2017 RANKING & REVIEWS

TOP RANKING BEST LONG-TERM DISABILITY INSURANCE

Find the Best Long-Term Disability Insurance Quotes in 2017

If an unexpected accident or illness happens that results in a long-term disability, keeping you from working, then having long-term disability benefits can be a real lifesaver for your family.

While medical insurance may help cover hospital bills, supplemental long-term disability insurance helps to cover monthly bills and household expenses when you can’t work.

Many people wonder about long-term disability insurance costs and whether the premiums will be worth the benefit.

But if you suffer a disabling injury that keeps you from working for an extended period of time, receiving regular disability insurance benefits can help make sure you keep your head above water while you’re recovering.

Award Emblem: Top 6 Best Long-Term Disability Insurance Quotes

While some people may think they don’t need to buy long-term disability insurance because they’re covered by Worker’s Compensation, they may not realize that fewer than 5% of disabling accidents and illnesses are work-related. About 90% of long-term disability claims are actually for disabling illnesses, not covered by worker’s comp.

No one wants to believe they will get a disabling injury or illness and need long-term disability insurance coverage, but it is something that can happen out of the blue. It can be a back injury, complication from pregnancy, or unexpected illness. During these times, the best long-term disability insurance can provide a blanket of comfort.

In this article, we will review the top 6 sites you can use to quote long-term disability insurance rates. We’ll also answer the questions, “What is a long-term disability?” and “What is long-term disability insurance?” to give you all the information you need to make an informed decision before you decide to buy long-term disability insurance.

See Also: Top Credit Card Balance Transfer Offers & Deals | Ranking | Interest-Free Credit Card Transfers

AdvisoryHQ’s List of the Top 6 Best Sites for Long-Term Disability Insurance Quotes

List is sorted alphabetically (click any of the long-term disability insurance site names below to go directly to the detailed review section for that site):

- AccuQuote®

- Disability Insurance Quotes

- Mutual of Omaha

- National Insurance Store

- PolicyGenius

- Zander® Insurance Group

Top 6 Best Long-Term Disability Insurance Quote | Brief Comparison & Ranking

Long Term Disability Insurance Site | Company or Broker | Long-Term Disability Insurance Quote Page |

| AccuQuote® | Broker | |

| Disability Insurance Quotes | Broker | Get Quote Here |

| Mutual of Omaha | Company | |

| National Insurance Store | Broker | Get Quote Here |

| PolicyGenius | Broker | |

| Zander® Insurance Group | Broker |

Table: Top 6 Best Long-Term Disability Insurance Quote Sites | Above list is sorted alphabetically

Long-Term Disability Insurance FAQ | What Is Long-Term Disability?

Long-term disability insurance provides you with a percentage of your income as a monthly payment if you become unable to work due to illness or injury. Unlike Worker’s Compensation or medical insurance, it doesn’t pay for medical expenses directly or pay long-term disability insurance benefits in a lump sum.

Image Source: Pixabay

Supplemental long-term disability insurance is designed to give you a percentage of your income, usually between 50 to 80 percent, up to a maximum set by the plan. The long-term disability benefits are paid in monthly payments through the term of the policy or when you reach about age 65.

Many wonder, “What is long-term disability insurance and how does it differ from short-term?” The length of the disability insurance benefits payout is the main differentiating factor. Short-term disability insurance pays benefits for typically 6-12 months, while the best long-term disability insurance can payout for 10 years or much more.

What Is a Long-Term Disability Injury/Illness?

Here are a few examples from the Council for Disability Awareness of the common causes for a long-term disability:

- Musculoskeletal disorders (arthritis, back pain, spine/joint disorders)

- Cancers and tumors

- Heat attack

- Diabetes

- Mental disorders

- Accidents/injuries/poisonings

- Respiratory system disorders

- Pregnancy complications

- Cardiovascular and circulatory diseases

Long-Term Disability Insurance FAQ | What You Need to Know About Long-Term Disability Insurance Rates

Before you buy long-term disability insurance, there are some things you need to know about the different policies and long-term disability insurance benefits. A few key factors affect the benefits you’ll receive, and they could cause you to get less disability insurance benefits than you expected if you’re not aware of them.

Image Source: Pixabay

Here are some of the main factors that affect long-term disability insurance cost and payouts:

- Employer-Purchased or Self-Purchased. Many employers offer plans that include long-term disability insurance coverage. These usually cost less than self-purchased long-term disability plans. However, you may want to get a higher coverage level than is offered.

- Length of the Benefit Period. Long-term disability insurance rates can vary widely depending upon the term length. Make sure you understand whether benefits cut off after 5 years, 10 years, or go until you’re 65 or older.

- Monthly Benefit Amount Paid. When you get a long-term disability insurance quote, there should be a set percentage of your pay that is designated to you monthly in case of a long-term disability. Many policies have maximums on the monthly benefit paid out.

- How Long-Term Disability Benefits Are Calculated. It’s important to ask your insurance provider how they will calculate your disability insurance benefits. Often, bonuses aren’t factored into the percentage of your salary. There can also be a deduction for any Social Security long-term disability benefits you receive from the government.

- Changes in Employment Status. If you have employer-provided long-term disability insurance coverage or if you resign due to an injury before filing for benefits, it could put them in jeopardy. Likewise, if you ask for a part-time or less strenuous job, it’s possible that it could disqualify you from filing for long-term disability insurance benefits.

Don’t Miss: Top Corporate Credit Cards | Ranking | Compare the Best Company, Corporate, and Business Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Sites for a Long-Term Disability Insurance Quote

Below, please find a detailed review of each product on our list of best long-term disability insurance quote sites. We have highlighted some of the factors that allowed these long-term disability insurance cost websites to score so highly in our selection ranking.

AccuQuote® Review

AccuQuote® is a site that is considered a broker or marketplace for the best long-term disability insurance, life insurance, or long-term care insurance. The site is owned by Byron Udell & Associates, Inc., who’ve been in business since 1995.

We chose AccuQuote® for our list of the best long-term disability insurance quote sites because of their excellent reputation and top companies they work with. They show multiple accolades from The Wall Street Journal, Forbes, and Kiplinger, in addition to others.

When providing long-term disability insurance rates, they quote from top companies such as MetLife, AIG, Prudential, and Pacific Life. AccuQuote® also offers multiple options when you’re asking what is long-term disability insurance that works for you. They can quote for those who already have employer-provided long-term disability insurance, need an individual policy, or who own a business.

Long-Term Disability Insurance Site Highlights:

- Helpful videos about disability insurance benefits

- Convenient customer support hours M-F and Saturday

- Their free quote form only requires email for contact, not phone

- Helpful earnings potential chart

Request a Long-Term Disability Insurance Quote Here

Disability Insurance Quotes Review

If you want to get quotes from a site that specializes in quoting the best long-term disability insurance, then look no further than Disability Insurance Quotes. The name says it all. While they don’t give as much background information on the company behind the site, they do work with some well-known insurance providers.

When you use Disability Insurance Quotes, you can find the long-term disability insurance cost from providers whose names you will definitely recognize, such as MassMutual, Aflac, and Principal℠ — all well-known and competitive providers of supplemental long-term disability insurance.

One impressive and helpful site feature is their blog articles that cover topics like Social Security disability insurance benefits, all you want to know about long-term disability insurance, and Keyman long-term disability insurance coverage.

Long-Term Disability Insurance Site Highlights:

- Easy quote form on every page

- Works with well-known providers

- Detailed blog articles

- Easy to navigate website

Request a Long-Term Disability Insurance Quote Here

Related: Top Credit Cards for International Travel | Ranking & Reviews | Best No Foreign Fee International Credit Cards

Mutual of Omaha Review

If you want to go right to the source to buy long-term disability insurance instead of quoting through several companies, it’s hard to find a more trustworthy name than Mutual of Omaha. The company has been an American mainstay since 1909 and is known for their program, Mutual of Omaha’s Wild Kingdom.

Because you’re buying direct from the source, you can find more detailed information about long-term disability insurance cost on their site than others. For example, they have a maximum monthly base benefit of $12,000 and options of benefit periods for 2, 5 or 10 years, or to the age of 67.

Mutual of Omaha does one of the best jobs we’ve seen of breaking down the various types of long-term disability insurance benefits. They also offer a wide variety of optional premium add-ons, like a Cost-of-Living Adjustment Rider or Return of Premium Benefit Rider.

Image Source: Mutual of Omaha

Long-Term Disability Insurance Site Highlights:

- Well-respected company

- Easy to understand listing of long-term disability add-ons and benefits

- Disclosure of multiple policy terms

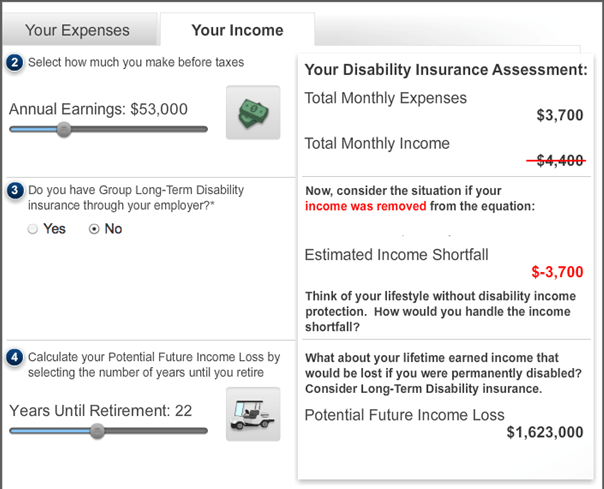

- Calculator to see how much long-term disability coverage you need

Request a Long-Term Disability Insurance Quote Here

National Insurance Store Review

The National Insurance Store is another broker site that matches you to the best carrier for your long-term disability benefits needs. The company has been around for over 40 years and has had an online presence since 1996. In addition to long-term disability insurance coverage, they provide health and life insurance quotes.

Some of the top companies they work with to quote long-term disability insurance rates are Assurity, Berkshire-Guardian, Lloyd’s of London, and Prudential. For federal employees, they also offer the FedAdvantage supplemental long-term disability insurance package.

Some things that helped National Insurance Store make our list of top sites for the best long-term disability insurance are the uncluttered site layout, the fact that they’ve been in business so long, and their multiple insurance offerings, such as dental, life, and Medicare supplement, in addition to long-term disability.

Long-Term Disability Insurance Site Highlights:

- Blog with helpful articles

- They work with top insurance companies

- They offer international insurance

- FedAdvantage plan available for federal workers

Popular Article: Top Best Credit Cards for Bad Credit | Ranking & Reviews | Bad Credit Cards

PolicyGenius Review

With a name like PolicyGenius, you know you’re in the right place to buy long-term disability insurance, or health, life, renters, or even pet insurance. They are fairly new, starting in 2014, but their mission to make people feel good about the insurance they buy has helped them become a startup darling of the industry.

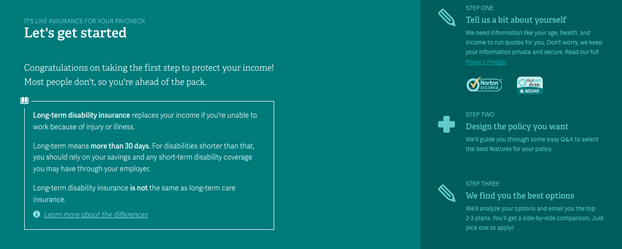

Image Source: PolicyGenius

If you like the look and feel of a modern website, then you’ll love navigating PolicyGenius to quote your long-term disability insurance cost. They have an easy, three-step process to find you the best options. Then they email you the top 2-3 long-term disability insurance rates with a side-by-side comparison.

One thing we really like about this site is that it is truly designed to give the customer the best possible experience they can have while finding the best long-term disability insurance. And the fact that you can buy insurance for your pet while you’re there is a nice bonus.

Long-Term Disability Insurance Site Highlights:

- Great design and “customer centric” navigation

- GeniusCenter blog with helpful articles

- Great press accolades

- Work with top insurance providers

- Handy insurance checkup tool

Request a Long-Term Disability Insurance Quote Here

Free Wealth & Finance Software - Get Yours Now ►

Zander® Insurance Group Review

Rounding out our list of the best long-term disability insurance sites is a company that’s been serving its customers for over 80 years, Zander® Insurance Group. In addition to providing long-term disability benefits quotes, they also provide life, health, auto, and home insurance, as well as identify theft protection.

One thing that stands out about Zander® Insurance Group is that they are very responsive and invite questions. They have an “Ask Dave” form on their site to ask Dave Ramsey, host of The Dave Ramsey Show, your insurance questions, along with another form to contact their “Executive Team.”

A helpful tool you may want to check out on their site is their Life & Disability Insurance Calculator to help estimate how much of each type of insurance you may need. They also have a Disability Education section to help answer questions like, “What is long-term disability?” and understand the types of policies available.

Long-Term Disability Insurance Site Highlights:

- Helpful calculator tool

- Well-established and respected company

- Detailed product information listing

- Offer multiple ways to reach out with questions

Request a Long-Term Disability Insurance Quote Here

Related: Top American Express Card Offers & Benefits | Ranking | Compare Top AMEX Card Offers

Conclusion – Top 6 Best Long Term Disability Insurance Sites

While no one wants to think about something happening to make them unable to work and unable to earn their regular paycheck, nearly 1 in 5 people have a disability, according to the U.S. Census Bureau. This means that long-term disability is a possibility for many people at some point in their lives.

We recommend you review these top six sites for long-term disability insurance cost and do your homework on the types of policies out there for supplemental long-term disability insurance. You’ll also want to know how Social Security disability might affect your benefits and understand any additional add-ons that could make a big difference for you.

With several options for long-term disability insurance coverage, you can sleep soundly at night knowing you can still get a portion of your monthly income if something unexpected happens. Whether you choose to get disability insurance benefits for 5 years, 10 years, or until you’re 65, you have choices to keep your family secure.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.