2017 Comparison Review: Discover Credit Card with Cash Back vs. Discover it® Student Card vs. Discover Miles Card vs. Discover Secured Credit Card

Over 167 million American adults have at least one credit card. 7.2% of these Americans have a Discover credit card, like the Discover it® for Students or a Discover card for cashback.

Discover Bank is one of the four largest credit card networks, behind Visa, MasterCard, and American Express. The credit card network had a $129 billion credit purchase volume in 2014, and that number has steadily climbed each year.

If you secure the Discover it® for Students Card, a Discover miles card or even a Discover secured credit card, you will be in good company. If you’re still second-guessing whether Discover is a legitimate credit card issuer, just consider that there were over 43,630,772 Discover credit cards in circulation at the end of 2014 alone.

Source: Store-Credit Cards

There are many Discover credit card benefits as well. You can get a Discover cashback bonus card or take advantage of the rewards that come with a Discover secured credit card or Discover student credit card.

Each of these credit cards has different features, so it is important to carefully consider what the best option is for you.

Throughout this article, we analyze the different credit cards that are offered by Discover.

By breaking down the different features of each of the four credit cards, you can decide, based on your individual preferences and needs, what credit card is best to add to your wallet: a Discover student card, Discover secured credit card, Discover miles card or Discover cashback bonus credit card.

See Also: Best First Credit Card | Guide | How to Find Good Credit Cards for First-Timers

Why Open a Discover Credit Card?

Discover credit cards, like the Discover it® for Students card, give you many benefits over simply having cash on you. They not only provide easy access to your funds through a credit limit, but there are additional benefits to opening a card that you might not have thought of.

Looking at Discover credit card benefits, the first thing that stands out is that you can easily make online purchases. With 8.1% of retail sales this year taking place online, it is important that you have a credit card that allows you to participate.

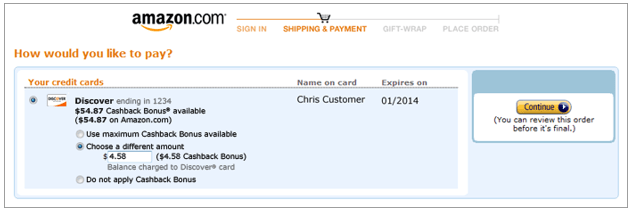

As a bonus, you can also redeem your Discover card cashback towards purchases on Amazon. This is one of the best Discover credit card benefits. By linking your credit card to your Amazon account, at checkout, you will be asked if you want to apply some amount of your Discover card cashback balance towards your purchase.

Source: Discover

Discover credit card benefits do not just stop at their ability to open up the e-commerce world to you. There are many more benefits associated with owning one of these credit cards.

No matter what credit card you get, even the Discover student credit card option, customer service is 100% based in the United States. You will also have access to your FICO credit score every month on your statement.

Furthermore, there are no annual or foreign transaction fees with any Discover credit card on our list. This alone helps to set Discover credit card benefits ahead of other networks.

There are many advantages to opening up a credit card, but the important thing to keep in mind is what benefits are most valuable to you.

2017 Comparison Reviews

The list below is sorted alphabetically:

- Discover it® Card

- Discover it® for Students Card

- Discover it® Miles Card

- Discover it® Secured Credit Card

Discover it® Card vs. Discover it® for Students Card vs. Discover it® Miles Card vs. Discover it® Secured Credit Card

Credit cards from the same network will have similar benefits when it comes to access, customer service, and online interfaces. However, when comparing cards, like a Discover student card to a Discover credit card with cash back, it is important to look at other features specific to each card, such as:

- Fees

- APRs & introductory offers

- Type of credit needed

- Discover credit card rewards

- Signup bonus

We will go into further detail in the following sections, but make sure to spend some time looking at each of the features listed above when researching a Discover card for students, Discover credit card with cash back, and others.

Don’t Miss: How to Get a Debit Card | Guide on Getting the Best Debit Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fees

Credit card companies make a profit in a variety of ways. They not only collect interest on the outstanding credit balances and earn a percent on purchases, but they also charge fees to their customers.

Fees on cards, like a Discover student credit card, come in different forms. There may be annual fees that are charged to customers every year for having access to the credit card benefits. There can also be foreign transaction fees for using a credit card internationally as well as balance transfer and cash advance fees.

When you are comparing a Discover miles card to a Discover student credit card and others, it is important to look at what fees are associated with the card.

One of the Discover credit card benefits is that none of the cards has an annual fee or foreign transaction fee. This feature is not something that all credit card companies provide, especially not for all of their credit cards.

The next fee on the list to look at is the balance transfer fee. This is the fee that is charged if you transfer a balance from another credit card to a card like the Discover miles card. There isn’t much comparison to do here, as all of the cards on our list have a 3% balance transfer fee.

When it comes to cash advance fees, there also isn’t any variance between the Discover secured credit card, the Discover student credit card, the Discover miles card, and the Discover it® Card. A cash advance fee of 5% will be charged for all of the cards.

These Discover credit cards may not differ much when it comes to fees, but it is still something to keep in mind if you are comparing a Discover credit card to other credit card companies.

APRs & Introductory Offers

An annual percentage rate (APR) is the annual rate charged by a credit card company for borrowing through one of its credit cards. A card like the Discover student credit card will charge an APR on the credit balance that you carry.

If you don’t plan to pay your balance in full every month, this is a very important number to look at. The lower the APR that comes with a card like theDiscover card with cashback, the less interest you will pay on the balance. This number matters less if you tend to not carry a balance on your card, but you never know when financial hardship might strike, so a lower APR is always better.

When it comes to APRs, the Discover it® Card and Discover it® Miles Card have the lowest minimum APRs. With a variable APR between 11.24% and 23.24%, if you have good enough credit to qualify for a Discover miles card or cash back card, these two are good options.

The Discover it® for Students has a slightly higher variable APR between 13.24% and 22.24%. Still, for a credit card that you can apply for with essentially no credit history, this is a good APR range.

At the bottom of the list falls the Discover it® Secured Credit Card. This Discover secured credit card has a set APR of 23.24%. This is not a card to get if you are looking to carry a balance, as the APR rate is quite higher than the other cards on our list. Still, when compared to other secured credit cards, this number does not look out of place.

Some cards also offer introductory APR periods. This is when they charge 0% interest for some length of time, which generally ranges between 6 and 21 months. If you are looking to make large purchases, definitely consider the availability and length of a Discover miles card or other card’s introductory APR offer.

When it comes to 0% introductory APR on purchases, most Discover cards have some type of offer. The Discover it® Card and Discover it® Miles Card, again, top the list with a 12-month 0% APR introductory period.

While the Discover secured credit card does not have an introductory APR offer, the Discover student credit card has a 6-month 0% APR on purchases. This is great if you are heading to college and have some larger upfront purchases coming up, like textbooks, dorm supplies or meal plans.

Related: Top Ways to Get the Best Free Prepaid Cards with No Monthly Fees | Guide

Type of Credit Needed

When you are looking for a credit card, it is important to consider what type of credit is needed to qualify. The credit score requirement for a Discover secured credit card will be lower than the credit score needed to qualify for a Discover miles card or Discover card with cashback.

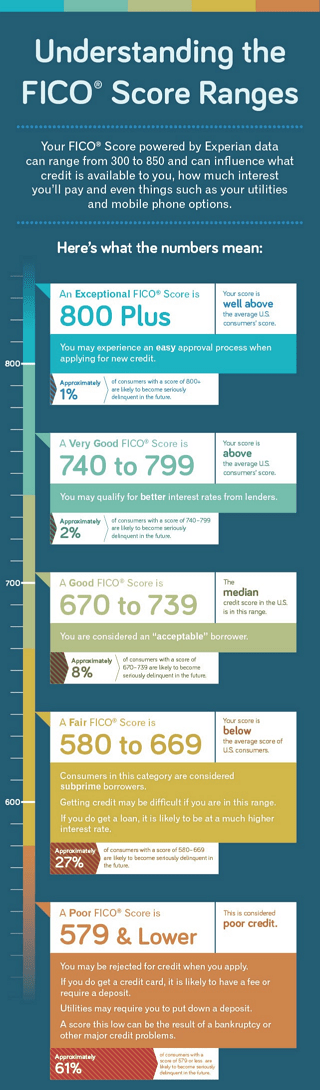

Before looking at the requirements of each card, it is important that you actually understand credit ranges and what constitutes as good credit. With a Discover card, you have access to your FICO credit score on your statement each month, so that is the range we will view. The image below, from Experian, shows a breakdown of FICO credit scores.

Source: Experian

When you look at the chart, any FICO credit score that falls below 579 is considered a poor score, and anything above 670 is a good score. These numbers are important to keep in mind as we compare options such as the Discover it® for Students.

If you have poor credit and are looking for a credit card, theDiscover it® Secured Credit Card is a good option for you. You can qualify for this card with no credit or bad credit, though you will need to put a refundable security deposit down as collateral.

A Discover student credit card is also a credit card that you can apply for with no credit or bad or poor credit. It is meant for first-time credit card holders, like students, so you don’t have to worry about having an established credit history to apply.

To qualify for the Discover it® Card and the Discover it® Miles Card, you will need to have, at minimum, fair credit. For this Discover miles card or cash back card, you are required to have at least a 580 credit score to qualify.

If you have poor or no credit, a Discover secured credit card or Discover student credit card might be a good option to help you build up your credit score. While the other cards our list require a higher score, you still do not need immaculate credit to qualify.

Discover Credit Card Rewards

The average American has 3.7 credit cards, which means that credit card companies are looking for ways to convince you to use their card over the other ones in your wallet. For some companies, this means offering rewards.

Rewards come in the form of cash back, points, and miles. For Discover credit card rewards, you will see cash back or miles. Your Discover card cashback can be redeemed for statement credits, gifts cards, merchandise, and more.

The Discover it® Card and Discover it® for Students card are similar when it comes to Discover card cashback earning. There are rotating 5% cashback categories every few months, and, aside from that, you will earn 1% cash back on all other purchases. The Discover it® for Students card also offers $20 cash back each year if you maintain a GPA over 3.0, on top of the regular Discover card cashback.

Most rewards are given in the form of Discover card cashback. However, the Discover miles card is a bit different since you earn rewards in miles. You will earn at least 1.5 miles for every dollar spent, depending on special categories.

While many secured credit cards do not allow you to earn rewards, Discover is different. With a Discover secured credit card, you will earn 2% cash back at gas stations and restaurants and 1% cash back on everything else. Though you don’t get the bonus rotating 5% categories, any cash back on a secured credit card is great.

Popular Article: Best Small Business Credit Cards for Small Business Owners |Ranking | Top Small Business Credit Cards

Signup Bonus

While companies offer motivation to use their card through rewards, they also occasionally offer incentives to encourage you to apply in the first place. Upfront signup bonuses come in the form of cash back, bonus points, airline miles, and even statement credits.

Unfortunately, Discover does not offer an upfront signup bonus for the Discover it® for Students card or any of its other credit cards.

Instead, Discover does something unique. For new card members, Discover will match, dollar for dollar, all of the cash back that you earn in your first year. Whether you have aDiscover secured credit card, a Discover student credit card or something else, your cash back at the end of the first year will be doubled.

While a signup bonus is a great feature to have, it is not a make-or-break feature for a Discover card with cashback. Keep in mind that other credit card features, such as APRs, fees, and cashback rewards, will carry through the life of the credit card.

Conclusion: Discover Card with Cash Back vs. Discover Student Card vs. Discover Miles Card vs. Discover Secured Credit Card

When you are choosing between a Discover card for students, a Discover secured credit card, the Discover it® Card, and a Discover miles card, it is important to consider the features we have detailed in this article.

Do you want a card with no fees that you can use internationally? Do you want a Discover card for students for when you head off to college? Do you have poor credit and need a card like the Discover secured credit card?

Whatever your decision, this guide is sure to help you realize the best for your unique financial needs.

Read More: Top Credit Cards for Miles | Ranking | Best Miles Credit Card Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.