Review & Comparison: Chase Savings vs. Ally Savings Account

Nowadays, savings accounts are talked about in a mocking tone. Personal finance blogs and gurus recommend you ditch your traditional savings account in favor of investments that can grow at a rate that keeps up with inflation.

Putting your long-term savings in something outside of a savings account is sage advice; you do not want your money to lose its purchasing power, but that does not mean you should forget about a savings account altogether.

You will have different savings goals throughout your life, including many short-term savings goals and hopefully an emergency fund that you are regularly replenishing. Having an account that has the flexibility of a checking account without the easy spending accessibility that comes with a checking account is beneficial, and this is where a savings account comes in.

There are several savings accounts available on the market to meet the diverse financial needs of consumers. The Ally savings account provides an online alternative to traditional savings accounts offered by brick-and-mortar banks while Chase Bank offers a more typical option serviced by a vast network of branches.

This article reviews the savings options offered by both Ally and Chase. It will review the Ally savings account and the savings account offered by Chase Bank.

See Also: How to Find the Best Banks with Free Checking and No Minimum Balance

Ally Savings Account Review: Ally Savings Account Fees and Features

Ally Bank is a bank that offers its services entirely online. Aside from a few main offices in the US, there are no branches for Ally Bank. Customers carry out transactions, monitor their accounts, and seek assistance online or by telephone.

This may make some bankers uncomfortable, but, for the most part, this approach works, appears to be the way of the future, and allows the bank to pass on its cost savings in the form of attractive products like its Ally savings account.

Ally Savings Account Review: Earnings and Fees

The Ally online savings account offers a whopping annual percentage yield (APY) of 1 percent.

Since online-only banks do not have to pay the same costs associated with operating branches that other banks do, they can save a significant amount of money and pass along some of those savings to their customers in the form of reduced fees and high interest rates.

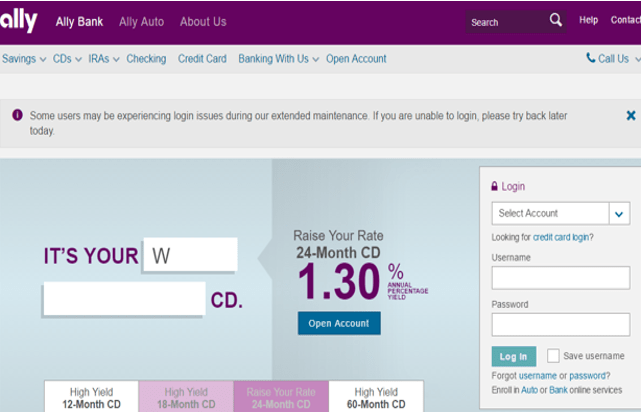

Image Source: Ally.com

With Ally online savings, there are no monthly maintenance fees. Customers benefit from a rate that is much more competitive than the rates offered by other banks. The national average on savings account interest rates is 0.06 percent.

That’s quite a difference between the national average and the full percent offered by the annual percentage yield of the Ally savings account.

Those with Ally online savings accounts benefit further because interest is compounded daily. Compound interest means earning interest on your principal amount plus any interest it has accumulated to date.

Ally savings account holders are also limited to six transactions per statement cycle. Going over the limit results in an additional fee, but if you are putting your money in your Ally Bank online savings to save, then there should not be that many transactions going through your savings account in the first place.

Ally Savings Account Review: Deposits & Insurance

The transactions for Ally Bank online savings are carried out online, but that does not mean that you cannot deposit physical checks.

You can put money from a physical check into your Ally savings account by using Ally eCheck Deposit.

Ally eCheck Deposit gives Ally high yield savings customers (and any other Ally customers for that matter) access to 24-hour banking. If you receive money and are eager to put it away before being tempted to spend it on something foolish, you can quickly put it into your Ally Bank online savings using Ally eCheck Deposit.

Ally eCheck Deposit for Ally high yield savings works using the online system or mobile app. You simply snap a picture of your physical check or scan it and then upload it to deposit your check into your Ally Bank high yield savings for convenient banking.

Ally high yield savings customers also have the option of mailing their check in with postage-paid envelopes in order to make deposits. Making a wire transfer from any US bank to your Ally Bank high yield savings account is also a choice. As it says on its website, “It’s good to have options.”

Naturally, an Ally Bank high yield savings account is insured by the Federal Deposit Insurance Corporation (FDIC). So if you are worried about the reliability of an online bank, you can rest assured that your Ally savings account comes with the same government guarantee that other banks have. Moreover, if you wish to up your coverage, you can also explore the options for maximizing your FDIC coverage for additional peace of mind.

If you decide that you want your Ally online savings to hold money for someone else, you can certainly set up your Ally high yield savings account as a trust.

The most salient feature pointed out by this Ally Bank savings account review is how competitive the Ally online savings account interest rate is.

Ally offers the same APY of 1.00 percent across all tiers. Additionally, it bests the rates offered by a number of popular competitors, including Capital One 360, Wells Fargo, and Bank of America.

If your main reason for reading this Ally Bank savings account review is to determine whether an Ally savings account is a profitable place to park your money, then an Ally high yield savings account is one of the most competitive options. Your money is insured, and if you do not plan on touching the money (just making deposits), the mainly online nature of the Ally savings account should not be a problem.

Don’t Miss: Top Ways to Open a Checking Account Online for Free with Bad or Good Credit

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Chase Savings Account Review: Examine the Account Features Before Learning How to Open a Chase Savings Account

Before looking into how to open a Chase savings account, a more advisable course of action is to research the fees, rates, and benefits of an account with Chase Bank.

If you have already looked up how to open a Chase savings account, you have likely been presented with links to information on the details of the account. If not, this article will provide you with information regarding Chase savings interest, what the Chase savings minimum balance is, and the availability of Chase savings account coupons.

Chase offers two main savings accounts, not including its certificates of deposit (CD). The two main savings accounts are the basic Chase Savings account and the Chase Plus Savings account.

Basic Chase Savings Account Review

The basic Chase Savings account is the more popular choice. It is helpful for everyday savings, and customers can accumulate Chase savings interest. There is a $5 maintenance fee and a minimum opening balance of $25 for this basic account, but the maintenance fee can be waived if customers set up an automatic monthly transfer of $25 to their savings account.

This encourages customers to save and allows them to benefit from saving money on fees.

Another way to waive this fee is to have a Chase savings minimum balance or minimum daily balance of $300. This is also beneficial for customers because it encourages them to keep their money in their savings as opposed to withdrawing it for unnecessary, discretionary expenses.

In addition to 24/7 online banking and customer service, Chase Bank has a network of 5,200 nationwide branches and 16,000 ATMs. Naturally, this kind of an extensive network results in certain fees that Chase customers (who do not wish to make a repeated monthly transfer) have to pay on their savings accounts. However, even those who do not want to set up this automatic transfer may be able to realize some savings through a Chase savings account coupon.

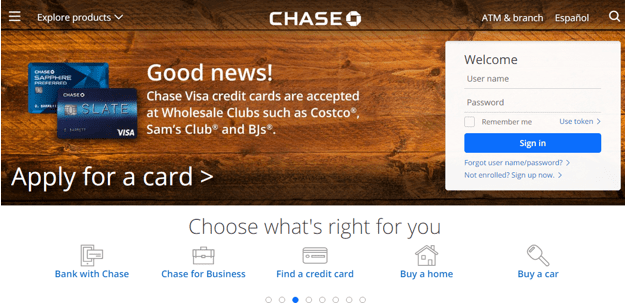

Image Source: Chase.com

New customers can get a Chase coupon for $150 when they open a Chase checking account and a $100 Chase savings account coupon when they open a Chase savings account. New customers can also receive a $250 Chase coupon if they decide to open both a Chase checking account and Chase savings account.

Related: No-Fee Checking Accounts | Top Tips to Finding Checking Accounts with No Fees

Basic Chase Savings Account: Chase Savings Interest

The Chase savings interest is an annual percentage yield (APY) of 0.01 percent for all balances. The Ally Bank savings rate blows the Chase rate out of the water in comparison.

Chase Plus Savings Account Review

The Chase Plus savings account offers higher Chase savings interest rates so customers can profit from higher yields with higher balances. This account is best for those with a significant lump sum of cash they do not need immediately but are not willing to tie up in investments just in case.

There is a $100 minimum deposit required in order to open a Chase Plus Savings account and a $20 monthly service fee. This service fee can be waived by maintaining a Chase savings minimum balance or daily balance of $15,000 or more.

Unlike the Ally Bank savings rate, which is applied to all tiers of deposits in an Ally savings account, Chase Bank has different interest rates for different Chase Plus savings account balances. However, even the highest interest rate (offered to account holders with a balance of $1,000,000 or over is only 0.06 percent – still less than the amount Ally online savings offers.

Again, the supposed reason why banks like Chase do not offer the same amount as others like the Ally Bank savings rate is due to the higher costs associated with operating so many brick-and-mortar banks.

Popular Article: Best Online Savings Account | How to Find the Best Online Savings Account in This Year

Which Savings Account Is Better: An Ally Savings Account or a Chase Bank Account?

So which savings account should you choose? Should you go with the more institutional choice and open a basic Chase savings account (or Chase Plus savings account), or should you buck convention and move your savings online by opening an Ally savings account?

It depends on your priorities. The easy answer would be to choose based on your preferences and how important a higher interest rate is to you.

If a competitive interest rate is not that important to you, but accessibility and a network of bank branches is, then perhaps a Chase savings account is the right choice, even with the lower Chase savings interest rate. However, if interest rate is more important to you, then an Ally online savings account would be the smarter option.

Ally Savings Account Gives You More Bang for Your Buck

This Chase savings account and Ally savings account review would venture to say that an Ally savings account is the smarter option.

The point of having a savings account is to prepare for short-term goals (a car purchase, a trip, etc.) or to build up some emergency savings. Depending on your financial situation, the amount of money you should have put aside to cover unexpected expenses is about three months to two years’ worth of expenses.

The more popular standard is about three to six months. This money is meant to help you if an emergency comes up, something need repairing or you unexpectedly lose your job. With this little nest egg, you do not have to go into financial free fall and get stuck in debt, using credit cards to keep yourself afloat until you get back on your feet. So what does this have to do with choosing an Ally savings account?

Well, there are only two reasons not to choose an Ally savings account: the fact that it provides online-only service and uncertainty about its reliability.

When it comes to the question of reliability, Ally Bank accounts, including its Ally savings account, are insured by the Federal Deposit Insurance Corporation. In regard to any concern about its online-only service, customers should consider what they are trying to get out of their savings account.

If you are putting money away to only access in case of an emergency or when it meets the amount you need for a specific financial goal, there should be no pressing desire for an account that has numerous branches from which you can access your money.

This is not to suggest that you cannot access your money from an Ally online savings account, but putting your money in an online-only bank where the Ally Bank savings rate will help you earn money and work in your favor is a silly thing to trade for the supposed comfort of branches.

If you choose a basic Chase account, you will not benefit from the same kind of earnings you get from an Ally Bank savings rate.

Moreover, if you choose to go for the Chase Plus account in an effort to gain the higher Chase savings interest (which is still lower than the Ally Bank interest rate) you will be required to maintain a Chase Savings minimum balance of $15,000 to avoid the monthly maintenance fee. There is no account fee for Ally Bank so long as you do not go over the permitted amount of transactions a month.

Be Proactive About Your Financial Security and Start Saving

About 29 percent of Americans say they have no money saved up in case of an emergency.

Relying on high-interest credit cards in case of an unexpected expense is not a place you want to be in. Additionally, proactive savings can help you handle other costs, like Christmas presents, big purchases, vacation costs or repairs, in stride. Explore the savings accounts out there, whether it’s through your existing bank or an online account like the Ally savings account.

Check out what is available, and select the product and institution that will allow you to earn money and save your earnings comfortably.

Read More: Banks with Free Checking Accounts | Top Ways to Find Free Checking Account Banks

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.