Intro – Citizens Bank Reviews & Ranking

Citizens Bank was recently ranked and reviewed by AdvisoryHQ as a top rated bank. Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our Citizens Bank review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The Citizens Bank reviews below provide a detailed review of Citizens Bank, including some of the factors used by AdvisoryHQ News in its ranking and selection of Citizens Bank.

Citizens Bank Review

Headquartered in Providence Rhode Island, Citizens Bank is a leader among the top banking firms, and also maintains a strong presence in a total of 11 states throughout the country. Citizens Bank is also one of the oldest financial services providers in the U.S., dating back to 1828.

Citizens Bank features convenience, cutting edge technology, and accessibility in the form of 1,200 branches and 3,200 ATMs. Services include retail and commercial banking products with services such as checking, savings, and mortgage and auto lending.

Image Source: Citizens Bank

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our Citizens Bank reviews, Citizens Bank was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Citizens Bank Review: One Deposit Checking

One Deposit Checking is an exclusive program from Citizens Bank that makes banking and more specifically, checking, incredibly simple. To avoid a monthly maintenance fee, account holders simply have to make one deposit of any amount each statement period.

What truly stands out about this checking account is the $5 Overdraft Pass. Under this policy, if your checking account is overdrawn by a transaction of $5 or less, you will not incur an overdraft fee.

Other benefits of One Deposit Checking include online and mobile access, a secure debit card, direct deposit options, low-cost check ordering, and several overdraft options.

Citizens Bank Review: Overdraft Options

This leader among banking firms offers various services and options that provide protection and peace of mind for customers. This includes several different overdraft options.

Overdraft options are:

- Savings Overdraft Transfers: In the event of an overdraft, automatic transfers are made from available funds from a linked savings account.

- Overdraft Line of Credit: With this option, automatic transfers are made from a Line of Credit to cover each item

- Debit Card Overdraft Coverage: Citizens may approve ATM and debit card transactions that will overdraft an account, but they will be charged a $35 fee. Users must enroll to participate.

There are also options for the approval and payment of checks and pre-authorized payment transactions that lead to an overdraft. This option is automatically applied.

Citizens Bank Review: Online Resources

Citizens Bank works to make sure account holders are well-educated and equipped with the tools and resources needed to successfully manage their finances.

Users can find a list of money solutions, tools, and guides within their Banking and Borrowing Resources.

Areas of focus including budgeting, credit, home borrowing, insurance and life events. There are specific guides to help people bank smarter, maximize their investments, and plan their budget.

Citizens Bank Review: Online Bill Pay

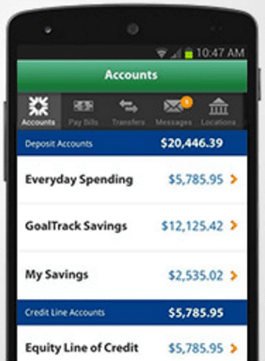

One of the many online features available at Citizens is the option to use Online Bill Pay.

Enrollees can pay most bills online or using the Citizens Mobile App.

Image Source: Citizens Bank Online Bill Pay

Features and benefits of Online Bill Pay include:

- The ability to view all payments in one centralized location

- Ability to schedule future and recurring payments

- Customizable payment alerts

- Capability to track payment activity anytime and anywhere

- Setup options to receive eBills directly

- AutoPay, Reminders, and Activity options are included on the interface

- View full account numbers for billers, if needed

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.