2017 RANKING & REVIEWS

TOP RANKING PPO HEALTH INSURANCE

What Is PPO Health Insurance?

PPO is something that stands for Preferred Provider Organization. This is a health insurance plan that offers freedom and flexibility because policy-holders can choose from a PPO network of providers and receive care from in-network and out-of-network providers without a referral.

PPO insurance plans don’t require the subscriber to choose a Primary Care Physician (PCP) or get referrals if they need to see a specialist. You simply go to your medical visits whether your doctor is a specialist or is in- or out-of-network without a referral from a PCP.

Award Emblem: Top 6 Best PPO Health Insurance Companies

With that being said, in most cases, it’s less expensive to go to an in-network provider with a PPO plan.

The following is a general ranking of the top PPO health insurance companies, meaning these companies do offer PPO health plan options, although they may differ based on the state or region in which the policy-holder lives, as well as in the specifics of their coverage.

You may also continue reading to see more about the specifics of a PPO plan and a PPO network to determine if PPO health insurance is the right option for you.

See Also: Top Cancer Hospitals in the U.S. | Ranking | Best Hospitals for Cancer Treatment

AdvisoryHQ’s List of the Top 6 Best PPO Health Insurance Providers

List is sorted alphabetically (click any of the PPO names below to go directly to the detailed review section for that PPO provider):

Top 6 Best PPO Health Insurance | Brief Comparison

PPO Health Insurance | Key Features | Key Benefits |

| Aetna | Aetna PPO plans are called Open Choice, and the network includes more than 470,00 providers | Aetna and care providers will handle claims and pre-authorization if it’s in-network |

| Blue Cross Blue Shield | Copayments and out-of-pocket limits are based on the plan you choose, and some are offered on state exchanges | BCBS has one of the widest care networks in the country |

| Cigna | Cigna PPO plans are available in several states in the U.S. | Members have access to the MyCigna app to find in-network providers quickly and easily |

| Humana | Primary PPO plan is a Medicare supplement | Members can participate in Go365, to improve their wellness and earn rewards |

| Kaiser Permanente | Kaiser’s network includes more than 638,000 providers | HealthConnect keeps care providers and members in contact for efficiency and improved quality of care |

| Medical Mutual | Insurance provider is only in Ohio | PPO plans include basic dental and vision coverage |

What Should You Know about PPO Health Insurance Compared to an HMO?

Consumers frequently wonder whether PPO health insurance or PPO insurance plans are right for them. As with any insurance plan, with PPO health insurance, there are advantages but also potential downsides.

Consider the following when you’re weighing whether a PPO health plan is right for you:

- While there is flexibility with PPO coverage regarding not needing a Primary Care Physician referral, if you go with an out-of-network provider, your costs are going to be higher in most cases.

- In exchange for the flexibility of PPO insurance, most plans have a higher premium, as well as a higher deductible and higher co-pays.All of this adds up to more out-of-pocket costs for people with a PPO plan.If you don’t see a lot of specialists or you have a PCP you enjoy working with, a PPO network plan might not be right for you.

- As compared to a PPO coverage plan, with an HMO (Health Maintenance Organization) plan, all of your healthcare is coordinated between you and your Primary Care Physician.What this means is that if you needed to see a specialist, you would first visit your PCP, who would provide a referral to an in-network specialist.

- With an HMO, you don’t have coverage for care that you receive from an out-of-network care provider including hospitals unless it is truly a medical emergency.

- With an HMO, your insurance company usually pays your healthcare provider directly, but with PPO insurance, if you go to certain providers you may have to file a claim for reimbursement, particularly if you go to an out-of-network provider.

- A PPO plan is going to have higher monthly premiums than an HMO plan, and with an HMO, you’re going to pay less out-of-pocket generally.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best PPO Health Insurance

Below, please find the detailed review of each of the PPO network insurance providers. We have highlighted some of the factors that allowed these PPO insurance companies to score so well in our selection ranking.

Aetna Review

Aetna is a managed health care insurance company serving many states throughout the U.S. with a range of plan options that can be purchased by individuals or are offered through employers.

Key Features and Menu Items Offered by This Pick for One of the Top PPO Health Insurance Companies

Below are some of the reasons Aetna is included in this ranking of the leading companies for PPO network and PPO provider options.

Open Choice PPO Options

Before delving into the specifics of Aetna PPO insurance plans, it’s important to again note that insurance options vary across state lines, so while the information provided regarding specific plans may apply to one state, it may not apply to another. The information given in each of these reviews of PPO insurance plans is to provide general information, and consumers should always consult the company or their individual plan for a specific Summary of Benefits.

With Aetna, there are generally a couple different PPO plan options, which are referred to as Open Choice Plans.

The two main options with these plans provide for the opportunity to visit either a network doctor or any doctor, and when visiting any doctor, the patient usually has to pay the difference between the amount covered by their plan and the amount charged by their doctor.

In-Network Visits

While an Aetna PPO coverage plan does allow for visiting out-of-network providers, when they visit a doctor who’s in-network, that doctor then handles their medical claims. This is also beneficial because the in-network doctor can arrange any necessary pre-authorization that may be required for certain services.

On the other hand, with an out-of-network provider and a PPO plan, the individual may have to arrange for approval from Aetna before getting certain services, and they may have to file their own claims.

Health Incentive Credit

A unique benefit that may be available with some PPO medical plan options from Aetna is the ability to receive something called a Health Incentive Credit. This means that PPO plan holders can earn credits that will go toward their deductible and coinsurance expenses by doing certain actions defined as healthy by the company.

It should be pointed out that Aetna also offers not just standard PPO insurance plans, but in some cases PPO dental plans as well.

Don’t Miss: Top U.S. News Best Hospitals | Ranking | U.S. News & World Report Hospitals

Blue Cross Blue Shield Review

Blue Cross Blue Shield is a trade association for locally owned and operated subsidiaries of the BCBS company. BCBS has a presence in all 50 states, and Washington D.C. This large-scale national company offers a wide variety of plan options including PPO insurance as well as HMO plans, among others.

Key Features of This Selection for a Best PPO Health Insurance Company

Specific features of PPO network plans and out-of-network plans from BCBS are highlighted below.

Flexibility

While specific plan features may vary depending on the area where you buy insurance, with many of the BCBS PPO coverage plans, there are little to no differences in out-of-pocket cost the insured person has to pay even if they go with an out-of-network provider.

This means that you have even more flexibility than what’s offered with many PPO provider plans, because, as an example, if you need primary care or a specialist visit, you will be responsible for paying the same amount out-of-pocket, whether you go in-network or out-of-network.

Network

When you go with a PPO insurance plan from a large company like BCBS, you get the advantages of an extensive network, which can be particularly useful with PPO insurance plans. With such a recognizable insurance brand as BCBS, your treatment and service options are going to be broad.

In many states, Blue Cross Blue Shield represents the largest health benefit plan company, and it’s the most recognized and accepted in the country.

Health Tools

For consumers with PPO insurance from BCBS, they can use many advanced tools offered by the company to compare quality of care, estimate costs, and make the most informed, empowered decisions about their care.

They provide tools that help people do more than just find doctors that are a BCBS PPO provider, and instead, they can keep their health care costs low while getting superior care.

Cigna Review

Cigna is a global insurance company that works with individuals, employers, and organizations. Cigna is also available through brokers for individuals and families. In addition to HMO and PPO plans, Cigna offers other options in many states including dental and supplemental insurance.

Key Factors That Led to Our Ranking of This as a Best PPO Health Insurance Company

Regarding offering options as a PPO provider and a best PPO health insurance company, the following are noteworthy specifics about Cigna.

Coast-to-Coast Coverage

People with certain Cigna plans, which are PPO insurance plans but are called Open Access, give policy-holders the opportunity to visit any healthcare provider that’s part of the Open Access Plus Network, which includes nationwide care providers.

When you receive care from a hospital or professional that’s in this network, you have less out-of-pocket expenses. You do also have the option to see providers that aren’t part of the OAP network, and coverage for that service is paid as an out-of-network benefit.

Cigna Informed Choice Program

A unique element of having a PPO health insurance plan or working with a PPO provider that’s part of the Cigna network is that you get access to their signature Cigna Informed Choice program.

This program is designed to provide more value and a better overall experience to members. This support outreach program educates people who have certain tests scheduled and gives them options to receive them at the most convenient and cost-effective facilities. It helps save money and make sure all the necessary preapprovals are in place.

MyCigna App

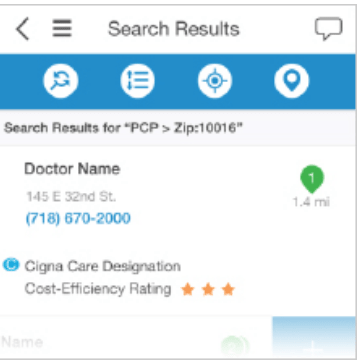

Another way Cigna is working to make the use of a PPO provider plan more efficient and convenient for members is through the implementation of innovative tools like their MyCigna app. This lets users find doctors in their network on their mobile device so they can avoid out-of-network costs. They can find cost and quality information regarding their PPO insurance providers, facilities, and procedures.

Other information that’s part of the app includes your personal network, coverage, deductible expenses, account information, and claims information.

Image Source: Cigna

Related: Best Medical Centers in the U.S. | Ranking & Reviews | Hospital Medical Center Reviews

Humana Review

Humana is a healthcare company that provides not only some of the best PPO health insurance options and PPO coverage, but also group insurance, pharmacy plans, dental and vision, and Medicare plans.

Key Factors That Led to Our Ranking of This as One of the Best PPO Health Insurance Companies

The following are some of the advantages of a medical PPO healthcare plan or PPO network plan from Humana.

Customizable Plans

All Humana plans, including their PPO network plans, are unique because they give members the opportunity to create customizable coverage. With a PPO product from Humana, members can go beyond the essential care coverage, and choose from a range of benefits to enhance their coverage with the individual medical plans they have available.

Users can choose from a PPO plan with a low deductible for dental coverage as well, or they can choose a prepaid plan that has small copayments.

HumanaChoice PPO Plan

One of the specific PPO provider plans available from this insurance company is called the HumanaChoice PPO plan, which is a Medicare Advantage PPO medical plan. With this PPO health plan, members enjoy predictable copays and coinsurance, so they can easily budget for the costs of their healthcare.

Other benefits of this specific PPO provider plan includes in-network home healthcare available at no cost to the member, coverage for most annual preventative screenings at no cost to the member, and prescription drug coverage that’s equal to or better than the standard requirements for the Medicare Part D plan.

Go365

Humana members can participate in an exclusive program called Go365, which is a personalized rewards and wellness program that helps members to make smarter, better decisions regarding their health and well-being.

This program can be managed online with a personalized dashboard, it includes tracking with apps and compatible devices, and participants get rewards when they meet milestones or make healthy changes. This is a great added benefit that you can take advantage of along with your PPO network plan from Humana.

Kaiser Permanente Review

Kaiser Permanente is an insurance company with a history that goes back more than 60 years, and it’s one of the country’s largest not-for-profit health plans. Kaiser Permanente is headquartered in Oakland, California, and has more than 11.3 million members.

Key Factors That Led to Our Ranking of This as One of the Best PPO Health Insurance Providers

The following are some specifics of Kaiser Permanente and the company’s PPO health plan options.

Extensive PPO Provider Options

With a medical PPO plan from Kaiser, members get access to a wide network of providers. The Kaiser PPO provider network includes more than 658,000 providers.

Members can also access any licensed non-participating provider, hospital, or lab that’s convenient for them. As with other PPO medical plan options, members of Kaiser can also access most specialists without a referral when they use both participating and licensed non-participating providers.

Care Management

When members of Kaiser have a PPO provider plan, they gain access to Permanente Advantage, which is a plan designed to improve the value and experience of treatment and services to PPO members. PA offers care coordination, which makes sure that medically necessary, quality patient care is a top priority.

It also works to ensure care is delivered in a way that’s efficient regarding both cost and timeliness.

PA is accredited by the Utilization Review Accreditation Commission to ensure programs meet the national standard for quality.

HealthConnect

HealthConnect is something that benefits members of Kaiser Permanente, whether they have a PPO health plan or another insurance plan. This is an in-depth electronic health record that’s one of the largest private health systems of its kind in the world. This integrated model connects more than 38 hospitals and 650 medical offices so that patients are always connected to their team of health care providers, as well as their personal health information.

It boosts communication between members and providers, and it improves the overall delivery of care as well as efficiency.

Medical Mutual Review

Medical Mutual, unlike the other names on this ranking of the best PPO options, isn’t a national insurance company but is a smaller company based in Ohio. Medical Mutual is the oldest and largest provider of health insurance in Ohio, and they have offices around the entire state.

Key Factors That Led to Our Ranking of This as One of the Best PPO Health Insurance Providers

Particular reasons Medical Mutual is an excellent option for a PPO medical plan are highlighted below.

MedMutual Advantage PPO

The primary medical PPO plan available from Medical Mutual is the Medicare Advantage PPO plan. This offers the most flexibility of all Medicare Advantage plans regarding selecting a hospital or doctor. Members can lower out-of-pocket costs with in-network providers, but they have the option to use an out-of-network provider and still have coverage.

Features

All Medical Mutual PPO medical plan options include a set of certain features designed to bring advantages to members. These features include:

- Hospital and medical coverage

- Benefits for prescription drugs

- Dental and vision coverage

- No-cost preventative services

- Extensive network of doctors and hospitals

In addition to including basic dental and vision coverage, the PPO insurance plans from Medical Mutual also offer the option to purchase additional dental and vision coverage when you enroll.

No-Cost Programs and Services

When someone enrolls in a medical PPO plan from Medical Mutual, they then gain access to a wide variety of programs and services at no additional cost. These include access to a 24/7 nurse line, as well as participation in the SilverSneakers program.

Also available to members is a Disease Management Program, a Home Meals program for members who have recently returned from an inpatient hospital stay, and a wellness rewards program.

Popular Article: Best Hospitals in the U.S. | 2017 Ranking | Major, Popular, Largest Hospitals in America

Conclusion—Top 6 Best PPO Health Insurance Options

A PPO health insurance plan is one that a lot of consumers find appealing. It offers the highest level of flexibility, and with a medical PPO insurance plan, you will have the ability to visit in-network and out-of-network providers. With that being said, there are also downsides to even the best PPO health insurance.

Image Source: Pexels

One of the biggest potential negative components of a PPO plan includes the higher out-of-pocket costs members pay.

Regardless, most PPO network options tend to work well for many consumers, and the above PPO insurance plans, which range from standard PPO insurance to Medicare Advantage PPO options, are great choices for someone who’s willing to trade higher out-of-pocket costs with more flexibility.

Read More: Best Hospitals in the World | Ranking | World’s Largest Hospitals

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.