2017 RANKING & REVIEWS

TOP BEST CREDIT CARD READERS

Discovering the Best Credit Card Readers

Whether you own a small business that you run from a stand or a larger brick-and-mortar shop, you know how important a credit card reader is to your sales.

These days, most sales occur through credit card exchanges, so a credit card reader machine is a must! Much of the latest technology revolves around the handheld credit card reader, which is a great advantage to both big and small businesses.

Small business owners who may not own a shop can easily use a credit card reader app to complete all of their transactions on a mobile device or tablet.

Award Emblem: Best Credit Card Readers

Bigger businesses can update from their old school registers and conveniently make use of the sleek design of a tablet credit card reader.

However, with such a great number of cc readers available to choose from it can become a difficult process selecting the best credit card readers.

In order to help you select a credit card reader for your business, we’ve compiled a detailed review of the best credit card readers currently available.

From this review you’ll feel more confident in choosing between a USB credit card reader and a free credit card reader.

See Also: Discover Credit Cards | Reviews & Rankings | Discover Card Offers & Comparison Review

Why Upgrade to One of the Best Credit Card Readers?

A credit card reader is a necessary business tool for both small and big businesses. Credit card transactions are a major part of business, and trying to run a business without a cc reader can put you in a financial hole.

Photo Courtesy of: Digital Trends

Small business owners will find that the best credit card reader for them is often a credit card reader app.

A credit card reader app is easily portable, lightweight, and a highly secured way for you to receive payments as well as for your customers to make payments.

Larger businesses will find that they can even utilize a free credit card reader because of the ample number of transactions they make per month.

AdvisoryHQ’s List of Top 6 Best Credit Card Readers

List is sorted alphabetically (click any of the credit card reader names below to go directly to the detailed review section for that credit card reader):

- ChargePass

- Dharma Merchant Services

- PayAnywhere®

- PayPal Chip Card Reader

- QuickBooks GoPayment

- Square Chip Card Reader

Top 6 Best Credit Card Readers | Brief Comparison

| Credit Card Reader | Accepts All Major Credit Cards? | Transaction Fee | Monthly Fee |

| ChargePass | Yes | None | None |

| Dharma Merchant Services | Yes | 0.25% plus $0.10 per transaction | $10/month |

| PayAnywhere® | Yes | Mobile: 2.69% per swipe; Storefront: 1.69% per swipe | Mobile: none; Storefront $12.95/month |

| PayPal Chip Card Reader | Yes | 2.7% per swipe; 3.5% plus $0.15 per key-in | None |

| QuickBooks Go Payment | Yes | Pay-as-you-go Swiped: 2.40%; Keyed: 3.40%; $0.25 per transaction | None |

| Square Chip Card Reader | Yes | 2.75% per swipe; 3.5% plus $0.15 per key-in | None |

Table: Top 6 CC Readers| Above list is sorted alphabetically

FAQ Section

How long does it take for my business to receive the money from transactions done on the cc readers?

Depending on the credit card reader you choose, your money will be received in different timely manners. Some cc readers will process your money in 1-2 business days.

What requirements need to be approved by most credit card reader merchants?

Typically speaking, the best credit card readers will want a voided check, proof of U.S. based address, and proof of bank account, along with your date of birth.

How does a no-fee processing USB credit card reader work?

If you decide to go with a free credit card reader, then your clients will be the ones paying the processing fee. The free credit card reader merchant will act as the service to which your clients will pay a service fee.

What devices is the tablet credit card reader compatible with?

The best credit card reader will often be compatible with iOS and Android mobile devices and tablets. You can also connect a USB credit card reader to your computer and compute transactions that way as well.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Don’t Miss: Discover vs Wells Fargo Secured Credit Card Review | Which Card Is Best?

Detailed Review – Top Ranking Best Credit Card Readers

Below, please find the detailed review of each card on our list of the top ranking best credit card readers. We have highlighted some of the factors that allowed these cc readers and credit card reader machines to score so highly in our selection ranking.

ChargePass Review

Offered by Frontier Payments, LLC, the ChargePass cc reader is the cheapest credit card reader on the market.

The ChargePass credit card reader machine is the perfect choice for small business owners looking for the cheapest credit card reader in order to avoid transaction fees.

Features Offered by the ChargePass Credit Card Reader:

- No-fee processing for merchants

- Free equipment

- 1-2 day funding

- No contract

- Analytics

Overview of the ChargePass CC Reader

No Transaction Fees

Unlike many of the best credit card readers, the ChargePass is a free credit card reader.

As a free credit card reader, ChargePass doesn’t charge the merchant any fee for transactions processed. Instead, customers will pay the fee as they are the ones utilizing the service.

The incentive between paying cash, which features an automatic discount, or paying a fee on a credit card reader will allow customers to make their own financial decision without negatively affecting you.

Free Credit Card Reader

Another feature that makes ChargePass the cheapest credit card reader is that they supply merchants with a free credit card reader.

You’ll be supplied with all of the necessary equipment needed to start up with your cc reader.

You may choose between a retail credit card reader machine, a credit card reader app, or a web portal cc reader option.

Dharma Merchant Services Review

Dharma Merchant Services is the best credit card reader for business owners who are looking for a straightforward company that doesn’t hide unnecessary fees.

Offering the cheapest credit card reader in terms of transaction fees, Dharma cc readers are an especially fantastic choice for non-profit business owners.

Key Assets of the Dharma Merchant Services CC Readers

Low Transaction Prices

As one of the best credit card readers, Dharma Merchant Services offers a transparent and fixed rate on all transactions.

Their cc readers allow you to estimate how much your transaction fees will amount to depending on business factors such as monthly credit card volume estimates and average transaction sizes.

If requested, their service will provide you with a full rate comparison of another credit card reader and the Dharma cc reader.

Updated Equipment for Cheap

All of the Dharma cc readers are up-to-date and feature chip technology in order to accept Euro-MasterCard-Visa credit cards.

Their credit card reader is the cheapest credit card reader available in terms of being updated.

They also guarantee that their cc readers will not become outdated after just a few months of use. Dharma tests all of their cc readers before handing them off to you as well.

Related: Best Starter Credit Cards | How to Find the Best Credit Cards for Young Adults

PayAnywhere® Review

Photo Courtesy of: PayAnywhere

The PayAnywhere® credit card reader offers merchants a free credit card reader app and a simple-to-use interface that anyone could master.

With a free credit card reader option along with a basic service fee of $12.95/mo for storefront technology, the PayAnywhere® cc reader is a reliable choice.

Highlights of the PayAnywhere® Credit Card Reader:

- PayAnywhere app

- Accepts all major credit cards

- In-app & online reporting

- Add unlimited users

- Email or print detailed receipts

Brief Outline of the PayAnywhere Credit Card Reader

Mobile Transactions

Designed for merchants that travel or don’t feature a brick-and-mortar institution, the PayAnywhere mobile version is a free credit card reader.

You’ll be supplied with a free mobile reader and app.

Transaction fees associated with the credit card reader app are 2.69% per swipe and 3.49% + $0.19 per keyed transaction.

Storefront Transactions

On the opposite end of cc readers is the storefront version of the PayAnywhere credit card reader.

With the storefront version, you’ll be supplied with a free tablet credit card reader, a stand on which to place it, and the credit card reader app.

With the storefront operation, you’ll pay a $12.95/mo fee, 1.69% transaction fee on swipes, and 2.69% per keyed-in transaction.

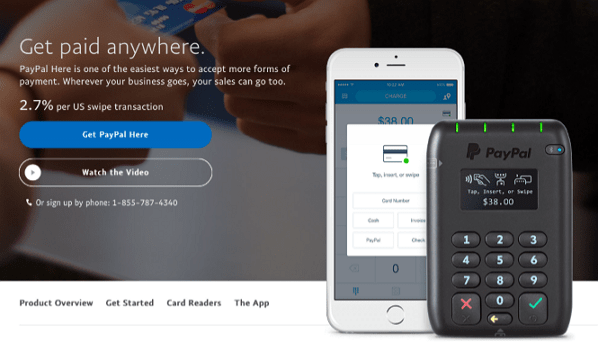

PayPal Chip Card Reader Review

Photo Courtesy of: PayPal

The PayPal Chip Card Reader, although on the pricier end of cc readers, is one of the best credit card readers for merchants looking for versatility.

Although the credit card reader machine itself is priced at $79, there are no start-up costs, termination fees , or monthly fees to worry about.

Top Features Included with the PayPal Chip Card Reader:

- Versatile payment methods

- Bluetooth enabled

- Compatible with iOS & most Android devices

- Mobile

- PayPal Here app

Detailed Review of the PayPal Chip Card Reader

Payment Options

There are several ways that you can receive payments when using the PayPal credit card reader.

As the PayPal handheld credit card reader accepts all major credit cards, you can either swipe or key in the information; however, transaction fees will vary.

The PayPal credit card reader also features a Chip Card reader, allowing you to accept an even wider number of payment options through a secure interface.

Bluetooth Enabled

Unlike a USB credit card reader, the PayPal Chip Card Reader can connect to your PayPal Here app on your mobile device or tablet through Bluetooth.

This Bluetooth technology makes the PayPal handheld credit card reader one of the best credit card readers for businesses constantly on the move.

Popular Article: Top Commerce Bank Credit Cards | Reviews | Commerce Bank Rewards, Secured, Business Cards

QuickBooks GoPayment Review

With a free pay-as-you-go plan and a monthly plan to choose from, the QuickBooks GoPayment credit card reader is a great free credit card reader choice.

Modeled after the well-known and highly utilized QuickBooks service, the QuickBooks GoPayment is neatly organized so that you can stay on top of your company finances.

Basic Attributes Offered by the QuickBooks GoPayment CC Reader

Free App and Reader

With the QuickBooks GoPayment credit card reader, you can choose between a free and paid plan. With the free plan ,you’ll receive a free credit card reader machine and free credit card reader app.

The only payment you’ll have to make is on the transaction fees. With the $0/month plan, you’ll be expected to pay 2.40% on swiped purchases and 3.40% on keyed purchases.

There is also an extra $0.25 transaction fee with all purchases.

Sync and Customize

The QuickBooks GoPayment also offers one of the best credit card reader management systems.

The credit card reader app automatically syncs all of the sales information with the QuickBooks and Intuit Point of Sale products.

You can keep track of your business easily and even customized features such as your receipts. You can add your business logo and a message to all receipts sent out to your clients.

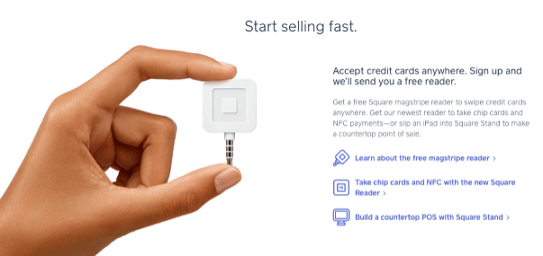

Square Chip Card Reader Review

One of the more popular and well-known cc readers, the Square Chip Card Reader has been a prevalent tablet credit card reader since its creation.

As a tablet credit card reader, the Square Chip Card Reader is sleek, easy to use, and highly innovative.

Quality Aspects Offered by the Square Chip Card Reader:

- Deposits on demand

- Fraud prevention

- Free protection from payment disputes

- Support center team

Overview of the Square Chip Card Reader

Photo Courtesy of: Square

Easy Set-Up & No Extra Fees

Setting up your Square Chip Card reader is an incredibly simple process. All you have to do is sign-up for a Square account, and you’ll receive a free credit card reader in the mail.

Plug your cc reader into your mobile or tablet device and begin processing all of the payments for your business. There are no monthly or sign-up fees, so you’ll only have to pay the 2.75% per swiped transaction.

Instant Deposits

One of the key features that quickly distinguishes Square as one of the best credit card readers is the instant deposits feature.

With the Square tablet credit card reader, you can access all of your payments in real time. You can instantly send money over to your bank account by the touch of a button.

If you don’t have time to wait the 1-2 business days necessary to process, you can use the instant deposits feature. With this feature, the credit card reader will simply charge you 1% of your entire deposit amount.

The credit card reader app also allows you to schedule deposits ahead of time so that you never have to worry about sending your money over manually.

Read More: Top Credit Cards to Build Credit | Ranking & Reviews | Credit Cards for Building Credit

Conclusion—Top 6 Best Credit Card Readers

This concludes our detailed review of the best credit card readers available for use today.

As stated, there are a wide variety of cc readers to choose from, each sporting their own particular highlights and conveniences.

Depending on whether you want to spend money on your credit card reader or go with a free credit card reader option, the best credit card reader for you will vary.

However, the best credit card readers will all provide you with a cc reader that accepts all major credit cards and is compatible for use with a mobile or computer device.

With the best credit card reader, your business will readily flourish as you easily process all of your payments.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.