2017 RANKING & REVIEWS

TOP RANKING BEST LARGEST LIFE INSURANCE COMPANIES

2017 Guide to the Biggest Life Insurance Companies

When it comes to protecting loved ones after your passing, a life insurance policy can give everyone the peace of mind they desperately need. How can you ensure that your life insurance policies are going to pay out when you need them to?

Opting for one of the biggest life insurance companies can give you an added layer of security. They frequently offer the most life insurance plans to give you a large selection of options for your loved ones after your passing.

Not only that, but the life insurance company ratings on a larger company are frequently made clearer.

Award Emblem: Top 6 Best Largest Life Insurance Companies

The largest life insurance companies hold a vast amount of the market share. In a life insurance comparison, weighing the top companies can go a long way toward ensuring your peace of mind after your passing.

AdvisoryHQ understands how important it is to have the life insurance policies you need from the best life insurance company around. That’s why we’ve compiled this list of the top-rated largest life insurance companies to get you started.

If you’re wondering what the life insurance company ratings really have to say, consider these US life insurance options.

See Also: Top Wells Fargo Credit Cards | Ranking & Reviews | Wells Fargo Secured, Student, Rewards, Business, Cash Back Cards

AdvisoryHQ’s List of the Top 6 Best Largest Life Insurance Companies

List is sorted alphabetically (click any of the life insurance company names below to go directly to the detailed review section for that life insurance company):

Top 6 Best Largest Life Insurance Companies | Brief Comparison & Ranking

Life Insurance Company Name | A.M. Best Rating | Market Share |

| Lincoln Financial Group | A+ | 4.98% |

| MassMutual | A++ | 3.82% |

| Metlife | A | 5.26% |

| New York Life | A++ | 5.74% |

| Northwestern Mutual | A++ | 8.46% |

| Prudential Financial | A+ | 3.91% |

Table: Top 6 Best Biggest Life Insurance Companies | Above list is sorted alphabetically

Determining the Best Largest Life Insurance Companies

When it comes to conducting a life insurance comparison, how can you truly tell which life insurance company offers the best products and security? After all, you purchase life insurance plans to offer peace of mind to your family. You want to know that there is a strong financial backing that can provide funds when your loved ones need them.

Image Source: Pexels

One of the biggest indicators for ranking the biggest life insurance companies is their financial strength ratings. These scores are issued by independent agencies, based on a comprehensive overview of the company’s financial situation. Each score will be based on slightly different factors, but the overall goal is to evaluate health.

Chances are, you may have already heard of the four primary ratings agencies for life insurance companies:

- A.M. Best

- Fitch

- Moody’s

- Standard & Poor’s

Consumers can weigh these US life insurance ratings before committing to any particular life insurance policy. While most of the biggest life insurance companies will have these scores readily available somewhere on their websites or fact sheets, you can access all of them through the rating companies themselves.

Understanding the scores may be a totally separate issue. Each ratings company will have a unique way of categorizing the biggest life insurance companies. To give you an idea of what the best ratings are, we’ve included them in the chart below:

Ratings Company | Highest Scores | Lowest Scores |

| A.M. Best | to A++ | E, F, S |

| Fitch | to AAA | C to CCC |

| Moody’s | A3 to Aaa | C to Caa1 |

| Standard & Poor’s | to AAA | CCC+ to CC, SD, D, R |

Beyond these numbers, you can also evaluate the biggest life insurance companies based on their market share. The higher the market share, the more consumers that have bought into the policies and protection offered by that life insurance company. Life insurance companies are considered the largest life insurance companies based on the number of consumers who buy into their protection plans.

The final factor for consideration in determining the best largest life insurance companies is the selection of policy types. A one-size-fits-all life insurance policy isn’t likely to work for every family and situation. A wide selection of life insurance plans helps us to qualify life insurance companies as some of the best.

In the sections below, we’ve detailed the major information that allowed us to rank these biggest life insurance companies as some of the top choices. Consider what each one has to offer before deciding which of the largest life insurance companies is the best fit for you.

Don’t Miss: Best 0 APR Credit Cards | Ranking | Top Credit Cards with 0 APR Offers (Reviews)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Largest Life Insurance Companies

Below, please find the detailed review of each company on our list of life insurance company ratings. We have highlighted some of the factors that allowed these biggest life insurance companies to score so high in our selection ranking.

Lincoln Financial Group Review

The Lincoln Financial Group offers almost every type of life insurance plans available. One of the biggest life insurance companies on today’s marketplace, they were ranked in fourth place among their competitors. They maintain a 4.98% market share, a large percentage compared to smaller life insurance USA companies.

They were even ranked as the #1 total life sales company as a publicly traded life insurance company.

According to independent ratings companies, the life insurance company from Lincoln Financial Group maintains stellar scores. Scores for this largest life insurance company include:

If you’ve been searching for some of the biggest life insurance companies, Lincoln Financial Group can fit the bill. Their third-quarter numbers for 2016 showed a total average account balance of $226 billion and a net income of $467 million.

Offerings

Lincoln Financial Group has a wide selection of life insurance policies even for one of the largest life insurance companies. No matter what type of coverage you are seeking, this life insurance company has something to offer:

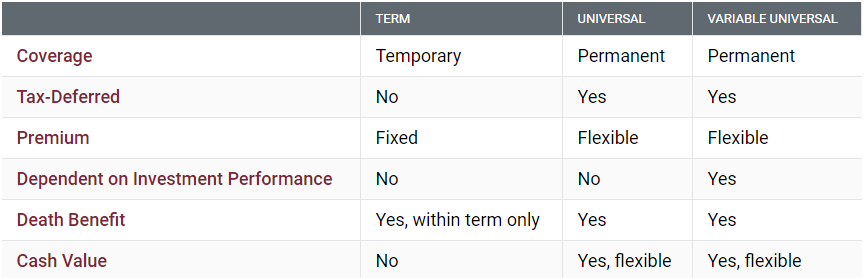

- Term life insurance

- Universal life insurance

- Variable universal life insurance

Image Source: Lincoln Financial Group

If you’re uncertain what type of US life insurance would be the best fit for you, Lincoln Financial Group offers a resource center. It includes a life insurance comparison chart of the three types they offer. Deciding on coverage amount is also made easy with a user-friendly calculator.

Related: Top Travel Credit Card Offers | Ranking | Best Credit Cards For Travel (Reviews)

MassMutual Review

In the past year, MassMutual has truly become one of the largest life insurance companies in the US marketplace. Their total adjusted capital grew to a total of $17 billion, an all-time high for this life insurance company.

Financial ratings for the largest life insurance companies are typically issued by independent companies. MassMutual ratings demonstrate strong financial stability with superior or excellent ratings from almost every company that gives ratings for the biggest life insurance companies.

A.M. Best granted MassMutual an overall score of A++. Meanwhile, Fitch and Standard & Poor’s each issued an AA+ score. The fourth and final major contender when it comes to ratings for a life insurance company is Moody’s which assigned it a score of Aa2.

The largest life insurance companies tend to hold large chunks of the market share. MassMutual maintains approximately a 3.82% market share.

Offerings

Another reason that MassMutual ranked as one of the best largest life insurance companies is its offerings. Potential customers can select the type of coverage that suits them best, ranging from:

- Whole life insurance

- Guaranteed acceptance life insurance

- Term life insurance

- Universal life insurance

- Variable universal life insurance

The sheer volume of potential choices for life insurance plans is one of the major benefits of selecting one of the biggest life insurance companies. Regardless of what type of policy you need, the largest life insurance companies such as MassMutual can provide it and back up your policy with high financial ratings and reviews.

Metlife Review

While differing somewhat from the vast selection of life insurance policies from companies like MassMutual, Metlife still gives consumers a number of options and the backing of one of the biggest life insurance companies. This life insurance company holds 5.26% of the market share while still maintaining excellent financial ratings.

For the life insurance USA branch of Metlife’s offerings, they are able to keep some of the highest financial strength ratings on today’s marketplace for the biggest life insurance companies. This life insurance company was granted the following scores from top independent rating companies:

Not only is Metlife one of the top contenders for the US life insurance sector, Fortune has also ranked it as #2 for global competitiveness. It is fourth in its industry rank (down from the #1 spot it previously held) and ranks as 39 on the Fortune 500.

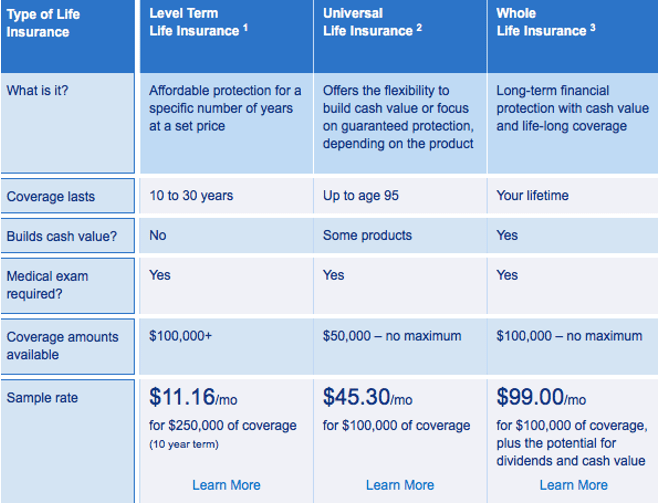

Offerings

What types of life insurance plans can you expect from Metlife? This life insurance company offers the three basic and most popular forms of coverage: term life insurance, universal life insurance, and whole life insurance. Universal life insurance will cover you up to the age of 95.

Sample rates for premiums are included on their overview page so you know what to expect in life insurance USA costs in advance.

Image Source: Metlife

Popular Article: Best Credit Card Balance Transfer Offers & Deals | Ranking | Interest-Free Credit Card Transfers

New York Life Review

Consumers searching for just the right largest life insurance companies will be interested in the offerings from New York Life. This life insurance company received some of the highest life insurance company ratings available. Its scores and reputation are what allowed us to rank New York Life as one of the top contenders for the best largest life insurance companies.

Just this past year, the top financial strength ratings companies bestowed the highest possible reward upon the life insurance company. Fitch granted it a score of AAA while Moody’s gave it an equivalent score of Aaa. Even A.M. Best allowed this life insurance company to maintain a superior score of A++.

As far as the biggest life insurance companies go, New York Life currently maintains a healthy section of the market share. This largest life insurance company currently maintains and holds a 5.74% market share. Compared to the competitors on our ranking, this makes New York Life one of the absolute biggest life insurance companies.

Offerings

New York Life may be one of the biggest life insurance companies, but their offerings can exclude consumers who would be interested. Online applications are only available to consumers between the ages of 30 and 80. Purchasing through an agent with the life insurance company, while less convenient, does allow participation of any age.

This life insurance company offers whole life insurance and term life insurance policies. Consumers interested in getting multiple types of protection from one life insurance company may also be interested in their long-term care insurance and annuities.

Northwestern Mutual Review

According to their market share, Northwestern Mutual is the largest life insurance company available. If you’ve been looking for a company that can offer plenty of consumer reviews and has the backing of a large percentage of consumers, Northwestern Mutual could be the right choice for you.

Northwestern Mutual easily holds 8.46% of consumer business. There are more than 4.3 million consumers utilizing their products for a total of $1.6 trillion of life insurance protection.

Not only is this life insurance company the largest life insurance company in terms of market share, but it still holds superior financial strength ratings as well. Across the four companies best known for their independent ratings, it has achieved the highest or second highest rating for all:

All except for the Standard & Poor’s score demonstrate the highest level of financial strength available. This life insurance company ratings can give you confidence that the policy will pay out when it needs to.

Offerings

This life insurance company also offers a number of products to give consumers flexibility with their choice. Their selection includes the most popular and well-known types of life insurance policies: whole life, term life, and variable life insurances.

They also offer CompLife Insurance, a blend of both permanent and term life insurance. The benefit of this program is that consumers are given the freedom to design their own blend of permanent and term life insurance. CompLife allows life insurance to fit into a budget more easily.

Read More: Top Credit Cards for International Travel | Ranking & Reviews | Best No Foreign Fee International Credit Cards

Free Wealth & Finance Software - Get Yours Now ►

Prudential Financial Review

For a well-known household name and one of the biggest life insurance companies, Prudential Financial can cover you with their life insurance policies. They feature a strong source of security for the payout of your policy upon your passing and plenty of consumer choices.

When it comes to the life insurance company ratings, Prudential is easily a strong contender. Their financial strength ratings from all four companies are part of what allowed us to include this life insurance company on our ranking of the best largest life insurance companies.

They hold an A+ rating from A.M. Best, as well as an AA- from Fitch and Standard & Poor’s. Moody’s granted this life insurance company an A1 rating as well.

When it comes to market share, Prudential holds 3.91% of consumer business in this sector. Slightly more than some of the other largest life insurance companies, Prudential has the support of a number of consumers.

Offerings

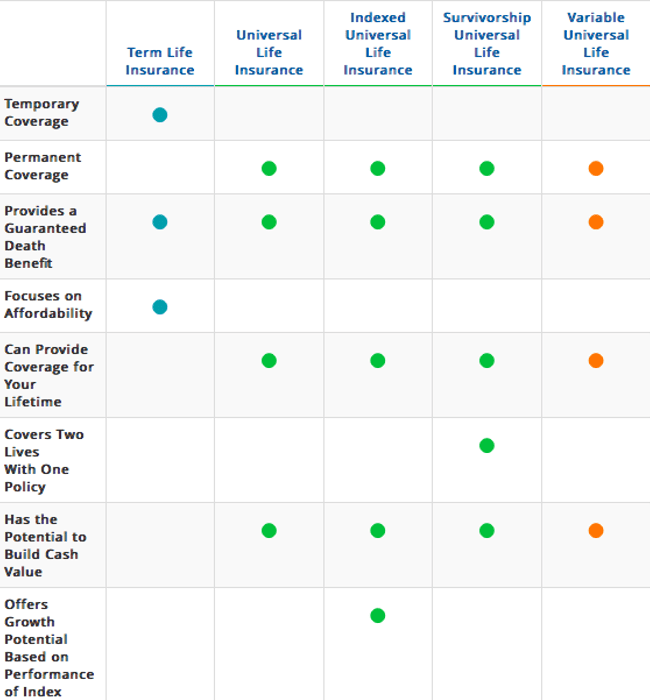

The other major advantage to choosing Prudential Financial as your life insurance company is the vast selection of policies available. Consumers can choose from any of five different types for one of the largest shopping options:

- Term life insurance

- Universal life insurance

- Indexed universal life insurance

- Survivorship universal life insurance

- Variable universal life insurance

Confused about what some of the lesser-known plans truly mean? You can compare the differences in their handy resource for side-by-side life insurance comparison.

Image Source: Prudential Financial

Conclusion—Top 6 Best Largest Life Insurance Companies

With the multitude of options available for the biggest life insurance companies, how can you possible decide which one is right for you and your family? Even before you decide what type of life insurance plans you need, it can be important to know which of the largest life insurance company options can offer it.

Take a look at their financial strength ratings to get a better feel for the reliability of the life insurance company. Protection won’t give you any peace of mind if you can’t feel certain that the company will pay out upon your passing.

Beyond that, you also want to look to see whether they truly are one of the biggest life insurance companies. How many consumers trust this particular company with all of the details of their personal protection policies?

This list of the largest life insurance companies should give you a clear starting point for where to go next. Let the data back up your decision to move forward with one of these best and biggest life insurance companies.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.