2017 RANKING & REVIEWS

TOP RANKING BEST STORE CREDIT CARDS FOR BAD-POOR-FAIR CREDIT

Introduction: How to Get Store Credit Cards for Bad Credit

With so many credit card options out there, why would anyone choose store cards for bad credit? The best department store credit cards for bad credit are offered by virtually every store around the nation and come with a variety of perks and benefits.

However, as with any credit card, easy store credit cards to get with bad credit need to be approached with caution.

When it comes to finding the best store credit cards that are easy to get approved for, it is important to understand how you plan to use that card, how applying for store credit cards for fair credit will affect your credit score, and how you can take advantage of the perks that come with that card.

Award Emblem: Top 6 Best Store Credit Cards for Bad/Poor/Fair Credit

In this brief article, AdvisoryHQ will review six of the best store credit cards for bad credit and store credit cards for fair credit. First we will explain what department store cards for bad credit are before offering a comparative table of the top best department store credit cards for bad credit.

In the following section, we will look at the potential pitfalls of the best store credit cards to build credit and the top features of clothing store credit cards for bad credit and other easy store credit cards to get with bad credit.

What Are Store Cards for Bad Credit?

Every store wants your business and will do whatever they can to bring in more customers. Offering department store credit cards for people with bad credit is a marketing strategy used by most stores to gain customers, particularly repeat customers.

There are two main types of department store credit cards for people with bad credit: cards that can only be used in the store offering the card and co-branded cards.

According to Consumer Reports:

“[C]o-branded credit cards bearing an American Express, MasterCard, or Visa logo…can be used anywhere those cards are accepted. You’ll earn points on all your purchases with the card, not just at the store that issues it, but you’ll probably earn less for using the card at other retailers. Another type of store charge card can be used only at the issuing retailer, a marketing tactic that aims to make it easier for you to spend now at the home store and pay later.”

The best store credit cards to build credit are usually less strict when it comes to credit score requirements. Department store credit cards for poor credit also most always come with a decent rewards program, though the annual percentage rate is much higher than other cards.

AdvisoryHQ’s List of the Top 6 Best Department Store Credit Cards for Bad Credit

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- Amazon Rewards Visa Card by Chase

- Barnes & Noble MasterCard®

- Gap Visa® Card

- Target REDcard™

- TJX Rewards® Credit Card

- Walmart MasterCard by Synchrony Bank

Top 6 Best Department Store Credit Cards for Poor Credit| Brief Comparison & Ranking

Store Credit Card for Fair Credit | % Purchase APR | Annual Fee | Sign Up |

| Amazon Rewards Visa Card by Chase | 14.49% -22.49% | None | $50 dollar Amazon gift card |

| Barnes & Noble MasterCard® | 14.24% – 25.24% | None | $25 dollar gift card |

| Gap Visa® Card | 25.24% | None | 15% off first Gap purchase |

| Target REDcard™ | 23.15% | None | 5% off purchases always |

| TJX Rewards® Credit Card | 27.24% | None | 10% off first in store purchase |

| Walmart MasterCard by Synchrony Bank | 17.15% -23.15% | None | 15% off first purchase at Walmart |

What Are the Potential Pitfalls of Store Credit Cards That Are Easy to Get Approved for?

With so many quality rewards programs and sign up bonuses associated with store credit cards for bad credit, why wouldn’t you simply sign up for a thousand store credit cards that are easy to get approved for?

One of the dangers of clothing store credit cards for bad credit is that if you sign up for several cards, your credit score may take a hit. If you are signing up for several easy store credit cards to get with bad credit, the credit bureaus may believe that you are vulnerable to a dangerous indebtedness.

Furthermore, since many of the best department store credit cards for bad credit have low credit limits, you may max out several of those cards, which is another cause of a falling credit score.

The 10-15% bonus on your first purchase that several department store credit cards for poor credit offer won’t add up to much. If, however, those store credit cards for bad credit cause your credit to drop, you may lose a few percentage points on a mortgage or car loan, which could cost you several thousand dollars.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Should You Look for in Clothing Store Credit Cards for Bad Credit?

Store credit cards for fair credit often come with an APR somewhere between 25 and 30%, which is considerably higher than other cards. If you tend to carry a monthly balance on your other credit cards, you need to look for department store cards for bad credit with a halfway decent APR for purchases.

Image Source: Pixabay

Also, when looking for the best store cards for bad credit, you should also take into consideration the sign up bonus offered. If the store credit cards for fair credit or the store credit cards for bad credit offer a percentage discount on your first purchase with the card, make sure you make the most of this offer by doing your Christmas shopping all at once.

If the department store credit cards for poor credit are offering a 15% discount on first purchases, youll only save $15 for a $100 purchase but $300 dollars on a $2,000 purchase.

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Store Credit Cards for Bad Credit

Below, please find the detailed review of each credit card on our list of the best store credit cards to build credit. We have highlighted some of the factors that allowed these department store credit cards for people with bad credit to score so highly in our selection ranking.

Don’t Miss: AMEX Starwood Credit Card vs Platinum Delta SkyMiles® Business Card vs Suntrust Business Credit Card vs TD Bank Business Card

Amazon Rewards Visa Card by Chase Review

Everyone loves shopping on Amazon.com, and the Amazon Rewards Visa Card by Chase is one of the best store credit cards for bad credit or store credit cards for fair credit. Among store cards for bad credit, this card allows you to earn 3% cash back at Amazon.com; 2% cash back at gas stations, restaurants, and drugstores; and 1% cash back on all other purchases.

Photo Courtesy of: Amazon.com

Furthermore, you will also receive a $50 Amazon.com Gift Card instantly upon approval for this card. Among the top store credit cards for bad credit and store credit cards for fair credit, this is one of the higher gift card bonuses. There is also no annual fee with this card.

Barnes & Noble MasterCard® Review

The Barnes & Noble MasterCard® is one of the best store credit cards for bad credit or store credit cards for fair credit for book lovers. With the Barnes and Noble MasterCard, you can earn double rewards at restaurants and regular rewards for all other purchases. For every 2,500 points that you accumulate through the use of this card, you will also receive a $25 Barnes and Noble gift card. This is one of the few easy store credit cards to get with bad credit that offers a long-term, continued bonus program.

Furthermore, with the Barnes and Noble Card, you can qualify for 12 months of Barnes and Noble membership after spending $7,500 on this card. Among department store credit cards for bad credit, this is a great reward that can save you hundreds of dollars if you’re a book worm.

Related: Top Best MasterCard Credit Cards | Ranking | MasterCard Rewards, Cash Back, Benefits and Offers

Gap Visa® Card Review

The Gap Visa® Card is another of the best department store credit cards for poor credit. You will earn 15% off your first purchase at Gap clothing stores.

Unfortunately, the terms and conditions on this card can be punishing if you use this card for everyday purchases. There is a $10 or 4% charge for all cash advances, which is significantly higher than other department store credit cards for poor credit and department store credit cards for bad credit.

Also, the Gap Visa® Card also offers 500 bonus reward point if you decide to sign up for paperless statements. The 25.24% APR for purchases is about the average for department store credit cards for poor credit, and there is no annual fee for this card.

Target REDcard™ Review

The Target REDcard™ is another of the best department store credit cards for bad credit or department store credit cards for poor credit.

The sign up bonus for this card offers 5% off of purchases every time you use the card at Target. While other department store cards for bad credit offer a one-time bonus, this card allows you to continue to receive benefits every time you use the card.

This card is a closed loop card, meaning that you can only use it at Target stores. However, while other department store credit cards for poor credit only allow you to purchase clothing, you can find most everything you need at Target, and that 5% off can add up over months.

Popular Article: Top Best Credit Cards to Build Credit | Ranking & Reviews | Credit Cards for Building Credit

Free Wealth & Finance Software - Get Yours Now ►

TJX Rewards® Credit Card Review

The TJX Rewards® Credit Card is another great option for store credit cards for bad credit or store credit cards for fair credit. For every $200 you spend, you can earn $10 in rewards certificates to be redeemed online or at the store, as well as 10% of your first in-store purchase.

Also, with the TJX Rewards® card, there is no limit to the number of points you can earn. The 27.24% interest rate is higher than other store credit cards for bad credit, so make sure you pay off your balance in full each month.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

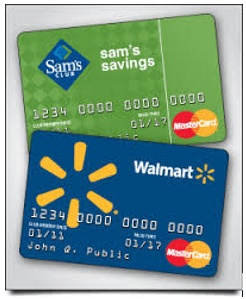

Walmart MasterCard by Synchrony Bank Review

Lastly, the Walmart MasterCard by Synchrony Bank is a great all around card for everyday purchases.

You can save 3% every day for purchases at Walmart, as well as receive $50 off of your purchases (or 15%) the day you open the card. Among the top store credit cards that are easy to get approved for, the Walmart MasterCard also offers a 2% savings on gas purchased at Walmart stores with gas stations or at Murphy gas stations.

Photo Courtesy of: Creditcards.com

Free Wealth Management for AdvisoryHQ Readers

Conclusion – Top 6 Department Store Credit Cards for Poor Credit

Finding store credit cards for fair credit is a great way to get access to credit while also earning some quality rewards. The best store credit cards to build credit also can help you regain control of your financial livelihood through responsible use over time.

If you’ve been searching for the top store credit cards for bad credit or store credit cards for fair credit, any of the six options reviewed above is a quality option.

Read More: Top Best Starter, First, Beginner Credit Cards for Beginners | Ranking | Good First Credit Cards

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.