Card.Com Reviews | Is It Legit? a Scam? What You Should Know about Its Fees & Prepaid Cards

It’s almost impossible to get around without a debit card these days. From shopping online to paying bills, there are lots of things you can’t do with cash. That’s why services like Card.com have become so popular. Card.com allows you to have the convenience of a debit card without opening a bank account.

But before you sign up for Card.com, you probably want to know a few things, like “Is Card.com legit? Is Card.com a scam?” There are tons of Card.com reviews out there to help answer these questions, so in this Card.com review, we’ll also give you a complete review of Card.com and its many features. We’ll also help you decide whether Card.com is right for you.

See Also: American Funds Review | What You Should Know About American Funds Retirement Solutions

What is Card.com?

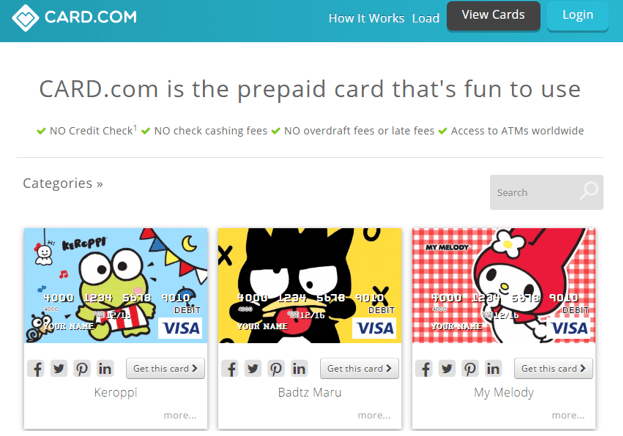

Image Source: Card.com

Before we get into the meat of our Card.com review, you may be wondering what exactly Card.com is. Card.com is a service that allows you to get a prepaid Visa or MasterCard without opening a bank account. You can sign up online and choose from a wide variety of card designs, ranging from cute cartoon characters to cityscapes.

Once you’ve chosen your card, you’re ready to load it with money. Card.com offers a variety of ways to load your card. You can load money through PayPal, have your paychecks deposited directly onto your card, or you can use the Card.com app to load money onto your card. (We’ll discuss the Card.com app more later in this Card.com review.)

The direct deposit feature is great for those who normally cash checks or deposit them to a card manually, as it allows you to access your money quickly without making a trip to the bank.

We should note that it will take several days for your card to be shipped to you, and some customers in other Card.com reviews have reported experiencing delays in shipping times. Therefore, it may be best to wait until your card has arrived to load money onto it—otherwise, you may not be able to access your money for several days.

Once you have your card and money on it, you can use it just like any other debit card—anywhere Visa or MasterCard is accepted. You can even use your card online to shop or pay bills. This excellent feature is mentioned in most Card.com reviews. Card.com gives you all the convenience of a debit or credit card without having to open a bank account.

Card.com Fees

One of the biggest concerns users have about prepaid cards is the fees Card.com charges. Card.com boasts that you won’t have to worry about late fees or overdraft fees with Card.com. This is because, as noted earlier in this Card.com review, you don’t need a bank account to get a card. This means you can only spend money that’s already on the card, so it’s impossible to overdraft, and you don’t have to worry about making payments.

However, when you use Card.com, fees are charged for other things. First, there’s a monthly maintenance fee of $9.95 per month. Although this is a steep cost, it can be avoided. As mentioned previously in this Card.com review, you can set up direct deposits to your card. As long as you direct deposit at least $1,000 each month, you won’t be charged Card.com’s fees for monthly maintenance.

There are other Card.com fees, however. While there are no Card.com fees for using ATMs within the Money Pass ATM network, there are substantial fees for using other ATMs. Every withdrawal at an out-of-network ATM will cost you $2.95, and even checking your balance at one of these ATMs costs $0.95.

These ATM fees are a bit higher than the fees you’d pay with a traditional bank, but finding a Money Pass Network ATM is easy, even in a small city. Plus, you can use the Card.com app (which we’ll discuss in the next section of this Card.com review) to search for Money Pass Network ATMs.

In addition to ATM fees, there are some additional Card.com fees. There’s a foreign transaction fee of 2.95% per transaction, a $1.95 fee if you request monthly paper statements, and fees ranging from $7.95 to $39.95 for a replacement card if yours is lost or stolen.

Don’t Miss: Allianz Travel Insurance Review | Is This Insurance Worth It?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Card.com App

Image Source: Card.com

One feature often overlooked in Card.com reviews is the Card.com app. In this Card.com review, we’ll go over all the features of the Card.com app and what it adds to the Card.com experience.

The Card.com app is available for both iPhone and Android through the App Store or Google Play. Both versions of the Card.com app have generally positive reviews—the Card.com app in Apple’s App Store has 3.5/5 stars, while the Card.com app in the Google Play store has 4.1/5 stars.

Just about anything you’d want to do with your card, you can do using the Card.com app. You can check your balance, see a record of recent transactions, get instructions on how to set up direct deposit, and transfer funds from a bank account or PayPal.

To make checking your account quick and easy, the Card.com app also has a feature called Quick Balance that allows you to see your balance and your last 5 transactions without logging in.

You can also deposit checks easily from anywhere using the Card.com app. Thanks to the app’s technology, you can take a picture of a check using your phone’s camera, and the funds will be available on your card immediately.

The Card.com app can also help you find in-network ATMs or locations where you can reload your card. A map will show you where Money Pass Network ATMs near your current location, as well as nearby cash reload locations.

Is Card.Com Legit?

We’ve already discussed how Card.com and the Card.com app work, which brings us to the questions most people are asking about Card.com: “Is Card.com legit? Is Card.com a scam?”

In our review of Card.com, we found that Card.com is legit—that is, it’s not a scam. There are many positive Card.com reviews available, and there certainly are many satisfied customers out there. Card.com has a B rating from the Better Business Bureau, and is BBB Accredited business.

Card.com offers a valuable service for those who want the convenience of a debit card without the hassle and added fees of opening a bank account. Card.com’s cards work just like regular debit cards, and they can be used online or in stores.

However, there are issues with Card.com. Despite some positive Card.com reviews, there are also many negative Card.com reviews out there. One of the biggest issues people report with Card.com is their customer service. Many consumers have complained that Card.com was unresponsive to their complaints, and that customer service was hard to reach.

Customers have also reported problems with Card.com putting a hold on cards too frequently, making it difficult for users to access their funds. Resolving the issue requires getting in touch with customer service, which can be unresponsive. The Card.com app is intended to make this easier, with a feature that allows users to open a chat with customer service or call them anytime.

Another common complaint in some Card.com reviews is that Card.com sometimes has issues with loading money onto the card. Customers have complained that direct deposits didn’t go through for several business days, causing them not to have access to their money for days. Other customers have had problems with Card.com charging certain transactions twice.

These concerns may have potential customers wondering about whether Card.com is legit, given the number and severity of problems reported in other Card.com reviews. While it’s not a scam, Card.com has significant issues that should make users think twice before signing up for a card.

Related: Nationstar Mortgage Reviews – What You Need to Know! (Pros, Complaints, & Review)

Should You Use Card.com?

Image Source: Card.com

After reading our Card.com review, you may still be wondering if Card.com is right for you. There are certainly advantages to using Card.com.

For one, Card.com is great for anyone trying to stay out of debt or avoid opening a new bank account. Card.com can help you manage your money safely, allowing you to access money easily on your card without the risk of overdrafting your account or incurring credit card debt.

As noted earlier in our Card.com review, one of the big advantages of Card.com is that it acts like a debit card without a bank account. You can only spend what you put on your card, so using Card.com can help you stay within a budget.

Card.com is also great for kids. If you want to be able to give your kids or teenagers an allowance without opening a separate bank account for them, Card.com’s cards are great. They’ll be able to use their card just like cash, and you can even see their transactions online or through the Card.com app.

However, we cannot recommend using Card.com for big purchases or as a primary card. Consumers have reported far too many issues with Card.com, namely that customer service is slow or unresponsive. Other customers have had issues accessing their money. This could be a real problem, especially if your entire paycheck is deposited onto your card. If you’re considering using Card.com, make sure you have a backup bank account or card in case of emergencies.

Card.com’s fees may also be a concern. Unless you’re depositing more than $1,000 per month onto your card, you’ll be stuck paying $9.95 in monthly fees. This is far more than most bank accounts or other prepaid cards charge in fees. So if you are using your card to give your kids a small allowance or for minor transactions, be aware of Card.com’s fees.

Even though, technically, Card.com is legit and safe to use, proceed with caution. As demonstrated in this Card.com review and in many other Card.com reviews online, despite the benefits of their product, Card.com continues to have serious problems with customer service.

Popular Article: LendUp Reviews—Is LendUp Legit & Safe for a Loan? Competitors & Sites Like Lendup Can LendUp Loans Help the Average American?

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.