bonus points for signing up and spending a certain amount of money. It is a charge card designed for consumers who want simplicity and to earn travel rewards. Rewards accumulate quickly with this charge card credit card, and rewards are perfect for people who frequently fly or stay in hotels.

In addition to the opportunity to earn rewards, this charge card credit card also features other travel rewards, shopping, and entertainment benefits, and like the other charge cards on this list, it features excellent customer service from American Express.

Source: American Express® Gold Card

Key Factors That Led to Our Ranking of This as One of the Best Charge Cards

Detailed below are specifics of why the American Express® Gold Card is ranked as one of the best charge cards.

Introductory Offers

While you can compare the difference between a charge card and a credit card, there are also similarities. One of the similarities you’ll see between charge cards and credit cards is the regular offering of introductory promotions.

The American Express® Gold Card offers excellent introductory promotions for new cardholders. To begin, new cardholders get 25,000 bonus points when they spend $1,000 on purchases on their new card in the first three months after they open the account.

Also, there is a $0 introductory annual fee for the first year of Card Membership. That then increases to $160 a year after the first year.

Points

The American Express® Gold Card is a rewards card that’s specifically designed for frequent travelers. When answering the question of “what is a charge card?” we mentioned the rewards component of charge cards, and this is an excellent example of a card with a premier rewards program.

To begin, this charge credit card lets cardholders earn rewards quickly. They can earn 2x points on flights booked directly with airlines and at U.S. restaurants. They earn 1x points on other purchases.

Cardholders also get 2x Membership Rewards points for every eligible dollar spent, as well as a $75 hotel credit they can spend when they book two consecutive nights at a participating hotel.

Membership Rewards can be used for anything from travel to gift cards, merchandise or entertainment. Points can also be transferred to eligible American Express frequent traveler programs.

Travel Services

When you’re answering the question of what is a charge card, there are similarities in features between all charge cards, but there are differences as well. One of the ways the American Express® Gold Card is distinctive from many other best charge cards is the fact that it’s a card for travelers. In addition to rewards points that can be redeemed for travel, the card includes the following travel-related benefits:

- No foreign transaction fees on purchases made outside the U.S.

- Personalized Travel Service so cardholders can book flights, hotel arrangements, and more over-the-phone

- Global Assist Hotline is available to cardholders who travel more than 100 miles from home, offering constant access to medical, financial, legal and other assistance and emergency services

- Baggage Insurance Plan

- Car Loss and Damage Insurance

- Membership Rewards Pay with Points

Shopping and Entertainment Benefits

American Express charge cards are known for offering some of the best benefits of a charge card. The American Express® Gold Card has excellent travel benefits, as well as shopping and entertainment benefits.

For example, with Amex Offers, cardholders have the opportunity to save on shopping, travel, dining, and more. There’s the Return Protection feature, which provides refunds from American Express on eligible items within 90 days of the date of purchase.

Shoprunner is an American Express exclusive that includes free 2-day shipping on certain purchases at more than 140 online retailers.

American Express® Green Card Review

The American Express® Green Card is one of the best charge cards on this ranking in terms of being an everyday spending card. Many of the cards on this list of charge credit card options are aimed at businesses or perhaps people making very large purchases, but this card tends to be a more flexible day-to-day charge card.

Among charge card credit cards, the American Express® Green Card features an excellent rewards program that is straightforward yet valuable, has bonus introductory offers, and as with other charge credit cards, has no interest rate or penalties if the balance is paid off each month.

Key Factors That Led to Our Ranking of This as One of the Best Charge Cards

Specifics of why the American Express® Green Card is included in this charge card ranking of the best charge cards and the best business charge cards are detailed below.

Competitive Annual Fee

When covering the details of what is a charge card above, the fact that charge cards often have high annual fees was mentioned. Many benefits of a charge card tend to offset this annual fee in the eyes of cardholders and businesses, but nonetheless, charge credit cards aren’t ideal if you want to avoid an annual fee.

However, while the American Express® Green Card does have an annual fee, it has one of the lowest of any other charge card.

There is a $0 introductory annual fee for the first year of Card Membership, and then the annual fee is only $95, which is actually significantly lower than some of the other names on this ranking of charge cards.

Points

The American Express® Green Card is a rewards charge card, so cardholders have the opportunity to earn rewards points simply for making routine purchases. A key difference between a charge card and a credit card is that charge cards often offer the chance to earn rewards at a faster rate, which is the case with this card.

Cardholders earn double Membership Rewards Points at amextravel.com. They also earn 1x points for every eligible dollar spent.

Membership Rewards Points can be used to pay for travel including all or part of a flight, hotel, vacation package, or cruise booking when it’s booked with American Express Travel. Rewards points can also be used toward dining, shopping, and merchandise, they’re unlimited, and they don’t expire.

Bonus Points

Another difference between a charge card and a credit card that should be highlighted is the fact that in addition to benefits like double points earning opportunities on certain spending, many charge cards also feature some of the best opportunities to earn bonus points when opening a new account.

With this particular card, for opening a new account, members receive a current special offer of 25,000 points after spending only $1,000 on purchases with the new card in the first three months.

This is in addition to the special introductory $0 annual fee for the first year.

Shopping Benefits

American Express isn’t just known as the leading provider of the best charge cards and business charge cards. It’s also a company that’s known for the provision of some of the leading services and cardholder benefits.

With many of their cards, including their charge credit cards, there is the opportunity to take advantage of exclusive benefits.

For example, with the American Express® Green Card, cardholders get features like Purchase Protection. With Purchase Protection, if something breaks or is stolen and was purchased with the card, American Express will provide additional protection for up to 90 days after the purchase date.

There are also other benefits such as access to exclusive Amex Offers, extended warranty protection, and return protection.

Popular Article: Top Best Credit Cards for Very Bad Credit | Ranking | Cards for Damaged, Horrible, and Really Bad Credit Histories

Platinum Card® from American Express Review

Of all the charge cards offered from American Express, the Platinum Card® from American Express is perhaps one of the most well-known, and it offers some of the most luxurious perks and benefits, although it does have a high annual fee. This card provides an excellent opportunity to earn high levels of points and travel rewards, and many exclusive travel perks come along with Card Membership as well.

When deciding between a charge card or credit card, it can be valuable for consumers to look at a card like the Platinum Card® from American Express with its many member perks that aren’t available with any type of conventional credit card. There are so many high-end benefits that come with this card, that only a very few can even be covered in this review.

Source: Platinum Card® from American Express

Key Factors That Led to Our Ranking of This as One of the Best Charge Cards

The Platinum Card® from American Express is included in this list of leading charge credit card options, for reasons like the ones listed below.

Points

When you’re looking at the difference between a charge card and a credit card, or trying to decide between a charge card or credit card, and rewards are your primary focus, the Platinum Card® from American Express can be an outstanding option. This charge credit card features the opportunity to earn bonus points for spending $5,000 on purchases on the card in the first three months after opening the account.

Also, cardholders earn 5x points for flights booked directly with airlines or with American Express Travel.

Cardholders with this charge credit card earn 1x Membership Rewards points for every eligible dollar they spend, and then 2x Membership Rewards points for every dollar of eligible purchases made when booking using an enrolled American Express Card on the American Express Travel website.

Points can be used toward travel experiences, as well as retail, dining, and entertainment purchases.

Airport Benefits

As mentioned, among the benefits of a charge card, the Platinum Card® from American Express features some of the best.

For example, cardholders can go to The Centurion Lounge in certain airports. This airport lounge provides a premium luxury experience with workspaces, locally-inspired fine dining, high-speed Wi-Fi, and unparalleled service. It’s all complimentary for Platinum Card Members.

In addition to The Centurion Lounge, cardholders also get complimentary access to more than 1,000 airport lounges around the world.

Cardholders get up to $200 a year in statement credits when they fly with qualifying airlines, and when a cardholder receives their Global Entry or TSA Pre-Check credential, they get credit for the application fees on their card statement.

Starwood Preferred Guest Gold

Platinum cardholders can upgrade to Starwood Preferred Guest Gold Status without meeting stay requirements, and they receive all the benefits of a Preferred Guest with other enhancements.

Some of these enhancements include the earning of 3 Starpoints for every eligible U.S. dollar spent, which is a 50% bonus over base-level membership. Also included are enhanced rooms, late checkouts, gifts at check-in, and more.

Cardholders also get Hilton HHonors Gold Status, which includes benefits at more than 4,700 hotels and resorts that are part of the Hilton Brand. Cardholders with the Platinum card also earn reward stays faster with their Hilton HHonors Bonus Points.

Shopping and Convenience Benefits

As mentioned, this is one of the best charge cards because of the sheer number of perks and benefits it comes with. In addition to fantastic travel opportunities provided by this card, there are also shopping advantages and conveniences. Some of these include:

- Platinum Concierge: With Platinum-level Concierge service from American Express, cardholders get complimentary assistance for everything, whether they need to make special reservations, get tickets to an event or show, or find the ideal gift.

- By Invitation Only: By Invitation Only experiences are an exclusive offering available to cardholders that give them unique access to customized, once-in-a-lifetime events.

- Platinum Dining Program: This program provides the opportunity to get reservations at more than 1,000 of the best restaurants in the world.

- Preferred Seating: With this option, cardholders with this charge credit card get access to some of the most in-demand concerts, entertainment events, and sporting events.

Premier Rewards Gold Card from American Express Review

The Premier Rewards Gold Card from American Express is a card that features, like other charge credit card options, no predefined interest charges since the balance is paid in full each month. It also includes an introductory annual fee special rate, and the opportunity to earn rewards points.

The card is great if you spend money on airfare, as well as restaurants, gas stations, and supermarkets in the U.S., because of how the rewards program is structured. There are also various opportunities to get perks like airline fee credits with this charge credit card.

Source: Premier Rewards Gold Card from American Express

Key Factors That Led to Our Ranking of This as One of the Best Charge Cards

When looking at the benefits of a charge card and comparing charge cards, the following are some reasons the Premier Rewards Gold Card is part of this ranking of the best charge cards and best business charge cards.

Points

There are a couple of groups of people this particular charge credit card might appeal to most. The first would be frequent travelers because the card includes trip points earnings on airfare purchased directly from airlines.

At the same time, this charge card is unique and stands out among the best charge cards and the best business charge cards because it features double points on everyday spending categories. These categories include U.S. restaurants, gas stations, and supermarkets. If these are areas you most frequently spend in, you may find this card is an excellent rewards charge credit card.

Then, in addition, there are 1x points earned on other purchases.

The Membership Rewards Points can be used for more than 500 top worldwide brands in categories including travel, entertainment, merchandise, and gift cards.

Bonus Points

Most of the charge credit cards on this ranking offer bonus points simply for opening a new account. The Premier Rewards Gold Card is no exception.

When a cardholder opens an account and spends just $2,000 on purchases on the card in the first three months, they receive a special promotional 50,000 points.

This is in addition to the introductory annual fee, which is $0 for the first year of membership, and then $195 after that.

Travel Benefits

When introducing the concept of the difference between a charge card and a credit card and answering the question of “what is a charge card?” at the beginning of this review, one of the things mentioned was the fact that charge cards can be great for people who travel often.

Typically, the best charge cards offer rewards programs specifically tailored to the needs of travelers, and this is true of the Premier Rewards Gold Card.

Travel benefits available with this charge credit card include:

- Up to $100 per calendar year in statement credits when incidental fees including baggage fees are charged to the Premier Rewards Gold Card account

- $75 hotel credit to spend on qualifying resorts and hotels when booking a stay of at least two consecutive nights at a participating property

- Personalized Travel Service can be used to book flights around the world, arrange hotel stays, schedule ground transportation, and more

- No foreign transaction fees

Entertainment Benefits

Having almost any American Express charge card comes with some exclusive opportunities in terms of shopping, travel, and events. This holds true with the Premier Rewards Gold Card.

For example, in addition to shopping benefits such as extended warranties and return protection on items purchased with the card, cardholders also gain exclusive access to Amex Offers. Amex Offers are discounts on shopping, travel, dining, and more.

The card also features entertainment access, including ticket presales and Card Member-only event access.

There’s also the Preferred Seating program, which gives cardholders access to the best seats for a range of events, based on availability.

The Enhanced Business Platinum Card® Review

The Enhanced Business Platinum Card® is one of the best business charge cards available from American Express. It’s full of features, offers excellent opportunities to earn high levels of points on business and airline purchases, and there are also promotional and bonus offers available with this leader among business charge cards.

This card is excellent for businesses that include frequent travelers who want access to global airport lounges and concierge service and any company searching for the best business charge cards for perks like internet access. This particular leader among business charge cards is from American Express OPEN, so this carries specific business-related benefits as well.

Key Factors That Led to Our Ranking of This as One of the Best Business Charge Cards

The Enhanced Business Platinum Card® is ranked as one of the best business charge cards for the reasons listed below, among others.

Limited Time Offer

This particular charge credit card from American Express OPEN frequently includes limited time promotional offers. For example, right now, this charge credit card features an excellent opportunity to earn up to 100,000 Membership Rewards points. Cardholders can first earn 50,000 Membership Rewards points after spending $5,000 on their new card.

They can then earn an extra 50,000 points for spending an additional $10,000 on all qualifying purchases within the first three months of card membership.

This specific offer expires at the end of January 2017, but this leader among the best business charge cards often includes similar opportunities.

Source: Enhanced Business Platinum Card®

Membership Rewards

Before exploring the specific benefits of the Enhanced Business Platinum Card®, one of the best business charge cards, it should be noted that it does have the highest annual fee on this ranking at $450; however, for businesses with a lot of spending and travel expenses, it tends to more than pay for itself.

That aside, the Membership Rewards program that is affiliated with this charge credit card includes double points for each dollar of eligible purchases made when booking on the American Express Travel website.

It includes 1.5x Points per dollar on qualifying purchases of $5,000 or more and up to 1 million additional points per year.

Finally, this leader among business charge cards then features 1x points for all other eligible purchases. This card lets businesses get 50% more points on large qualifying purchases.

Membership Rewards Pay with Points can then be used to cover all or part of eligible airline fares including first and business class tickets.

Premium Travel Benefits

As one of the best business charge cards, the Enhanced Business Platinum Card® features premium travel benefits to cardholders. Some of the many premium travel benefits include:

- Members have complimentary access to The Lounge Collection, which is a network of more than 1,000 luxury airport lounges around the world, including The Centurion Lounge network, Delta Sky Club, Priority Pass Select Lounges, and more.

- An annual $200 airline fee credit can be given in the form of statement credits when incidentals are charged to the card

- No foreign transaction fees

- When members use their Membership Rewards Pay with Points program to cover all or part of their fare, they get 50% of those points back on eligible fares

- Gogo and Boingo Internet access on airlines and at more than one million hotspots

- Free credit for Global Entry or TSA Pre-Check

- Gold Status in the Starwood Preferred Guest program without any stay requirements

- Business Platinum Travel Service

OPEN Benefits

In addition to the benefits listed above, this charge credit card also includes benefits that are part of the American Express OPEN program, specifically for businesses. OPEN benefits that are included with this charge card credit card include:

- RecieptMatch helps companies manage their card expenses by letting them add receipts, notes, and tags to their transactions on their desktop or mobile device

- OPEN Savings are benefits that provide extra value when making eligible business purchases

- Account Alerts will let business cardholders know when payments are due and when activity seems irregular with alerts that can be set up to monitor employee spending

- Cardholders are assigned a dedicated Account Manager who can help do things like review statements and dispute charges

- There are mobile and tablet apps for convenience

- Online statements are available, making it easy to budget, prepare reports, and create invoices

Read More: Top Best Barclays Credit Card Offers | Ranking | Reviews of Barclays Bank Cash, Travel & Other Cards

Free Wealth & Finance Software - Get Yours Now ►

The Plum Card® Review

One of the best business charge cards, The Plum Card® is different from many of the other charge card credit card names on this ranking because of its flexibility and unique payment options that can make it more convenient for businesses. This card also includes special introductory offers and a lower annual fee than some of the other business charge cards on this ranking of the best charge cards.

This charge card from American Express also includes the business-related benefits that come with the OPEN program, and there are general card membership benefits available with its usage as well. It’s a good all-around card if you’re searching for business charge cards that give you a bit more versatility and more payment options.

Key Factors That Led to Our Ranking of This as One of the Best Business Charge Cards

Among charge card credit card options, the following are specifics of why this is ranked as one of the best business charge cards.

Introductory Offers

One of the benefits of a charge card from American Express are the excellent introductory offers the cards include. With The Plum Card®, there is a $0 introductory annual fee for the first year. After that, the annual fee is $250, which is lower than what’s offered with many other business charge cards.

Also, there are regular, limited-time promotional and welcome offers available with this charge card.

For example, right now, new account holders who open this charge card credit card can earn up to $600 cash back. New cardholders receive a $200 statement credit after each $10,000 spent in purchases on the card, up to $30,000 within the first three months of Card Membership.

Early Pay Discount

The biggest difference between a charge card and a credit card, and a key consideration when selecting a charge card or credit card, is the fact that charge cards require the balance of the card be paid in full each month.

This particular card from American Express is unique because, while it is a charge credit card, it does have flexibility in the payment options available.

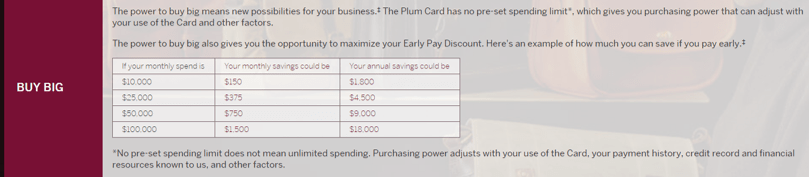

For example, one offering of this leader among business charge cards is the opportunity to take advantage of the Early Pay Discount. There is a 1.5% discount available on the portion of a balance paid within 10 days of a statement closing date, as long as the cardholder pays at least their Minimum Payment Due by the Payment Due Date.

There is no cap on the 1.5% that can be earned by paying early, and that money can be reinvested in the business.

Extra Days to Pay

When looking for the best business charge cards, business owners may be worried about what happens and the fees they may be required to pay if they’re not able to pay their balance off at the end of each month. This card is distinctive because it offers options, and as mentioned, a sense of flexibility.

When cash flow is unpredictable or hits a road bump, the Plum Card lets cardholders take up to 60 days from their statement closing date to pay in full, without having to pay interest.

This provides some of the most flexibility of any of the cards on this list of the best business charge cards and the best personal charge cards.

Spending Power

Often, businesses need a charge credit card that provides them with a high level of spending power, and credit cards with limits can be problematic. That’s a key reason business charge cards are so valuable, and that’s certainly the case with The Plum Card. The Plum Card has no pre-set spending limit.

This means cardholders have spending power that’s adjustable based on their use of the card and a range of other factors. The factors that determine how much cardholders with this charge card can spend include usage, payment history, credit record, and financial resources.

There are also great opportunities to earn a lot through the Early Pay Discount.

For example, if a business spends $50,000 on their card a month, they could save $750 a month and $9,000 a year.

Conclusion—Top 6 Best Charge Cards and Best Business Charge Cards

All of the above charge cards named on this ranking of the best charge cards are from American Express, because they are one of the only providers of these type of cards, and they also specialize in business credit cards.

Charge cards can be particularly valuable for companies with fluctuating cash flow and high purchasing power requirements. While there are business charge cards included in this ranking, there are charge credit cards named for personal use as well.

Each of the best charge cards on this list features great rewards options as well as perks and benefits that might not otherwise be available with a regular credit card.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.