2017 RANKING & REVIEWS

TOP RANKING BEST HMO COMPANIES

Understanding HMO Insurance and HMO Providers

Selecting the right insurance can be complicated, but an HMO is one of the primary options available to consumers. HMO stands for health maintenance organization. With HMO health insurance, policyholders are required to choose a Primary Care Physician from a network of providers in their area.

Then, if the person needs to see a specialist or visit a hospital, they’re referred by their Primary Care Physician (PCP). In most cases, an HMO insurance plan won’t cover out-of-network care and services unless it’s an emergency.

Award Emblem: Top 6 Best HMO Health Insurance Companies

One of the primary benefits of HMO insurance plans from HMO companies is the fact that they’re generally less expensive for the subscriber. Out-of-pocket medical costs and monthly premiums tend to be lower than what you would get with another type of plan, such as a PPO.

If you don’t see a lot of specialists, an HMO might help you save money on the overall cost of your insurance.

The following ranking looks at some of the top HMO companies that provide these types of HMO health plans.

It’s important to note, however, that insurance varies across states. While this review gives a general overview of HMO companies, not all plans are available in all states, or the details of HMO insurance may differ from one area to another.

This review of HMO providers and HMO coverage should be used for education only and not as a specific buying guide for HMO insurance.

See Also: Top Cancer Hospitals in the U.S. | Ranking | Best Hospitals for Cancer Treatment

AdvisoryHQ’s List of the Top 6 Best HMO Companies

List is sorted alphabetically (click any of the names below to go directly to the detailed review section for that HMO insurance):

Top 6 Best HMO Companies | Brief Comparison

Largest HMO Providers | Key Features of HMO Insurance Plans | Key Benefits of HMO Insurance Plans |

| Anthem | Members can self-refer in-network, but deductibles and coinsurance amounts apply | As part of BCBS, Anthem has a very extensive network of PCPs to select from |

| Blue Cross Blue Shield | A large selection of PCPs are available as part of the BCBS network | No referral is needed for some specialists, including dermatologists and OB/GYNs |

| CareFirst | Range of deductible and out-of-pocket maximums for different budgets | Policyholders have access to extensive BCBS network with CareFirst |

| Cigna | Open Access plan allows policyholders to choose whether or not they’ll have a PCP | Users can track their plan, claims, and spending with the myCigna app |

| Kaiser Permanente | Plans feature out-of-pocket maximums | No-cost preventative care may be available |

| UnitedHealthcare | No charge for preventative services | UHC offers a variety of cost-estimating and saving tools to members |

Things to Consider About HMO Health Insurance

Before deciding whether HMO health insurance is right for you, there are key considerations to keep in mind.

While the cost may be lower with HMO insurance plans, there are potential downsides as well.

Image Source: Pexels

When you choose an HMO plan, your Primary Care Physician will be the point person for coordinating all of your other medical care.

You will need to have a relationship with this person, feel comfortable with them, and trust them to help you make critical care decisions since with an HMO health plan you will be connected to specialists and all of your other healthcare via this person.

On the other hand, if you want flexibility or you have existing specialists you’d like to maintain your relationship with, HMO health insurance might not be right for you.

You might instead opt for something like a PPO plan. With a PPO as opposed to an HMO plan, you would have the flexibility to see any healthcare provider without a referral. PPO plans have in-network and out-of-network providers, and you can see both, although the costs might be higher if you go out-of-network.

Ultimately, the primary considerations when choosing between an HMO plan and a PPO are cost (primarily out-of-pocket costs and premiums), how much flexibility you want, and how often you see specialists.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking HMO Providers

Below, please find the detailed review of each of the top HMO companies. We have highlighted some of the factors that allowed these HMO insurance providers to score so well in our selection ranking.

Anthem Review

Anthem is a health insurance company offering a variety of group medical, dental, and vision plans for small businesses and other organizations, as well as Medicare and individual and family plans.

Key Features and Menu Items Offered by This Pick for One of the Top HMO Providers

Features of the HMO health insurance from Anthem, as well as general benefits of this insurance company, are highlighted below.

Enhanced Personal Health Care

Anthem features something called Enhanced Personal Healthcare. This HMO health plan company enacted this program as a way to make sure doctors coordinate care and work with patients across every area of their personal health.

This program encourages doctors to spend more time with patients and to understand them in a more in-depth way, which will help doctors provide stronger care while managing treatments and prescriptions more effectively.

With this health maintenance organization provider, patients have doctors who also coordinate their care across other physicians and specialists.

Wellness Programs

Holistic wellness is an important component of HMO insurance and HMO health plan options from Anthem. They have a range of lifestyle programs designed to help members remain motivated and on-track with their health goals.

Anthem also features programs for members who are managing specific health issues, such as depression or diabetes.

Additionally, support programs are available to match medical HMO subscribers with specialists who will work with the policyholder as well as their doctor to manage chronic conditions or improve health.

Network

In many states with Anthem HMO insurance, the company is part of Blue Cross Blue Shield, making them one of the most recognized HMO providers in the country.

HMO plans with Anthem provide not just an extensive physician network for choosing a PCP from a broad HMO directory, but also the lowest-cost health care options. With HMO Choice programs available in some states, members can also self-refer to any provider they choose within the network, but deductibles and coinsurance amounts will apply.

Don’t Miss: Top U.S. News Best Hospitals | Ranking | U.S. News & World Report Hospitals

Blue Cross Blue Shield Review

Blue Cross Blue Shield is a broad company name referring many different subsidiaries that are located in most states across the country. Blue Cross Blue Shield companies insure one in three Americans, and in states with BCBS, the insurance companies are independently and locally operated.

Key Features of This Selection for a Top HMO Health Insurance Company

Some of the reasons BCBS is on this ranking of the top HMO companies and HMO insurance plans are below.

Blue Distinction

BCBS, one of the top HMO providers in the country, has a program called Blue Distinction, which seeks to recognize doctors and hospitals that provide safe and effective care. In order to be part of this program, facilities and physicians must meet very high standards.

Blue Distinction Total Care is a program for primary care, and there’s also Blue Distinction Specialty Care.

Predictability

With HMO insurance or an HMO plan from BCBS, there’s a level of predictability that helps policyholders more efficiently plan and manage their healthcare costs. There is a predictable, stable copayment in most cases, no deductible, and the policyholder isn’t responsible for filing paperwork.

HMO insurance plans from BCBS also frequently include something called Away From Home Guest Membership coverage, which is for members who live out of their service area for at least 90 consecutive days.

No Referrals for Certain Specialists

In many states, if you have a BCBS HMO insurance plan, you don’t need a referral to see certain specialists.

These can include a network OB/GYN, as well as a network dermatologist, network ophthalmologist, and a network optometrist.

CareFirst Review

CareFirst is an insurance company with programs available in the Maryland and D.C. areas. For more than 75 years, this insurance company has been serving the area, and it’s the largest healthcare insurer in the Mid-Atlantic region.

Key Factors That Led to Our Ranking of This as a Top HMO Health Insurance Provider

Below are some of the benefits of CareFirst in terms of being a provider of HMO insurance plans and HMO coverage.

HMO Plan Options

CareFirst is a subsidiary of Blue Cross Blue Shield, and their insurance is offered on state exchanges created by the Affordable Care Act.

Plan options regarding a health maintenance organization option include Bronze, Silver, and Gold. Each medical HMO insurance plan has a different deductible and out-of-pocket minimum, so consumers can select the plan that works best for their needs and their budget.

Care Options

Whether you opt for an HMO health insurance plan from CareFirst or another type of plan, you have extensive options when it comes to your care.

With HMO coverage from CareFirst, members get access to the largest network of doctors in the region. There are also ways for subscribers to manage their health care costs, including getting care at places with lower out-of-pocket costs.

In many cases, even with an HMO health plan, no referrals are needed as long as the doctor is in-network.

Traveling Coverage

If you have an HMO health plan with CareFirst and you’re traveling, you still have an option for HMO coverage.

With the BlueCard program, when a member of this HMO insurance company sees an out-of-area but participating Blue Cross Blue Shield physician or hospital, they are only responsible for the co-pay. Benefits will be paid at the in-network level.

Also, if you’re traveling for more than 90 days, you may be eligible to participate in the Away From Home Care program.

Related: Best Medical Centers in the U.S. | Ranking & Reviews | Hospital Medical Center Reviews

Cigna Review

Cigna is a U.S. insurance company offering HMO health insurance, among other plan options. Cigna was ranked 90 on the 2015 Fortune 500 list and is one of the largest health insurance companies in the country.

Key Factors That Led to Our Ranking of This as One of the Top HMO Providers

Among HMO providers and HMO healthcare insurance options, the following are specific ways Cigna excels.

HMO Open Access Plans

In some states and counties, Cigna offers something called an HMO Open Access plan. This plan provides the flexibility of a PPO with many of the benefits of an HMO plan.

These medical HMO insurance plans provide options for whether or not the subscriber will choose a Primary Care Physician. Policyholders have the possibility to pick a PCP, but it’s not required.

For care to be covered, members simply have to see providers who are part of the Cigna network.

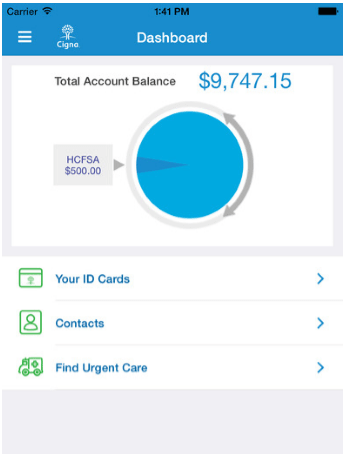

myCigna

Regardless of whether you have HMO insurance plans and HMO coverage from Cigna or another type of plan, you have access to myCigna, which is available online and as an app. MyCigna makes it easy for people with an HMO plan to check claim statuses, get account balances, search for a doctor, and more.

Users of myCigna can also learn more about their HMO healthcare plans, view their claim history, estimate costs for medical treatment and procedures, find out more about hospitals, and take advantage of the Quicken Health Expense Tracker.

Image Source: iTunes

Predictable Costs

For a lot of consumers, one of the biggest benefits of any medical HMO plan is predictability in out-of-pocket costs, and that’s something you get with health maintenance organization insurance from Cigna.

A big component of their HMO Open Access plans is predictability in out-of-pocket costs across services, alleviating the anxiety that can come with uncertainty in service prices.

HMO plan holders will know exactly what to budget for when they’re seeing a provider.

Kaiser Permanente Review

Kaiser Permanente is a national insurance company offering plans to consumers ranging from California to Georgia, including HMO coverage. A leader among HMO companies, KP has a history dating back more than 60 years in the provision of health coverage.

Key Factors That Led to Our Ranking of This as One of the Top HMO Companies

Particular reasons KP is ranked as one of the best HMO providers of HMO health insurance are below.

Preventative Care

When someone opts to go with a deductible or HMO plan from KP, they are provided with a range of tools and programs that help them make informed health decisions and maintain control over their health.

These medical HMO healthcare options from KP also offer preventative care services at no cost or copay in many cases, although this does depend on the particular HMO plan.

Preventative services can include routine exams, cholesterol screening, and mammograms, among others.

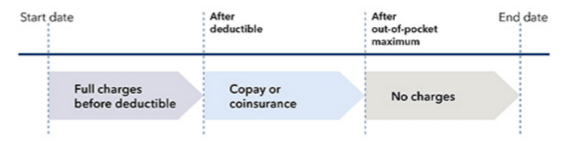

Out-of-Pocket Maximums

One of the many advantages of working with this leader among HMO companies is that with these plans, once you reach your deductible, you pay less out-of-pocket in copays and coinsurance.

Charges, copays, and coinsurance all count toward the member’s out-of-pocket maximum, and this, in turn, limits how much members are required to pay for their healthcare. Once someone reaches their out-of-pocket maximum with one of these health maintenance organization plans, they wouldn’t have to pay for covered services for the remainder of the year.

Image Source: Kaiser Permanente

Tools to Maximize Your HMO Healthcare Coverage

When you have HMO insurance from KP, they offer tools and programs to maximize your coverage.

One example is My Health Manager, which is available on the KP website and lets members log in and do things like email their doctor’s office, order refills on prescriptions, schedule routine appointments, and get plan information.

They also offer healthy living classes and free, personalized healthy lifestyle plans to help members improve their wellness.

Popular Article: Best Hospitals in the U.S. | Ranking | Major, Popular, Largest Hospitals in America

UnitedHealthcare Review

United Healthcare is a provider of health insurance plans for individuals, families, and employer-sponsored plans, including medical HMO coverage. UHC also offers short-term health insurance, plans for small business, dental plans, and Medicare plans.

Key Factors That Led to Our Ranking of This as One of Top HMO Providers

The following details some of the top reasons UHC is one of the best HMO providers.

Cost Control

A big part of the focus at UHC, whether you’re considering HMO insurance or another type of plan, is helping members keep their costs under control. UHC strives to help members stay on-budget with their costs from the time they choose their plan to when benefits are collected.

This leader among HMO providers has a range of online tools that help members estimate and compare costs and value so that they make the best possible decisions.

Preventative Care

A key advantage of choosing an HMO from UHC as compared to another type of insurance plan is the fact that preventative care is entirely covered if it’s in-network.

That means that when you go for your preventative care appointments and see in-network providers, you have no out-of-pocket costs.

UHC also has an extensive network of providers throughout the country, including hundreds of hospitals and thousands of pharmacies, along with tens of thousands of doctors.

Health4Me App

The Health4Me app is available to all UHC policyholders, including people with an HMO health plan. Features and capabilities of this app include:

- Users can take advantage of the search tool to find an in-network doctor, hospital, or clinic

- There are options to locate nearby fast care, such as an Urgent Care or ER

- Members can compare costs and see reviews of providers, as well as see their account balances

- A registered nurse is available 24/7

- The Talk To Me tool can be used to connect with a customer service representative who can answer questions about benefits and claims

Conclusion—Top 6 Best HMO Providers

Choosing an HMO health insurance plan is a popular option for many consumers. When you opt for HMO healthcare coverage as opposed to an option like a PPO, you get some benefits that work well for many people.

One of the biggest is the fact that the out-of-pocket costs tend to be lower. Another advantage of a health management organization plan is the fact that you can develop a strong relationship with your PCP, who will serve as your health advocate, and it’s easier to estimate and budget for healthcare costs with these plans.

The above list represents companies that excel in their provision of HMO insurance plans. These HMO insurance options from top HMO providers offer all of the standard benefits of an HMO, but also additional features, such as some level of flexibility in the care you receive, covered preventative care, and mobile apps and tools to help members better manage their care.

Read More: Best Hospitals in the World | Ranking | World’s Largest Hospitals

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.