2017 RANKING & REVIEWS

CITIBANK CREDIT CARD OFFERS

Find Citibank Credit Card Offers to Earn Cash or Rewards

Many of us use our credit cards everyday for the necessities. If we have to spend money on groceries, gas, and meals, why not make a little extra something in the process? The Citibank cash back credit cards and rewards cards described in this article will do just that.

AdvisoryHQ has done a comprehensive Citibank cash back credit card review and Citibank rewards credit card review to come up with 6 of the top Citibank credit card offers for 2017.

Award Emblem: Top 6 Citibank Credit Card Offers

We have looked at all of the Citibank credit card promotions and found these types of offers for you:

- Citibank travel credit card choices

- Citibank cash back credit card options

- Citibank credit card rewards offers

- Citibank rewards credit card availability for students

Each and every option will make you money or offer you great rewards. You can feel confident knowing that your Citibank rewards credit card or Citibank cash back credit card offers you nothing but the best.

See Also: Top Best 0 APR Credit Cards | Ranking | Top Credit Cards with 0 APR Offers (Reviews)

What Is Citibank All About?

Before we take a look at these top Citibank credit card offers, it is important to learn a bit about who is offering these six card options. So let’s talk about the financial services company itself. Citi offers:

- Banking

- Lending

- Investing

- Credit

- Business finances

Founded in 1812, the long history of Citi can give cardholders confidence and reassurance that their Citibank cash back credit cards and rewards cards are in responsible hands.

AdvisoryHQ’s List of the Top 6 Best Citibank Credit Card Offers

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- Citi® / AAdvantage® Platinum Select® World Elite™ MasterCard®

- Citi® Double Cash Card

- Citi Prestige® Card

- Citi ThankYou® Preferred Card

- Citi ThankYou® Preferred Card for College Students

- Costco Anywhere Visa® Card by Citi

Top 6 Best Citibank Credit Card Offers| Brief Comparison & Ranking

Credit Card Names | Annual Percentage Rate (APR) | Intro APR Offer | Annual Fee | Top Benefits |

| Citi® / AAdvantage® Platinum Select® World Elite™ MasterCard® | 14.24%–22.24% | N/A | $95 (Waived first year) | Ultimate flyer’s Citibank travel credit card |

| Citi® Double Cash Card | 13.24%–23.24% | 0% for 18 months | $0 | Top Citibank cash back credit cards |

| Citi Prestige® Card | 15.49% | N/A | $450 | High-end Citibank rewards credit card |

| Citi ThankYou® Preferred Card

| 13.24%–23.24% | 0% for 15 months | $0 | Solid Citibank rewards credit card |

| Citi ThankYou® Preferred Card for College Students | 14.24%–24.24% | 0% for 7 months | $0 | Citibank rewards credit card for students |

| Costco Anywhere Visa® Card by Citi

| 15.49% | 0% for 7 months | $0 with Costco Membership | Top Citibank cash back credit cards |

Table: Top 6 Best Citibank Cash Back Credit Cards & Rewards Cards| Above list is sorted alphabetically

Factors in Our Citibank Cash Back Credit Card Review

As we have looked through the Citibank cash back credit cards to find the best options for you, we looked for certain features in particular:

- No annual fee or minimal annual fee

- Reasonable annual percentage rates (APR)

- 0% APR introductory offers

- Ways to make more than 1% cash back

These points help assure you that your Citibank cash back credit card will actually earn you money each year instead of losing you money in fees or interest rates.

Factors in Our Citibank Rewards Credit Card Review

While we looked through the Citibank credit card rewards to find the top choices for you, we searched for certain features in particular:

- No annual fee or minimal annual fee

- Reasonable annual percentage rates (APRs)

- 0% APR introductory offers

- Ways to make more than 1 point per dollar spent

- Various ways to redeem rewards points

- A strong rewards system that could outweigh higher fees

We have found multiple Citi bank rewards credit card options that fit the bill. This way, you can focus more on earning rewards points than on paying fees.

Image Source: Pixabay.com

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Citibank Rewards Credit Card Options

Below, please find a detailed review of each credit card on our list of Citibank credit card rewards. We have highlighted some of the factors that allowed these Citi bank credit card offers to score so high in our selection ranking.

Don’t Miss: Top Capital One Credit Cards | Ranking | Compare Best Capital One Credit Card Offers & Promotions (Reviews)

Citi® / AAdvantage® Platinum Select® World Elite™ MasterCard® Review

The first top Citibank rewards credit card we will look at is the Citi® / AAdvantage® Platinum Select® World Elite™ MasterCard®. This Citibank travel credit card is the ultimate choice for frequent flyers.

Earn 2 miles for every dollar spent on American Airlines purchases and 1 mile for every other dollar. In addition, this Citi bank rewards credit card throws in first checked bag free, Group 1 boarding benefits, and 25% in-flight dining.

Furthermore, the Citibank credit card promotions for this card include 30,000 bonus miles after spending $1000 within the first 3 months.

Citibank Rewards Credit Card: The Other Highlights

- First year waived annual fee ($95 thereafter)

- No foreign transaction fee

- Chip technology enabled for global use

- Lost baggage protection

- Travel and emergency assistance

Citi® Double Cash Card Review

When it comes to Citibank cash back credit cards, you cannot beat the Citi® Double Cash Card. This Citibank cash back credit card offers an opportunity for earning cash twice.

Image Source: Citi Cards

For each dollar you spend, you will receive 1% cash back. However, as you pay for those purchases, you will receive an additional 1% cash back. This encourages spending but also wise repayment.

With no annual fee and a low APR, this Citibank cash back credit card is perfect for anybody looking to make money instead of spending money in fees or high rates.

Citibank Cash Back Credit Cards: The Other Highlights

- 0% introductory APR offer for 18 months

- No cash back caps

- No cash back category restrictions

- Chip technology enabled for global use

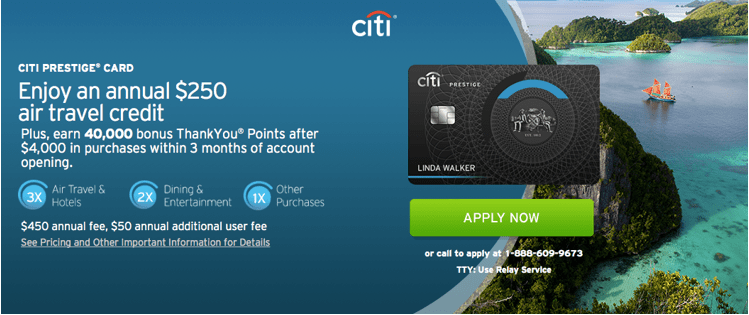

Citi Prestige® Card Review

Without a doubt, the Citi Prestige® Card has the highest fees of all the cards on our list of the best Citibank credit card offers. However, the reward payout is absolutely wonderful for frequent travelers.

Image Source: Citi Cards

This Citibank travel credit card earns 3 points on travel, 2 points on dining out or entertainment, and 1 point on all other purchases. Of course, points on this Citibank rewards credit card can be spent on travel as well as gift cards, electronics or points transfer.

Plus, the Citibank credit card promotions for this card include 40,000 bonus points, an annual $250 travel credit, a complimentary 4th night stay, complimentary access to VIP lounges, and more.

Citibank Rewards Credit Card: The Other Highlights

- No foreign transaction fee

- Global Entry or TSA Pre Application Fee Credit

- Worldwide car rental insurance

- Chip technology enabled for global use

- Lost baggage protection

- Travel and emergency assistance

Citi ThankYou® Preferred Card Review

Next on our list of the best Citibank credit card offers is the Citi ThankYou® Preferred Card. This low-fee, low-APR Citibank rewards credit card is an excellent choice for many.

Earn 2 points> on dining out or entertainment and 1 point on all other purchases. This Citi bank credit card offers many options for redeeming these points, including gift cards, travel, entertainment tickets, electronics, and more.

At 13.24%–23.24% APR, this is the lowest Citi bank rewards credit card interest rate (Double Cash is the lowest Citibank cash back credit card). This means you can easily earn more than you spend in rates/fees.

Citibank Rewards Credit Card: The Other Highlights

- 0% introductory APR offer for 15 months

- No rewards expiration or limit

- Chip technology enabled for global use

Popular Article: Top Best Credit Cards for Miles | Ranking | Best Miles Credit Card Reviews

Citi ThankYou® Preferred Card for College Students Review

What about a Citibank rewards credit card that appeals to students and those with no credit or bad credit? The Citi ThankYou® Preferred Card for College Students is the perfect option for those categories.

Just like the regular Citi ThankYou® Preferred Card, you earn 2 points for dining and entertainment and 1 point on everything else. However, the Citibank credit card promotions for this card include 2500 bonus points after spending $500 in the first 3 months.

The APR is a little higher, but these Citibank credit card rewards give students with no credit the opportunity to build their score – and earn a little extra along the way.

Citibank Rewards Credit Card: The Other Highlights

- 0% introductory APR offer for 7 months

- No rewards expiration or limit

- Chip technology enabled for global use

Free Wealth & Finance Software - Get Yours Now ►

Costco Anywhere Visa® Card by Citi Review

Finishing up our list is one of the best Citibank cash back credit cards, the Costco Anywhere Visa® Card by Citi for Costco Wholesale members. There are nearly 500 Costco locations in the United States, making this Citibank cash back credit card accessible and convenient for many people.

This Citibank cash back credit card offers a high 4% cash back on gas, 3% back on restaurants and travel, 2 % on Costco purchases, and 1% on all other purchases.

For those with Costco memberships, this Citibank cash back credit card does not have an annual fee. The basic Costco membership costs $55. You may consider getting a Costo membership just to receive these great offers.

Citibank Cash Back Credit Cards: The Other Highlights

- 0% introductory APR offer for 7 months

- Chip technology enabled for global use

- Cash back is provided as an annual reward certificate

Conclusion – Top 6 Citibank Credit Card Offers

Now that we have gone through and highlighted the best Citibank cash back credit cards and Citibank rewards credit card options, it is time to decide which one will work best for you and your needs.

Here are a few important questions to ask yourself in order to discover which Citi bank credit card offers are tailored for you:

- Do you often keep a balance on your credit card? Then the goal should be to choose one of the Citibank credit card offers with a lower APR. There is no point in gaining rewards points if you are spending hundreds of dollars on high interest.

- Do you travel frequently? The best Citibank rewards credit card will be one of our top Citibank travel credit card options. In fact, even choosing a Citi bank rewards credit card with higher fees could save you money in the long run. Be sure to do the math to make sure.

- Do you prefer spending flexibility? You may want to choose one of the top Citibank cash back credit cards. You can use these rewards in any way you like.

- Do you worry about high fees? Choose one of the three Citi bank credit card offers on the list with no annual fee.

Take in all this information from our Citibank cash back credit card review/Citibank rewards credit card review. In no time, you will be able to find the ideal Citibank credit card offers for you in 2017.

Read More: Top Best Travel Credit Card Offers | Ranking | Best Credit Cards For Travel (Reviews)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.