2017 Guide & Review: Which Bank Offers the Best Checking Account Promotions & Bonuses?

Almost everyone needs or wants a checking account. Whether you want a safe place to store your money rather than use cash or your job requires one for direct deposit, you depend on it for your daily finances.

Why not take advantage of a checking account bonus or checking account promotions for something you need anyway?

Most banks offer some type of promotional offer to their customers. Some give checking account promotions to current customers for signing up for other financial products. Others promote new checking account offers to entice new customers to sign up for an account.

Image Source: Today.com

You can even get a checking account bonus for using your account frequently and responsibly, setting up direct deposit, or making a specific number of transactions within a specific time period.

Where can you go to find the best checking account bonus offers? And what banks have the best new checking account offers?

This guide will cover why banks offer checking account deals, types of new checking account offers and checking account promotions, and how to find the best checking account offers.

We will also discuss our three top picks for banks that offer a checking account bonus and their promotions: Wells Fargo checking bonus, Bank of America checking account bonus, and Chase checking account bonus.

See Also: Banks with Free Checking Accounts | Top Ways to Find Free Checking Account Banks

Why Banks Offer Checking Account Deals

What does a bank gain from offering a checking account bonus? Quite simply, they want your business. Most checking accounts offer similar services and the checking accounts from popular banks are usually comparable. What better way to stand out and entice new customers with checking account bonus offers?

Additionally, banks use a checking account bonus as a way to keep current customers around longer. A bank may offer a $100 bonus to a current customer, for example, when the customer signs up for a new financial product from that bank, like a savings account or credit card.

It makes more sense for the bank to offer one-time checking account promotions than to lose that customer to another bank.

There is also the financial benefit to a bank that some checking account promotions give as well. When a bank offers a promotion that requires a customer to make several transactions or deposits, the bank is benefitting from transaction fees it may charge and usage of the account.

A bank can also take away your checking account bonus if you do not meet the requirements for the promotion within the specified time frame. When this happens, the bank still benefits from you signing up and using your account, but you lost the money from the promotion.

New checking account offers can benefit both the customer and the bank, but be sure to understand the requirements before signing up.

New Checking Account Offers

Banks promote new checking account offers to people who do not yet have an account with that bank. Banks offer these promotions to entice those without checking accounts to bank there or to persuade customers of other banks to switch.

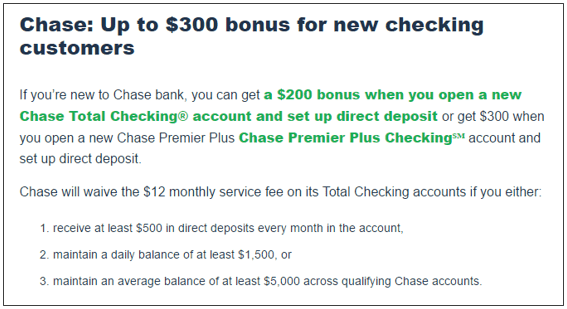

New checking account offers are usually in the form of a cash bonus for meeting specific requirements. A Chase checking account offer, for example, gives $300 to new customers when they open a Chase checking account and set up direct deposit. The Chase checking account bonus is only valid when a new customer sets up direct deposit within 60 days and makes a $25 minimum deposit.

Most of these checking account bonus offers for new customers will not be deposited into an account until you fulfill the requirements. Banks that deposit the bonus immediately reserve the right to withdraw it if you do not fulfill requirements for the bonus.

New checking account offers do not always come in the form of a cash bonus, but instead can be a promotional reward. TD Bank, for example, offers a free Samsung Galaxy smartphone when you open a new checking account with them.

However, restrictions apply with the type of service and data plan you can receive with your phone. Always check the fine print with checking account bonus offers for new customers to ensure that the promotion is helpful for you. The best checking account offers are those with few restrictions and easy-to-understand fine print.

Don’t Miss: Free Money Management Tools & Discount Offers

Checking Account Promotions

In addition to new checking account offers, banks sometimes offer checking account promotions for current customers. Banks typically promote these offers to encourage current customers to sign up for other financial products from that bank, like a credit card or retirement plan.

Why? Because the more financial products you have from one bank, the more likely you will remain loyal to that bank for a long time. These are known as cross-selling products.

When you become a customer of a bank or a member of a credit union, your financial institution wants to keep you as a customer.

It may occasionally offer checking account deals to entice you to use your account more often, set up direct deposit, or sign up for a new product. That is, after all, how the bank makes more money and ensures that you are an engaged customer.

Currently, a Bank of America checking account bonus of $300 is available for current Bank of America customers who open a new checking account and receive at least $4,000 from direct deposits within the first 90 days of opening the account.

To receive the Bank of America checking account promotion, you must currently have another Bank of America financial product, like a credit card or savings account. Other banks have similar offers for current customers, like the $100 Wells Fargo checking bonus for new or current customers when they open a new checking account.

How to Find the Best Checking Account Offers

If you are a current customer of a bank, first check with your bank to find out if it has a current checking account bonus. Just because it is not blatantly advertising it, it could still have one available.

But, if your bank does not have a checking account bonus available and you want to find the best checking account offers, you can first check individual bank websites. Some banks will outline their promotions on their websites as advertisements for new customers to see, like the $300 Chase checking account promotion.

However, other banks make you search a little more. You can try a web search for “checking account bonus” or “new checking account offers” to find some of the best, most current offers.

Image Source: The Simple Dollar

Websites like NerdWallet and The Simple Dollar compare the most recent checking account promotions for both new and current customers. For example, Simple Dollar outlines the current Chase checking account offer in simple terms so you can compare it with other available offers from banks.

The Hustler Money Blog also gives a quick overview of current checking account promotions in a table form with its links to the reviews of each promotion. This lets you compare each promotion quickly and conveniently so you can decide which one might work for you.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bank of America Checking Account Promotion

There are currently several Bank of America checking account promotions available for regular and business customers. Through December 31, 2016, you can receive a Bank of America checking account bonus between $100 and $300, depending on the type of account you open.

Bank of America’s offers apply to various types of customers, which makes it one of the top providers for great checking account promotions.

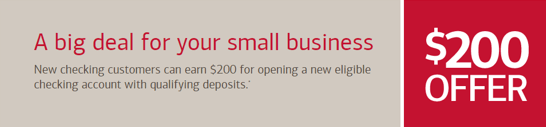

Image Source: Bank of America

Small-business owners are eligible for a $200 Bank of America checking account bonus when they open a new, qualifying business checking account and make qualifying deposits. Business owners can be a current customer with Bank of America and still qualify for the checking account bonus, but they cannot have a current business account.

Current Bank of America customers can qualify for a $300 Bank of America checking account promotion when they open a new checking account. After opening their account, they must have at least $4,000 in direct deposits in their account within the first 90 days to be eligible for the promotion.

Bank of America also offers new checking account offers for new customers. When you open a new checking account with Bank of America and receive at least two direct deposits of at least $250 within 90 days, you can get $100 in your checking account.

Chase Checking Account Promotion

Chase offers a large variety of Chase checking account offers to current and new customers, making it a top pick for bonus offers.

For new checking account offers, a $350 Chase checking account promotion is available when you open both a checking and savings account. To qualify, you must set up direct deposit with your Chase Total Checking account and deposit at least $10,000 to your savings account within 10 business days. You also have to maintain that balance for at least 90 days to receive the full bonus.

Image Source: Chase

You also can choose to only receive the $200 Chase checking account bonus if you do not want a savings account. Or, if you only want a savings account, you can get a $150 bonus rather than the full checking account bonus and savings account bonus for $350.

If you would rather sign up for a Chase Premier Checking account, you can qualify for a Chase checking account bonus of $300. For this Chase checking account offer, you must deposit at least $25 and set up direct deposit within 60 days of opening your account.

Popular Article: Top Ways to Open a Checking Account Online for Free with Bad or Good Credit

Wells Fargo Checking Account Promotion

Wells Fargo does not offer as much variety in its promotions as some other banks, but it does have fairly consistent Wells Fargo checking bonus offers through the year that are simple to qualify for when you use your account. This is why we chose it as a contender for top providers of checking account promotions.

Wells Fargo

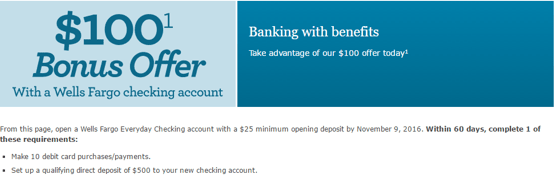

Currently, the Wells Fargo checking bonus of $100 is available for new checking accounts. However, you can be a current Wells Fargo customer and still qualify for its new checking account offers by opening a new checking account.

To qualify for this checking account bonus, you have to either make 10 debit card purchases using the account or set up direct deposit and have at least one $500 deposit made to your account within 60 days. Either option will get you the bonus, but make sure that you also open the account with a minimum $25 deposit.

Compared to other checking account promotions, this Wells Fargo bonus is easy for most customers to qualify for.

Conclusion

Most banks offer checking account promotions to both catch the eye of new customers and keep their current customers loyal. A checking account bonus is beneficial to both the customer and the bank. The bank gains and keeps its customers while its customers get some extra spending money without much work.

To find the best new checking account offers or offers for current customers, first check with your bank and ask about their promotions. Then, do a web search to see what is currently available from top banks.

We recommend looking into the checking account deals from Bank of America, Chase, and Wells Fargo because of their simple terms and excellent promotions.

Be sure to read the fine print of any promotion you choose to make sure its requirements are doable so you can receive your bonus.

Read More: Best Bank Accounts for Bad Credit | How to Find Great Accounts When You Have Bad Credit

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.