(2017 Guide) Best Savings Account for Students: Chase vs. Bank of America vs. TD Bank

This day and age, saving is more important than ever. If you aren’t saving now, what’s your plan for the future? Savings accounts are actually the safest way to invest your money while being able to earn a return.

It is never too early to get started. As soon as you graduate high school and start college, open a student savings account to get you on the right foot. That may leave you wondering about the best savings account for students.

The Importance of a Student Savings Account

Just about everyone knows that saving for the future is important, but the problem is that a lot of teens and young adults live in the now. They don’t really think too far into the future, and student savings is probably the last thing on their mind. That isn’t to say that all young people skip a student savings account, but more people are behind on saving for their retirement than ever before. This is likely because people are waiting until later in life to start saving.

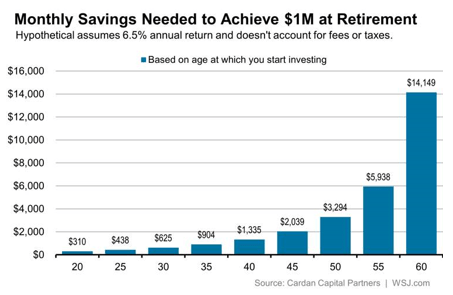

Let’s take a look at some numbers that will help you to understand the importance of starting early on saving each month with your savings account for students. Let’s say that you want to have $1 million when you retire.

This chart featured in the Wall Street Journal breaks it down to show you how much money you need to save monthly in order to reach that $1 million goal to retire.

Source: Monthly Savings Chart

The kicker, however, is that the older you are when you start investing your money, the more money you need to save each month to reach that goal. This is just one of the main reasons that a student savings account is so important.

Student savings accounts also benefit in the following ways:

- Teaches you how to manage your money properly

- Gives you a safe way to save while earning interest

- Allows you to keep money aside for emergencies

More teens and college students need to jump on this bandwagon so they can be more prepared for the future and what will come along with it. Life is always an unexpected string of events, and even with the best planning, it can be quite stressful. Be money smart and open a student savings account today.

See Also: Free Money Management Tools & Discount Offers

What to Consider When Choosing a Student Savings Account

Now that you know why you need a student savings account, it is time to delve a little deeper into choosing the right one. Before choosing a best savings account for students, it’s important to know what you need to consider. Here are a few key questions to ask:

- What are the current interest rates?

- How much does the account cost (fees, minimum deposits, etc.)?

- Do they offer ATM cards for convenience?

- Do they offer mobile or online banking services?

- Can you link the account to your checking account?

- Is your money secured by the FDIC?

- Is it specifically a savings account for students?

Interest rates are probably one of the most important factors that you want to consider. You can’t expect an extremely high return on a savings account, with the national average right around 0.06% in 2016 according to the FDIC. Typically, the higher your balance, the higher your interest rate. This is equally true with a savings account for students.

When you are looking into a savings account for students, make sure that you understand the fee schedule associated with the account.

Some of the savings accounts, especially a student savings account, will be free of charge with no monthly maintenance fee. This is often the case if you open your account with the same bank that you use for checking. Another benefit of using the same bank for both is the ability to link the accounts for easier deposits.

Convenience factors, such as ATM cards and linking your account to your checking account, can really make banking easier for you. Just remember, when things are easier for you, it also means it may be easier for you to get into trouble with the account.

ATM cards make it easy to make deposits, but they also make it just as easy to get money out. You really have to make sure to save and bank responsibly with your savings account for students.

So, what is the best savings account for students?

Don’t Miss: Finding the Best High-Interest Checking Accounts & High-Interest Online Savings Accounts

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Comparing the Top Choices of Savings Accounts for Students

Without further ado, let’s take a look at some of the top choices when it comes to a student savings account.

We are going to compare and contrast Chase Bank, Bank of America, and TD Bank student savings options.

Chase Bank Student Accounts

Image source: Chase Bank

Chase Bank, formerly known as JP Morgan Chase Bank, is headquartered in Columbus, Ohio, and has been offering banking solutions for more than two centuries (through mergers).

They definitely have some good options for a savings account for students, with more than 5,100 bank branches and 16,100 ATMs across America.

With Chase Bank student accounts, you can do your checking and savings all in the same place. While they don’t have specific student savings accounts, they do have savings accounts that are ideal for students. Choose from their Chase Savings or the Chase Plus Savings.

Chase Savings: What You Need to Know

Your Chase student savings account will come packed with benefits. Each account will not only earn interest at the current market rate, but it is also fully insured with the FDIC insurance protection. The interest rates of your student savings account will vary, sometimes day to day. Click here to check the current rate. (Rate as of October 4, 2016 is 0.01%.)

Now, let’s see what the fees look like with student savings. A flat rate fee of $5 is charged each month for account maintenance unless you have it waived by meeting one of the following requirements:

- $300 minimum daily balance

- $25 or more automatic transfer deposit from your Chase checking account

- account holder is under 18 years of age

- account is linked to Chase Premier Plus Checking, Chase Premier Platinum Checking, or a Chase Private Client Checking account

Other fees that may be associated with your Chase bank student accounts include a $5 withdrawal limit fee that is assessed for each withdrawal you make over the limit of six that you get for free each month. That means you can make six withdrawals, but on the seventh and subsequent withdrawals, you will be charged $5 for each transaction.

Open your account today with a minimum deposit of only $25.

Image source: gettyimages.com

Chase Plus Savings: What Makes It PLUS?

The Chase Plus Savings account for students has all of the same benefits and advantages of a regular Chase Savings account, and then some.

With this account, higher balances may be able to earn more interest. You can also get a better interest rate by linking your qualifying Chase checking account to your Chase Plus Savings, allowing you to get their relationship rate with your student savings account. Click here to take a look at today’s current Chase Plus Savings rates.

Withdrawal limit fees work the same with this account as they did with the Chase Savings, but the monthly fee associated with this account are $20 unless you meet one of the following requirements:

- $15,000 minimum daily balance

- account is linked to Chase Premier Plus Checking, Chase Premier Platinum Checking, or a Chase Private Client Checking account

It seems that these accounts both have a lot in common, but the Chase Plus Savings is geared more toward people who keep a higher balance in their savings account. You also have to have a bit more to open the account, with a $100 minimum deposit to open. These are some of the best savings account for students offered by Chase.

Related: The Best Checking Accounts | Tips to Finding the Best Bank for a Checking Account

Bank of America Student Savings Accounts

Bank of America offers well-rounded banking options for students. Bank of America is the 11th largest company in the world, according to Forbes. That means that they must know a little bit about what consumers want and need. They have student checking options and a few good savings account options that are ideal for college students, including their regular savings account and the Bank of America Rewards Money Market savings account.

Bank of America Savings Accounts: What You Should Know

First, let’s look at Bank of America’s regular savings account. This account has a standard Annual Percentage Yield of 0.01% with a low minimum opening deposit of $25. The fees are very similar to that of the Chase Savings account. You will pay a flat rate of $5 per month unless one of these criteria is met:

- $300 minimum daily balance

- a linked Bank of America Interest Checking account

- become a Bank of America Preferred Rewards client

- $25 or more in automatic transfers to account

Bank of America savings accounts also allow up to six withdrawals or transfers before charging the $10 withdrawal limit fee.

Popular Article: How to Open a Free Checking Account with No Deposit | Online Accounts & Banks with No Opening Deposits

Bank of America Rewards Money Market Savings Account: What’s the Difference?

Like Chase, Bank of America also offers a second type of savings account for students to consider. The Rewards Money Market Savings Account offered by Bank of America earns a higher-than-normal interest rate of 0.03%, with a boost in interest rate for Preferred Rewards clients:

- 0.04% for Gold clients

- 0.05% for Platinum clients

- 0.06% for Platinum Honors clients

The monthly fee for this account is $12 per month, but you have the opportunity to waive it, similar to the other account with Bank of America. Simply keep a minimum daily balance of $2,500 in your Bank of America savings account, link your Bank of America Interest Checking account, or become a Preferred Rewards Client. (Withdrawal limit fees are the same as the regular savings account through Bank of America.)

TD Bank Student Savings Account

TD Bank has simple solutions that will make saving easy, even as a student. Pair their student checking accounts with one of their easy-to-manage TD Bank student savings accounts. Choose from the TD Simple Savings, TD Growth Market, and TD Select Savings.

TD Simple Savings: Building Your Student Savings

The TD Simple Savings is actually quite similar to the basic savings account for students offered by Chase and Bank of America. It has a $5 monthly maintenance fee ($4 if you use online statements), and the interest rate is actually quite high for a basic savings account. The current interest rate is right at 0.05% (the other basic accounts held a 0.01% interest rate).

Ways to waive the monthly maintenance fees:

- For 12 months, link your TD Bank student savings account to a TD bank checking account

- $300 minimum daily balance

- Recurring transfer of at least $25 from your TD Bank account

- 18 years of age or younger

About TD Growth Money Market: Grow Your Savings and See Rewards

As you start to grow your student savings, the TD Growth Money Market may be a good option for you. Benefits of this account include:

- Free bill pay

- Interest rates ranging from 0.05% to 0.35%, based on your balance

Avoid the $12 monthly maintenance fee ($11 with online statements) by keeping a minimum daily balance of at least $2,000 in your account.

TD Select Savings: Earn More with a Higher Balance

Not that there are many students out there that would need this account, but the TD Select Savings is another option for those with a higher balance in their student savings account. Benefits include:

- Waived ATM fees

- Free money orders

- Interest rates ranging from 0.05% to 0.45%, based on your balance

The monthly maintenance fee is a bit higher for this account, at $15 ($14 with online statements). You can waive it by keeping a minimum daily balance of $15,000. This may not be the best savings account for students, but is ideal for those who have a large cash flow.

Conclusion: What Is the Best Savings Account for Students in 2017?

As you can see, all three of these banks offer great student savings account options—each with different benefits and advantages. So, should you go with the Chase Bank student accounts, Bank of America Student savings account, or TD Bank student savings account? Let’s recap our review of these three options.

The good news is that you could get an account with any of these financial institutions and most likely have a great experience with it. You really have to decide what features are most important to you. Ask yourself these questions before choosing the best student savings account for your personal needs:

- How much money do you plan to use to open your account?

- How much money do you plan to keep in the account on a daily basis?

- Do you travel a lot and need access to your money in states other than your home state?

- Is it important for you to have a free student savings account?

Once you have your own personal preferences decided, you will be able to choose the best savings account for students based on these answers. The TD Simple Savings account, with its 0.05% interest rate, has one of the higher rates for a basic student savings account. If you travel a lot, however, you may want to consider the Bank of America Student Savings account since they offer more branch and ATM locations across the country. It all depends on what you are looking for in a best saving account for students.

Read More: How to Find the Best Banks with Free Checking and No Minimum Balance

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.