U.K. Citizens Voted to Leave the European Union, Sending Shockwaves Across the World

Stock markets across the globe plunged sharply on Friday after citizens of the United Kingdom surprised the world by voting to leave the European Union.

Britain held a referendum on whether to leave the European Union, a process commonly referred to as the “Brexit” (Britain’s Exit).

Overall, 51.9% of all eligible U.K. citizens voted to leave the E.U. It is a historic decision sure to reshape the nation’s place in the world.

Global Markets Plunge

The risk of another global recession escalated Friday after Britain’s stunning decision to leave the European Union. Wall Street was slammed from the moment trading opened, with the Dow Jones Industrial Average dropping more than 500 points within minutes.

U.S. markets plunge:

DJIA and S&P have biggest drops in 10 months

Europe stocks plummet by 7% in one day:

- FTSE -199.41 -3.15%

- DAX -699.87 -6.82%

- CAC -359.17 -8.0%

- IBEX 35 -1097.60 -12.35

Asia markets capitulate within hours:

- NIKKEI -1,286.33 -7.92%

- SHANGHAI -38.33 -1.33%

- HSI -609.21 -2.92%

The gut-wrenching moves were the latest sign of panic that began when the Brexit referendum results began to trickle in overnight. Japan’s Nikkei index temporarily halted futures trading amid the sweeping global selloff and closed down 8 percent. The turmoil then hit European stock markets, with France’s major index also dropping 8 percent, while Germany’s fell nearly 7 percent. The London-based FTSE 100 initially plummeted nearly 9 percent but ended the day with a 3 percent decline.

World leaders and international policymakers have long warned that the sluggish recovery from the Great Recession has left the world economy more vulnerable to another downturn. “We think the time has come to consider that a financial market crash today may push a world economy teetering on the verge of a contraction over the edge,” said Carl Weinberg, chief economist at High Frequency Economics.

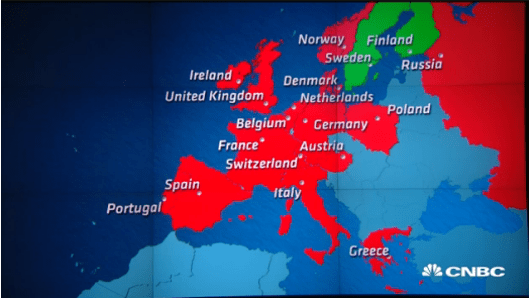

Markets Across Europe Plunged

http://www.cnbc.com/2016/06/24/us-markets.html

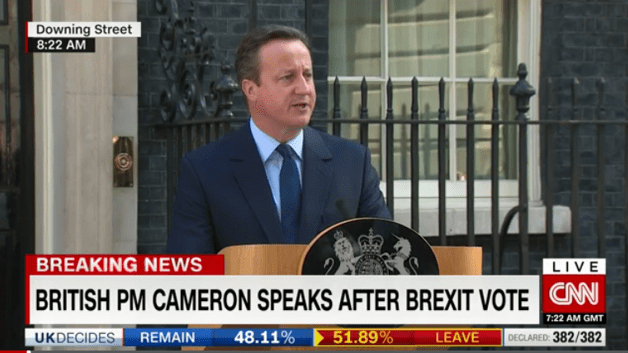

U.K. Prime Minister David Cameron Resigns

As reported by The Guardian, British Prime Minister David Cameron has resigned, bringing an abrupt end to his six-year premiership, after the British public voted to reject his entreaties and turn their back on the European Union.

Just a year after he clinched a surprise majority in the general election, a visibly emotional Cameron, standing outside Number 10 on Friday morning, said, “The will of the British people is an instruction that must be delivered.”

The prime minister campaigned hard for the U.K. to remain with the E.U., appearing at hundreds of public events and rallies up and down the country to argue that a Brexit would be an act of “economic self-harm.”

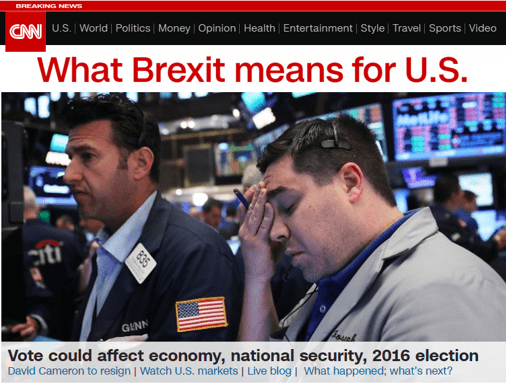

How the “Brexit” Vote Could Impact Americans

According to ABC News, about half of the American workforce participates in their company’s 401(k) or other retirement plans, and such investments are at risk from the market turbulence.

As Wall Street joins the global market selloff today, your 401(k) will decrease in value temporarily. The good news is that these retirement funds are long-term investments and should be able to weather the storm.

Obama Seeks to Calm U.S., Global Fears After Brexit Shock

With world financial markets reeling from the shock, U.S. President Barack Obama put out a press statement on Friday.

“The people of the United Kingdom have spoken, and we respect their decision.” He added that the “special relationship” between the U.S. and the U.K. is “enduring,” and that the latter’s membership in NATO “remains a vital cornerstone of U.S. foreign, security, and economic policy.”

On his last visit to Britain in April, President Obama stood beside U.K. Prime Minister David Cameron and came out strongly against the U.K. leaving the E.U.

U.S. Federal Reserve Chair

Janet Yellen (Federal Reserve Chair): “A U.K. vote to exit the European Union could have significant economic repercussions.”

Janet Yellen – Fed Reserve Chair

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.