Overview: Best Small Business Accounting Software – Australia

Ever since launching AdvisoryHQ, the site has become one of the fastest-growing review & ranking media sources for the financial sector (software, financial advisors, accountants, and wealth managers).

Software review articles that we have published include the 5 Best Personal Finance Software & Apps, Overview of the 6 Top Financial Planning Tools, and the Top 5 Ranked Budgeting Software.

Below, we present a detailed review of the top ranking, subscription-based, and free accounting software in Australia.

Selection Methodology – Best Small Business Accounting Software

So what due diligence process and selection methodology did we use in identifying, researching, and selecting this list of best small business accounting software in Australia?

Using publicly available sources, we first identified a comprehensive pool of business, bookkeeping, and accounting software in Australia.

We then developed and applied a wide range of selection thresholds and factors (ease of use, invoicing capabilities, automated data entry, bank fees, security level, account payable and receivable flow, user satisfaction, account aggregation capability, advance mobile capabilities, comprehensiveness, features, cost, interfaces, maintenance level, and longevity).

After applying our selection methodology logic to the initially identified universe of Australia accounting software…

… we were able to narrow down the list to the final selection presented in the list below of paid and free Australia accounting software applications.

Longevity Selection Factor

How long will a small business accounting software application be around for?

Whenever we perform software reviews, longevity is always a very important but also complex selection factor for us to determine for each reviewed software apps.

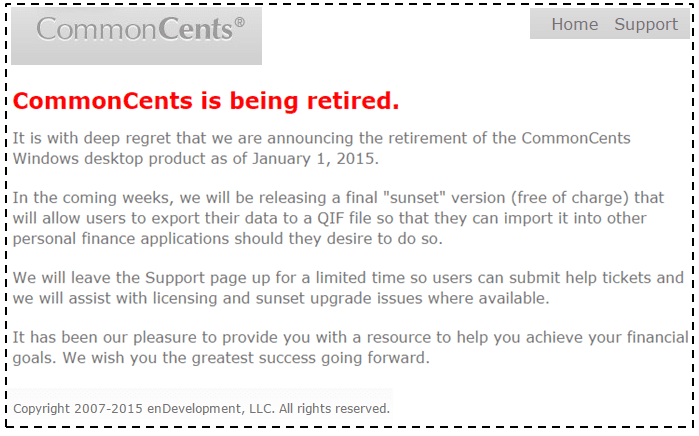

A finance app like CommonCents is a good example of a “come and gone” finance application.

Image Source: CommonCents

As such, when researching and selecting the list below of the best small business accounting software in Australia, we needed to ensure that we were selecting those with a high probability of being around next year, two years from now, or even five years from now.

We applied user growth, revenue capability, popularity, and user reviews to estimate each accounting product’s longevity.

When it comes to longevity for small business accounting software applications, revenue is one of the biggest components.

A platform that is losing money will need to be sold at some point (if possible) or shut down. As such, we focused on paid and free accounting software with revenue generating potential.

Note: Just because an accounting software is free does not mean it is not a revenue generator. Mint is a free accounting software application in the US but generates millions of dollars each year for its parent company.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s List of the Top 5 Small Business Accounting Software in Australia

Below is the list of the best small business accounting software in Australia, followed by a review of each top ranking software.

Sorted Alphabetically:

1. Intuit QuickBooks: Highly Ranked Australian Accounting Software

Intuit’s QuickBooks is one of the most popular accounting software used by Australian small business owners.

There are two key factors contributing to QuickBooks’ popularity as a top small business accounting software in Australia.

The first is its price.

You can pay $12/month (sale price) for QuickBooks’ most basic software and a max of $21/month (sale price) for the premier version.

The second factor is the comprehensive level of features that QuickBooks provides.

Business owners across Australia use QuickBooks to track their business income, expenses, and profits.

They are able to send an unlimited amount of invoices, access their data online across a wide range of mobile and desktop platforms (PC, Mac, tablet, or smartphone), manage/pay bills, and make payroll payments for free.

For security, QuickBooks has the same security and encryption as banks.

The above factors are just a few features that come with Intuit’s QuickBooks.

See the image below for additional features.

Intuit provides a free 30-day trial, so you can try out the software for free before pulling the trigger on subscribing.

2. MYOB: Top Rated Australian Accounting Software

MYOB is one of the best accounting software programs in Australia, but it aims to be more than just functioning accounting software.

The platform was designed from scratch to perform your regular accounting functions. However, in addition to this, it was structured to help business owners increase profitability and make better decisions with a real-time view of a business’s financial operations.

For Australian retail business owners, MYOB accounting software is more than just a store register. With the MYOB Kounta interface, your point of sale (POS) transactions can be integrated into your entire business operation.

Most importantly, the MYOB Kounta interface works both online and offline, and your customers will never even notice if your Internet connection slips.

For some Australian business owners, the ATO compliant capability is a huge attraction.

MYOB’s free ATO-certified SuperStream solution is designed to help you stay up-to-date with your compliance obligations and also provides the ability for you to work online with your bookkeeping personnel.

With MYOB’s Add-On Center, you can easily extend and build out your MYOB software with a range of add-on solutions from the firm’s comprehensive suite of tools.

MYOB has five accounting software versions (presented below) for Australian small business owners.

MYOB charges between $50/month and $99/month depending on the version you select.

Each MYOB subscription comes with a free 30-day trial.

3. Reckon: A Comprehensive Suite of Accounting Features

Reckon aims to be the best accounting software for Australia businesses, accountants, and bookkeepers.

Reckon small business accounting software is well-recognized as Australia’s most affordable cloud accounting software for small & medium-sized businesses.

With the platform’s payment process interface (Reckon Pay), you can accept debit/credit card payments via your phone.

For Australia businesses that perform point of sale (POS) transactions, Reckon provides a complete and comprehensive POS system that links your sales transactions to the desktop software suite.

Reckon provides one of the most comprehensive suites of small business accounting features.

Its comprehensive suite of accounting features include value billing, credit management, resource planning, practice IQ, client relationship management, document management and portal, business process automation, digital imaging, corporate registration, desktop super, tax processing, and many more.

Reckon provides affordable, easy-to-use online accounting software that can scale up as your business grows.

Reckon starts at $5/month and also has a free trial.

4. Saasu – Accounting Software of the Future

Saasu claims to be the future of accounting. Based on our due diligence analysis, we might just agree!

With Saasu accounting software, Australian businesses can instantly perform cash flow cashing with one click and with no extra setup or syncing.

You can very quickly connect your Saasu accounting platform with your CRM, e-commerce store, email platform, and more.

It also provides smart bank fees that quickly and efficiently perform bank reconciliations and save you time.

With the invoicing interface, you can easily create customized invoices, with or without accompanying payments, all from the same screen.

For collection functions, you can effectively reduce the possibility of accounts payable or debtors from falling behind with Saasu’s scheduled statements and reminders.

You can set the interface to automatically prompt your customers for payments, follow-ups, and automatically enquire about overdue accounts.

With Saasu, businesses with international operations can manage transactions in over 50 different foreign currencies.

You are able to run, manage, and operate foreign currency accounts, where transactions are automatically converted back to your base currency for easy reporting.

Using the Saasu accounting application allows you to automatically schedule recurring sales and expenses and never worry about invoices not getting sent out or falling through the cracks.

In essence, Saasu is one of the very best accounting software programs for Australian businesses. It has everything you need to run your business from anywhere, using any platform.

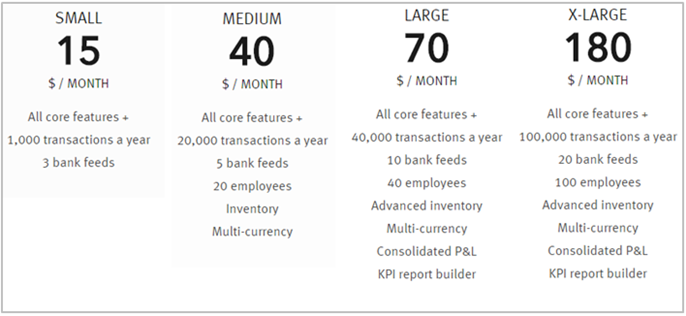

Below are the four software versions. Each version comes with a free 30-day trial – no credit card required.

Image Source: Saasu

5. Xero: Top 5 Small Business Accounting Software – Australia

Xero is highly popular Australian online accounting software with real-time data monitoring capabilities.

It currently has over 500,000 subscribers using the platform.

The software application comes with a wide range of business accounting features.

It provides fast online invoicing, and you receive an update when your customer opens your invoice.

Using a wide range of mobile or desktop platforms (Mac, PC, tablet, and smartphone), you can easily run your business on the go to reconcile, send invoices, and create expense claims.

Xero’s advanced reconciliation process allows you to import and categorise your bank transactions. All you have to do is click on “OK” to reconcile, and your most recent banking, credit card, and PayPal transactions are imported and categorised.

With Xero, paying your employees is a breeze. Quickly calculate payroll, pay employees, and effectively manage payroll taxes.

See below for additional information on Xero’s small business accounting platform for Australia businesses.

Xero pricing: Xero subscription ranges from $9/month for the starter software version to $70/month for the premium accounting software version.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.