Summary: Cash Out Refinance Mortgage | 2017 Guide | What Is Cash Out Refinance?

Mortgage interest rates have hit an all-time low, which is why many homeowners are choosing to refinance their home loans.

Refinancing your mortgage can provide many benefits to you, like lower interest rates, a shorter term, and lower monthly payments.

If you have looked into refinancing your home, you might have stumbled upon refinance cash out options.

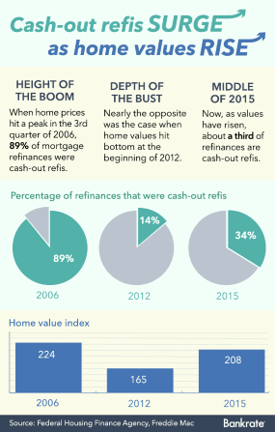

Although there are several refinance options available, an increasing number of homeowners are choosing to cash out mortgage loans through refinancing. In fact, about one-third of homeowners who refinanced in 2015 chose a cash out loan.

Image Source: Bankrate: Cash out refinance

Not only are homeowners choosing a cash out mortgage for their own homes, but they are also choosing cash out refinance investment property loans to save money.

This article will further explain “What is a cash out refinance loan?” as well as the pros and cons of using a cash out loan, how to use a refinance cash out calculator to better understand your savings, and how to find the best cash out refinance rates.

See Also: Best Mortgage Companies (Overview of the Top Mortgage

What Is a Cash Out Refinance Loan?

A cash out refinance mortgage is a type of mortgage refinancing loan that lets you cash in on your home’s equity. Say you have had your home for three years. In those three years, you built up about $50,000 in equity. If you choose to use cash out refinance to refinance your mortgage, you can cash out the money you built in equity by adding it onto what you owe on your loan.

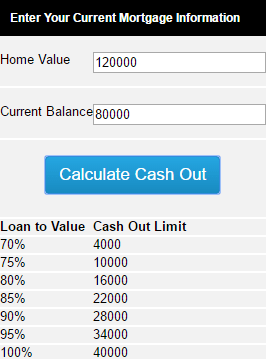

Image Source: Cash Out Refinance Loan

Typically, cash out refinance options allow you to:

- Cash out between 80-90% of your home’s equity

- Use the cash out loan for what you need, like a financial emergency or home repairs

- Obtain a better interest rate or shorter loan term

A refinance cash out loan should not be confused with a home equity loan. A home equity loan is a separate loan that does not roll into your mortgage. Instead, it gets added to your original mortgage.

In contrast, a cash out refinance loan does get rolled into your refinanced mortgage so you only have to make one payment. Also, a home equity loan does not require closing costs, but if you choose to use cash out refinance, you will pay closing costs.

Types of Cash Out Refinance Plans

If you research “What is cash out refinance?” you will likely find many confusing terms or incomplete explanations. Do not get discouraged. Learning about cash out refinance rates can be time-consuming, but it could be well worth your efforts.

Let’s take a look at some of the different types of cash out refinance loans that you are likely to hear when you research “What is a cash out refinance?”

Image Source: Zillow.com – Homeowners Cost Beyond Mortgage

Cash out refinance mortgage is the most common type of refinancing using cash out. This is simply when you refinance your own home’s mortgage using the cash out option to give you money borrowed against your home’s equity. You can use a refinance cash out calculator to give you an idea of the money you can receive and how much it might add to your refinanced mortgage.

You also might choose to cash out refinance investment property loans. The process for this is much like using refinance cash out options to refinance your own home.

However, you might consider choosing to cash out refinance investment property for different reasons. For example, say you want to upgrade the kitchen and bathrooms to charge more for rent or to prepare to sell the property in a few years.

Finally, the Federal Housing Administration (FHA) offers FHA cash out refinance options. The FHA cash out loan cashes out 85% of your home’s equity if you decide you need that much. The FHA cash out refinance loan is one of the most coveted for its lower cash out refinance rates than others of its type and its option for buyers to take up to 30 years to pay back the loan.

Whether you choose a traditional cash out mortgage or an FHA cash out refinance loan, you should first consider whether a cash out refinance loan is a good choice for you and your finances.

Don’t Miss: Capital One Mortgage Reviews – Get What You Need to Know! (Home Loans, Complaints & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Is Cash Out Refinance Right for Me?

We have covered the question of “What is cash out refinance?” and its different types. But is it the best choice for you? Remember that when you choose to use cash out refinance rather than other refinancing methods, you are essentially borrowing against your home’s equity and that amount gets added to your refinanced mortgage.

Technically, you are again paying for what you already have built in equity. However, cash out refinance rates are some of the most competitive in the industry, and refinancing this way could be an excellent long-term solution for you. Before ultimately deciding to get a cash out mortgage, you should do your research.

First, learn the basic pros and cons of cash out refinance, which we will get to in a moment. You might also consider using a cash out refinance calculator to better understand the financial impact refinancing will have on your finances, which we will detail further in this article.

Related: Churchill Mortgage Reviews – What You Want to Know (Complaints & Review)

Pros of Cash Out Refinance Loan

There is a reason cash out refinance has increased dramatically over the past few years. Housing values are also increasing dramatically, which makes refinancing a great option to have better interest rates and lower mortgages.

Cash out refinance rates are usually very competitive and offer a steady interest rate rather than an adjustable one. This allows for predictability of mortgage amounts that most home owners crave. Check out cash out refinance rates for your current mortgage using a cash out refinance calculator.

If you are struggling with debt, cash out refinance can work for you. You may choose to use this option if you want to pay off student loan or credit card debt. A refinance cash out can give you a large sum of money to help consolidate debt, therefore raising your credit score. This can ultimately make you more credit-worthy for future refinances with better terms and interest rates.

Another excellent benefit of cash out refinance is its ability to provide you with money to put back into your home, therefore increasing its value over time. Whether you need to make some minor home repairs or want to remodel a room or two, the money you receive from your cash out refinance loan will help. Fortunately, the money you put into your home now will likely provide return on investment in the future.

Popular Article: Cost to Build a Home – What You Might Be Missing! (Typical Closing Costs, Estimated & Average)

Cons of Cash Out Refinance Loan

Where there are pros for something, there are usually cons, and refinancing with cash out is no different. One drawback to this type of financing is cash out refinance rates are typically higher than similar refinancing options.

Yes, your interest rates are usually lower with this financing, but cash out refinance rates are usually higher than market rate because you will be paying for a longer term.

With cash out refinance, you will also pay closing costs for your refinanced mortgage. Other options, like home equity loans, do not require closing costs. Closing cost amounts can be thousands of dollars depending on the amount you are refinancing. You will want to take this into consideration before deciding if the refinance is worth it. You can check closing costs by using a refinance cash out calculator.

Another drawback of a cash out mortgage is the financial drain it can put on you. Consider the following possible effects of refinancing using cash out:

- The start of bad habits. Receiving a cash out refinance mortgage may seem like a great way to consolidate debt. However, if you are not careful about your spending habits, you could soon run up the debt again and you might not have another refinancing option available to help the second time.

- You could owe more than your home is worth. When you borrow against the equity of your home, you are taking a risk. Using a refinance cash out loan could put you in danger of losing home value if prices plummet.

- Your mortgage will be higher. Since you are adding additional money to your mortgage when you use cash out refinance, your mortgage amount per month will be higher. You should consider whether you can afford to pay a higher amount per month in exchange for the immediate loan and long-term benefits.

- You may need to pay private mortgage insurance (PMI). Borrowing more than 80% of your home’s value requires you to pay PMI, which is an added cost on top of your already-higher mortgage. Remember that cash out refinance rates over time will be higher too, and all of these costs can add up significantly each month.

Once you have considered the pros and cons and decided that a cash out loan is right for you, you should learn how to find the best cash out refinance rates to further benefit your financial situation.

Finding the Best Cash Out Refinance Rates

If you believe that a refinance cash out is your best option, you should research the best cash out refinance rates so you can ensure you receive a mortgage that fits with your financial goals. But what are the best ways to find the best rates?

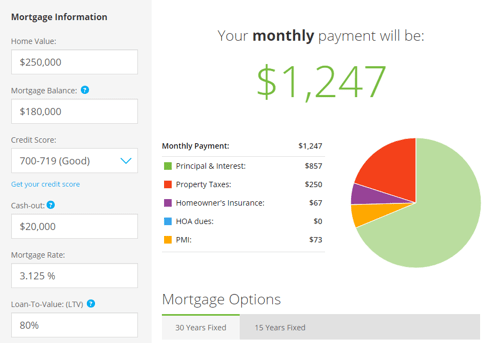

Image Source: MortgageCalculator.org

First, look no further than a cash out refinance calculator. These calculators are readily available on the web for free. They vary from simplified calculators that request your home’s value and current balance to more detailed calculators that also ask for your credit score, cash out amount, and more.

Image Source: Lending Tree Mortgage Options

A refinance calculator not only shows you how your new interest rate will affect your loan, but also how much additional cost will be added due to your cash out amount. A cash out refinance calculator allows you to manipulate amounts so you can see what the best refinancing scenario is for you.

Several websites that offer these calculators also will show you the mortgages with the best cash out refinance rates that fit within your criteria. For example, when you input information into LendingTree’s refinance calculator, the website will then show you some 15- and 30-year mortgage options that match your inputted information.

From here, you can compare the suggested refinancing options to see what might work for you. Remember to check out all the cash out refinance details, such as the amount you are allowed to borrow, the interest rate, the cash out refinance rates and what amount, if any, PMI you are required to have. You should also check online lender reviews so you can learn what real customers think of their services.

Read More: FHA Loan Requirements – What You Need to Know – FHA Mortgage & Home Loan Requirements

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Cash Out Refinance Mortgage

As with any refinance option, cash out refinancing might not work for everyone. It is an excellent option for those who need money immediately to meet various financial needs. The cash out funds can even be used to add value to your home.

However, a cash out loan can also lead to further financial strain if you are not careful with how you spend your funds or further spending habits. Remember to research your options, use a cash out refinance calculator, and contact prospective lenders with any questions or concerns you might have.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.