Guide: Safe Investments with High Returns for Your Portfolio

Everyone wants to turn their money into more money. The concept of your money earning you more money is a novel concept, but is there a safe way to do it? Generally, the higher the investment return, the higher the risk.

Still, investing money is a part of life. If you kept your money in a normal savings account, which generates little more than half of a percent of interest on average, you won’t see much gain. Though it may be a safe investment, there are investing options that can give you a higher investment return than that.

So where do you invest your money? What are good investment options that won’t leave your entire savings at risk? Sure, you want the highest return on investment, but you need to weigh that against the risk you will face.

It’s hard to choose safe investments that are also high-yield investments. Getting a high investment return usually means higher risk. Fortunately, there are some safe investments with high returns. Though these are not the highest returns on investments that you will find, there are good investment ideas that are less risky.

The trick is finding the best investment returns for your risk preference. You likely won’t see high-return investments with double-digit yields, but there are safe investments that can still generate more than a standard bank savings account will.

With many good investment ideas floating around on the Internet, it can be hard to choose the best return on investment. Throughout your search, you probably have many ideas and questions, such as:

- Are there safe investments with high returns?

- What should you look for in the best investment returns?

- Do high yield investments always come with a lot of risk?

- What good investment options give you the best return on investment?

Throughout this guide, we will answer the questions you have about safe investments with high returns. We will explain what to look for in high return investments and break down the risks of investing money. Finally, we will provide a detailed review of the six best return on investment options.

By the end of this article, you should have a better idea of what the best return on investment options for you are and how to choose high return investments for your portfolio.

Top 6 Best Safe Investments | Brief Comparison

Safe Investments | Risk Level | Type |

| Annuities | Low | Offering a lump sum of cash in exchange for a set or variable return |

| Certificates of Deposit | Very Low | Deposit money for a specific amount of time for a guaranteed return |

| Dividend-Paying Stocks | Medium | Choosing stocks that pay out a dividend |

| High-Yield Savings Accounts | None | Savings accounts that offer the highest return on investment |

| Money Market Funds | Low | A mutual fund focusing on maintaining a Net Asset Value of $1/share |

| Treasury Inflation Protected Securities | Very Low | Bonds offered by the US Treasury |

What to Look for When Investing Money in the Best Investment Returns

Trying to find safe investments with high returns can be a frustrating process. You may be drawn to high-yield investments, only to realize that they come with a lot of risk.

It is not easy to choose the investment that will give you the best return on investment, because markets are unpredictable. Thankfully, with some research, you can find safe investments that also have a higher yield than your boring savings account.

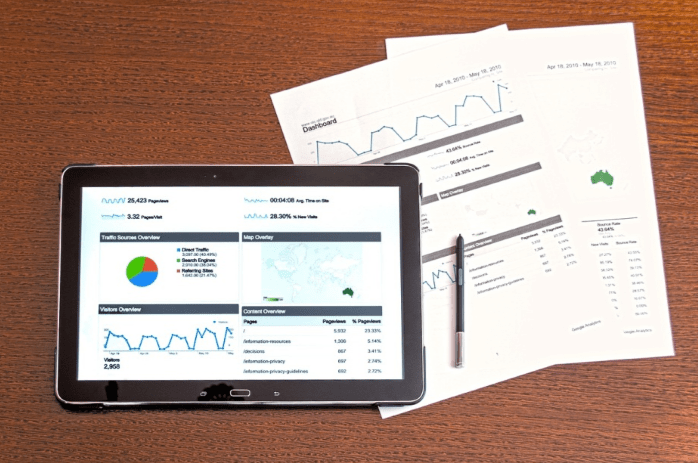

Image Source: Best ROI

Before choosing an investment option, it is important to put thought into the options. When you are trying to determine what option will give you the best return on investment, be sure to consider the following:

- Type of investment: There are many different good investment options for you to consider. From annuities and certificates of deposit to high-yield savings accounts, you should choose the type of safe investments that fit your preferences best.

- Duration: Some investment options, like certificates of deposit, require that you deposit money for a set duration. Make sure the duration that your money is tied up fits with your financial goals and needs.

- Return: Your return, or yield, is the percentage that your money earns you over time. Obviously, you want the best return on investment that you can find, but you need to weigh it against the risk.

- Risk: Even safe investments vary in their degree of risk. The amount of risk also depends on your preferences. Some investors are more risk adverse than others, while some just want the best return on investment.

It is possible to find safe investments with high returns, but it will take some effort. Be sure to consider these factors listed above before deciding where to invest your money.

Don’t Miss: Investment Advisor Search—Top Investment Companies

Investing Money in Good Investment Options Is Not Always Foolproof

When you are investing money, there is generally no option that is 100% safe. This, combined with the frustration and confusion that comes when trying to vet good investment ideas, is why people choose to leave all their money in standard savings accounts.

This however, prohibits you from the advantages that high-yield investments offer. That advantage of course, is the opportunity to earn much more than the half of a percent that many banks offer.

However, you need to realize that even “safe investments” can have some risk attached to them. It is important to note the risk comes with which investment option. Risk can also come in different forms.

A certificate of deposit may have very little risk associated with it when compared to common stocks that fluctuate with the market, but your money will be tied up for a set duration with a CD. That can be a risk in itself if you find yourself in an emergency situation, such as paying costly medical bills or the loss of a job.

Be sure to consider different types of risk, and decide what level of risk you are willing to undertake. This will help you determine the best safe investments for you.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Annuities

Though there is often some scrutiny placed behind them, annuities can be a good investment option if you are looking for a safe investment.

There are many types of annuities, but when you purchase them you are essentially offering a lump sum in exchange for a guaranteed rate of return. The yield can be variable, fixed, or you can get an equity indexed annuity. These types of annuities are based on how the stock market fares and offers you protection from a volatile downswing.

Since you are getting a guaranteed return, annuities are considered safe investments. Your risk is low, and your money is protected by the insurer that holds it.

If you are interested in annuities, one company that offers them is Fidelity. You can browse the different types and see if any fit your financial preferences.

Related: How to Find the Best Real Estate Investments When Starting a Real Estate Investment Company

Certificates of Deposit (CDs)

If you are looking for safe investments with very low risk, certificates of deposit might be a good option for you. Though often considered boring investments, CDs can be found through credit unions, banks or even investment brokers.

Image Source: High-yield investments

A CD requires you to deposit a set sum of money for a specific period. You are given a guaranteed rate of return on your money. This is great for those seeking safe investments because no matter what happens to the market or interest rates while your money is invested in a CD, you are guaranteed the set interest rate.

There is slight risk if you don’t like having your money tied up for a set period, but you can usually pay a penalty to pull it out early. If you select a CD from an FDIS insured financial institution, your money is backed and guaranteed by the government, up to $250,000.

If CDs seem like a safe investment option that you are interested in, you can compare different rates to choose one that meets your preferences and financial goals.

Dividend-Paying Stocks

If you don’t mind facing some of the volatility that the stock market offers, the dividend paying stocks might be a good investment for you. Stocks that pay a dividend offer a payment every quarter or year, that can help offset some of the market swings.

Though you are faced with the volatility of the market when you invest in these high-yield investments, given two stocks that perform the same over the course of a year, choosing the one that also pays a dividend is the better investment decision.

However, it is important to note that picking stocks is not always an easy task, or a safe bet by any means. You are accepting higher risk for high-return investments.

Using a site like E*TRADE will allow you to find dividend-paying stocks and do the necessary research before choosing to invest.

Popular Article: Stockpile Reviews | Will Stockpile Last? Can It Revolutionize Wall Street?

High-Yield Savings Accounts

If you want a zero-risk, safe investment option, then high-yield savings accounts are a good bet. You will earn limited interest on your balance and these savings accounts won’t give you the best investment returns. In a time where markets are volatile or uncertain, they can’t serve as a safe haven for your finances.

Discover and Ally both offer savings accounts with higher yields. Discover offers .95% APR, while Ally offers 1% APR. These can be good options if you are looking for more interest than the standard Bank of America savings account offers.

When you are looking for the best high-yield saving accounts, be sure to find one with no fees and competitive interest rates. A number of savings accounts that offer annual interest rates around 1 percent. Some even have offer bonuses for bringing substantial balances over.

Money Market Funds

If you are looking for a safe investment option, Money Market Funds are another option. Money market mutual funds are a type of fixed income fund that invests money into debt securities that have short maturities and minimal credit risk. This shelters them from the volatile markets, which is why many consider them safe investments.

While there is some risk associated with them, it is minimal, and fund managers often have decades of experience managing these funds.

You also need to be aware of the tax implications of these safe investments with high returns. Depending on the type that you invest in, they may be taxable.

Companies like Charles Schwab offer a variety of Money Market funds for you to choose from. Be sure to look at the yields and risk when you are deciding to add money market funds to your investment portfolio.

Treasury Inflation Protected Securities (TIPS)

Treasury Inflation Protected Securities (TIPS) is one of the lowest risk safe investments that you will find. TIPS are a type of bond that comes with two different growth methods.

One is a fixed interest rate that will not change throughout the life of the bond. The alternative is a bond that has built-in inflation protection that is backed by the government. This means that the value of your investment will rise by the rate of inflation for the length of time that you hold the TIPs.

TIPs can be purchased in a mutual fund, or individually. Vanguard is a site that offers these types of safe investments with high returns.

Read More: Coinbase Review | How Safe Is Coinbase? Is it Really Legit? (Coinbase Price, App, and Wallet)

Conclusion—Top 6 Best Safe Investments with High Returns

Having high-return investments is a great way to build your portfolio, but you also want to make sure that these are safe investments.

Investing money in a foreign company that promises to double your money sounds great. However, imagine if the company folds and takes your investment with it. You certainly will not be happy.

This proves the point that just because an investment option gives you the best return on investment does not mean it is the best investment option. Finding safe investments with high returns is the investing trick.

Anyone can locate high-yield investments. The real difficulty is finding high-yield investments that are safe to put your money into.

However, with the amount of good investment ideas floating around, it can be hard to choose the right ones.

It is important to know what you are getting yourself into when you make an investment. With your financial future and security resting on your decision, be sure to ask yourself the following:

- What level of risk are you willing to assume?

- What sum are you looking to invest?

- What type of investment seems most appealing?

- How long can your money be tied up for?

These are just a few questions to ask yourself when considering good investment options. Take the time to different investment options, until you find the best safe investments with high returns. With your money in safe investments, you can rest a bit easier.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.