The Top Ranked Best Personal Accounting Software for Home Use

When it comes to tracking your saving and spending, there are methods out there that either won’t cost you a dime or will barely put a dent in your wallet.

Using an Excel document is one option while another one is using a pencil and notepad to get you started right away. However, while these may sound rudimentary and ineffective for modern consumers, the truth is that many personal accounting software programs don’t offer much more. The vast majority of personal accounting software programs out there can’t help you transcend what you’re able to do by yourself at your desk.

This is why we created the list of the top 5 best personal accounting software for home use. These programs won’t cost you very much (in the case of Personal Capital, they’re free).

And what’s more, they come packed with the kinds of tools and capabilities to help you get a handle on your finances in ways you haven’t done before. Read on for our explanation of how we compiled our list of the top 5 best personal accounting software for home use.

Award Emblem: Top 5 Best Personal Accounting Software for Home Use

AdvisoryHQ’s List of the Top 5 Best Personal Accounting Software for Home Use

TOP PERSONAL ACCOUNTING SOFTWARE – PERSONAL CAPITAL

Personal Capital is an online, fee-only financial advisory firm founded by Bill Harris, the former CEO of PayPal and Intuit. The firm specializes in blending industry-leading technology with top-tier financial advice and free personal accounting software online.

Personal Capital has registered over 1 million users to the tune of $214 billion in tracked accounts and $2 billion in AUM. It is headquartered in Redwood City, California, with offices in San Francisco (CA) and Denver (CO).

Image Source: Personal Capital

What Does Personal Capital’s Accounting Software Cost?

One of the nicest things you’ll notice about Personal Capital’s software is that most of it is completely free.

This stands in stark contrast to many financial planners and money managers in the market today. Clients usually have to be wealthy to book a discovery meeting with a financial advisor (oftentimes, making a minimum of $500,000 or more).

However, even if you can get your foot in the door, you might not be able to afford the advisor’s consultation services or premium memberships required to use whatever independent software that it makes available to you.

This is changing with the rise of robo-advisors and mixed financial planning services (firms that blend robo-advisor online software with regular human consultation), and more and more people are now able to take charge of their finances. In other words, you don’t have to make a lot to have powerful financial planning and money management tools at your side.

That’s where Personal Capital comes in. It is an online fiduciary financial advisor offering a host of money management and personal accounting tools free to anyone who needs them.

Sure, it still doles out the pricey wealth management advice to high-net-worth individuals. However, it does one better by extending help to everyone in need.

In fact, the only way you’ll ever pay a dime to Personal Capital is if you seek out a financial planning contract with them. Otherwise, your use of its financial accounting software costs nothing more than your time.

Image Source: Personal Capital

How Secure Is Your Information?

The first thing you need to know about Personal Capital’s online personal accounting software is that it’s exactly that: online.

You won’t be downloading software directly to your computer. On the downside, if your Internet is down or your computer can’t connect, you can’t log in to your account until you gain Internet access.

Otherwise, there are plenty of pluses to this online-only feature:

- Your financial records won’t get wiped out if your computer crashes

- You can access your account from any device that gets Internet, including a PC, tablet or mobile phone

- Immediately view real-time updates and transactions; no waiting until you get home to enter the info

- Being an online portal, Personal Capital can sync with all your major accounts, including credit cards, bank accounts, savings accounts, mortgage, car payments, direct deposits, investment accounts, 401(k), and more!

No doubt, there are still reasons to be concerned that some of your most vital and important information is stored on some company’s online servers. Thieves are crafty, and if the protection around your financial data is weak, then you and your money become vulnerable.

Personal Capital shares these concerns. It knows if its financial info was being transmitted across the web, it would want multiple layers of protection surrounding it.

To that end, Personal Capital encrypts each service and each account with the highest levels of security. Your sensitive personal and financial data are protected each step of the way. Practice sound password management on your end, and the entirety of your information will be further secured.

Click Below to Open Your Free Account with Personal Capital

►► Open Your Account with Personal Capital ◄◄

To make sure your details are kept safe, Personal Capital houses your account info at Yodlee, not at Personal Capital. With Yodlee, you get an “information custodian” that defends you against hackers through a comprehensive, three-pronged approach:

- Network security: The Personal Capital network, over which your information is transmitted, is constantly monitored and protected.

- Information security: Your personal financial data is systematically encrypted, both during transmission and storage.

- Application security: The tools themselves and, by extension, the Personal Capital online portal are encrypted and guarded at all times.

Personal Capital also engages in its own security best practices in the following ways:

- Rated “A” by Qualys SSL Labs: Personal Capital maintains one of the strongest security ratings assigned by Qualys SSL Labs, an SSL server-testing lab. The A rating is considered stronger than the vast majority of major financial institutions, including brokers and banks.

- Daily Transaction Monitor: This tool enables you to quickly track, identify, and report suspicious activity on any of your linked accounts.

- Multi-device authentication: While Personal Capital allows you to access your information on a variety of media platforms, such as a PC, tablet or mobile phone, each new device must be registered and authenticated in order to be recognized for future use. This allows Personal Capital to shut down any attempt by thieves to access your data through an unrecognized device. To confirm that each new device you register is done so by you and not an impostor, Personal Capital asks for your verification by email, phone call or text message.

- Touch and PIN authentication: Yet another layer of security – this time, it’s exclusive to mobile phones. iPhones come with Touch ID authentication while iOS and Android phones require a personal identity number (PIN).

What Accounting Software for Home Use Does Personal Capital Offer?

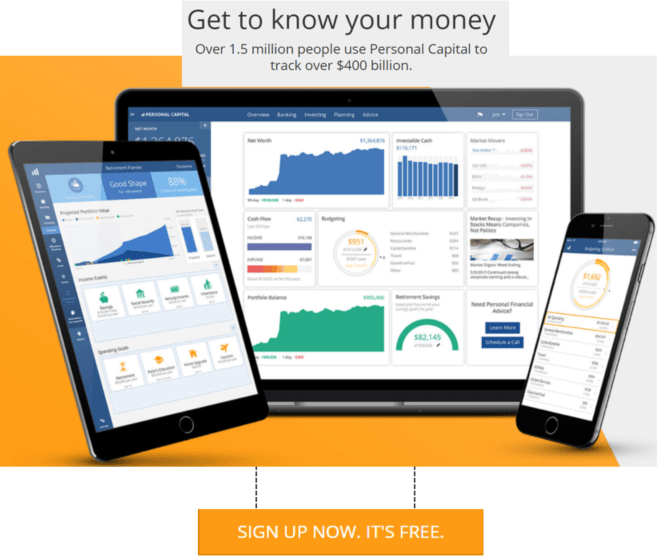

Personal Capital offers a suite of extremely valuable, free personal accounting software. These include:

- Net Worth & Cash Flow Analyzer

- Fee Analyzer

- Investment Checkup Tool

- Retirement Planner

Each tool is packed with powerful metrics designed to help you get the most out of your financial planning and tracking.

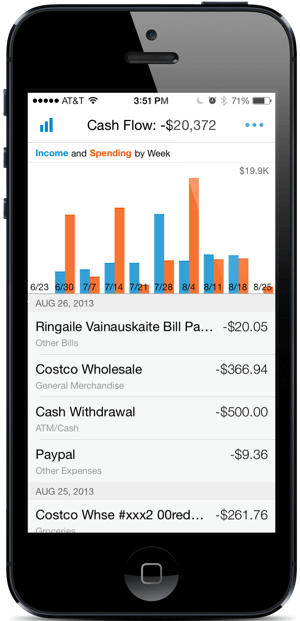

When you sign up for a free Personal Capital account, you enjoy access to a customized Personal Capital Dashboard. On this dashboard is the Net Worth & Cash Flow Analyzer.

The Analyzer lets you keep track of your net worth by syncing all of your accounts: everything from car loans and leases, mortgages, savings accounts, checking accounts, credit cards, 401(k)s, IRAs, investment accounts, and more.

Personal Capital believes it is your net worth – what you own minus what you owe – that is the most important number regarding your financials. In Personal Capital’s opinion, this is the truest measurement of your financial health.

Not only that, but your net worth informs every projection you have concerning your financial future or the goals you’ve set thereof.

Click Here to Join Personal Capital Now!

In an ideal world, the proper balancing of your myriad of accounts results in a healthy and growing net worth. After all, if your spending and saving are disciplined, and if you’re living within your means, then your total assets will grow. This, of course, bars unforeseen circumstances, such as protracted illness, home repair, sudden unemployment, and the like.

Plus, if you have investment accounts, focusing on your net worth relieves you of the sometimes arduous task of tracking your assets’ every move. Likewise, you see the “big picture” of debt management and how each liability impacts your bottom line and, consequently, your future.

The Net Worth and Cash Flow Analyzer lets you see in one simple step whether you’re moving nearer or farther from your financial goals. However, what you may not know – indeed, what many people using free home accounting software don’t know – are the implications of excessive fees on your various accounts.

Are you aware of all the fees you’re paying on each of your accounts? Do you know how your fees stack up to competitors’ fees?

Personal Capital lets you know with its Fee Analyzer. You not only learn if you’re paying hidden fees, but you’re also shown custodial fees, 12b-1 fees, inactivity fees, mutual fund expense ratio fees, and more.

Personal Capital’s own number-crunching has found that many people lose hundreds of thousands of dollars in fees over the life of their accounts. The Fee Analyzer shows you how to cut down these fees and put that money back into your savings.

This can add an extremely significant amount to your retirement planning, home-buying plans, college funding planning for your children, disaster savings, and beyond. In this way, Personal Capital helps you build extra security into your future. However, what if you’re already paying the minimum in possible fees while struggling with an underperforming investment portfolio?

That’s where Investment Checkup comes into play. Personal Capital gives you a “second opinion” service by analyzing your investments on your behalf.

It tells you how your portfolio is doing, if it could be doing better, and what changes to incorporate to improve overall performance. These recommendations are customized to you and your personal needs.

Personal Capital’s suggestions incorporate asset allocation synergized with balanced asset location and global diversification, all the while staying geared toward maximal returns on minimal risk.

For additional perspective, you can also view how your revamped portfolio would have performed in the past. In the event that you want Personal Capital to implement and manage its recommended portfolio, you have the option of entering into a financial advisor contract.

Personal Capital will then earn a percentage of assets under management (AUM) on your account and nothing more. This makes for a conflict-free experience and helps build greater trust between you and your Personal Capital advisor.

The Net Worth, Fee Analyzer, and Investment Checkup tools alone give you the power to optimize your financials for continued success. However, what about planning for that one day in the future – however distant or not-so-distant – when you’d like to stop working and start supporting yourself and your family with the money you grew and protected?

Enter Personal Capital’s Retirement Planner. This online personal accounting tool gives you a snapshot of your progress toward retirement. You no longer have to wonder where you stand and if your future dreams are in jeopardy.

Instead, you can see clearly the impact that each spending decision has on your target. Are your spending habits taking away from your target? Are your investments underperforming and stalling your progress? Retirement Planner shows you what changes to make to get back on track.

Let’s say retirement is still 10 years or more away. During that time, you’ll need to fund at least two college educations, buy a summer home, and add to your nest egg on top of it all.

Retirement Planner lets you coordinate these major life events while keeping your short-term goals manageable and your long-term goals reachable. With this personal accounting software – free of charge – in concert with the above three tools, you can breathe easier and focus on enjoying life both now and later.

FREE Finance Software – State of the Art

►► Get Your Free Highly Advanced Software from Personal Capital◄◄

What’s the Learning Curve on Personal Capital Home Accounting Software?

It’s virtually nonexistent.

Sure, you’ll need to enter some information now and then, and syncing your accounts is your responsibility initially.

However, even these beginning steps don’t take long to complete. Not to mention, they are simple, oftentimes requiring the most basic information necessary to digitally access your multiple accounts.

Once those accounts are loaded onto your Personal Capital Dashboard, the real-time monitoring and tracking is taken care of for you. You don’t have to scour complicated and involved spreadsheets for line-item figures.

Personal Capital synchronizes all of your relevant financial data, summarizes account activity, and, in the case of retirement planning, projects your progress toward your target. But what to do if you’re a personal accounting newbie who’s afraid of getting lost and confused within mounds of technical jargon?

Fear not because Personal Capital streamlines everything for you. Each tool features a smooth, intuitive interface built to teach you about your finances. And in the event that you’re stumped or fear an error has been made on your account, Personal Capital is always available to field your questions and concerns.

Join Personal Capital Now For Free Financial Tools!

Image Source: Personal Capital

TOP PERSONAL ACCOUNTING SOFTWARE – QUICKEN

Quicken is one of the oldest personal accounting software programs still available today.

Originally launched in 1984 by parent company Intuit, Quicken was later relaunched in 1997 as Quicken.com. By 1998, Quicken had become the most popular site for web-based personal accounting software.

As of March 3, 2016, Intuit announced it will sell Quicken to H.I.G. Capital.

Through the years, Quicken has maintained an active market presence when it comes to accounting software. Personal finance, however, like any sector that enjoyed a surge during the dot.com boom of the late 90s, has undergone much evolution since then.

As a result, the market is greatly diversified, and consumers have many more choices than they had nearly two decades ago. Thus, Quicken is no longer the powerhouse it once was.

Image Source: Best Personal Accounting Software

Image Source: Best Personal Accounting Software

Nonetheless, it stands as a testament to the high quality of the program that it’s still around and attracting new users every year. What makes Quicken so great? What are some of the questions you should be asking to determine if Quicken is right for you?

►► Get Your Free Personal Finance Software from Personal Capital◄◄

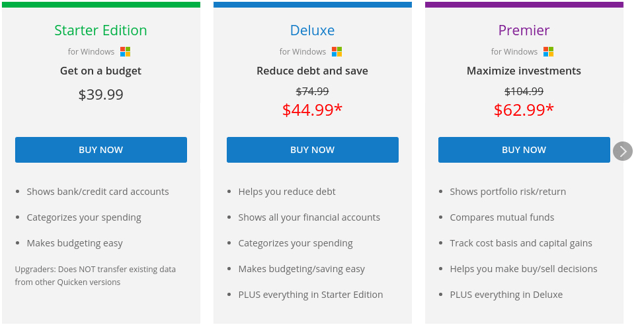

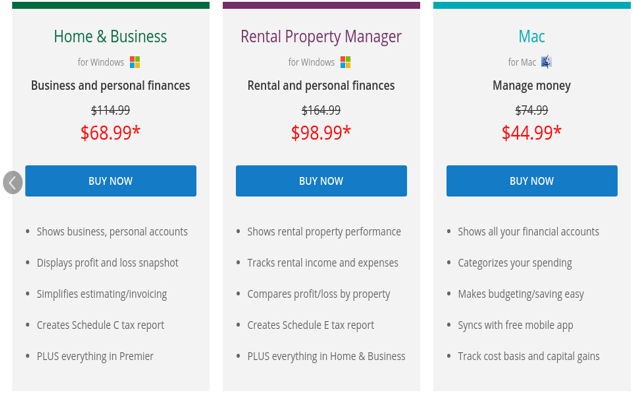

What Editions Are Available for Quicken Accounting Software?

Personal accounting programs are typically offered in only a few distinct editions. Quicken, however, recognizes that everybody’s needs are different.

You might require software that can track investments, create asset and liability reports or assist in budgeting money toward a new home.

Accounting software free of such bells and whistles, however, might be more appropriate for a friend with no complicated debt or cash flow concerns. Purchasing software that shares the same sophistication as yours would either be cost-prohibitive or just plain unwarranted.

The editions of Quicken, along with its primary features, are listed as follows:

More information about each edition of Quicken can be found here.

Does Quicken Come with Bonuses or Extra Features?

Credit scores are heavily sought-after pieces of information in our society’s drive to maximize individual purchasing power. However, requesting a copy of your credit score isn’t always the most convenient thing to do during your free time.

Intuit wants to help you get this done. To that end, it offers you free access to your Equifax® credit score every 90 days. There are no additional charges or hidden fees for this service.

Quicken will send you alerts anytime Equifax® receives new information about your credit from creditors. This allows you to stay on top of your credit score and prevent unwanted or mistaken hits against your credit.

Additionally, editions of Quicken from the Premier level and higher offer Portfolio X-Ray®. This feature gives you a more detailed insight into your investments. You can track the individual assets within your mutual funds and get a glimpse of your portfolio’s diversification, bond style, stock style, and more.

Quicken can also export your financials directly into TurboTax tax preparation software. This saves you a lot of time and energy come tax season. You simply export your files without needing to print them or take them to an accountant.

Both TurboTax and Quicken are owned and distributed by Intuit.

►► Free Wealth Management Software◄◄

How Does Intuit Protect My Information?

Quicken features a service called One Step Update. This allows the software to update your account information every time you log onto your Quicken program.

That information is kept private and confidential. Quicken does not release the info to any outside party for any reason. It is reserved solely for proper functioning of the One Step Update service in relation to your account details.

Aside from its privacy policy, Quicken ensures that your information is protected in other ways. These include:

- Secure Socket Layer (SSL) protocol: The SSL protocol encrypts your financial data when it travels from your financial institutions into your Quicken software and vice versa. This makes your information unreadable during transmission.

- Integrity checks: Intuit double-checks that the transmitted information was not changed in any way during travel.

- Firewall: Intuit houses your information inside servers protected by a firewall. The servers are located inside Intuit’s secure data center.

- Two-Step Verification: You must sign into the Quicken software using a password. However, you must also enter a password provided by your bank or financial institution every time your software connects to the Internet. The password can be changed whenever you like. To add an extra layer of protection, you have the choice of securely storing passwords in Password Vault.

- Additional password protection: Not only does Quicken come with password protection for opening the program itself, as well as connecting to your financial accounts, but you can password-protect your individual files, too.

Is Quicken Affordable?

One of the things we really like about Quicken is that it is priced under multiple tiers. This helps users who really need quality accounting software but don’t have the money to afford more expensive editions.

When considered together, these editions assist every budget, purpose, and need. These editions include:

- Quicken Starter for $39.99

- Quicken Deluxe for $44.99

- Quicken Premier for $62.99

- Quicken Home & Business for $68.99

- Quicken Rental Property Manager for $98.99

- Quicken, Mac version for $44.99

All editions of Quicken come with a 60-day money-back guarantee. If you buy Quicken but don’t like it, you can return it for a full refund.

Quicken Bill Pay is an add-on that can be downloaded at the additional cost of $9.95 per month.

A Quicken mobile app for iPhone and Android is available free of charge.

Does Quicken Offer Free Updates?

When an update is available, Quicken automatically installs it upon connecting to your financial institution through One Step Update.

The update only applies to the current version that you own. This is the difference between an “update” and an “upgrade.”

Upgrades do not involve advancing between editions (for example, from Quicken Starter Edition to Quicken Deluxe Edition) or edition year (from 2015 to 2016, for instance).

Thus, if you purchase Quicken Starter Edition 2016, you will not receive an upgrade to Quicken Starter Edition 2017 when it launches. Instead, you will continue receiving updates to Quicken Starter Edition 2016 even after new yearly editions are released.

However, if you use the same version of Quicken long enough, a “sunset provision” will kick in. This means Quicken will no longer issue updates for that particular version, requiring you to purchase the latest version at that time.

To upgrade your software, you’ll need to purchase your desired edition and version at full or sale price.

TOP PERSONAL ACCOUNTING SOFTWARE – QUICKBOOKS

As you’ve seen in the previous entry, Intuit delivers well-rounded personal accounting software for home use with its Quicken program. The software, like the company, has been in business for decades and appears poised to maintain its place in the market for some time.

However, flush with the success of Quicken and its dominance within the personal financial management market in 1997, Intuit wasn’t content to stop there. Instead, it launched QuickBooks soon thereafter, tooling the software toward small- to medium-sized business owners.

Intuit has never looked back. At one point, QuickBooks’ popularity helped it command a 90% market share. Today, that share hovers around 87%. Maintaining the majority of the market for so long is a tremendous feat, evidencing true durability, flexibility, and sound commercial appeal.

So, why recommend QuickBooks on a list of the best personal accounting software?

These days, we understand that not all businesses are run from a warehouse, office space or storefront in the center of town. So many people manage their day-to-day operations from the comfort of their home studies, couches or back porches.

Thus, we’d be remiss to skip over one of the most powerful and well-rounded business accounting tools around. Read on for how QuickBooks can transform your company’s finances.

Who Can Benefit from QuickBooks?

In truth, QuickBooks can be used by any small, medium or large-sized business. It is multifaceted, robust, and leaves no stone unturned in helping business owners address their accounting needs.

Some examples of owners to whom Intuit markets QuickBooks include:

- Independent contractors, including freelancers, part-time workers, and consultants.

- Professionals & field services, such as architects, wedding planners, and landscapers.

- E-commerce stores, along the likes of eBay sellers, Etsy sellers, and other online retail outlets.

- Non-profits, like charities, private foundations, and religious groups.

- Retail brick-and-mortars, including coffee shops, daycare centers, craft stores, and more.

- New businesses that could use a hand in getting up and running smoothly.

What Are QuickBooks’s Features?

We called QuickBooks powerful for a reason. This software comes loaded with an array of capabilities, each of them streamlined, efficient, and intuitive. This lessens the time needed to learn the software so you can get back to running your business.

A sampling of QuickBooks’ more standout features includes, but is not limited to:

- Expense tracking: Record all your expenditures and easily collate them when preparing your taxes. QuickBooks also lets you snap pictures of your receipts and save them to your account via smartphone.

- Tax prep: QuickBooks automates tax prep by downloading, reconciling, and filing your banking and credit card expenses.

- Invoicing: Customize invoices with your company logo and other branding. Include only the fields you need.

- Receive online payments: For a small, extra fee, QuickBooks lets you accept online payment from clients. This can help you receive payments faster and with less physical paperwork.

- One-click reporting: QuickBooks lets you produce several different reports with the single click of a button.

- Conduct payroll: For an extra charge, QuickBooks can cut paychecks for company personnel.

- Team involvement: Allows your accountant or other team members to connect securely to your company’s files.

- Pay bills: Make a record of bills and submit payments. An automatic recurring payment option is also available.

- Multiple devices, apps, and users: QuickBooks can be accessed on multiple devices, including tablets, smartphones, and PCs. It can also sync your information across many apps, such as PayPal, Square, and more. QuickBooks also allows up to five users to utilize the same licensed program.

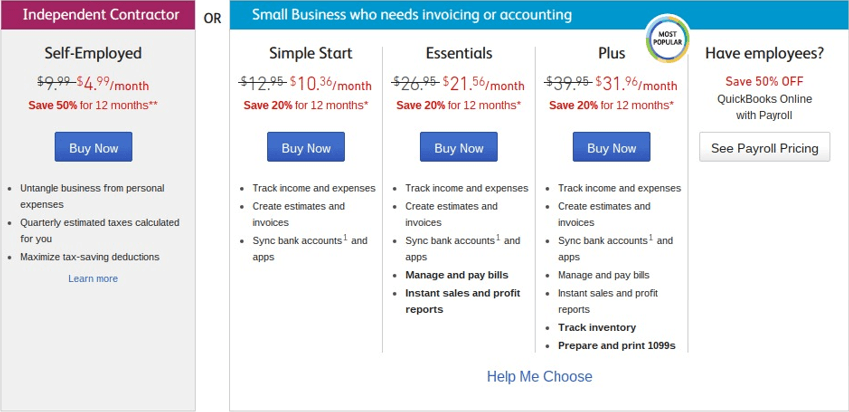

How Much Does QuickBooks Cost?

QuickBooks, unlike its sister program Quicken, features only three versions of the software. The versions are tailored according to complexity, with each ascending version capable of handling more functions for bigger businesses.

The following graph highlights QuickBooks’s prices and the main features available for each plan:

Image Source: QuickBooks

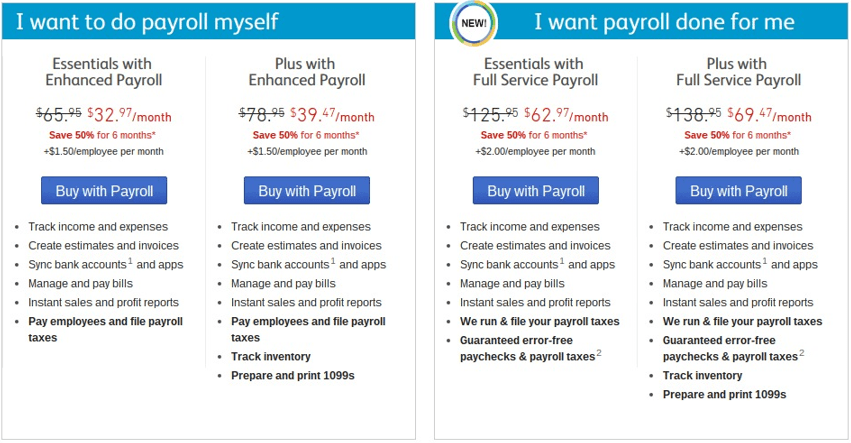

QuickBooks also offers the option of adding its Payroll services for an extra fee. Payroll services come in two varieties: (1) Enhanced Payroll and (2) Full Service Payroll.

The fee is prorated according to the services included in the chosen package.

The Payroll packages include:

Image Source: QuickBooks

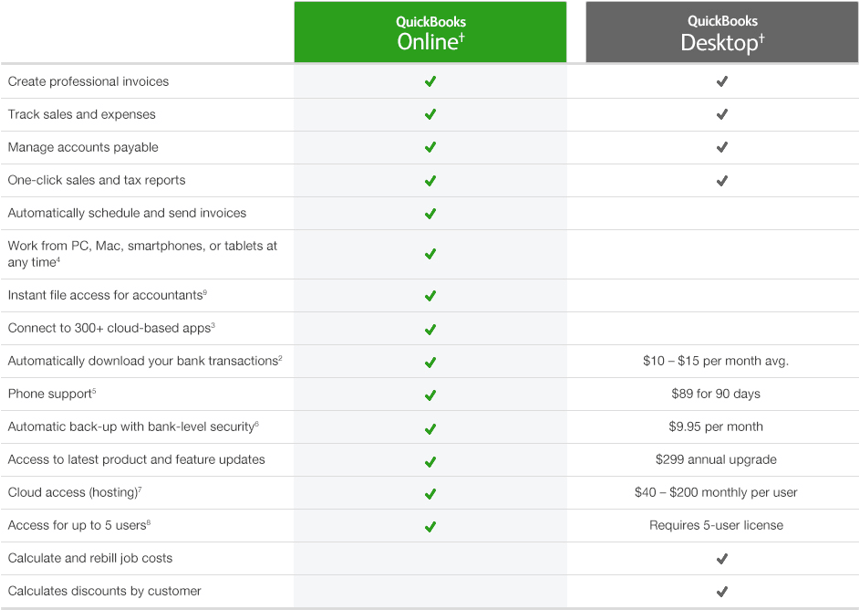

Intuit also offers QuickBooks Desktop for users who prefer to store all of their business information on a PC. However, the Desktop functionality is vastly inferior to QuickBooks Online in terms of capabilities.

The differences between QuickBooks Online versus QuickBooks Desktop are as follows:

Image Source: QuickBooks

Does Intuit Provide Training for QuickBooks?

Intuit offers several ways to learn and master QuickBooks personal accounting software.

- FAQ, community support, and trending questions: You can search the QuickBooks Help page for frequently asked questions or browse the community forums to find answers. A list of trending questions aggregates often-repeated inquiries that provide troubleshooting tips from other users.

- Video tutorial library: Intuit peppers the QuickBooks site with instructional and educational videos relevant to the topics at hand. These videos demonstrate a wide assortment of various QuickBooks functions.

- QuickBooks blog: The QuickBooks blog regularly publishes QuickBooks releases and product updates. It’s also a treasure trove of tips for the ambitious user who seeks an edge in mastering the software.

- QuickBooks Find-a-ProAdvisor: This service gives you a listing of certified QuickBooks Advisors in your area. These advisors have been trained directly by Intuit to answer all your questions and help solve QuickBooks-related issues.

- Small Business Center: Any question you could possibly have regarding the operation of your small business can be found at the Small Business Center. The list of resources on this page are too numerous to delineate here, but, suffice it to say, you can get wrapped up looking for answers to questions you didn’t even know you had.

- Self-Employed Center: There is a difference between small business and self-employed. Intuit knows the difference, and that’s why it has a dedicated self-employed resource page to help you out. The Self-Employed Center features a wealth of articles that address a myriad of concerns specific to self-employed workers.

TOP PERSONAL ACCOUNTING SOFTWARE – RICHORPOOR

RichOrPoor is household accounting software distributed by Shortcutsoft, Inc. Shortcutsoft has sold professional personal accounting programs since its founding in 2001.

Read more below to learn why RichOrPoor easily made our list of the best home accounting software.

How Does RichOrPoor Protect User Information?

Unlike other programs on our best personal accounting software list, such as Personal Capital, RichOrPoor is not a web-based program. No information is transmitted over the Internet by way of the software.

In this way, security is nearly entirely up to you. When you download RichOrPoor, it behooves you to ensure that your antivirus and malware programs are both up-to-date and strong enough to adequately protect your sensitive financial data.

You do have the option of password-protecting your software, however. This prevents intrusions by individuals in your home from whom you wish to prevent unwanted access. If this is the case for you, then secure storage of your password is vital.

Furthermore, the information you enter into RichOrPoor is preserved only to the extent that you backup your data. Performing regular backups each time you use the software guarantees that your most recent financials are saved in the event of a PC crash.

Any number of means is available to accomplish a successful backup. This includes utilizing Microsoft OneDrive, Dropbox, flash drives, SD cards or external hard drives, to name only a few.

Does RichOrPoor Offer a Free Trial?

One of the things we liked about RichOrPoor is that you can test out the software for 30 days with no obligation. If you prefer another program and wish to stop using RichOrPoor, you may do so without spending a single penny.

However, if you do purchase RichOrPoor, you have an additional 30 days to use it. If you’re not satisfied, Shortcutsoft will refund your money guaranteed.

All told, that’s 60 days to test out this software for free. That beats much of the competing personal accounting software available today.

Has RichOrPoor Received Awards or Recognition?

RichOrPoor posts a lengthy list of awards and recognitions on its website. Several 5-star reviews and ratings are prominently featured from a wealth of online reviewers.

However, one note of caution: RichOrPoor encourages affiliate partnerships with sites that advertise RichOrPoor home accounting software. Reviews of RichOrPoor on review sites pose a potential conflict of interest if Shortcutsoft, Inc. is financially remunerating these reviewers in exchange for advertising space.

Can RichOrPoor Handle Complicated Financials?

RichOrPoor can handle the financials for anything as complex as a small business. By extension, this means that this simple personal accounting software can handle accounts for large families, too.

However, unlike the free programs offered by Personal Capital, all of your financial data will need to be entered directly by you. RichOrPoor will not log into your bank, mortgage, car or investment accounts to verify and download your information.

For this reason, if you have complicated financials, but you still wish to download RichOrPoor accounting software for personal finances, be prepared to do a lot more work.

Your total number of accounts may either make this task breezy or involved. Regardless of just how much data you need to enter, the plus side of RichOrPoor is that it’s as stripped down as possible. Learning your way around the program won’t take very much time at all as there is no expert knowledge required.

The software comes with the ability to set up different account types. You can set up as many as you need, and the options are standard for personal investors and small business owners.

Choices include but are not limited to:

- Savings accounts

- Bank accounts

- Checking accounts

- Credit card accounts

- Investment accounts

- Asset accounts

- Liability accounts

- Cash accounts

Families wanting to use the software for multiple members of the family may do so by creating separate files. One file will be assigned per user with the user designating his/her own password protection.

Can RichOrPoor Create Reports and Charts?

RichOrPoor issues up to 33 reports and charts depending on your needs.

You can print reports on your income, spending, copies of your budget, investment reports, and more. No matter how much debt you own, how many revolving accounts you have open or the complexity of your asset management, RichOrPoor has a report it can print for you. This makes it a sturdy, sound little piece of accounting software.

Personal investors aren’t the only ones who can benefit from RichOrPoor’s report and chart creation. Small business owners are able to print liability reports, assets, company budgets, and more.

Furthermore, you can print reports based on specific criteria that you specify. From there, RichOrPoor customizes the attendant report to your liking.

For instance, you can track company expenses related to a specific employee, customize the report, and print it accordingly. The same is true when it comes to printing reports for departments, categories or other filters that you set.

What Does RichOrPoor Cost?

We liked that RichOrPoor can be test-driven for 30 days without any commitment to buy at the end of the trial. After that, the cost to download a fully functional version registered with Shortcutsoft, Inc., as well as eligibility for 2-year upgrades, is a very affordable at $29.95.

RichOrPoor can be downloaded directly from the RichOrPoor website here.

TOP PERSONAL ACCOUNTING SOFTWARE – YNAB

We can’t say enough good things about YouNeedABudget.com (henceforth, YNAB).

There can be a real beauty in simplicity – in getting back to the financial basics. Oftentimes, we lose sight of the fundamentals while overthinking solutions to money woes or stressing over future goals and the impact money (or lack thereof) can have on them.

This is why we really appreciate sites like YNAB and why it made our list of the top 5 personal accounting software for home use. It presents a series of four profound, rock-solid principles that have consistently guided customers into the promised land of accomplished personal financial planning.

Jesse Mecham, founder of YNAB, and his wife were newly married in early 2003, with very little money to their name. To top it all off, they were still in school.

Whereas such scenarios typically foreshadow financial despair and ruin, Jesse and his wife beat the odds. Not only did they survive, but they thrived. The Four Rules, having been borne of sheer necessity, ended up paving the way for the newlyweds’ financial security.

Jesse launched YNAB in September 2004, nearly two years after walking down the aisle. This was after two years of hard, real-world experience testing the Four Rules and making sure they worked.

Today, YNAB has grown to 32 employees across several states and continents. It continues to garner major buzz for its simplicity and dedicated approach, continually making converts out of people who’ve tried the big-name or costly budgeting programs and gotten nowhere.

Read on for more about the Four Rules and the YNAB approach.

What Does YNAB Cost?

YNAB has two subscriptions: (1) monthly or (2) annually.

The monthly subscription costs $5, and the annual subscription costs $50 – a $10 savings over the monthly option.

However, the savings don’t stop there. According to YNAB’s estimates, your average savings during the first month of using the program will be around $200. After nine months, that figure increases to an astonishing $3,300.

Does YNAB Come with a Free Trial?

You can test run YNAB for 34 days at no charge. The trial is fully functional and doesn’t require your credit card for access.

Is YNAB Supported Across Multiple Platforms?

You can use YNAB on a PC and take it with you on your iPhone, Android smartphone or iPad.

Does YNAB Post Case Studies or Customer Testimonials?

YNAB has one particularly inspiring case study posted as part of its site tour.

Dan and Tracy used YNAB over the course of 18 months to accomplish two amazing feats concurrently: (1) eliminate over $50,000 worth of debt and (2) save $25,000 for their upcoming wedding.

The remainder of the site tour explains more about the ease of use that Dan and Tracy felt in implementing YNAB. It also reviews the Four Rules and how the couple was able to begin mastering the rules almost immediately.

More testimonials are provided through the YNAB blog, but an interesting factoid listed on the About Us page hints at many more satisfied customers.

According to the details listed about the company, 19 of the 32 present employees became team members after using the YNAB personal accounting software. That accounts for more than half of the company or just above 59%.

Does YNAB Provide Training for Its Software?

The YNAB team provides ample online training and education. The YNAB blog is packed full of helpful articles about budgeting, debt, expenses, and more.

One unique feature of YNAB’s approach is its live classes. It offers four distinct live classes to help newcomers learn the ins and outs of the YNAB system. All you have to do is let them know your time zone and register for a time that works for you.

These classes are:

- Get Started: Prioritize

- Deal with Your Debt

- Age Your Money

- Savings Workshop

More information about the live classes, including class schedules, descriptions, and teachers, can be found on the Live Classes page.

What Is YNAB’s Approach to Budgeting?

YNAB has set itself apart from most other personal accounting software programs by adhering to a philosophy of saving and spending that it calls the Four Rules.

The Four Rules include:

- Give Every Dollar a Job: Determine your priorities and assign money toward them. You don’t assign more money than what you have; therefore, remaining disciplined and focused on your highest goals and objectives. Money is not assigned in a slipshod manner but actively funneled into real, actionable categories until every last dollar is accounted for.

- Embrace Your True Expenses: This step involves getting realistic about your future plans, goals, and dreams by balancing them with present-day action. Whether you want to buy a sports car within the next year or save for a trip to the other side of the world, it doesn’t matter according to YNAB’s approach. Everything you need to spend money on is an expense that needs to be reflected in your monthly budget.

- Roll with the Punches: While it’s great to have a plan and be dedicated to it, YNAB knows you’re not going to stay on it for long if it’s not flexible. Sometimes, plans change because of an illness, unforeseen car or home repair, unexpected travel, and more. Other times, you may under-budget or overspend in some categories. YNAB emphasizes that, relative to your budget, these events are no cause for alarm. Instead, you use some of the money you have in another category and move on. After all, you have prioritized your budget, so, more often than not, under the YNAB system, you’ve already cleared the way for remedying these surprises. That happens because you’ve given every dollar a job toward those goals which are most important and urgent to you.

- Age Your Money: The idea with this last step is to widen the gap between the time you receive your money and the time you spend it. The more you can widen that gap, the more secure and flexible your financials. This occurs naturally as a byproduct of following the first three rules. You’re not spending haphazardly, which gives your money time to “mature” while waiting to be used. This provides an extra level of comfort and security that you can’t get living paycheck-to-paycheck.

How Does YNAB Protect My Information?

YNAB protects your privacy and your sensitive financial data in several ways:

- Your data won’t be accessed unless mandated by law or requested by you. Otherwise, only six engineers have access to the production database that YNAB uses to house customer information. Unauthorized access of customer data will result in the offending employee’s immediate termination.

- According to the YNAB’s Security page, YNAB passwords are “one-way salted and hashed using multiple iterations of a key derivation function for passwords. (Those sound like made-up words, but these are best practices!) Even if someone were to steal the YNAB database of passwords, they would not know your password and would be forced to (very slowly!) guess every possible password in order to find it.”

- YNAB assists you in creating the strongest possible password. It must be a minimum of 8 characters long and cannot use the top 2,085 most common passwords as defined by Google.

- Customer information is “encrypted at rest,” which is another way of saying that, in the off chance someone did successfully steal customer data, he/she wouldn’t be able to read it.

- In the event you choose to discontinue using YNAB by deleting your account, YNAB removes all traces of your budget data. Nothing is left inside YNAB’s servers, and the process is irreversible. Should you return to YNAB at a later date, you would be required to open a brand new account.

- Data is encrypted at bank-grade or higher. Your computer is forced into an encrypted connection. If, for some reason, your computer refuses this connection, then YNAB’s servers will not “talk” to your computer.

- Industry standard 128-bit encryption is used.

- YNAB employs browser content security policy settings, making it impossible to conduct certain breaches against YNAB’s servers.

- To protect against phishing, YNAB enacted a policy forbidding employee-customer contact wherein the employee requests your username or password. Contact made to this end does not originate with YNAB and should be reported immediately.

- Extended Validation SSL, or a green bar at the beginning of the URL, should be present

- YNAB will only direct your computer to https://app.youneedabudget.com. At no time will YNAB ever ask you to sign into a different page.

- YNAB subjects its servers, source code, and personnel to regular audits by 3rd-party organizations that also audit such well-known companies as Github, Digital Ocean, and AT&T.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 5 Best Personal Accounting Software for Home Use

With our list of the top 5 best personal accounting software for home use, there’s something for everybody. You don’t have to struggle with keeping track of and growing your finances any longer.

Do you want personalized recommendations on how to calibrate your investment portfolio? Do you want a program to check your fees and suggest ways of reducing them? Do you want a tool that measures your progress toward meeting your retirement goals?

If so, Personal Capital’s accounting software is for you.

Do you want a strong, diverse accounting platform that helps track expenses, investment accounts, bills, and more – but without the threat of transmitting your information online?

Then, RichOrPoor has what you need at a very affordable price.

Do you want something even stronger? Check out Quicken. Or what about the leading supplier of accounting software for small businesses? Visit QuickBooks. Would you rather have a fundamentally sound, disciplined approach to managing and building your own savings? Then, look over YouNeedABudget.com for a streamlined, immediately employable tool.

What we particularly like about these personal accounting software programs is how they let you take them for a trial spin.

Whether free to start with (Personal Capital), free for 30 days or slightly longer (RichOrPoor and YNAB) or free for a whopping 60 days (Quicken and QuickBooks), you need not fear that you’re being handcuffed to one program for the rest of your life.

If you try one of these programs and don’t enjoy it, simply cut yourself loose before the trial ends.

What if you find the personal accounting software that meets all of your needs and more? You can start right away with tweaking your savings, budget, investment strategy, and more. Best of all, you might be able to start today.

Best FREE Finance & Money Management Software

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.