In The Military or a Veteran? Learn How to Find the Greatest VA Mortgage Rates Today

Buying a home is a big life step, and it is probably the largest life purchase you will ever make. For those in our military, forms of home loan relief are possible. One significant savings comes from getting a VA mortgage with lower military mortgage rates.

In order for military members to take advantage of these savings, we have compiled a how-to guide on getting the best VA mortgage rates and finding those VA mortgage rates today, focusing primarily on 15-year VA mortgage rates and 30-year VA mortgage rates.

Understanding the ways you can save money by getting the lowest VA mortgage rates is valuable information for active military members as well as veterans.

Image Source: Pixabay

As The Mortgage Reports wrote, “VA mortgage rates routinely beat ‘market’ ones by more than a quarter of a percentage point. That’s a huge difference in your housing bottom-line. Additionally, VA mortgages get approved more easily that other loan types.”

This guide will help you understand:

- VA mortgage loans

- VA mortgage rates

- How to get the best VA mortgage rates

- How to find top VA mortgage refinance rates

- Whether you should choose 15-year VA mortgage rates or 30-year VA mortgage rates

By the end, you will feel empowered with all the basic information you need to find the VA mortgage interest rates for you and your new home this year.

What Is a VA Mortgage Loan? Important Definitions

Before we take a look at 15-year VA mortgage rates or 30-year VA mortgage rates, it is important to fully understand exactly what a VA mortgage is.

Here are a few important definitions to help you along with this guide:

- VA: Acronym for “Veterans Affairs”

- VA Mortgage Loan: A home loan for eligible members, veterans, or spouses of the military

- VA Mortgage Rates: The interest rates attached to your VA mortgage; often, the best VA mortgage rates are considerably lower than conventional mortgage rates

- 15-Year VA Mortgage Rates or 30-Year VA Mortgage Rates: The number of years indicates the span of your home loan (Examples: 15-Year VA Mortgage Rates are the interest rates you will have if you get on a plan to pay your home off in 15 years; 30-Year VA Mortgage Rates are those you get if you pay your home off in 30 years)

- VA Refinance Mortgage Rates: A VA refinance is similar to a conventional refinance; you get a new home loan at a lower rate to save money on interest rates

It is important to note that taking advantage of these military mortgage rates allows you to get any of the following. This is only true as long as the VA mortgage loan rates are being used to buy a home for your own personal occupancy—not for someone else or as a rental.

- Buy a home

- Buy a condominium unit in a VA-approved project

- Build a home

- Purchase and improve a home at the same time

- Improve a home with energy-efficient features or improvements

- Purchase a manufactured home or lot

Who Is Eligible For VA Mortgage Rates Today?

Now that we understand what a VA mortgage rate is, who can actually take advantage of these home loans with VA mortgage loan rates?

Here is a list of those who may want to look into getting a valid Certificate of Eligibility to apply for a home loan with the lowest VA mortgage rates.

- Current members of the military

- Veterans (honorably discharged)

- National Guard members

- Reservists

- Spouses of an active duty member who died in service, is missing in action, or is a prisoner of war

- Surviving spouses of some totally disabled veterans

- Surviving spouses who “remarries on or after attaining age 57, and on or after December 16, 2003”

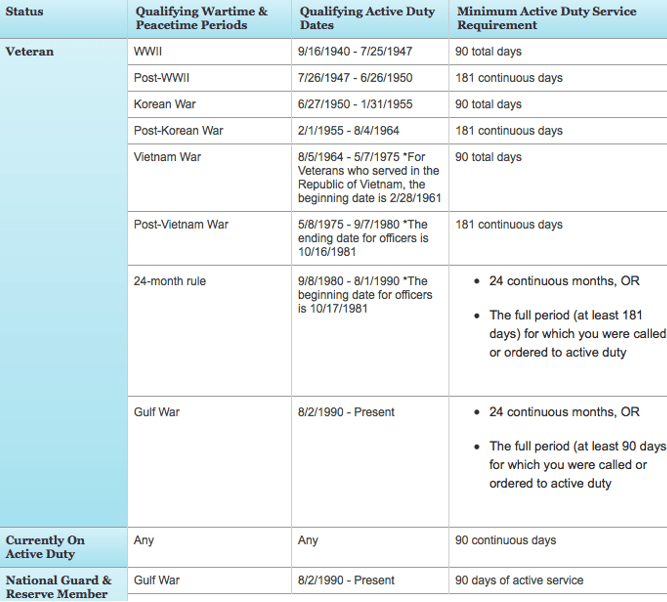

This is a helpful guide from the U.S. Department of Veterans Affairs for those who want to see if their service qualifies them to take advantage of VA mortgage loan rates.

Image Source: U.S. Department of Veterans Affairs

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to Find the Best VA Mortgage Rates Currently

The truth about VA mortgage interest rates (or any mortgage rates) is that there is not one steady rate. It all depends on both you and the market.

We will start this guide by considering choices you can make today to help you get even better VA mortgage rates. If you want the best VA mortgage rates, these are tips you will want to follow.

On top of that, VA mortgage interest rates can change every single day. It depends upon the market, the lender, and the economy in general. This is true of both 15-year VA mortgage rates and 30-year VA mortgage rates.

You will have to do some of your own research to find out the VA mortgage loan rates each day. To help with this process, we have gathered ways to help you find VA mortgage rates today and each day after.

Finally, we will discuss how to find the very best VA mortgage refinance rates.

Get the Best VA Mortgage Rates Step 1: Credit Score

Just like any other loan, your credit score will have an impact on your VA mortgage interest rates.

The higher (better) your credit score, the lower your VA mortgage rate. This is because the lender will consider you a safer bet for allowing you to borrow their money.

The lower (worse) your credit score, the higher your VA mortgage rate. This is because the lender will consider you a higher risk for allowing you to borrow their money.

Start the process of finding VA mortgage rates today by checking your credit score. If you find that the score is too low for your liking, start implementing these actions to lift it up, and get the best VA mortgage rates:

- Pay every single bill on time

- Pay consistently each month

- Start paying down your balances

- Avoid adding any new large purchases (other than your house), so you do not struggle to pay your payments

Best VA Mortgage Rates Step 2: Compare Other Loans

Another important aspect of understanding the VA mortgage rates today is to also see what the top conventional loans are offering that day, too.

The ultimate goal is to get the lowest interest rate to keep costs down on your new home, so comparison shop. Never just go with the first offer you hear about.

Check to see what other lenders are offering for VA mortgage rates, but also check current conventional home loan rates. It is worth it to take the time to learn as much as you can about the current home loan rates.

These actions will help you know that you are receiving the best VA mortgage rates and the lowest VA mortgage rates.

Related: Best Fixed Deposit Rates | Guide | How to Find & Get Top Fixed Term Deposit Accounts & Rates

Best VA Mortgage Rates Step 3: 15-Year VA Mortgage Rates vs. 30-Year VA Mortgage Rates?

Choosing between 15-year VA mortgage rates and 30-year VA mortgage rates can have an impact on you getting the best VA mortgage rates as well.

15-year VA mortgage rates come with a 15-year home loan term length. Overall, you should pay significantly less interest from only paying on your loan for 15 years. But this can mean your interest rate is higher.

30-year VA mortgage rates come with a 30-year home loan term length. Overall, you should pay significantly more interest since you will have been making interest payments for 30 years. In exchange for this convenience, the interest rate is typically lower.

15-year VA mortgage rates save money in the long run by spending a little extra now. And 30-year VA mortgage rates save a little money in a lower monthly payment, but you will often pay more overall.

You could easily make an argument, then, for either one of these options to qualify as the best VA mortgage rates. It all depends on your financial situation and how much you have to spend each month.

What Are VA Mortgage Rates Today? Search Lenders & Online Tools

One way you can learn about the VA mortgage rates today is to search the individual lenders who offer the loans. You can call and ask for the most current information on VA mortgage loan rates. Or you can check their websites for military mortgage rates.

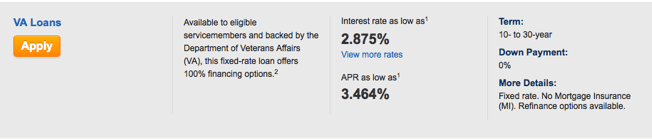

Image Source: Navy Federal Credit Union

Here are a few popular lenders that offer VA home loans. Click on the links below to be led to the their VA mortgage rates today. Of course, there are more options, but these are a few to get you started.

There are also online tools that will help you see the VA mortgage rates today. Here are two of the top choices:

BankRate: Bankrate has a “Mortgage Rates Today” tool. Each day, you will be able to check the mortgage rates specific to your location, loan amount, and credit score. There is an option to see 30-year VA mortgage rates on this tool.

Veterans United Home Loans: Veterans United has an interactive tool that allows you to put in some personal information (approximate home price, location, when you plan to buy, etc.). Then, they will give you either estimated 15-year VA mortgage rates or estimated 30-year VA mortgage rates.

Popular Article: The Savings Account Interest Rates and Yields | How to Find & Get the Top Account Rates

What About VA Mortgage Refinance Rates?

Up to this point, we have focused on the best VA mortgage rates for original mortgages. But it is important to take a peek at VA mortgage refinance rates as well.

As we have discussed, VA mortgage rates are typically lower than conventional loans. But if you have an older VA home loan with a higher VA mortgage rate than the current VA mortgage rates today, you may consider VA refinance mortgage rates.

Fabulous options for VA mortgage refinance rates are the VA Interest Rate Reduction Refinance Loan or the VA Streamline Refinance.

There is also the VA Cash-Out Refinance Loan offering VA refinance mortgage rates if you want to also take out some cash from your home’s value.

These three are fairly simple options for those who want VA refinance mortgage rates to drop their monthly payments even lower. Learn more by clicking on the links above.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: The Top VA Mortgage Rates Today

Now that you have a better idea of how to get the best VA mortgage rates and how to find the current VA mortgage rates today, you can begin the process of getting your very own VA home loan.

Follow the steps we mentioned above: check your credit, compare loans, choose if you would rather pay 15-year VA mortgage rates or 30-year VA mortgage rates, and then you can start applying.

Taking advantage of these lowest VA mortgage rates is only a very small way the country can thank you for your service, so it makes sense to take advantage of the military mortgage rates and gain some financial freedom this year.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.