2017 RANKING & REVIEWS

TOP RANKING BEST SITES TO COMPARE LIFE INSURANCE QUOTES

2017 Guide to Compare Life Insurance Plans

From time to time, we all have to consider what will happen to our loved ones after our death. Will they have what they need to pay the bills, to cover your final expenses, or to assist in putting your kids through college?

The best way to make sure that these questions are answered with a resounding yes is to put life insurance plans in place.

Covering yourself with some of the best life insurance available may not sound like a great way to spend an afternoon, but it will give you peace of mind for surviving family members. If you’re concerned about an untimely death, it’s time for you to start looking into a life insurance comparison to get the coverage that you need.

Award Emblem: Best Sites to Compare Life Insurance Quotes

There are many different ways to compare life insurance from looking at the rates, the plans, and the companies themselves. What is the best way to compare life insurance quotes and to compare life insurance companies quickly and easily? Using one of the many sites available to compare life insurance policies will likely be to your advantage.

See all of the potential plans from top providers in a quick life insurance comparison. You’ll be able to compare life insurance quotes in no time at all to get you and your family the protection and peace of mind you’ve been craving.

See Also: Top Credit Cards for People with No Credit History | Ranking and Reviews

AdvisoryHQ’s List of the Top 6 Best Sites to Compare Life Insurance Quotes

List is sorted alphabetically (click any of the life insurance websites below to go directly to the detailed review section for that life insurance comparison website):

Image Source: Pixabay

Top 6 Best Sites to Compare Life Insurance Quotes | Brief Comparison & Ranking

Top Life Insurance Comparison Websites | Types of Coverage | Highlights |

| AccuQuote | Term Life Insurance Whole Life Insurance Child Life Insurance | Educational resources and calculators Other coverage options such as long-term care insurance |

| IntelliQuote | Term Life Insurance Whole Life Insurance | Educational resources No medical exam coverage for older individuals |

| NerdWallet Quotacy | Term Life Insurance | Thorough explanations and example rates Ratings and synopsis of company information |

| PolicyGenius | Term Life Insurance | Experience in covering individuals with complex medical history Easy to change coverage with real-time life insurance rates |

| QuickQuote | Term Life Insurance Permanent Life Insurance | Does not require contact information Can modify coverage from results screen |

| SelectQuote | Term Life Insurance | Coverage advice available from customer service representatives Real-life scenarios and cost examples |

Table: Top 6 Best Sites for Life Insurance Comparison | Above list is sorted alphabetically

What’s the Difference between Term Life and Whole Life Insurance?

When you begin to compare life insurance quotes, one of the first major questions you will face is whether you want term life insurance or whole life insurance. Both are relatively well-known and common, but term life insurance tends to be the more popular option among consumers. How do you know which option is right for you before you compare life insurance?

First, let’s take a quick look at the numbers before we compare life insurance quotes and information. In the United States, there are more than 850 life insurance companies available to choose from. The average face amount of individual policies comes close to $160,000 per year, but the largest segment of consumers have coverage amounts ranging from $25,000 to $100,000.

With all of that coverage, how are they deciding which type to choose when they compare life insurance?

Here is a breakdown of the two major types included in our life insurance comparison:

- Term Life Insurance: When you compare term life insurance, you’ll notice that this is typically the most popular option in part because it has the lowest monthly premiums. This allows you to purchase life insurance plans for a specific amount of coverage and a set period of time. As time passes, your needs could change, and term life insurance quotes will allow you to change your policy accordingly.

- Whole Life Insurance: When you compare term life insurance and whole life insurance, the major difference is that whole life provides you with coverage for the duration of your life. One fixed premium rate guarantees you a policy that will last at the same value for the rest of your life.

While some of the websites to compare life insurance are used only for the more popular term insurances, others will allow you to see life insurance rates for both. Consider where you are in life and which type of coverage is best suited to your needs. Knowing which is the best life insurance for you will help you to make a wiser decision than you otherwise could.

Don’t Miss: Top Credit Cards with No Balance Transfer Fee (15–21 Months with Zero Balance Fees)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Sites to Compare Life Insurance Quotes

Below, please find the detailed review of each website on our list of sites for life insurance comparison. We have highlighted some of the factors that allowed these sites to compare life insurance policies to score so high in our selection ranking.

AccuQuote Review

AccuQuote allows you to compare life insurance quotes from many of the top providers in the insurance industry. They have been vetted by the likes of Kiplinger’s, The Wall Street Journal, USA Today, and Forbes, just to name a few.

You’ll find life insurance rates on almost every type of coverage available including:

- Term life

- Guaranteed life

- Permanent life

- Accidental death

- Child life

The major disadvantage to using AccuQuote to compare life insurance is the necessity of entering all of your contact information. When you enter your phone number and email address, you are giving the site electronic consent to contact you. The only way around this clause is to reach them via phone instead of through the online page.

Many people prefer to compare life insurance policies and compare life insurance rates side by side in print. Calling into their customer service center does take this freedom and flexibility away from you.

Advantages

Unlike some websites that specialize in life insurance comparison, AccuQuote doesn’t assume that you already have it all figured out. They offer extensive resources for your education.

You can use AccuQuote’s short videos and articles to learn more about how to compare life insurance quotes. Calculators are also available through their website to help you adjust your coverage accordingly for a better life insurance comparison.

If you prefer to do all of your insurance shopping in one fell swoop, AccuQuote offers a convenient solution. You can not only compare life insurance plans but also long-term care, disability insurance, and more. Using their tools to compare life insurance quotes is helpful, but you can be even better prepared for the future by taking a look at additional products.

IntelliQuote Review

IntelliQuote offers a life insurance comparison website that allows consumers to put premature death concerns on the back burner. Committed to providing thorough and exceptional service to compare life insurance, this site places an emphasis on customer satisfaction.

While they also offer quotes from top providers such as Prudential, American General Life Companies, and Mutual of Omaha, they have standards for companies who want to be included. IntelliQuote looks closely at ratings received from independent companies such as A.M. Best, Standard & Poor’s, Fitch, and Moody’s.

All companies included in their life insurance quotes must maintain an A- or higher rating from A.M. Best.

You can use this site to compare life insurance for both term and whole life policies, as well as long-term care. If you’ve been on the fence about which will be the best life insurance for you and your family, you can begin by trying to compare life insurance rates.

Advantages

Take a look at their detailed calculator to determine how much coverage you should request when you compare life insurance quotes. It will walk you through your current income, immediate cash needs and long-term income needs, and available resources. This tool should leave you better educated to prepare your family’s finances after your passing.

You can compare quotes from top companies instantly after submitting your information. Filling out the form should take only a few minutes, but be aware that you are giving the company permission to use automatic dialing to contact you. You can also reach them via their customer service phone line for a life insurance comparison.

For consumers who are older in age, IntelliQuote also features policies that require no medical exam. Senior and final expense insurance can offer up to $150,000 in coverage for those between the ages of 45 and 65 with no medical exam necessary.

Related: Top Hotel Rewards Programs & Hotel Credit Cards | Ranking and Reviews

NerdWallet Quotacy Review

NerdWallet is well-known for providing high quality financial advice and recommendations to consumers, but now you can also use them to compare life insurance quotes. From the very first page of NerdWallet Quotacy, you can begin a thorough education that is easy to understand.

Their home page sends you to a variety of links to give you more in-depth details about the best ways to compare life insurance policies. It covers the major questions, including what it is, why you should buy it, and how much of it you’ll need. It even takes you to a calculator to find out the appropriate level of coverage.

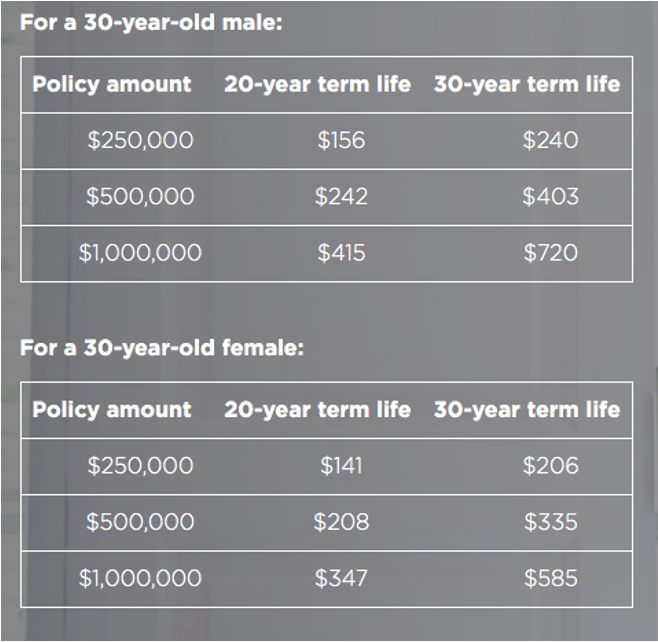

Before entering your personal information, you can see average rates for a 30-year-old male and female under different policy amounts. This allows you to compare life insurance rates quickly without having to even enter in your information.

Image Source: NerdWallet

Immediately after entering your information (which should take less than two minutes), you can see a range of prices in an easy-to-read format. Instead of scrolling through different policies, you’ll see the lowest and highest estimated monthly or annual premiums for the recommended policy value and duration.

Advantages

Once your information has been completed and submitted, you can keep moving to view more detailed results. Personalizing your health history gives you access to the specific life insurance comparison of providers and pricing.

One of the major benefits of the NerdWallet Quotacy program is the ability to view ratings and a synopsis of company information from the same page where you compare life insurance companies.

PolicyGenius Review

Whether you want to compare term life insurance or just compare life insurance companies, PolicyGenius has a solution. Their service is free to use, and their sales personnel are paid on salary instead of commission. All of this is done to ensure that you receive the best advice possible to help you compare life insurance quotes.

Image Source: PolicyGenius

Their questionnaire is designed to gather the most accurate information possible before giving you a life insurance comparison. It will ask questions regarding your health history, driving history, and personal information such as height and weight.

The initial survey to help you compare term life insurance should take only a few minutes to complete before giving you final results. You can choose to show prices on a monthly basis or an annual one, which can boost savings of up to 10%.

From this screen, it is also simple to adjust the amount of coverage you want when you compare life insurance and the term length. Each time you adjust, it will give you a real-time update so you can compare life insurance rates.

Advantages

Once you have the results of your life insurance comparison, you can move quickly toward purchasing a policy. The PolicyGenius website will help you to fill out your application with no cost and no obligation.

Consumers with a complex medical history will also want to consider the possibility of using PolicyGenius to compare life insurance. They have experience in helping compare life insurance plans for individuals who fall into this category.

Not only are they experienced and qualified to provide you with a comprehensive look at the top life insurance plans, they also only feature A-rated providers. You don’t have to worry about buying second-rate life insurance plans when you fill out an application and use any of the providers on your life insurance comparison from PolicyGenius.

Popular Article: Top UNSECURED Credit Cards to Rebuild Credit | Ranking | Unsecured Cards to Build Credit for Bad, Poor & No Credit Individuals

QuickQuote Review

QuickQuote gives consumers a detailed method to compare life insurance plans side by side with one another. All you need to do is follow along with their simple process to get your very own life insurance comparison.

You can find a number of options when it comes to being able to compare term life insurance. This company features popular coverage options such as:

- No medical exam term life insurance

- Return of premium term life insurance

- Permanent life insurance

- Accidental death life insurance

Note that when you compare life insurance, policies that feature more convenience such as the no medical exam options will likely have a higher cost. You can find policies that go into effect much faster with options like these on QuickQuote. Traditional life insurance policies may take several weeks to go into effect, whereas these more convenient solutions can be effective in as little as 24 hours.

Advantages

Perhaps the largest advantage of using QuickQuote to compare term life insurance is the ability to get pricing without surrendering your contact information. While many of the top companies do require you to consent to phone calls or emails, QuickQuote does not gather that information in its initial questionnaire.

They advertise themselves as a “free” tool to compare life insurance because they don’t charge you a fee or force you to hand over your contact information.

When you’re filling out the application to compare life insurance quotes, you can also modify the coverage directly from the results screen. This saves you the hassle of returning to previous pages and reentering all of the available information.

Free Wealth & Finance Software - Get Yours Now ►

SelectQuote Review

Boasting a title as America’s #1 term life sales agency, SelectQuote has been around for more than thirty years. You can compare life insurance policies from their trusted providers and partners to find the right term life insurance for you and your family.

Companies that partner with SelectQuote to provide a life insurance comparison are required to have some of the top A.M. Best ratings available. Any company with a rating below an A- will not be represented when you compare life insurance policies. They also feature companies that are known to provide great rates to those with higher risks including smokers, those with high cholesterol, and those with blood pressure issues.

Image Source: SelectQuote

Some of the top companies where you can compare life insurance quotes are:

- American General Life Insurance Company

- Fidelity Life Association

- United of Omaha Life Insurance Company

- William Penn Life Insurance Company

- Pruco Life Insurance Company

Of course, they also offer plenty of other solutions to give you the best life insurance policies available on today’s market for your personal factors.

Once again, one of the major disadvantages to SelectQuote and several of the other top choices to compare life insurance is the necessity of entering all of your contact information into the online form. This information can be used to reach you via phone and text message to encourage you to proceed with your quotes. Calling into the customer service department can allow you to forego this experience.

Advantages

If you’re still new to the world of life insurance comparison, you can reach out to an agent to receive advice on how much coverage will be necessary for you. Unlike a calculator that won’t be able to answer your questions, you can receive live feedback and ask more detailed questions of a trained professional when you compare life insurance rates.

If you want to get an idea of how much you can expect to pay when you compare life insurance rates, they offer examples of real-life scenarios and quotes. This is great for research purposes before you commit to handing over your contact information to a SelectQuote agent.

Conclusion—Top 6 Best Sites to Compare Life Insurance Quotes

Knowing what you need to do to compare life insurance can be a confusing process. Selecting different coverage amounts, terms, and types of life insurance quotes are all difficult aspects to consider for a topic that already feels heavy and depressing. Using a website to compare life insurance quotes makes it easy to see the best pricing and policies all in one convenient location.

Decide what type of life insurance plans suit your family’s needs the best. Depending on the answer, it may help you narrow down which of these life insurance comparison sites will work the best for you.

If you’ve been stressing over what your financial situation will be like upon your passing, give yourself some peace of mind by applying for the best life insurance. These websites will set your feet firmly on the right path to gaining the coverage and protection you need for the future.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.