Overview: How to Find the Top Mortgage Brokers

The house buying process can be difficult, especially when there is a mortgage involved. Banks and financial institutions are tricky to deal with, and the process itself is quite complicated.

This leaves people turning to mortgage brokers to walk them through the process. However, finding a mortgage broker that is right for the job is not as simple as it seems.

People, especially first time homebuyers, don’t even know what to look for when using a mortgage broker. A good mortgage broker can help make the process run smoothly, but there are variable factors. With so much to consider, people often wonder things such as:

- What are the benefits to using a mortgage broker?

- What are the best ways to go about finding a mortgage broker?

- Can you find a mortgage broker online?

- What constitutes a good mortgage broker?

- Are there benefits to using local mortgage brokers?

If you are searching for a home and need help determining the best mortgage broker for you, then keep reading. In our “Guide on How to Find Top Mortgage Brokers,” we walk you through the process.

From the benefits of using a mortgage broker and finding a mortgage broker to determining what a good mortgage broker looks like, we can answer your questions and help you find the best mortgage broker for you.

See Also: USDA Loans Program | Guide | Requirements, Eligibility, and Qualifications

What Do You Know About Mortgage Brokers?

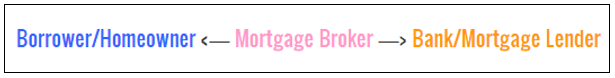

Chances are that you’ve heard the term mortgage broker thrown around if you are in the process of buying a house. While they have declined since the market crash in 2008 and now have only 9.7% of the origination market, top mortgage brokers are still a great asset for you. Do you know what a mortgage broker actually does? As shown in the diagram below, a good mortgage broker essentially acts as a middleman between you and the bank or lender.

Source: The Truth About Mortgage

Top mortgage brokers have their own way of doing things, but generally a mortgage broker will:

- Gather important information

- Determine the proper loan amount

- Shop different lenders

- Submit loan applications

- Ensure lending process goes smoothly

When you first contact a good mortgage broker and obtain their services, they will begin to gather information from you. They will ask for your income, employment documentation, assets, and a credit report. Then they will set the proper loan amount and determine what type of loan and lender will be the best option for you.

The next step is where you truly see the benefit of having the best mortgage broker possible. The top mortgage brokers will really shop around to find you the best mortgage rate. They will apply for loans with different lenders to find the lowest rates for you. By negotiating terms, the top mortgage brokers will secure the best mortgage rate possible.

The Benefits of Getting the Best Mortgage Broker

Having the best mortgage broker on your side while shopping for a house can be a huge benefit. Though some people prefer to do the work themselves, there are many benefits to finding a good mortgage broker, including:

- They save you time and energy

- They have more access

- They can find you the best rate

- The act as your advisor

- They can save you fees

There are so many benefits to getting one of the top mortgage brokers, whether they are an online mortgage broker or one of your local mortgage brokers. By gathering all of your information and shopping around for the best mortgage rate, they save you countless time and energy. The best mortgage broker will also have access to more lenders. They have developed special connections and relationships with lenders over time, which benefits you in the long run.

Another benefit to snagging the best mortgage broker you can find is that they will act as your advisor through the process. If this is your first home, you may not know how complicated and frustrating the process will be. Having one of the top mortgage brokers to walk you through the process will make it that much easier.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Finally, a local or online mortgage broker may be able to save you some fees. The relationships that they have built and their knowledge of the lending markets allow them to negotiate for you. In some cases, a good mortgage broker will be able to get lenders to waive origination fees, appraisal fees, or even application fees.

Mortgage brokers do charge a commission on the services that they offer, but that is usually only around 1% of the loan. For a $150,000 house, it will cost you $1,500 for the assistance of some of the top mortgage brokers. That’s a small price to pay when you think of the time, energy, and money that they will save you.

Don’t Miss: Tips to Finding USDA-Approved Lenders | Guide to USDA Financing & USDA House Loans

Where to Find a Mortgage Broker Online

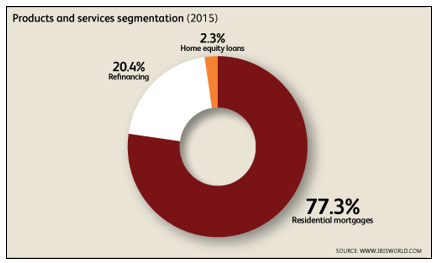

An online mortgage broker is a great asset to have. While annual growth in the online mortgage broker industry from 2010-2015 declined 2.1%, for the next five years it is projected to have an annual growth rate of 11.1%. According to a report from IBIS Web, 77.3% of mortgage brokers are specialized in residential mortgages. This makes them a terrific resource for the home buying process.

Source: www.ibisworld.com

When you are looking for the best mortgage broker, the internet is the place to start. To get a mortgage broker online, all it takes is a simple web search. You can search for a mortgage broker online in the following ways:

- By company or institution

- By ratings

- By location

When you are looking for a mortgage broker online, one option is to search by the company they work for. Some companies have great reputations. By searching within an institution that you are familiar with and that has an upstanding reputation, you have a better chance of finding some of the top mortgage brokers.

Another way is to search for the top mortgage brokers, regardless of the institution they work for. There are many online mortgage brokers that might not be affiliated with a top company but that still do a phenomenal job. Don’t limit your options to only mortgage brokers who work for the best mortgage broker companies.

When conducting your search, you can also specify a location. An online mortgage broker search can actually reveal local mortgage brokers that you didn’t know existed. Local mortgage brokers can actually have a few benefits over online brokers, too.

The Benefits of Using Local Mortgage Brokers

Local mortgage brokers can be very knowledgeable and help walk you through the process. Unlike an online mortgage broker, these local mortgage brokers have a few added benefits, including:

- Ability to meet face-to-face

- Local connections

- Knowledge of the local market

Some people don’t mind doing everything over the phone or through email with an online mortgage broker. The benefit of a local mortgage broker, though, is that they have an office and can actually sit down and speak with you. Getting to know someone face to face can help establish a better rapport. As an added bonus, you won’t need to worry about time zones getting in your way either, as you will be on the same schedule.

A local mortgage broker will also have connections in the area that online mortgage brokers will not. They know the local banks in the area and how they operate when assessing and approving loans. These relationships may help them negotiate better terms and find you the best rate.

Image Source: Best Mortgage Brokers

Finally, if you use a local mortgage broker, they will know the local market better. When assessing your loan amount, they will know what type of house you will be able to afford. In the initial assessment, they may even be able to tell you whether your expectations are realistic. An online mortgage broker may not have location-specific market knowledge, which can put you at a disadvantage.

Related: Bad Credit Boat Loans | Top Tips to Getting Boat Financing with Bad Credit

How Do You Find One of the Top Mortgage Brokers?

We all want the best mortgage broker to walk us through the mortgage and home buying process. It doesn’t matter if you use an online mortgage broker or one of your local mortgage brokers, you simply want one of the top mortgage brokers on your team. To find the best mortgage broker, you need to do a few things:

- Ask the right questions

- Research their company

- Read the good AND bad reviews

When you look for the top mortgage brokers, you should interview at least three of them. They are essentially applying for a job to work for you, and you need to take this seriously. Be sure to ask how they like to communicate with clients, how long their average turnaround times are, and what lender fees you will be responsible for. Top mortgage brokers will be able to easily answer your questions and provide more information than you even asked for.

It is also important to research the company, as well as the lender. They might be the best mortgage broker for you, but what if they leave and you get someone else at the company? What if the company is in financial trouble and goes under? Make sure that you have a Plan B and that it is something that you can live with.

During the process, review sites will be your best friend. It is important to read an assortment of reviews on your mortgage broker, if there are any. Even if they’re a referral and your friend or family member loved them, not everyone has the same experience. Also, be sure to read all of the fine print. Know what you will be paying up front and how your relationship with the local or online mortgage broker will work.

Conclusion

A mortgage broker is not for everyone because some people enjoy the do-it-yourself approach. To others, a good mortgage broker is a useful asset. If you do choose to use one, make sure that you find the best mortgage broker for you. It is important to note that this will mean different things to different people.

Some people just want the absolute best mortgage rate, while others want someone to hold their hand through the entire process. Be sure to thoroughly interview your local or online mortgage broker before signing on with them. Know what is important to you and ask questions accordingly to find the best mortgage broker.

When you buy a home, you are in for the long haul. A good mortgage broker simply will not cut it; you need the best. Even an extra quarter of a percentage point on your mortgage rate can mean thousands, if not tens of thousands, of dollars in the long run. Take your time to carefully choose the best mortgage broker and lending institution that will put you in the best spot financially for the future.

Popular Article: Steps to Buying a House | What You Should Know: House Buying Process – Step by Step

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.