Getting the Best Mortgage Rates in Oklahoma City (10-15-30-Year Fixed, 5/1, 7/1 ARM)

Although home values in Oklahoma are steadily rising, homeowners looking to buy a home in OKC will be much better off than other homeowners across the country.

According to Zillow, the median home value in Oklahoma City is currently $133,700. Although this marks a rise of 3 percent over the past year, an Oklahoma mortgage is still poised to be an affordable purchase when compared to the national median home value of $201,900.

Of course, home values and prices are only part of the equation—for a home purchase to truly be affordable, you’ll need to find great mortgage rates in Oklahoma City.

Luckily, for those planning on buying a home in Oklahoma City, there are plenty of mortgage lenders in OKC offering competitive Oklahoma City mortgage rates.

Current Mortgage Rates in Milwaukee | Best Milwaukee Home Loans & Mortgages

Hidden Costs of Oklahoma City Mortgage Rates

Before you even start the application process, it’s helpful to consider the following “hidden costs” of Oklahoma City mortgage rates:

- Mortgage application fees (typically 1-2 percent of the total purchase price)

- “Good faith deposit” (helps the seller know that you intend to buy)

- Down payment (20 percent of the total mortgage)

There are also closing costs to consider, which can include a wide range of expenses from:

- Mortgage points

- Attorney’s fees

- Inspections or surveys

- Title insurance

- Escrow deposit

- City recording fees

Although all Oklahoma City mortgages are subject to differences depending on loan amount, location, appraisal, etc., Bankrate estimates that the average closing costs for a Oklahoma City mortgage can be as much as $1,847.

Current Mortgage Rates in Denver | Best Rates & Terms for Denver Mortgages

Current Mortgage Rates in Columbus, Ohio | Best Columbus Mortgage Rates for Good-Excellent Credit

What Influences Your Interest Rate?

There are plenty of factors that could make a difference in the rates you receive from mortgage companies in Oklahoma City. For example, your Oklahoma City mortgage rate could be impacted by any of the following:

- Type of loan and term length

- Your credit score and history

- The overall amount of the loan

- The initial down payment amount

Generally speaking, Oklahoma City mortgage rates will be primarily based on your credit score, since lenders use this to gage their level of risk, or whether a borrower will default on a loan.

In addition to the factors listed above, mortgage rates in Oklahoma City are constantly in a state of flux, meaning that the current financial market could also impact Oklahoma City mortgage rates from one day to the next.

Good, Great, or Excellent Credit Scores for Oklahoma City Mortgages

Most mortgage lenders in OKC that provide competitive Oklahoma City mortgage rates use a FICO score to determine if a borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

FICO scores for Oklahoma City mortgage rates generally fall into these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

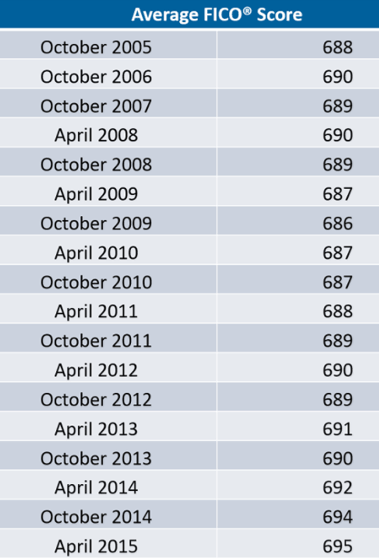

If you’re curious about the average credit score, see the table below for average FICO scores from 2005-2015. According to CNBC, as of this year, the average score is 700.

Current Mortgage Rates in Detroit | Best Detroit Home Mortgages for Good-Excellent Credit Borrowers

Current Mortgage Rates in Portland, Oregon | Best Rates & Terms for Portland Mortgage Rates

Conclusion – Getting the Best Mortgage Rates in Oklahoma City

Buying a home is anything but a quick process. The average processing time for Oklahoma City mortgages is anywhere between 30-45 days, including the start of application to the closing.

Given this, home buyers should create a plan to avoid unnecessary delays or extra expenses when dealing with mortgage lenders in OKC.

With rising mortgage rates in Oklahoma City, home buyers can gain a significant advantage from providing a down payment that is 20 percent or more of the total home price.

Not only does this lessen the burden of Oklahoma City mortgage rates over time, but it can also make home ownership more affordable, since many mortgage lenders in OKC will remove the cost of mortgage insurance.

First Time Home Buyers in North Dakota | Best Loans for ND First Time Home Buyers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/new-england-style-house-2826065/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.