Intro – Coastal Federal Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in North Carolina, a list that included Coastal Federal Credit Union.

Below we have highlighted some of the many reasons Coastal Federal Credit Union was selected as one of the best credit unions in North Carolina.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Coastal Federal Credit Union Review

Based in the Triangle, Coastal Community Credit Union has been a leading presence in the Raleigh-area financial environment since 1967. Coastal was created by eight employees of IBM, who wanted a financial institution that would serve the needs of their colleagues. In 1991, the Coastal field of membership was expanded to include other Triangle and NC-area employees of certain companies.

Now, there are 16 branches located throughout the area including not only in Raleigh but also Apex, Carrboro, Cary, Durham, Garner, and the Research Triangle Park. The mission of Coastal is to help members “with a lifetime of financial solutions, one experience at a time.”

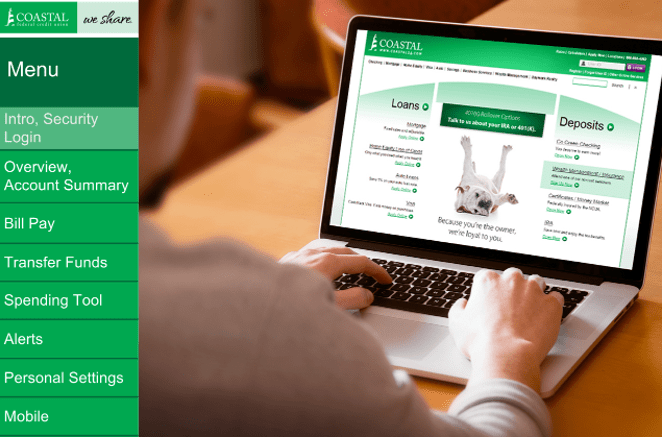

Image Source: Coastal Community Credit Union

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Coastal Federal Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Coastal Federal Credit Union Review: Mortgages

Coastal is a lender, and products include home mortgages. Coastal will finance 100% of a first-time buyer’s mortgage through the First Time Home Buyer Mortgage program. There’s the possibility of borrowing up to $300,000 without any money down, so buyers then have the option to put their money elsewhere when they obtain a new home.

There is no private mortgage insurance charge, so the payment is even lower every month, and there’s no income cap. The First Time Home Buyer Mortgage can either be adjustable or fixed-rate and if there are co-borrowers, it’s even easier to qualify for this valuable mortgage.

As with most credit union loans, the First Time Home Buyer Mortgage also features an excellent, competitive interest rate.

Coastal Federal Credit Union Review: Flexible Auto Loans

The auto loan options available from Coastal are not only offered with attractive rates but are also flexible and customizable, whether you’re purchasing a new or used vehicle. Coastal lets members decide how long they want their loan term to be, with financing up to 84 months. This allows them to tailor their payment to what works for them. There are no prepayment penalties, either.

Image Source: Coastal Community Credit Union

Members can purchase any make or model they like, back to 2002, and gap policies are available to protect the borrower for the difference between what’s owed on a car and what an insurance company says it’s worth.

The pre-approval loan amount that you can obtain from Coastal is an excellent tool to for negotiating and obtaining a better deal when purchasing a car as well.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Coastal Federal Credit Union Review: High Yield Checking

While there are many checking account options available from Coastal, designed to suit a wide variety of needs, including No Frills Checking and Student Checking, for those members who want more, there’s the High Yield Checking account.

This is designated as the premier account available from Coastal, and it currently includes 2.25% APY, as long as you’re using your debit card at least 30 times in a month. If you meet this requirement, there is no minimum balance requirement.

Dividends are tiered, and there is also no monthly service fee. As an added benefit included with this account, up to 5 ATM fees each month are waived as well.

Additionally, account holders can opt to participate in the One Cent Overdraft and BounceGuard Plus programs with this account.

Coastal Federal Credit Union Review: Second Chance Checking

The team at Coastal Federal Credit Union understands that members may have found themselves in difficult financial situations somewhere in the past. As a result, they could have a credit or ChexSystem history that might prevent them from getting a traditional checking account, but that is the foundation of any financial management plan.

Fortunately, Coastal offers the Second Chance standard checking account. This account has no minimum balance requirement and is designed to help people as they rebuild their checking history and learn smart money management. It also includes access to complimentary financial counseling and budgeting services.

The monthly service fee is low, and members can qualify for an upgrade to a Go Green Checking account, once they’ve maintained their Second Chance account for 12 months.

In addition to the above Coastal Federal Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking Firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.