Intro: Where to Invest 100k & the Best Ways to Invest $100,000

If we work hard and are lucky, certain times in our lives can make a big difference for our future, such as the opportunity to invest $100,000 or more.

Whether you hit it big through inheritance, winnings at the casino or track, savings, a huge bonus, or making that perfect stock bet on a tech company that paid off, you’ll want to know the absolute best way to invest $100,000 to ensure you retire wealthy.

The scope of investing changes when you have significantly larger sums at your disposal.

Finding where to invest 100k means making different decisions than when you invest $10,000 or invest $50K. If you’re looking for the best way to invest 100k, there’s a good chance that you’ll find more opportunities open up to you.

More of your money is on the line, plus you have the best chance to secure a bright and comfortable future for yourself and your family.

Once you hit that six figure mark, you will want to take a very close look at your potential rate of return, the number of years before you’d like to retire, and what type of nest egg you will need before finding the best way to invest 100k.

These factors will guide the choices you make for the best way to invest 100,000 dollars and where to invest that $100,000 to make it grow.

In this article, we will walk you through the formulas needed to calculate what you need to reach your retirement nest egg goal, go through some basics on how to invest $100,000, give you some investing tips from the pros, and list the absolute best ways to invest $100,000 to secure your future.

See Also: Top Long Term Investments – Detailed Overview

Calculating Returns for Your Retirement Goal

Before you get started on where to invest 100k and how to invest $100,000, you need to know some important details, which are vital in helping you choose the right investment options.

Best Way to Invest 100k

You’ll want to write down the following:

- How much money you’re investing – In this case, we are using $100,000, but you can easily adjust that.

- How many years until your goal retirement year.

- How much money you want to have gained from investing for retirement.

These are the key bits of data that will help you calculate a realistic goal to find the best way to invest $100,00 and also give you a target return rate to look for in your investments based upon your end goal and how long you have to achieve it.

So, now that you have this information, here is what you’re going to use: an online investment or compound interest calculator. There are many to choose from and some are easier than others; we looked through several, inputting the information to invest $100,000 and seeing what type of return was possible.

Don’t Miss: Investment Advisor Search – Top Investment Companies

Online Calculators You Can Use

Using an online calculator can be a great resource in finding the best way to invest 100k. We took a look and found three calculators that are available for free use online, listed below.

Compound Interest Calculator

Investor.gov offers one of the easiest ROI calculator tools out there. Although it’s not specifically a “retirement” calculator like some, it’s very easy to use for calculation of compound interest on an investment.

We input the $100,000 investment as current principle, no monthly addition, 25 years to grow, and chose a 6% interest rate. As a result, our investment could grow to $429,187.07 (if nothing were added to it) in those 25 years. (A better return of 8% would increase it to $684,847.52).

Bloomberg Retirement Calculator

The Bloomberg.com Retirement Calculator is another nice one that has just a few input fields, including current age and expected retirement age.

It also generates a chart, which is helpful for those who prefer to see a visual representation of their investment planning.

Finra Retirement Calculator

If you love data and want to input everything from the inflation rate to both the current tax rate and retirement tax rate, then the Finra.org Retirement Calculator has all those bells and whistles.

So, once you have a good feel for what is possible and how the number of years and the return rate all calculate into what you end up with at retirement, you now are empowered with the information you need to find the best way to invest $100,000 or even the best way to invest $1,000,000.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to Invest $100,000 – What Are the Options?

First, we are going to talk about your options; there are many, but they are not all created equal.

Not all of them will be the best way to invest 100,000 dollars, so be sure to continue reading through this article for the tips from the pros and the best investment picks about where to invest $100,000.

Now, you may be the type who never wants to risk too much with your investments, or you may love to take a little risk looking for a high reward. While no investment is completely risk-free, let’s break down the options on where to invest $100,000 into Lower Risk and Higher Risk choices.

Best Way to Invest 100k – Lower Risk

According to GoodFinancialCents.com, these are some low risk investments for high return:

- Peer-to-Peer ending

- Certificates of Deposit

- Treasury Inflation Protected Securities (TIPS)

- Money Market Funds & ETFs

- Municipal bonds

- U.S. savings bonds

- Annuities

- Cash value life insurance

These last two are more “middle” risk:

- Dividend paying stocks and mutual funds

- Preferred stock

Best Way to Invest 100k – Higher Risk

According to Bankrate.com, these are some high-risk investments that are best left to the pros:

- Initial Public Offerings (IPOs)

- Venture capital

- Penny stocks

- Emerging markets

- Rental houses

- Options

- Futures

- Collectibles

- Precious metals

Related: Best Asset Management Firms | Best Asset Managers

What Can I Expect for a Return When I Invest $100,000?

We would all love to have a 25% rate of return and retire early, but that is not typically realistic.

Now, nothing is impossible, but that type of return would usually come with a high risk, and you could find yourself never able to retire at all. Returns can vary widely according to investment, so we’ll give you a “ballpark” figure.

According to Financial Post, 6% is a good rule of thumb to use when calculating investment returns. Actuaries use this number to gage a middle ground that is realistic among all the variable returns.

Of course, you may see anywhere from less than a percent to more than 20, just depending upon the investment and climate. Do your research and check “Current Rate of Return” for any investment that you intend to make.

Where to Invest $100,000 – Who Should I Trust?

There are a lot of trustworthy financial firms out there that would offer a good place to invest $100,000, but some are not so great. Let’s take a look at the top 6 companies that were ranked best according to the J.D. Power & Associates 2016 U.S. Full Service Investor Satisfaction Study.

Top Investment Firms for Investors

Here are the firms that investors ranked above average for their investment services:

- Edward Jones

- Fidelity Investments

- Charles Schwab

- Wells Fargo Advisors

- Raymond James

- Ameriprise Financial

- UBS

Now, if you’re looking into mutual funds as your best way to invest $100,000 and want to know the most trusted names, here is a list of the top 10 based upon a Cogent survey of 1,390 registered advisors.

Top 10 Mutual Fund Firms Most Trusted by Advisors

Here are the mutual firms that advisors trust most for their investment services:

- American Funds

- Franklin Templeton

- BlackRock Funds

- Vanguard

- Fidelity Investments/Advisor funds

- Oppenheimer Funds

- MFS Investment Management

- T. Rowe Price

- First Eagle

- Dimensional Fund Advisors (DFA)

Popular Article: eToro – Review and Ranking

The Best Way to Invest $100,000 – Tips from the Pros

When you want to find how to invest $100,000 or even the best way to invest $1,000,000, it’s helpful to hear what successful investors and business people have to say.

Many of them have vast experience both losing and winning on their investments, which has made them all the wiser and a great resource for determining where to invest 100k.

Business Insider has gathered some great investment advice from billionaires:

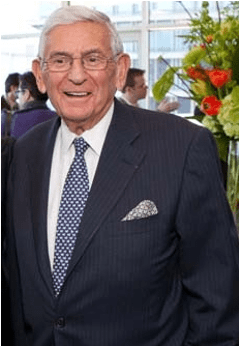

How to Invest $100,000 – Eli Broad

Eli Broad – He went from building houses to buying and selling insurance companies.

His investing advice: High-quality multinational consumer companies such as Proctor & Gamble, Coca-Cola, and Kraft.

Mikhail Prokhorov – Owner of the New Jersey Nets.

His investing advice: Data to watch – Germany IFO data for global manufacturing, U.S. conference board data for American consumer confidence, Chinese PMI manufacturing data for China growth and exports.

John Paul DeJoria – Co-founder of Patron tequila.

His investing advice: The best way to invest $1,000,000 is 25% in gold, 25% in silver, 25% in the NYSE blue-chip stocks that pay dividends and 25% between Asian and European blue chips that pay dividends.

Donald Trump – American businessman and the 45th President of the United States.

His investing advice: Invest in equities, corporate bonds, and, if you know what you’re doing, purchasing foreclosed homes from banks.

Now that we’ve heard from the billionaires, let’s hear what some other experts have to say about the top investing tips to invest $100,000 or any amount of money for retirement.

Advice From Trusted Sources on How to Invest $100,000 and Plan for Retirement

Bankrate has some great tips to keep your planning on track to a happy retirement:

- Save money, early and consistently

- Use a tax-advantaged account

- Increase savings with each raise you receive

- Learn the basics of investing

- Pay down your debt

- Asset allocation should reflect your life stage

- Factor in risk tolerance and time horizon

- Control the fees

- Don’t obsess over your portfolio

- Consider hiring a pro

U.S. News has some great saving for retirement advice according to where you are in life:

Investing in Your 20s

Learn to appreciate the time value of money. At this age, if you start saving–even a little–you have over 40 years that it can grow before you’re getting ready to retire. Take advantage of that time and don’t wait too long to start saving and looking into the best way to invest 100k.

Investing in Your 30s

As your financial obligations grow, like children or a mortgage, balance spending and saving. Don’t let spending derail you from continuing to save for your future.

Investing in Your 40s and 50s

This is the time in life when retirement doesn’t seem like some faraway place anymore. Drill down into your planning, make realistic goals, and execute paths to achieve them.

Investing in Your 60s

You’re getting ready to head into retirement, but you should still stay on top of your money and investments. You can live longer than you thought or have unexpected medical expenses, so planning is key.

Also, make the most of your Social Security benefits by educating yourself about when you should start tapping into those.

Read More: What Is a Timeshare? Overview of Buying and Selling Timeshares

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: You Can Retire Wealthy With Some Planning

Don’t let the thought of impeding retirement make you anxious. There is a lot you can do by planning the best way to invest 100,000 dollars.

For example, let’s say you find the right mutual fund (like this Vanguard Long-Term Investment-Grade Fund) that is currently around an 8% return. If you invest $100,000 when you’re 35, assuming you don’t put in another penny, you’d have over a million dollars to retire with at age 65.

Plus, investing in stocks that pay dividends can mean a comfortable income for you to do whatever you desire during your “golden years.” The main thing to remember is to keep your risk at a level that you can afford while also looking for the best return you can get on that $100K investment.

We hope that you’re feeling a little more secure now and feel like you have a roadmap for not only how to invest $100,000 but also the best way to invest $100,000 for a comfortable and secure future.

Saving and investing is a habit, and if you do it regularly, the dollars can add up to a wonderful, long-term retirement.

Image Sources:

- https://pixabay.com/photos/money-dollars-success-business-1428594/

- https://en.wikipedia.org/wiki/Eli_Broad

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.