2017 RANKING & REVIEWS

TOP RANKING BEST CREDIT CARDS FOR YOUNG ADULTS

Finding Good Credit Cards for Beginners Is Not as Hard as It Seems

The great paradox to a credit score is that you need good credit to get a credit card, but you first need that credit card in order to build good credit. Where are the young people without credit turning to find credit cards they can actually use? Are there good credit cards for young adults?

Luckily, there are good credit cards for beginners who are young in both age and financial experience.

This article will stand as your guide for finding the best first credit card options for young people who need to start building up their credit scores. We will do this by highlighting the best credit cards for young adults in the forms of secured cards and student cards.

Award Emblem: Top 6 Best First Credit Cards for Young Adults, Teenagers, and First-Timers

We will also answer popular questions on the topic of good credit cards for beginners, such as:

- How do you get the best credit cards for young people if you do not already have credit?

- What is the difference between a secured card and a student card when it comes to the best credit cards for 20 year olds?

- What are the best credit cards for teens under 18? Is opening a credit card for teenagers even possible?

- What are the best credit cards for young adults? Best credit cards for 20 year olds? Best credit cards for young adults with no credit?

See Also: Top Best Credit Cards With No Foreign Transaction Fees | Ranking | Credit Cards Without Foreign Transaction Fees

AdvisoryHQ’s List of the Top 6 Best First Credit Card Options

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- BankAmericard Cash Rewards™ Credit Card for Students

- Citi ThankYou® Preferred Card For College Students

- Discover it® for Students Card

- Discover it® Secured Credit Card

- nRewards® Secured Credit Card

- U.S. Bank Secured Visa® Card

Top 6 Best First Credit Cards | Brief Comparison & Ranking

Good Credit Cards for Beginners | APR Ranges | Cash Back |

BankAmericard Cash Rewards™ Credit Card for Students | 13.24% – 23.24% | YES |

Citi ThankYou® Preferred Card For College Students | 14.24% – 24.24% | YES |

Discover it® for Students Card | 13.24% – 22.24% | YES |

Discover it® Secured Credit Card | 23.24% | YES |

nRewards® Secured Credit Card | 9.24% – 18.00% | YES |

U.S. Bank Secured Visa® Card | 19.24% | NO |

Table: Top 6 Best Credit Cards For Young Adults | Above list is sorted alphabetically

What Are Student and Secured Credit Cards?

Our list of the best credit cards for young adults showcases three student cards and three secured credit cards. Both are the best credit cards for young adults with no credit and can help you build that credit up.

Credit Cards for Young Adults #1: Student

- Student credit cards are for young adults who have yet to start earning credit because they are in school still. These are one of the best credit cards for young people in general.

- Typically, you do still need access to income in order to qualify for one of the best credit cards for young adults in the student category.

Credit Cards for Young Adults #2: Secured

- With a secured credit card, you put up a deposit for collateral since you have no credit history.

- In order to qualify as one the best first credit card options, the secured credit card should be sending your reports to all the major credit bureaus.

Is a Credit Card for Teenagers Even Possible?

Since we are talking about the best credit cards for young adults, it is important to take a moment to talk about the best credit card for a teenager.

A lot of people search for a credit card for teenagers. Others search for the best credit cards for teens under 18. Unfortunately, teenagers under 18 cannot open their own credit cards at all due to the Credit Card Act of 2009.

The only way for a teenager to have a credit card is if their parent makes them an authorized user on the parent’s card. Technically, there are no best credit cards for teens under 18, as they will simply have a copy card of their parent’s personal credit card.

Essentially, there is not really any “best” credit card for a teenager because they don’t actually exist independent of a parent account. This is why we will focus on credit cards for young adults in this 2017 guide.

Don’t Miss: Top Best Credit Cards with No Balance Transfer Fee (15–21 Months with Zero Balance Fees)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best First Credit Card

Below, please find the detailed review of each credit card on our list of good credit cards for beginners. We have highlighted some of the factors that allowed these best credit cards for young people to score so highly in our selection ranking.

BankAmericard Cash Rewards™ Credit Card for Students Review

First up on our list of the best credit cards for young adults is the BankAmericard Cash Rewards™ Credit Card for Students. These are good credit cards for beginners not only because they are for young people who have not had time to earn credit, but also because they earn you cash back.

This card offers 2% back at grocery stores and 3% back on gas for the first $2,500 each quarter. For all other purchases, you can earn 1% back. Not only are you building credit, you are earning cash rewards while doing so, a huge qualifier for the best credit cards for 20 somethings.

Best First Credit Card #1 Highlights:

- No annual fee

- Added awards if you have a Bank of America checking or savings account

- BONUS OFFER: $100 when you spend $500 in the first 90 days

Citi ThankYou® Preferred Card for College Students Review

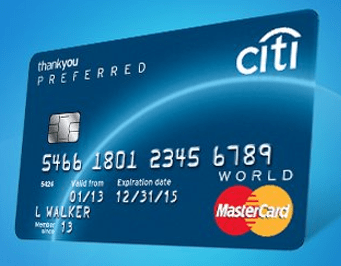

The next student card on our list of the best credit cards for 20 somethings is the Citi ThankYou® Preferred Card For College Students. Though the APR is slightly higher than the other student cards, the rewards point system is quite flexible.

Source: Citi ThankYou® Preferred Card For College Students

As one of the best credit cards for young people, this card allows students to slowly build their credit in school while earning rewards points on the things they are going to spend money on anyway, including restaurants and entertainment.

Best First Credit Card #2 Highlights:

- No annual fee

- 0% APR for first 7 months (then a range between 14.24% and 24.24%)

- No foreign transaction fee

- BONUS OFFER: Earn 2500 bonus points when you spend $500 in the first 3 months

Related: Top Best Credit Cards for People with No Credit History | Ranking and Reviews

Discover it® for Students Card Review

Both of the other student cards that made our list of the best credit cards for young adults had some sort of cash back/rewards system. The Discover it® for Students Card has similar offers, but with a unique spin. Students can actually earn cash back when they keep a GPA of 3.0 or higher.

Not only that, whatever you earn in regular cash back (such as on gas or restaurants) in the first year will be matched by Discover. This easily makes Discover it for Students good credit cards for young adults.

Best First Credit Card #3 Highlights:

Discover it® Secured Credit Card Review

Now that we have covered the three best credit cards for 20 year olds who are students, it is time to look at the best credit cards for 20 somethings who are not students. We will go back to Discover to look at their Discover it Secured Credit Card.

Each time you use the Discover it Secured card, you are building your credit history, as the reports are sent to all three credit bureaus (a must for good credit cards for beginners). At the same time, you can earn cash back on every purchase: 1% on all purchases and 2% back on gas or restaurants.

Best First Credit Card #4 Highlights:

- No annual fee

- Get your FICO score for free

- Your security deposit can potentially get refunded

- Late payments do not raise your APR

- No foreign transaction fee

nRewards® Secured Credit Card Review

Next on our list of the best credit cards for 20 year olds is the nRewards® Secured Credit Card from Navy Federal Credit Union. By a large margin, nRewards has the lowest APR rate on our list of credit cards for young adults. This is a huge advantage for those who might carry a balance from month to month.

Source: nRewards® Secured Credit Card

This card is not only one of best credit cards for young adults with no credit, it also has a great rewards program. With nRewards, young adults can earn 1 point for each dollar they spend on their card. All those points can be exchanged for gift cards and other merchandise.

Best First Credit Card #5 Highlights:

- No annual fee

- Extremely low APR range when it comes to best credit cards for 20 somethings

- Collision damage waiver

- Simplified online banking process

- Discount coupons with participating merchants

Popular Article: Best Credit Cards to Have | Guide | What is the Best Easy to Get Credit Card to Apply For?

Free Wealth & Finance Software - Get Yours Now ►

U.S. Bank Secured Visa® Card Review

To finish up our list of top credit cards for young adults is the U.S. Bank Secured Visa Card. This is one of the more simple and straightforward choices on the list. This is one of the best credit cards for young adults with no credit, as well as those with poor credit.

The APR is significantly lower than Discover’s secured card, but there is not a cash back or rewards system. If you keep a balance from month to month, it often makes more sense to have a low APR than a rewards system.

Best First Credit Card #6 Highlights:

- Zero fraud liability

- Auto rental insurance

- Easy online banking/bill pay

Conclusion — Top 6 Best Credit Cards for Young Adults

We have gone over the best credit cards for young adults and explained how a few of these card options work. We have also learned that while there is not really a list of the best credit cards for teens under 18, there is still a legal avenue to get a credit card for teenagers. In the end, the best credit card for a teenager is simply an authorized copy of a parent’s card.

Now is the time to decide what card is right for you (or you may be looking for the best credit card for a teenager or young adult in your family). Ask yourself some of these important questions to help you decide which of the credit cards for young adults are for you:

- Am I a student or will I be soon? Then choose credit cards for young adults in the student category

- Do I want to build credit so the major credit bureaus will see my reports? Then choose the best credit cards for young people in the secured category.

- Will I keep a balance from month to month? Then choose one of the best credit cards for young adults with a low APR.

- Do I want to keep costs at a minimum? Then choose of the best credit cards for 20 year olds without annual fees.

Before you know it, you will have chosen the best credit cards for young adults that will serve you and your finances well in 2017.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.