Introduction: Finding the Best Money Market Mutual Funds | What You Need to Know about

You probably already know that money market mutual funds are not the simplest topic. Perhaps, then, it should come as no surprise that there is a lot of misinformation and confused terminology on the Internet concerning this subject.

In this article, we will shed light on money market mutual funds and clear up any confusion surrounding this topic.

We will strive to give you the integral components of money market mutual funds: what money market mutual funds are, finding the best money market mutual funds, money market mutual fund rates, and definitions.

This article is not intended to be advice on how you should manage or invest your finances. Rather, it seeks to be an elemental overview of money market mutual funds, as well as a guide that directs you to reliable sources of information on this type of investment.

Source: Mutual Funds

If you read on, we believe that you’ll find this article more useful than many top-ranking summaries and reviews on this topic.

Money market funds are a form of mutual fund that are often explained using complicated terminology. Thus, we diligently researched this topic for you in order to convey the information in a digestible way.

Furthermore, we’re going to compare money market mutual funds to something simple and fun: ice cream sundaes!

See Also: Top Biggest Stock Losers and Gainers (Today, This Week & This Month)

What Are Money Market Mutual Funds?

What is a money market mutual fund, anyway? First, let’s address what money market mutual funds are not. Money market mutual funds are not the same thing as a money market account (MMA). There is a common misconception that these terms are interchangeable, but they are fundamentally different.

Banks offer savings and money market deposit accounts (MMDAs); these should not be confused with money mutual funds.

Money market accounts (MMAs):

- Are a type of savings account

- Are insured by the FDIC

- Carry a minimum balance requirement and offer a higher interest rate

Money market mutual funds (also called money market funds):

- Are open-ended mutual funds, meaning a collective investment scheme which can issue and redeem shares at any time

- Are not insured by the FDIC

- Pay dividends that reflect short-term interest rates

- Invest in short-term debt securities (generally, money market mutual funds mature in 13 months or less)

What is a money market mutual fund regulated by? The Securities and Exchange Commission (SEC) regulates money market funds—they are required to invest in low-risk securities.

What is a money market mutual fund for? If you have money that you do not immediately need, then you may choose to invest those funds temporarily in order to secure money market mutual funds’ interest rates. (There is more on money market mutual funds’ interest rates later in this article.)

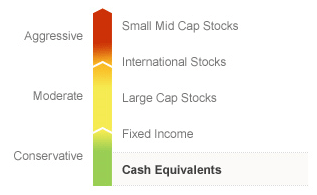

Money market funds are a form of mutual fund that invests in “cash equivalents”—loans to creditworthy corporate or government borrowers. For example, government securities, certificates of deposit (CDs), commercial paper, and other highly liquid, low-risk securities.

How to Get Money Market Mutual Funds and What to Consider

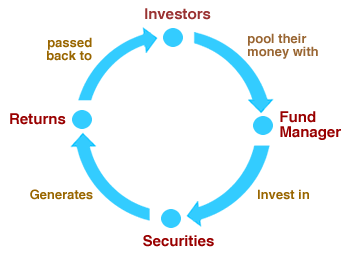

Source: Mutual Funds Basics

Now let’s begin our ice cream sundae reference. Money market mutual funds are the ice cream. The suppliers of the ice cream are where you purchase these funds, and the professional fund managers select what flavors your ice cream consists of.

You can purchase money market funds—MMFs—through banks, brokerages, or a fund family. These are the suppliers of your ice cream. There are several hundred mutual-fund families in the United States alone; a few examples are Fidelity, T. Rowe Price, and Vanguard. Each group typically has many fund options to choose from.

Money market mutual funds are managed by one or more professional fund managers, who make decisions about what to buy and sell within the funds. But how do you find out which managers to trust with managing your funds?

Don’t Miss: Real Estate vs. Stock Market Investing | Making Money in Real Estate vs. Stocks

CNNMoney recommends that you read, agree to, and follow the investing philosophy laid out in the fund’s prospectus document. Similarly, the SEC advises that finding the best money market mutual funds for you involves carefully reading all of the fund’s available information—such as its profile and the most recent shareholder report.

An important consideration for your ice cream sundae: what’s holding it together? Money market funds are a form of mutual fund wherein your individual situation should determine the type of container you select.

Weighing the best money market mutual funds involves considering your individual risk tolerance and asset allocation. Let’s think of risk tolerance and asset allocation as the foundation of your ice cream sundae. Is the foundation a more fragile bowl like crystal, which could potentially make you more money if you chose to sell it? Or is it a less expensive bowl that is more of a safe bet and less likely to shatter if tested?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Risk Tolerance

Your risk tolerance is a measure of how much fluctuation—also referred to as volatility, ups and downs, and market risk—you can handle. Should you look into low-risk or high-risk investments, or even something in between? There are various risk tolerance calculators online that can assist you in measuring risk tolerance for your situation.

Source: Money Market Fund

Along the same lines, asset allocation will reflect your level of risk tolerance—either aggressive (high-risk tolerance), moderate (medium-risk tolerance), or conservative (low-risk tolerance).

The higher your risk tolerance, the more stocks you will have in your portfolio in relation to bonds and cash. Most investors consider stocks riskier than cash equivalents like bonds due to greater volatility.

Finding the Best Money Market Mutual Funds

So how should you begin your research into finding the best money market mutual funds? Let’s examine some resources and considerations.

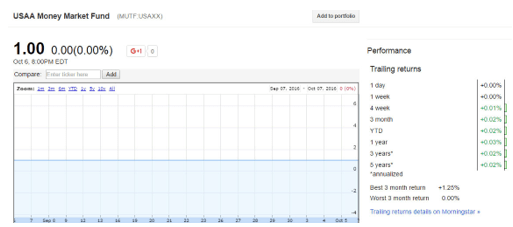

If you want to get your feet wet, try poking around Google Finance. What money market funds are the best performers? Who has above-average returns? What are the expense ratios and other fees?

Some good places to begin your research include:

Source: USAA Money Market Fund

TheBalance.com—the “money” version of About.com—recommends using a fund screener or comparing performance to a benchmark; considering the important qualities of mutual funds like fees, expenses, and manager tenure.

Some factors to consider include the following:

- Performance: Past performance is always important to research and know well.

- Market sector: Investing in one industrial sector can be risky. It’s recommended that you allocate no more than around 5% of your portfolio in any one sector. Diversification is an important factor.

- Appreciation values: Long or short-term capital appreciation can affect your investments, so you should research which one makes sense for you.

- Fund categories: There are small cap, mid cap and large cap stocks, foreign stock, fixed income (bond), sector funds and money market funds.

Related: Online Investing | What You Should Know to Invest Money Online

Money Market Mutual Fund Rates: Taxable or Tax-Exempt

Money market mutual fund rates all depend on your individual situation. Which will benefit you the most?

The investor must determine, given their tax bracket, if the lower yield on the tax-free fund exceeds the after-tax return on a taxable fund. Tax-free money funds tend to be most appealing to investors in high tax brackets. To determine which makes more sense for you, you can compare the tax-equivalent yields of both funds.

Now, let’s move on to money market mutual fund rate of return.

Money Market Mutual Fund Rate of Return

What are money market mutual funds’ rates of return? The money market mutual fund rate of return (ROR) refers to the gain or loss on an investment over a specified time period and is expressed as a percentage of the investment’s cost.

Money market mutual funds typically offer higher rates of return than traditional bank deposits. However, there is no guarantee that the fund will maintain a stable $1 share price as is intended—the yield will vary. Money market mutual fund rates are market-based.

Due to their short duration, money market mutual funds interest rates are typically subject to less interest rate risk than longer-maturing bond fund investments. Nevertheless, the value of the fund’s investments may fall when interest rates rise and could lose money if the issuer of a debt security is unable to meet financial obligations.

In other words: if the temperature rises, and your ice cream starts melting, the structure of your asset allocation and portfolio diversification (your sundae bowl) should be sturdy enough to prevent it all from leaking through. Later, when interest rates presumably lower the temperature, your ice cream can be salvaged.

Money Market Mutual Funds: Conclusion

Source: Money Mutual Funds

What have we learned about money market mutual funds?

- Your risk tolerance and asset allocation should form your foundation

- Professional fund managers decide what to buy and sell within the fund

- The rate of return affects how much you will be served up—the same as, more, or less than you expected

This article should have given you important factors to consider when evaluating money market mutual funds and links to resources that can assist you in such research. We sought to go beyond many other resources’ basic answers to the questions: what is a money market mutual fund, and what are money market mutual funds for?

Read More: Best Short-Term Investments | Investing Short-Term

We’ve covered money mutual funds, money market mutual fund rates, and money market mutual funds’ rate of return. Besides money market mutual funds’ interest rates, we’ve gone over where you can start if you want to find the best money market mutual funds.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.