Intro – Community First Credit Union Reviews & Ranking

Community First Credit Union was recently ranked and reviewed by AdvisoryHQ as a top rated credit union. Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking, four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our Community First Credit Union review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The Community First Credit Union review below provides a detailed assessment, including some of the factors used by AdvisoryHQ News in its ranking and selection of Community First Credit Union.

Photo courtesy of: Community First Credit Union

Community First Credit Union Review

Community First Credit Union of Florida is a federally-insured, state-chartered credit union based in Jacksonville, Florida. Operating under a community-focused charter, this credit union serves anyone who lives or works on the Florida Coast, including Nassau, Clay, Duval, and St. Johns Counties.

The credit union serves more than 119,000 members and has assets in excess of $1.4 billion. Community First has 18 branch locations and approximately 300 employees.

Community First Credit Union is among several credit unions that have the federal low-income designation. This credit union is also a member of the Federal Home Loan Bank (FHLB).

As a member of the FHLB, Community First is able to offer lower-income consumers competitive mortgages and home loans that are partly backed by the FHLB.

According to the National Credit Union Administration (NCUA), credit unions with the low-income designation (LID) are able to offer additional banking products and services to consumers. In order for a credit union to qualify for the LID, the majority of its membership (more than 50%) must qualify as low-income.

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed reviews, Community First Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

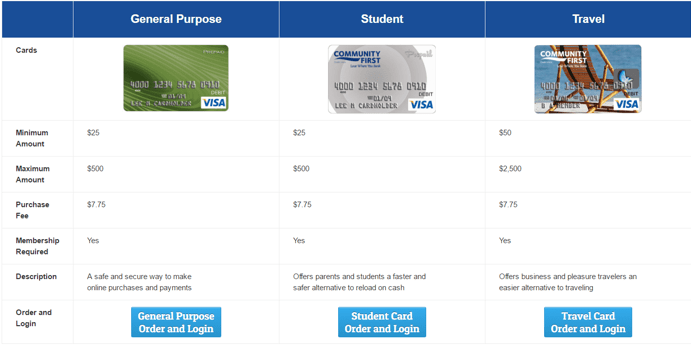

Community First Credit Union Review: Reloadable Cards

With Reloadable Cards, you spend only what you load on the card, track purchases online, and reload your card anytime you need. Reloadable cards are also great on the go.

The cards are backed by Visa’s® Zero Liability Policy and are useful for parents and students, those managing employee expenses, and people working to manage their finances effectively.

Photo courtesy of: Community First Credit Union

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Community First Credit Union Review: TruStage Insurance

TruStage is insurance offered through many credit unions nationwide. TruStage products and programs are offered only to credit union members. TruStage Insurance products offered through Community First Credit Union include:

- Term life insurance – For a specific number of years to cover a critical period in life

- Whole life insurance – Accumulates value and can last your whole life, and premiums stay the same

- Auto and home insurance – Offering credit union members discounted rates and quality service

Community First Credit Union Review: Dental Benefits Max

Benefit Services of America is the largest dental benefits provider to the credit union industry in the U.S. and offers a comprehensive dental plan exclusively to Community First members.

The Dental Benefits Max service offers customers great savings on dental needs at special rates. Discounted dental services are provided through more than 132,000 Aetna dentists and specialists nationwide.

Community First Credit Union Review: Investment and Insurance Services

CFE has a full set of insurance and investment services to assist members with preparing for the future.

In addition to financial planning and life insurance, CFE also offers a broad range of services and support. Services available through CFE include:

- Estate planning

- Complimentary educational seminars

- Mutual funds

- Tax-deferred annuities

- Individual retirement accounts (IRAs)

- Roth IRAs

- Coverdell Education Savings Accounts

- 529 College Savings Plans

- Retirement plans – 401(k), 403(b), SEP

- Corporate and municipal bonds

- U.S. Government securities

- Disability income insurance

- Long-term care insurance

In addition to reviewing the above Community First Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top credit unions:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.