Intro: Caliber Home Loans Reviews

Caliber Home Loans is a relatively young company, having been launched in 2013. The company was born out of the merger of two companies that had been in business since 2008: Caliber Funding and Vericrest Financial.

With headquarters out of Irving, Texas, Caliber is a private company in the residential mortgage loan business. It is owned by affiliates of the private equity fund manager Lone Star Funds.

They have offices and branches on a national level and a branch locator service using an interactive map of the United States. Click on your state, and branch locations in that state will be displayed using a map similar to the one below.

Caliber Home Loans uses the marketing tagline “Imagine,” as part of their strategy of “turning daydreams into real estate realities by offering mortgage loans to qualified buyers.”

They claim to be a customer-centric lender that thrives in today’s complex financial marketplace as a “mortgages are our only business” provider. There is evidence that their claims are faithful to their purpose, though there is some dark history that you should be aware of (Wikipedia has a “not so flattering” page on Caliber Home Loans that is well referenced).

Image Source: Caliber Home Loans

Caliber Home Loans Reviews – Loans and Programs

Caliber has an extensive selection of mortgage loans and programs to choose from, ranging from conventional loans to government loans to the Caliber Portfolio Lending Program loans. Visit the Caliber Home Loans product offerings at this link to review those products.

The more unique Caliber Home Loan products are discussed in their Caliber Portfolio Lending Program and deserve some special mention here.

- Jumbo Alternative – This loan is meant to serve mortgage loan customers who are looking to finance a high-value property but don’t qualify for an industry standard Jumbo mortgage loan. Asset-based qualifications can substitute for lack of income-based requirements. The full description and terms of these mortgage loans can be found here.

- Homeowner’s Access – Another alternative to a traditional loan to accommodate mortgage loan applicants. The key to this loan is the ability to use non-traditional methods to prove your creditworthiness following events such as a bankruptcy or other personal financial meltdowns. View the details of this mortgage loan here.

- Fresh Start Program – This mortgage loan diverges from the traditional as well. The key features are focused on mortgage loan applicants who do not have a traditional credit history and associated score or have an abnormally low credit score due to past financial difficulties. View the details here.

- Investment – This mortgage loan focuses on applicants who want to finance rental or other investment properties. The terms of qualifying are lenient: you can qualify with a credit score as low as 620. View the details here.

- Foreign National – This mortgage loan is targeted at foreign nationals who visit the U.S. on a regular and consistent basis. It has a high downpayment requirement but does take into account that the borrower will not have a domestic credit history or score. View the details here.

Caliber Home Loan Reviews

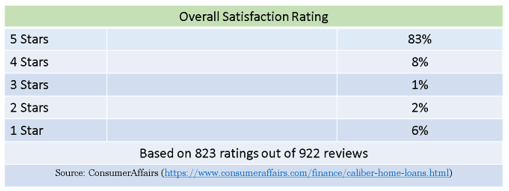

The website Consumer Affairs has been collecting and analyzing Caliber Home Loans reviews over time. This is an important insight into Caliber given that they consider themselves an active consumer-oriented business in putting the customer first in all of its transactions and loan originations. The statistics are very much in their favor as evidence of their success in making the loan customer happy.

Image Source: Consumer Affairs

A sampling of some of the more recent Caliber Home Loan reviews posted to Consumer Affairs provide a useful reference for anyone thinking about approaching Caliber Home Loans for a mortgage. Consumer Affairs verifies that each person submitting a review is an actual Caliber Home Loan customer.

The majority of the Caliber mortgage reviews are positive, with this review from Sherry in Mechanicsville, VA, on June 9, 2016.

“My experience with Caliber Home Loans was excellent due to the diligence and commitment to detail by Rod ** and Judy **. They were my guides and gurus and helped me through the process. I am a 64-year-old widow and had never done anything like this on my own. I was overwhelmed and frightened that I might lose my home. I never thought I could qualify on my own but with their gentle guidance and constant communication, I did it! It changed my life, and I am forever grateful to these people.”

We encourage you to look at these Caliber Home Loan reviews in depth to gain an appreciation for the nature of how they do business.

There is a dissatisfied group, however, and you would be remiss in not giving those Caliber mortgage reviews equal time. They just might hold that one thing that really turns you off in doing business with a company. These Caliber Home Loan complaints deserve your attention.

You will note that Caliber responds to positive feedback but does not respond to negative feedback which provides another perspective in making an informed decision to do business with Caliber Home Loans.

Don’t Miss: Best Mortgage Companies (Overview of the Top Mortgage Lenders)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Better Business Bureau (BBB) Status

It’s always a good idea to check how the BBB finds a company. They have filed a Caliber Home Loans review. The value here is that the BBB is an unbiased, neutral third party.

Caliber Home Loans’ BBB Accreditation is in good order and meets all of the BBB accreditation standards. Their first active accreditation was granted on May 19, 2014, so their track record has yet to mature fully. That tells you two things:

1. Caliber Home Loans does acknowledge consumer complaints and makes an effort to resolve them. The statistics in the chart below support that premise.

2. BBB accreditation does not evaluate the actual products and services of the member company nor endorse them. It just tells you that they are responsive to customer questions and problems.

Caliber Home Loan Complaints Summary complaints closed with BBB in last 3 years | 97 closed in last 12 months

Complaint Type | Total Closed Complaints |

| Advertising / Sales Issues | 10 |

| Billing / Collection Issues | 168 |

| Delivery Issues | 3 |

| Guarantee / Warranty Issues | 1 |

| Problems with Product / Service | 214 |

| Total Closed Complaints | 396 |

Customer Caliber Home Loan Reviews Summary | Read customer reviews

Customer Reviews on Caliber Home Loans

Customer Experience | Total Customer Reviews |

| Positive Experience | 1 |

| Neutral Experience | 0 |

| Caliber Home Loans Complaints | 14 |

| Total Customer Reviews | 15 Customer Reviews |

These Caliber mortgage reviews are not as pretty as the reviews collected on Consumer Affairs. That is to be expected, though, since the BBB is a clearinghouse for problems between a company and its customers. You would be well advised to read them at the link above and weigh these Caliber Home Loan complaints with the positive ones on Consumer Affairs.

Related: Imortgage Reviews – What You Should Know (Complaints & Review)

Dark Matter

This wouldn’t be a complete review without putting Caliber Home Loans under a microscope and examining its business practices and leadership.

Let’s take leadership first. The majority of the C-suite at Caliber are people who ran Countrywide Financial’s Consumer Markets Division. The Federal Department of Justice found irregularities in their business practices and settled the legal dispute for $335M. Another settlement was reached with CountryWide Financial Consumer Markets Division for $16B that covered the “origination of defective residential mortgage loans by Countrywide’s Consumer Markets Division” and “the fraudulent sale of such loans to the government-sponsored enterprises Fannie Mae and Freddie Mac.” That action was taken after Countrywide had been bought out by Bank of America.

Couple that with the negative Caliber mortgage reviews filed with the Better Business Bureau, and it paints a poor picture.

Caliber Home Loans is also having an issue with the State of New York and their Attorney General. An investigation was launched looking into the business practices of the company. The essence of the concern is embodied in this excerpt from The New York Times on October 15, 2015:

“Critics have taken issue with Caliber’s standard loan modification that temporarily reduces a borrower’s payments for five years but then reverts back to the original payment terms in the sixth year, often with all the deferred payments added to the back end of the loan. The critics contend the temporary modifications merely enable Caliber to begin collecting payments on a loan that has been delinquent for many months or years, but provide no permanent relief to a borrower whose income has declined because of a financial crisis.”

This investigation is looking into Caliber Home Loans business practices on its conventional and standard industry products that service a majority of their customers in the state of New York.

Popular Article: Best Bad Credit Mortgage Lenders for Bad Credit Borrowers (This year’s Mortgage Lenders and Programs)

Final Thoughts

Caliber Home Loans has a solid mortgage loan business model that has been accepted by the financial and consumer mortgage community. Feedback, for the most part, has been positive with strong implications of fair practices.

Some mitigating factors might make some consumers think twice about pursuing a loan with Caliber Home Loans. However, it comes down to choosing a company you trust. Do your homework and settle all of your issues before you sign any contracts. Obtain the services of qualified legal counsel and review the loan terms and contract language thoroughly so your expectations of how the loan will work and your obligations under that loan are clear.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.