Getting the Best Fort Worth Mortgages (10-15-30-Year Fixed, 5/1, 7/1 ARM)

Are you in the market to buy a home in Fort Worth? As a home buyer, one of the biggest challenges is finding a competitive Fort Worth mortgage that won’t break the bank.

Conversely, if you’re looking to refinance an existing Fort Worth mortgage, you’ll want to find Fort Worth mortgage lenders that offer affordable and flexible rates to ensure that the process is as beneficial as possible.

Whether you are buying a home for the first time or looking for the best refinance rates, taking the time to examine your options is key to saving money in the long-term.

Current mortgage rates in Fort Worth are subject to change from one day to the next, so it’s important to weigh your options between Fort Worth mortgage companies to help you identify the best Fort Worth mortgages.

Current Mortgage Rates in Des Moines | Best Offers & Terms for Des Moines Mortgages

Good, Great, or Excellent Credit Scores for Fort Worth Home Loans

Most lenders that provide competitive Fort Worth mortgage rates use a FICO score to determine if a borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

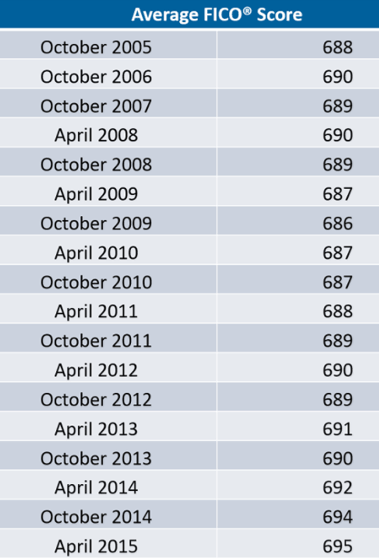

FICO scores for Fort Worth mortgage rates generally fall into these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

If you’re curious about the average credit score, see the table below for average FICO scores from 2005-2015. According to CNBC, as of this year, the average score is 700.

Current Mortgage Rates in Raleigh, NC | Best Raleigh Mortgages for Good-Excellent Credit Borrowers

Today’s Orlando Mortgage Rates | Best Offers & Rates for Orlando Home Loans

Credit Score Tips for Fort Worth Mortgage Rates

As a home buyer in Texas, having a solid credit history will play a huge role in determining the types of Fort Worth mortgage rates you receive.

Whether your score is low or high, it’s important to understand where your credit score is at before you start speaking with Fort Worth mortgage companies.

Below, please find a few credit score tips to help home buyers get the best rates and terms on Fort Worth mortgages:

Know What Type of Credit Score You Will Need

As with any other type of loan, higher credit scores will get you the best rates, but even home buyers with less than ideal credit can find the right Fort Worth mortgage for them.

According to Quicken Loans, a score of 660 or higher will provide a wide range of options, but an FHA loan for a Fort Worth mortgage can be approved with a score as low as 580.

No matter what type of Fort Worth mortgage you are considering, it’s a good idea to do your research beforehand so that you know exactly what type of credit scores are required by Fort Worth mortgage companies.

Monitor Your Credit Score Regularly

If you aren’t already checking your credit score on a regular basis, now is the time to do it. As a home buyer, you’ll want to carefully review every aspect of your score to prepare for evaluation from Fort Worth mortgage companies.

This is a great opportunity to resolve any errors or identify areas for improvement, like paying down credit cards or eliminating old bills.

Using a free credit monitoring service like CreditKarma is a great way to prepare yourself for great mortgage rates in Fort Worth.

Consult with a Mortgage Expert

If you’re worried about whether your credit history may impact your ability to get great Fort Worth mortgage rates, you may want to speak with a financial expert.

Getting additional guidance and advice can provide invaluable direction on how to improve your chances of getting affordable Fort Worth mortgages, even if your credit score is not as high as you had hoped.

Current Mortgage Rates in Boise, Idaho | Best Boise Mortgage Rates for Good-Excellent Credit

Current Mortgage Rates in Cincinnati | Best Cincinnati Mortgage Rates & Offers

Conclusion – Getting the Best Rates & Terms for Fort Worth Mortgages

Once you know what type of loan you are interested in, your next step is to start evaluating lenders to find the best Fort Worth mortgage rates and terms.

Just as with any other shopping experience, it’s important to weigh in your options and compare offers from multiple Fort Worth mortgage lenders to ensure that you are getting the best deal possible.

Affordable and manageable Fort Worth mortgages are determined not just by monthly payments, but also by interest rates and Fort Worth mortgage terms.

As such, don’t be afraid to shop around until you find the best mortgage rates in Fort Worth for your financial needs.

Current Pittsburgh Mortgage Rates | Best Offers, Terms, & Rates for Pittsburgh Mortgages

Current Mortgage Rates in Tulsa | Home Loans in Tulsa for Good-Excellent Credit Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

- https://pixabay.com/en/texas-flag-texas-flag-state-usa-1221026/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.