Getting the Best Rates on El Paso Mortgages (10-15-30-Year Fixed, 5/1, 7/1 ARM)

For home buyers looking to purchase a home in El Paso, one of the biggest financial challenges will be finding competitive rates on El Paso mortgages.

This is especially true for first time home buyers in El Paso, TX, since not all El Paso mortgage companies offer affordable rates and terms for a first time El Paso mortgage.

Additionally, for current home owners interested in refinancing their existing El Paso mortgage, it’s important to find competitive El Paso mortgage rates to maximize the benefits of refinancing.

Whether you are a first-time home buyer in El Paso or a homeowner looking for the best refinance rates in El Paso, taking the time to examine your options is key to saving money in the long-term.

Current mortgage rates in El Paso are subject to change from one day to the next, so it’s important to weigh your options between mortgage companies in El Paso, TX to get the best rates and terms.

Today’s DC Mortgage Rates | Best Washington, DC Mortgage Rates & Offers

Current Mortgage Rates in St. Louis | Best St. Louis Mortgages for Good-Excellent Credit

Making Larger Down Payments

Whether you are a first time home buyer in El Paso, TX, or a seasoned home buying professional, every little bit helps when it comes to getting lower mortgage rates.

Although some El Paso mortgage companies require a down payment of 3 percent, the best way to secure affordable El Paso mortgages is to put down closer to 20 percent of the home’s value.

Along with getting more affordable El Paso mortgages, a higher down payment means that you can avoid paying extra for private mortgage insurance (PMI).

Many mortgage companies in El Paso, TX, require the purchase of mortgage insurance for smaller down payments to protect their investments in case borrowers stop making payments.

Typically, borrowers must continue paying until they reach a loan-to-value ratio of 80 percent. While it may not help you cut down costs over the long-term, it certainly does provide short-term affordability for a first time home buyer in El Paso, TX.

According to Zillow, the average premium for PMI ranges between $30-$70 for every $100,000 borrowed, which could make it an affordable compromise for first time home buyers in El Paso, TX, that can’t put down the full 20 percent.

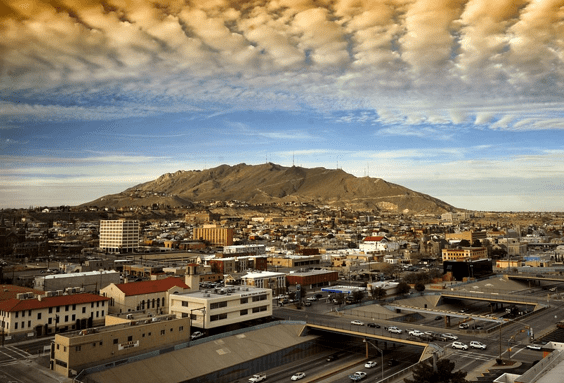

El Paso, TX

Current Mortgage Rates in Tampa | Best Rates, Terms, & Offers from Mortgage Companies in Tampa

Current Fort Worth Mortgage Rates | Best Fort Worth Mortgages for Good-Excellent Credit

Importance of Credit Score

As a home buyer in Texas, having a solid credit history will play a huge role in determining the available rates on El Paso mortgages.

Whether your score is low or high, it’s important to understand where your credit score is at before you start talking with mortgage companies in El Paso, TX.

Just like any other loan, a borrower’s credit score is used as a benchmark for reliability. El Paso mortgage companies see high credit scores as proof of reliability, offering more affordable El Paso mortgages as a result.

Lower credit scores can be problematic for lenders, as they raise doubts on whether a borrower can manage the cost of El Paso mortgages.

While exploring mortgage rates in El Paso, take the time to examine your credit score. Look for ways to boost your score through paying off any old debts or resolving errors before committing to a mortgage rate in El Paso.

If you are a first time home buyer in El Paso, TX, you may be able to receive better rates and terms for a first mortgage, regardless of your credit score.

As such, don’t forget to ask about available options for first time home buyers in El Paso, TX, to ensure that you don’t miss out on promotional rates and terms.

Current Mortgage Rates in Des Moines | Best Offers & Terms for Des Moines Mortgages

Conclusion – Getting a Top Mortgage Loan for a Home in El Paso

Purchasing a home can be an exciting time—particularly for first time home buyers in El Paso, TX, it marks change, renewal, progress, and the pride of ownership.

As you search for the best El Paso mortgages, you may want to ask yourself the following questions:

- Have I evaluated all my options as a first time home buyer in El Paso, TX?

- Can I get better rates from online or local El Paso mortgage companies?

- Are there any opportunities to improve my credit score before applying for El Paso mortgages?

Ultimately, finding the best El Paso mortgages is a combination of evaluating long-term affordability and partnership.

No matter what El Paso mortgage companies you prefer, it’s important to partner with a financial institution that you trust and are comfortable working with for the next few decades.

There are plenty of ways to identify the best mortgage companies in El Paso, TX, including fees, quality of customer service, support for El Paso new home buyers, and how competitive their rates on El Paso mortgages are.

Current Mortgage Rates in Raleigh, NC | Best Raleigh Mortgages for Good-Excellent Credit Borrowers

Today’s Orlando Mortgage Rates | Best Offers & Rates for Orlando Home Loans

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image source:

https://pixabay.com/en/el-paso-texas-buildings-landscape-123727/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.