Guide: How to Find the Best Online Payday Loans for Bad, Good, or Poor Credit Borrowers

At one time or another, many people find themselves in need of some quick cash and seek out some best payday loan lenders to get their family through a tough time until their next paycheck.

These short term loans are offered several places online, which gives people more choices, but it can also make finding the best online payday loans more difficult because there are bad lenders mixed in with the good ones, and you have to sort through them all to find the best cash loans available.

It can also be more difficult if your credit isn’t great to find the best payday loans for bad credit or the best payday loans—no credit check required—that won’t charge you an exorbitant interest rate.

It only makes matters worse when you need the best cash advance you can find short-term, to only then have to pay a large sum for the interest.

In our “10 Tips for Finding the Best Online Payday Loans with Bad, Good, or Poor Credit” article, we are going to show you how to navigate through the risky lenders to find the best payday loans online that will get you the short-term cash you need without plunging you deeper into a financial hole.

We will go through the top 10 payday loans sites that can help you find the best cash loans whether you have good or bad credit, provide top payday loans consumer protection information from the Federal Trade Commission (FTC), and give you the tools you need to identify the top online payday loans offered.

Image Source: Pixabay.com

Tip #1: Know How Top Payday Loans Work

Before you start searching out the best online payday loans, you should know what to expect and exactly how it all works when using the best payday loans online you can find for a short-term cash loan.

While each company may have slightly different rules for their best cash advance offers, there are certain averages, according to CFA Payday Loan Consumer Information, that most lenders offering the best payday loans will follow.

How Top Payday Loans Typically Work:

You write a check for the loan amount, including fees and interest, or give access to your bank account for an electronic charge. The lender gives you the loan, then puts the check or charge through after the agreed-upon time.

- Average loan size: $100 to $1,000

- Average loan term: about 2 weeks

- Average interest rates: 390% to 780% APR

- Average requirements: a bank account, a steady source of income, identification

Image Source: Top Payday Loans

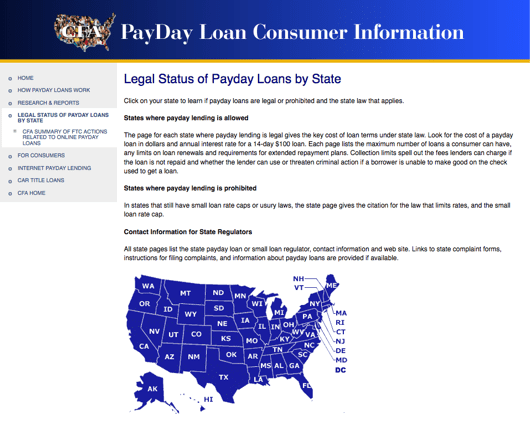

Tip #2: Check Your State’s Lending Laws

There are eighteen states and the District of Columbia that prohibit extremely high costs when it comes to best online payday loans lenders. For example, New York and New Jersey limit interest rates for top payday loans to 25% and 30%.

Thirty-two other states have enacted legislation that authorizes best cash advance loans based upon checks written on a consumer’s bank account at triple-digit interest rates or without a rate cap.

You can visit Paydayloaninfo.org to find your state’s regulations relating to the best payday loans online.

Tip #3: Research Rankings from Top 10 Payday Loans Rating Sites

You can save yourself some time in your initial search for best payday loans online by checking out the rankings from these top 10 payday loans rating sites.

Not all short-term best cash loans are created equal, so by cross-referencing the ratings sites below, you should get a good idea, no matter what type of credit you have, of where to find the best payday loans for bad credit and the best payday loans—no credit check needed.

- Consumer Affairs—Top 10 Payday Loans & Title Loan Companies

- LeadersUS—Top Lenders United States: Best Cash Loans Short-Term (2016)

- Top 10 Reviews—Top Online Payday Loans Reviews

- AdvisoryHQ—Top 5 Best Payday Loans Lenders: 2016

- The Top Tens—The Best Payday Loans Companies

- Business News Daily—The Best Online Payday Loans Services

- OnlinePaydayLoans.org—Highest-Rated Top Online Payday Loans Lenders

- SuperMoney—Best Payday Loans Reviews

- Knoji Consumer Knowledge—4 Reputable, BBB-Rated Best Payday Loans Online

- Top10PaydayLenders.com—The Top 10 Payday Loans Lenders

Tip #4: Know What States They Can Lend In

After an extensive search, you may think you’ve found the best online payday loans company for your needs, but when you go to apply, you find out they can’t lend within your state, and it’s back to the drawing board.

Save yourself time by reviewing the fine print or FAQs for any of the best payday loan companies you’re considering to see which states they can do business in.

Some top payday loan companies, like Check ’N Go, do business in several states but not all of them.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Tip #5: Know the Difference between a Best Cash Loans Finder and Lender

When you’re searching for the best payday loans for bad credit and the best payday loans—no credit check required, you need to know the difference between a website that is a finder for top online payday loans and one that is actually the lender where you can directly apply for your best cash advance loan.

For example, 100DayLoans.com notes that they are not a lender and do not make any offers for the best payday loans. Instead, they provide a service wherein they submit the information you provide to one or more best online payday loans lenders and attempt to search for a lender for you to meet your needs.

In contrast, if you’re looking for best payday loans online and visit CheckIntoCash.com, you’ll see that this company is one that actually approves your application and lends you the money and will not give you a listing of other best cash loans options.

Image Source: Top Payday Loans OLA

Tip #6: See If They’re a Member of OLA or CFSA

You’ll see on several of the best online payday loan websites a symbol that says they are a member of OLA (Online Lenders Alliance) or CFSA (Community Financial Services Association of America). The OLA members “abide by a list of Best Practices and Code of Conduct to ensure their customers are fully informed and fairly treated.” The CFSA is a national organization dedicated to “advancing financial empowerment for consumers through small-dollar, short-term loans.” Their members also follow a set of best practices.

While any best payday loans online lender can either follow the good or bad practices of their choosing, if they are a member of either OLA or CFSA, it can give you an extra level of confidence that this particular best payday loans online lender has taken an extra step to ensure consumer protection when they provide best cash loans offers.

Tip #7: Know What to Watch Out For

You do need to be aware of traps that may be set by less-than-honorable lenders that may try to present themselves as the best payday loans for bad credit providers and advertise the top payday loans. There are plenty of good companies out there that provide the best payday loans—no credit check or background check required—but in order to find them, you need to know what to avoid from the bad ones. It is also a great idea to review the Federal Trade Commission Online Best Payday Loans information.

Best Online Payday Loans Things to Watch Out For:

- Watch out for companies getting around state loan interest limits by charging a large weekly or monthly loan “fee” (which is not counted as “interest”)

- Fees for late payments that are exorbitant

- Companies with a bad online reputation

- Extra charges on your bank account if you’ve given them debit access

- Offers to loan you more than you asked for (which of course comes with higher interest rates and fees)

- Opt-in auto-debits that renew the loan amount before you’ve asked

- Identity theft—non-reputable top online payday loans offers can come from companies that sell your personal information to the highest bidder

Tip #8: Check Reputations for Best Payday Loans Online Lenders

There are some reliable, consumer-focused websites that will give you more insight into the background of the best online payday loan lenders. From the Better Business Bureau to Glassdoor, a site where employees review their own company, you can often use them to get more insight into the business practices of a top payday loan company before you give them your personal data.

Check reputations for best payday loans companies at:

- Better Business Bureau (BBB)

- Glassdoor.com

- Whois.com (check who has registered their website)

- Google.com Search for lawsuits (use “v company name”)

- U.S. Securities and Exchange Commission EDGAR filings

- Twitter (do a #companyname search on Twitter)

Tip #9: Review Interest Rates and Fees

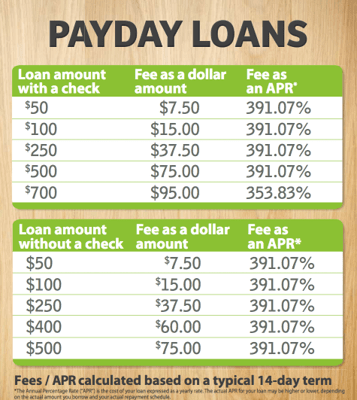

Most people know going in that if they’re looking for the best cash advance in a short time frame, then the interest rate is going to be higher than that of a conventional loan. Typically, there is no credit check done because the amount is usually $1,000 or less, and the term is usually just two weeks (or until the next payday).

But there can be vastly different rates between the top online payday loans, so you definitely want to shop around.

Of course, your state may regulate a cap on the APR, but be sure to note the fees, as those can often be a workaround. Below is an example from Moneytree relating to their loan fees in Washington state.

Image Source: Best Payday Loans Online

Tip #10: Use an Online Calculator

Any lender giving one of the best payday loans is going to present the data related to APR and fees so it looks best for them, but that’s not always the most transparent for the consumer. In order to make sure you understand all the costs of the best payday loans online that you find, use can use an online calculator that will let you input the annual percentage rate and any associated fees to give you a full picture of the total cost of the loan. Here are a few that you can use:

Best Payday Loans Online Recap

While seeking out one of the top payday loans might not be something anyone wants to do regularly, it is nice to know that there is cash to access when you need it.

Many companies offer the best payday loans—no credit check needed—and even give best payday loans for bad credit, which can come in handy if you have an unexpected expense like a car repair or major appliance that needs replacement, like a refrigerator or air conditioning unit.

As with any type of information you provide online, you want to make sure you’re giving it to a reputable best cash loans company, so you should do a little homework on the lender to see if they’ve got either OLA or CFSA membership and also check them out with the Better Business Bureau or just a general Google and Twitter search to see what others say about them. A little time spent upfront checking out a potential top payday loan company can save you a costly headache later.

If you utilize the top 10 payday loans rating sites, it will help you save some time and also greatly narrow down the full list of the best online payday loan sites to take a look through. You can definitely access needed cash until that next payday through a reputable best payday loan site, but you want to be sure that you’ve fully researched their reputation to ensure you’re getting the best and most trustworthy deal possible.

Read More: Lawyer Retainer Cost | How Much Do Retainers Cost? Full Details

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.