2017 RANKING & REVIEWS

TOP RANKING BEST MUTUAL FUNDS FOR SIP

Tapping into the Best SIP Plans to Invest in Mutual Funds Easily

Investing is not always an easy thing to do. There are many variables and things to learn before most people feel confident putting their money in any sort of investment. Choosing a systematic investment plan (SIP) and a top mutual fund for SIP, however, can make the process simple.

This article will be your guide to not only the best SIP plans and the top 5 mutual funds for SIP in 2017, but it will also help you fully understand what an SIP mutual fund is.

Award Emblem: Best 5 SIP Plans

We will start by explaining a systematic investment plan, including important definitions and concepts. These are important ideas for this guide to the best mutual funds to invest in SIP as well as for investments in general.

Then, we will begin listing the best mutual funds for SIP in many different categories, including best SIP mutual fund for large cap, top mutual fund for SIP in small/mid cap, and best SIP mutual funds in other categories.

Before you know it, you can be taking advantage of the best SIP plans and the best mutual funds for SIP for you in 2017. Perhaps this year can be the year you bring investments into your financial life with these top 5 mutual funds for SIP.

See Also: Top Unsecured Credit Cards for Bad & Poor Credit with No Deposit| Ranking & Comparison Reviews

AdvisoryHQ’s List of the Top 5 Best SIP Plans

List is sorted alphabetically (click any of the SIP plan names below to go directly to the detailed review section for that SIP plan):

- Birla Sunlife Frontline Equity Fund

- Franklin India Prima Plus

- HDFC Balanced Fund – Growth

- Kotak Select Focus Fund – Regular Plan

- Mirae Asset Emerging Bluechip Fund

Top 5 Best Mutual Funds For SIP | Brief Comparison & Ranking

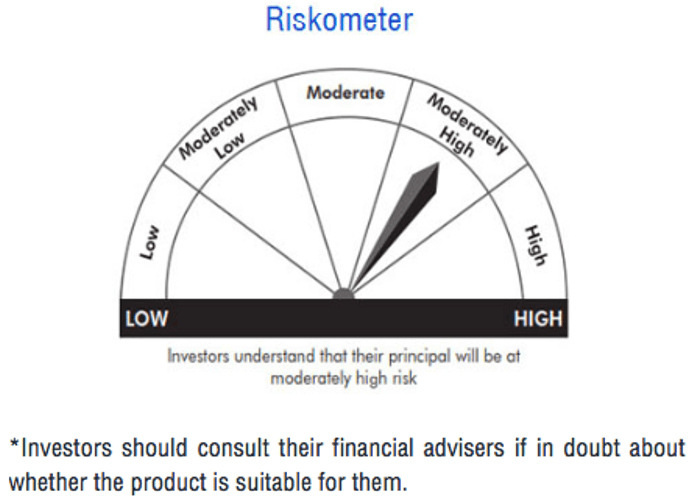

Best SIP | Category | Launch Date | Risk | Benchmark |

Birla Sunlife | Large Cap | August 30, | Moderately High | S&P BSE 200 |

Franklin India | Diversified Equity | September 28, | Moderately High | NIFTY 500 |

HDFC Balanced | Balanced | September 11, | Moderately High | CRISIL Balance Fund |

Kotak Select | Large Cap | August 20, | Moderately High | NIFTY 500 |

Mirae Asset | Small & Mid Cap | June 22, | Moderately High | NIFTY MIDCAP 100 |

Table: Top 5 Best SIP Mutual Fund Choices | Above list is sorted alphabetically

What Is a Systematic Investment Plan (SIP)?

Before we get into the top 5 mutual funds for SIP, it is important to make sure we all understand what the best SIP investment plan actually does for you.

SIP stands for systematic investment plan. This is an investment structure found in India that is both simple and smart.

Image Source: Pixabay

You determine a fixed amount that you feel comfortable investing regularly, and then you choose a pay interval (example: weekly or quarterly). Next0, you choose from the best mutual funds for SIP. This is your systematic investment plan (SIP).

Each time that interval comes around, the money will be automatically deposited from your bank account into your chosen top mutual funds for SIP. This allows you to invest regularly. The more regularly you invest, the better chance of piling up earned interest.

The top 5 mutual funds for SIP below are potential options for this investment mode.

Important Definitions to Understand the Best SIP Plans

Here are a few other important definitions to help you understand everything we will talk about below in the list of best mutual funds for SIP.

Mutual Fund: Investopedia defines mutual fund this way: “An investment vehicle made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets.” This means the best mutual funds for SIP are a collection of other funds, providing safe diversification.

Scheme: When you look through many of the top 5 mutual funds for SIP linked websites below, you will often find that companies refer to the best SIP plans as “schemes.” This is not the negative connotation of the word. Here, scheme only means an organized system.

Large/Mid/Small Cap: Whenever we mention “large cap best SIP mutual fund” the “cap” stands for capitalization. This is how you organize what type of companies are in the mutual fund. Small cap best mutual funds for SIP typically are made up of companies that capitalize less than 1 billion dollars; large cap means companies typically making more than 8 billion; mid is the in the middle.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best SIP Plans

Below, please find a detailed review of each systematic investment plan on our list of top mutual funds for SIP. We have highlighted some of the factors that allowed these best SIP mutual funds to score so highly in our selection ranking.

Don’t Miss: Top Prepaid MasterCard Cards | Ranking | Details on MasterCard Gift, Secured, Reloadable Cards

Birla Sunlife Frontline Equity Fund Review

First up on our list of the top 5 mutual funds for SIP is the Birla Sunlife Frontline Equity Fund. Ranked #2 in the large cap category by India’s MoneyControl, this is one of the best SIP mutual funds for investing in mutual funds with larger capitalization.

What Birla Sunlife boasts about this particular SIP mutual fund is that it “invests in approximately the same proportion as the industries in the S&P BSE 200, giving each industry its due importance and thereby keeping your money invested across industries in any given time.”

As one of the best SIP mutual fund choices, Birla Sunlife has offered positive returns over the past 5 years:

- 1 year = 7.3% returns

- 2 years = 4.3% returns

- 3 years = 16.0% returns

- 5 years = 17.9% returns

The top sectors of this best mutual fund for SIP include banking/finance, automotive, technology, pharmaceuticals, and oil/gas. The asset allocation for this best SIP mutual fund is as follows:

Franklin India Prima Plus Review

As we continue to examine the best SIP plans for 2017, we will take a look at the Franklin India Prima Plus. MoneyControl ranks them #2 in diversified equity, making this growth fund one of the best mutual funds to invest in SIP.

Franklin recommends this SIP mutual fund for those who want “long term capital appreciation” as well as those who want “primarily a large cap fund with some allocation to small/mid cap stocks.”

Continually one of the best mutual funds for SIP, Franklin India Prima Plus has offered these positive returns of the past 5 years:

- 1 year = 4.9% returns

- 2 years = 5.3% returns

- 3 years = 19.7% returns

- 5 years = 18.5% returns

The top sectors of this top mutual fund for SIP include banking/finance, automotive, technology, pharmaceuticals, and engineering. The asset allocation for this SIP mutual fund is as follows:

Related: Best Secured Credit Cards for Bad Credit | Ranking | Top Secured Credit Cards for Bad Credit

HDFC Balanced Fund – Growth Review

Next up on our list of top 5 mutual funds for SIP is the HDFC Balanced Fund – Growth. Ranked #2 by MoneyControl in the balanced category, this is a safe bet for those wanting a more balanced mutual fund as part of their best SIP plans.

Image Source: HDFC Mutual Fund

HDFC says the main goal for this best SIP mutual fund is to “generate capital appreciation along with current income from a combined portfolio of equity and equity related and debt and money market instruments.”

Here are the positive returns this best SIP mutual fund has earned over the past 5 years:

- 1 year = 10.1% returns

- 2 years = 7.0% returns

- 3 years = 19.7% returns

- 5 years = 18.5% returns

The top sectors of this best SIP mutual fund include banking/finance, engineering, technology, oil/gas, and automotive. The asset allocation for this best mutual fund for SIP is as follows:

Kotak Select Focus Fund – Regular Plan Review

We will continue our guide to the top 5 mutual funds for SIP with an overview of the Kotak Select Focus Fund – Regular Plan. Money Control ranked this the #1 best SIP mutual fund in the large cap category.

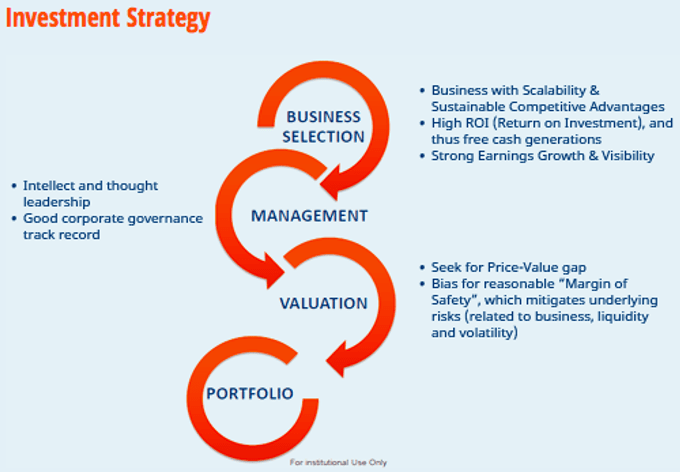

The purpose of this top mutual fund for SIP, according to Kotak, is for generating “long-term capital appreciation from a portfolio of equity and equity related securities, generally focused on a few selected sectors.”

As one of the best mutual funds for SIP, Kotak Select Focus has offered positive returns over the past 5 years:

- 1 year = 9.2% returns

- 2 years = 6.5% returns

- 3 years = 20.7% returns

- 5 years = 19.6% returns

The top sectors of this top mutual fund for SIP include banking/finance, oil/gas, automotive, cement, and manufacturing. The asset allocation for this best SIP mutual fund is as follows:

Popular Article: Top UK Credit Cards | Ranking | UK Best Credit Cards Comparison and Reviews

Mirae Asset Emerging Bluechip Fund Review

The final mutual fund on our list of the best mutual funds for SIP is the Mirae Asset Emerging Bluechip Fund. Ranked #1 in the small and mid cap category by MoneyControl, this is one of the top mutual funds for SIP on the market in India.

Image Source: Mirae Asset

According to Mirae Asset, this best SIP investment plan mutual fund is made for “an opportunity to tap into the value of today’s mid and small sized companies which have the potential to perform well in the coming years.”

Undoubtedly the best mutual fund for SIP on this list of top 5 mutual funds for SIP when it comes to recent returns, this is what the Mirae Asset Emerging Bluechip has earned:

- 1 year = 7.7% returns

- 2 years = 12.9% returns

- 3 years = 33.5% returns

- 5 years = 30.0% returns

The top sectors of this best mutual fund for SIP include banking/finance, automotive, pharmaceuticals, oil/gas, and miscellaneous. The asset allocation for this top mutual fund for SIP is as follows:

- Equity: 97.10%

- Others: 0%

- Debt: 0%

- Mutual Funds: 0.46%

- Money Market: 0.35%

- Cash/Call: 2.12%

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 5 Mutual Funds For SIP

Now you have a better idea of what the best SIP plans can mean for you and the top 5 mutual funds for SIP in 2017.

Of course, there are countless other options for choosing your SIP mutual fund. Some of the best mutual funds for SIP may work better for what you are interested in than others. But these five top mutual funds for SIP are great bets and a nice place to start.

If you feel like starting one of the best SIP plans is the right choice for you and your finances, The Economic Times in India has laid out a guide on how to start a systematic investment plan (SIP) online.

You can also take advantage of the best SIP investment plan calculator on the website MoneyControl. This will help you see how the top mutual funds for SIP can work for you.

But no matter which best SIP mutual fund you end up choosing, you can feel great that you have made the decision to begin an investment program in 2017.

Read More: Top HSBC Rewards Credit Cards | Review | HSBC Platinum, Cash Back, Rewards, Balance Transfer Cards

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.