2017 RANKING & REVIEWS

TOP 6 RANKING BEST HOUSE LOAN CALCULATORS

Introduction: The Importance of a House Payment Calculator

Making the decision to take on a mortgage is one of the biggest, most exciting, and scariest financial decisions that most of us will ever make. The idea of willingly indebting yourself for 15 or 30 years (or more) isn’t always an easy thing to swallow, especially considering the uncertainty of these economic times.

However, owning your own home is also one of the soundest economic investments one can make. A house loan calculator or a house mortgage calculator is a simple online tool that can help better understand the financial implications of taking on a mortgage.

In this brief article, AdvisoryHQ will review six of the top house payment estimator tools on the internet. We will look at why everyone should learn how to calculate a house payment and offer a helpful comparative table of the top features of six of the best house loan payment calculator on the web.

Award Emblem: Top 6 Best House Loan Calculators

In our FAQ section, we will let you know what features to look for in the best house mortgage calculator to help you estimate a house payment, as well as when to choose a regular house payoff calculator versus a house payment calculator with taxes. Finally, we will offer a quick review of six of the top house loan payment calculators on the web today.

Why Should You Learn How to Calculate a House Payment?

When negotiating a mortgage, most people simply trust the bank to do the calculations for them. You might ask for the lowest possible rate or ask them to give you a lower monthly payment plan, but very few people actively participate in the true negotiations of the terms and conditions of their mortgage.

While many banks may offer sound financial advice, no one understands your particular economic situation as well as you do.

Learning how to use a house loan calculator to estimate a house payment is an easy way to begin to take better control of your money management. Since a mortgage is most likely the largest purchase that anyone ever takes on, learning how to calculate a house payment will help you find out how much you can pay per month. Learning how to use a simple house loan payment calculator, then, could end up saving you thousands of dollars.

Let’s say, for example, that the bank has offered you a monthly mortgage payment of $1,000. You might find that to be a reasonable monthly payment plan and simply accept the terms and conditions they offer you.

If, however, you were to use a house payment estimator or a house payment calculator with PMI, you might find that by raising your monthly payment to $1,500 (if still achievable according to your monthly budget), you would end up saving thousands of dollars in interest payments over the course of your mortgage.

See Also: Top 0 Balance Transfer Credit Cards | Ranking & Reviews | 0 APR Credit Card Balance Transfer Fee

AdvisoryHQ’s List of the Top 6 Best House Loan Calculators and House Mortgage Calculators

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that calculator):

- Bankrate House Payment Calculator with Taxes and Insurance

- Bankrate Regular House Payment Calculator

- Calculator Soup House Payment Calculator

- Mortgagecalculator.org House Payment Calculator

- U.S. Bank House Payment Calculator

- Zillow House Payment Calculator

Top 6 Best House Loan Calculator or House Mortgage Calculator | Brief Comparison & Ranking

Monthly House Payment Calculators | Free or Paid | Includes Taxes and Insurance? | Other Notable Functions |

Bankrate House Payment Calculator with Taxes and Insurance | Free | Yes | Helpful and easy-to-read bar graphs |

Bankrate Regular House Payment Calculator | Free | No | Includes ads from potential lenders |

Calculator Soup House Payment Calculator | Free | Yes | Helpful and easy-to-read tables |

Mortgagecalculator.org House Payment Calculator | Free | Yes | Includes monthly versus bi-weekly payment plans |

U.S. Bank House Payment Calculator | Free | No | Gives options for four different mortgage terms |

Zillow House Payment Calculator | Free | Yes and No | Allows you to decide whether or not to include taxes and insurance in the calculations |

Table: Top 6 Best House Payoff Calculator | Above list is sorted alphabetically

What to Look for in the Best House Mortgage Calculator to Help You Estimate a House Payment

When searching for the best monthly house payment calculator, it is important to understand what you are looking for and where you are at in your search for a home mortgage. If you are in the preliminary stages of searching for your dream home, you may simply want a house loan repayment calculator to look at possible monthly payments according to home values. This house loan repayment calculator might very well be the easiest to use, as it doesn’t require much data input.

Image source: Pexels

If, however, you have found the home of your dreams on a hot market and are trying to beat out other potential buyers, you might want a house payment calculator with PMI that also connects you with several potential lenders to compare specific terms, conditions, and rates from different lenders.

Whichever monthly house payment calculator that you choose, it is also important to be on the lookout for options that give you as much varied information as possible. If a calculator only shows you one possible monthly payment plan, then they’re not doing anything different from what a bank would. Finding a house payment calculator with taxes that gives you multiple options is always preferable.

When to Choose a Regular House Payoff Calculator Versus a House Payment Calculator with Taxes

As you will see in the house loan calculators that we review below, some include taxes and insurance and others do not. A house payment calculator with taxes and insurance will offer you a more complete picture of what your monthly payment plan will look like. However, not everyone who uses a house mortgage calculator wants to know how taxes and insurance are included.

Taxes and insurance can vary widely by state, so one of the risks of using a house payment calculator with taxes and insurance is that you may get an artificially high or low estimate for your monthly payment on your mortgage. There is, after all, a huge difference between buying a home in downtown Manhattan and in rural Appalachia.

You might consider using a house payment calculator with taxes or a house payment calculator with PMI (primary mortgage insurance) if you are planning on buying a home in an average market where those costs follow from the nationwide norms.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best House Loan Calculator and House Mortgage Calculator

Below, please find the detailed review of each free debt snowball calculator. We have highlighted some of the factors that allowed these snowball calculators to score so highly in our selection ranking.

Don’t Miss: Best Credit Card Payoff Calculators | Guide | How to Find Top Credit Card Repayment Calculators

Bankrate Regular House Payment Estimator Review

The Bankrate regular house payment estimator is a simple and easy-to-use tool that can help you calculate a house payment plan. This house loan calculator doesn’t include taxes and insurance, which makes it a great option for folks who are beginning their search for different monthly payment options.

Furthermore, with this house mortgage calculator, you also get access to a number of quotes from different mortgage lenders. On top of that, if you are not sure of the APR associated with a mortgage, Bankrate will give you today’s going mortgage APR rates.

Bankrate House Payment Calculator with PMI Review

Another Bankrate house loan calculator that we will review here is their house payment calculator with PMI. This option requires you to input data for all relevant taxes and insurance regarding your mortgage including property taxes. If you don’t know those figures, you will have to do your research online for average taxes in your area and ask your bank what they charge for primary mortgage insurance.

Image source: Bankrate

Once you collect all the necessary information, this quality house mortgage calculator will display your payment information with unique bar graphs to clearly differentiate your payment on principal and on interest over the term of your mortgage.

Related: Best Car Interest Calculators | Guide | How to Find & Use the Best Car Loan Interest Calculators

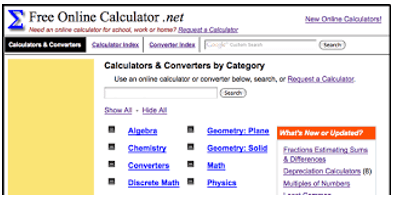

Calculator Soup Review

Calculator Soup is an online leader in different types of financial calculators. They offer a quality house payment calculator that clearly defines the different terms for the data you need to input. This house loan calculator does ask for your yearly taxes and insurance information in order to give you a more complete estimate of your monthly payment.

Image source: Calculator Soup

Furthermore, with this house mortgage calculator, you can create an amortization schedule with the click of a button. If you are looking for a regular house payment estimator without taxes and insurance, Calculator Soup also offers that option here.

MortgageCalculator.org Review

MortgageCalculator.org also offers a quality house loan calculator. This option also includes taxes and insurance as well as asking you for your monthly HOA payment, making it one of the most complete options out there. Furthermore, with this house mortgage calculator, you can print an amortization schedule.

Image source: MortgageCalculator.org

Once calculated, the mortgage repayment summary offered by this house payment calculator is one of the most complete, including information on total interest paid, total taxes paid, loan pay off date, and other pertinent information.

Popular Article: Best Car Lease Calculators | Guide | How to Find Best Auto Lease Payment Calculators

U.S. Bank House Loan Calculator Review

The U.S. Bank house loan calculator is the only option we review here that is specifically tied to a leading home mortgage lender. With this house payment calculator, you simply have to add information regarding the estimated value of the home you want to buy. Since U.S. Bank is a specific lender, they will calculate the taxes, insurance, and rates.

Image source: U.S. Bank Corporation

If for example, you are looking into buying a $300,000 home, this house mortgage calculator will offer your information regarding the rate, APR, and estimated monthly payment for four different mortgage terms: a 10-, 15-, 20-, and 30-year fixed mortgage.

Zillow House Loan Repayment Calculator Review

Zillow is a leader in the online real estate market. They also offer a quality house loan calculator that you can find here. The house payment calculator offered by Zillow comes with a simple breakdown of your payment terms. However, you can also gather more complete information through the schedule and full report options that they offer.

Image source: Zillow

The house mortgage calculator offered by Zillow is also unique in that you can get pre-approved by a local lender for a mortgage in order to see an even more accurate estimate of your monthly mortgage payment. If you are a serious buyer wanting the most accurate mortgage payment information, this might be the best option for you.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 6 House Loan Calculator and House Mortgage Calculator

Taking the time to learn how to calculate a house payment is an important part of any future homeowner’s financial education. If you’re not a great numbers person, a simple house loan calculator or house mortgage calculator might be the best way for you to understand the complex terms and rates associated with mortgages.

A house payment calculator is a simple (and free) online tool that will help you gather the information you need regarding the payments on your mortgage. For penny pinchers, a house payment calculator can also help you find the best way to save money over the term of your mortgage through analyzing different monthly payment options.

Whether you choose the Bankrate house payment calculator with taxes and insurance, the Bankrate regular house payment calculator, the Calculator Soup house payment calculator, the Mortgagecalculator.org house payment calculator, the U.S. Bank house loan calculator, or the Zillow house mortgage calculator — any of these options will help you take better control over the most important aspect of your financial management.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.