Intro – Columbia Bank Reviews & Ranking

Columbia Bank was recently ranked and reviewed by AdvisoryHQ as a top rated banking firm. Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our Columbia Bank review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The Columbia Bank review below provides a detailed assessment, including some of the factors used by AdvisoryHQ News in its ranking and selection of Columbia Bank.

Columbia Bank Review

A Northwest community bank, Columbia Bank started in 1933.

It’s headquartered in Tacoma, and throughout the years it has grown and expanded, both organically and through the acquisition of other institutions.

With over 150 banking locations, Columbia Bank maintains a strong presence throughout Washington, as well as locations in Oregon and Idaho.

Photo courtesy of: Columbia Bank

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our detailed reviews, Columbia Bank was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Columbia Bank Review: Foreign Currency

For Columbia Bank customers that are traveling overseas, Columbia Bank offers a variety of services to address foreign currency banking needs. Columbia buys and sells most foreign currencies, and can also assist with special requests.

Customers can quickly and easily order currency over the phone, and pick it up at any Columbia Branch, or visit the International Banking office in downtown Tacoma.

The foreign currency program can help customers avoid possible charges or collection fees, and major currencies including the euro, English pound and Canadian dollar are normally stocked at all times.

Columbia Bank Review: Personal Debit Cards

When you open certain accounts with Columbia Bank, you can take advantage of the use of a Columbia Bank Visa Debit Card. These cards work like checks, yet are convenient and easy to use, and accepted at millions of worldwide locations.

Visa Debit Cards from Columbia can be used to set up automatic bill payments on a weekly, quarterly, or monthly basis and purchases and transactions are protected by Visa’s Zero Liability program, as well as Verified by Visa.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Columbia Bank Review: Checking Accounts

Columbia features several different checking accounts, designed to suit a variety of needs.

These checking accounts include;

- Neighborhood Account: The maintenance fee can be waived if account holders meet certain criteria, such as ten debit card transactions, aged 62 or older, one direct deposit, or a Student ID on record.

- Relationship Account: This interest-bearing account provides refunds for non-CB ATM fees, complimentary cashier’s checks and money orders, and more.

- Foundation Account: Built to benefit those aged 17 or younger, this checking account has no overdraft fees, continuous overdraft, or return item fees.

Columbia Bank Review: Wealth Management

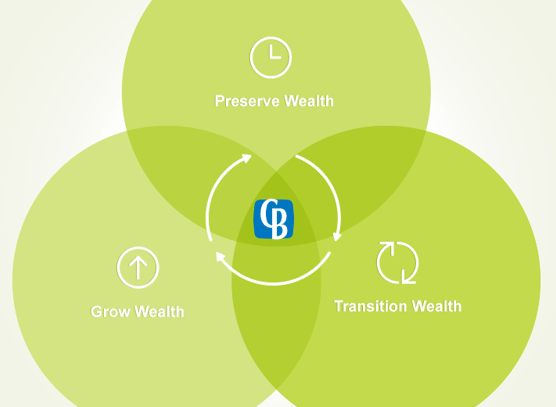

In addition to traditional banking, Columbia offers wealth management services. They have a model based on three stages, which are “Grow, Preserve, Transition.”

The professional team of wealth management experts employed by Columbia help clients grow their assets over time based on broad financial advice, create personalized strategies to protect and preserve that wealth, and develop comprehensive plans aimed at successfully transferring wealth.

Photo courtesy of: Columbia Bank

In addition to reviewing the above Columbia Bank review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.