Intro – Chase Mortgage Reviews

Are you considering a Chase Mortgage? If so, we’ve got the Chase mortgage review you need to read. Chase bank is one of the largest banks in the country, and they offer mortgages to people looking to buy a home or other piece of property.

If you’re considering signing up for a Chase mortgage, you need to sit down and do your homework before you put your signature on the line.

Chase Mortgage Reviews – Complete Report (Jumbo Rates, Complaints, & Home Loan Reviews)

Image Source: Chase Mortgages

In this Chase mortgages review we are going to go over the basics of Chase mortgages and mortgages in general. Even if you decide to go with a different bank, this review will still be helpful. We are also going to review Chase mortgage complaints to see what problems past customers have had.

Signing up for a Chase mortgage can be intimidating. You’re signing off on a lot of debt, often in the hundreds of thousands of dollars, or even millions. You’re buying a home, which means you’re completely responsible for it. Given the 2008 housing crisis and the bad reputation mortgages gained due to certain sub-prime mortgages and predatory lending practices, no one could blame you for taking time to research Chase mortgages.

A Chase home loan, like all mortgages, is secured by the actual property itself. This is different from a credit card where there is no collateral and the risks are higher.

See Also: Imortgage Reviews – What You Should Know (Complaints & Review)

Chase Mortgage review: Interest rates are the key

Interest rate key facts:

- Even small rate differences, even less than 0.5%, can make a huge difference

- Shorter Chase home loans are cheaper because you pay less interest

- Interest rates on Chase mortgages are affected heavily by credit score

When it comes to mortgages, interest rates are the most essential thing for you to understand. Regulation means that the “fine print” of many mortgage contracts is pretty similar (although you should always read the fine print just to be safe!).

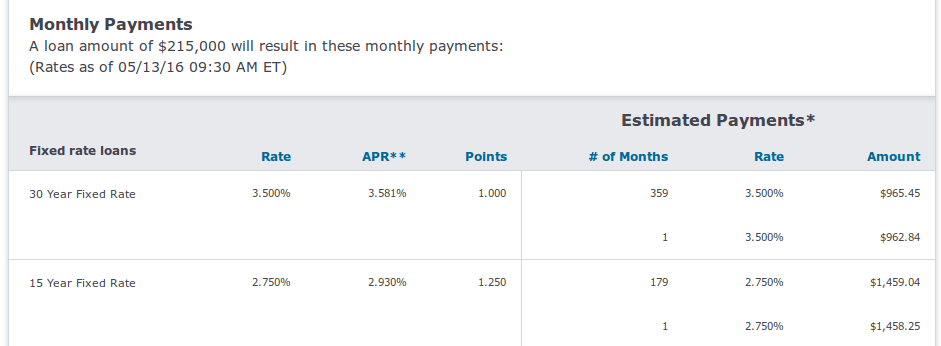

Many banks, including Chase Mortgage, will post the current rates for mortgages. You should know, however, that the displayed rates are estimates and generally refer to people with very good credit scores who are putting down a big down payment. If you have a low credit score, banks will view you as more of a risk and will thus charge a higher interest rate.

Image Source: Chase Mortgage

If you want to spend as little money on your Chase mortgage as possible, you are better off choosing a 10- or 15-year Chase mortgage, rather than a 30-year mortgage. Payments for a short-term Chase mortgage, however, will be higher than they would be for a longer-term mortgage. Plus, there are opportunity costs. You might make more money in the long run by lowering your monthly payments with a longer-term mortgage and investing that money in the stock market, for example.

Don’t Miss: SunTrust Mortgage Reviews – What You Should Know (Complaints, Loan & Mortgage Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Is Chase a good option for a mortgage?

According to our research, Chase Mortgage rates are generally competitive within their local markets. Chase may offer the best rates near you, or you may be able to secure a lower interest rate, even from other national banks such as Bank of America.

Mortgages exist in a market place, so if you decide to take out a mortgage, we recommend you call several banks and let them know what competitors are offering. It is possible that a competing bank will offer you better rates. You could also show these better rates to a Chase Mortgage loan officer; they just might match or even beat the interest rate offered. Either way, for most major banks, interest rates will be quite close.

Another thing to consider when taking out a mortgage is the mortgage officer. Real estate experts recommend that you find a mortgage officer you are comfortable with. Most of the Chase Mortgage reviews we found show that Chase Mortgage officers are generally friendly. This includes many of the negative Chase home loans reviews. If an officer doesn’t seem honest or friendly, then you should probably find a different mortgage officer, if not a different company.

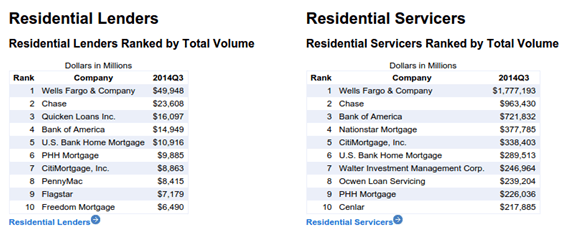

One factor we considered in our Chase Mortgage review was the total volume of mortgages given out. According to the basic principles of the market, if a lot of money is flowing to a company, like Chase Mortgage, it’s probably because they are doing something right. People vote with their dollars, and in terms of volume, Chase Mortgage is the second largest mortgage lender in the United States.

Image Source: Chase Mortgage Stats

Chase fixed-rate mortgages vs. Chase ARM (adjustable rate) mortgages

Traditional vs. ARM Chase home loans:

- Traditional loans have fixed rates

- Traditional Chase home loans are lower risk

- With ARM Chase mortgages, interest rates can change over time

- ARM loans are often cheaper, but be careful because rates can rise dramatically

There are two general types of mortgages that you can purchase. First, there is a fixed-rate mortgage, in which interest rates are set through the entire life of the mortgage. These loans are perhaps the most commonly known Chase mortgages, and for many home buyers, they will be the best option.

When it comes to fixed-rate mortgages, these Chase mortgages are often seen as safer because rates will never go up. We’ve all heard horror stories about people who took out an adjustable rate mortgage with low interest rates, only to see these interest rates grow by several multiples down the road. In fact, many of the Chase mortgage reviews we read complained about interest rates increasing rapidly.

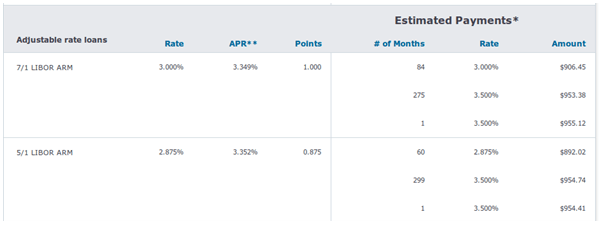

There are some cases when a Chase adjustable rate mortgage (ARM) will make sense, however. When used properly, a Chase ARM mortgage can save you thousands of dollars over the course of the loan’s life. If interest rates increase, you can always refinance your loan. Remember the fixed interest rates for Chase mortgages we showed you earlier? Compare them to the ARM rates!

Image Source: Chase Mortgage

We must warn you, however, ARM loans are very complex; unless you can plan ahead and know exactly what you are doing, you might be better off with a fixed-rate mortgage from Chase. This is especially true if you plan on living in your home for a long period of time and have limited income flexibility.

Related: Stearns Lending Reviews – What You Want to Know (Home Loans, Complaints & Mortgage Reviews)

Chase Mortgage Jumbo Rate Mortgages

As with other mortgage rates, Chase jumbo mortgage rates are generally in line with the overall market. Chase jumbo mortgage rates come in both fixed and variable interest rates. Our Chase jumbo mortgage review has found that Chase is a generally competitive company with jumbo mortgages.

Jumbo vs. traditional:

- Jumbo loans can be “big,” in excess of $417,000

- Traditional loans can’t go over certain thresholds

- Jumbo loans have more stringent requirements, such as income and credit score

You will need to use a jumbo mortgage when purchasing a home above a certain threshold. There are some regional variations, but generally, a Chase jumbo mortgage will be necessary when you purchase a home that costs more than $417,000 dollars but less than $3,000,000 dollars. Jumbo mortgages are necessary because of regulatory requirements. Above a certain threshold, Fannie Mae and Freddie Mae will not purchase these types of mortgages.

Despite what you might think, Chase jumbo mortgages can sometimes actually be cheaper than conventional Chase mortgage rates. There are usually more stringent requirements, however, and you’ll be at greater risk of facing legal issues and other problems if you fall behind. Usually, you will have to pay more money down, and have a higher credit score in order to qualify for a Chase jumbo mortgage.

Chase Mortgage complaints: Be careful what you sign

If you head to ConsumerAffairs.com, you will find that Chase Mortgage has earned a lot of negative reviews. Keep in mind that Chase Mortgage services a lot of customers, and when you serve high volumes of people, you’re likely to get bad reviews. No company or person is perfect, after all.

Most frequent complaints:

- Chase mortgage customer service is unresponsive

- Competitors will offer lower interest rates

- Payments to Chase mortgage have been lost

- Interest rates on ARM Chase home loans go up dramatically

We should not worry that Chase bank mortgage reviews only weighed in at 1 star on Consumer Affairs. This Chase mortgage review rating is about the same as Bank of America and Wells Fargo. It’s important to remember that websites like Consumer Affairs attract mostly people who are upset and want to complain. This doesn’t mean you should disregard the Chase mortgage reviews found on said sites, but you should remember that they tell only one side of the story.

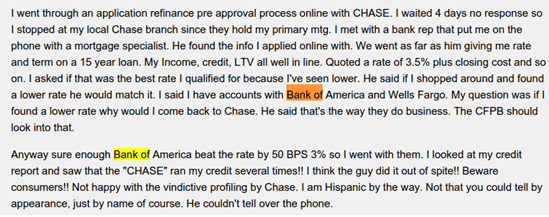

Some people have also stated that they have found lower interest rates with other banks, such as Bank of America. We encourage people to shop around and inquire what the best potential rates are. If another company is offering a mortgage rate significantly lower that Chase, you may be better off going with them. Of course, you should make sure you read the fine print, as fees can rack up quickly and variable interest rates can swing dramatically.

Image Source: Chase Mortgage Reviews

One of the most frequent complaints we have seen is from customers claiming that Chase Mortgage simply lost their payments. Customers claim that they sent in checks that were never cashed. This puts people at risk of falling behind on their payments and potentially racking up fees or hurting their credit score.

When it comes to making payments, we advise people to keep a very close eye on their money. Make sure checks are being cashed, and if not, get in touch right away. This is true for any company, not just Chase mortgage.

Another complaint we’ve seen a few times is that Chase Mortgage will run credit checks multiple times for the same customer. It does not appear that this situation is widespread, but it could happen. Why should you care? When credit checks are run multiple times, it can hurt your credit score!

Financial life management tips

- Use credit score services frequently

- Monitor for any malicious activities from any company

- Follow up if there is any malicious activity

Make sure you keep an eye on your credit profiles, and if you notice Chase Mortgage or anyone else running multiple checks, you should get in touch with the company and consider filing a complaint with credit agencies. At the very least, you should file a negative Chase mortgage review!

The above complaints are serious, and you should take them seriously. That being said, these complaints represent only a small number of the total customers served by Chase Mortgage. While deliberate malicious activity cannot be ruled out, it’s more likely that with Chase Mortgage being the huge company it is, some things simply got mixed up.

Chase Mortgage review conclusion: competitive but not the only option

Our review of Chase Mortgage and other informational websites has found that Chase Mortgage is about as good as most other big banks. If you are considering Chase mortgage, you’re off to a good start. Some issues may arise, but honestly, these issues could arise with any mortgage lender, not just Chase mortgage.

Popular Article: US Bank Mortgage Reviews – What You Should Know (Home Mortgage, Complaints & Loan Reviews)

Free Wealth & Finance Software - Get Yours Now ►

Final Checklist

- Read the fine print of any Chase mortgage loan!

- Shop around for better rates than Chase is offering

- Closely consider ARM loans and the risks

We always recommend that you read your Chase mortgage contract carefully. We also recommend that you take some time to dig through Chase mortgage reviews yourself to guard against repeating others’ bad experiences.

Signing a mortgage is a big deal, so make sure you are very careful before signing up for a Chase mortgage. There are tons of Chase home loan reviews available on the web, so click on the links in this article and keep exploring complaints!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.