Intro: What You Should Know about Consumer Credit Counseling Service

Understanding how to pay down your debt and still manage your current expenses can be a time-consuming and confusing ordeal if you aren’t used to handling your finances well. However, there is help available to assist you with making a budget and a plan to decrease your debt and increase your savings.

Nonprofits, like the Consumer Credit Counseling Service, can link you with a confidential and trained counselor to help you create more flexibility in your financial situation, educate yourself on fiscal responsibility, and work towards managing excessive amounts of debt.

Consumer Credit Counseling Service

About Consumer Credit Counseling Service

What is the Consumer Credit Counseling Service? What conclusions do credit counseling reviews come to?

We will review how credit counseling services work and how to identify a reputable one that will give you the greatest chance for success. Find out whether or not this service would suit your needs as we explore what it is and what it claims to do for its clients.

What Is the Consumer Credit Counseling Service?

For those that have been seeking to reduce debt, the question often arises, “What is the Consumer Credit Counseling Service?”

Founded in 1912, this nonprofit aims to work alongside families and individuals to help them “maintain and achieve financial stability and improve their quality of life.” This bold claim manifests itself through a variety of avenues, including education on debt and finances, professional counseling, advocacy, and financial management classes and programs.

The Consumer Credit Counseling Service is a nonprofit 501(c)(3) company under the umbrella of the Family Service Association of Sheboygan, Inc. This agency is capable of completing financial assessments, education, budgeting services, and counseling for housing, bankruptcy, credit counseling, and debt management.

It is funded through a combination of private donations and fair share money from creditors it works with. These services are available to clients in Wisconsin and Minnesota.

The Consumer Credit Counseling Service maintains a variety of accreditation and certifications to better help its clients and put your mind at ease regarding the accuracy of its advice.

It is associated with the National Foundation for Credit Counseling. This same foundation also certifies all of its credit counselors that assist you in analyzing your current finances and constructing future plans. In addition, the Consumer Credit Counseling Service is licensed with the Wisconsin Department of Financial Institutions and the Minnesota Department of Commerce.

Consumer Credit Counseling Service can provide bankruptcy counseling and education through its HUD-approved agency and its approval by the Executive Office of the United States Trustees. Housing counseling, prevention of foreclosure, and loss mitigation are other services offered under its broad scope of work.

See Also: Experian Reviews – What Is Experian?

How Can Consumer Credit Counseling Service Help?

Credit counseling services can help you get your financial affairs in order in a number of ways. First and foremost, a professional counselor trained by the National Foundation for Credit Counseling helps you to gather up all the financial documentation you need to paint an accurate picture of your current expenses versus your income. This initial phone call or conversation typically takes around an hour if you are already prepared with your information.

From this stage, the counselor is able to craft a unique budget for your situation and lifestyle. He/she can offer advice on ways to save more money on your monthly bills (e.g., packing lunches from home instead of dining out) and free up a little more cash flow for paying down debt.

Your counselor may also offer a debt management plan – a relief option where Consumer Credit Counseling Services would work alongside your creditors to reduce your interest, waive penalty fees, and arrange a lower monthly payment.

Debt management plans can only include unsecured debt or credit card debt. Secured debts are not included in these plans nor are student loans or money owed to the government for taxes.

According to credit counseling reviews, decreasing your unsecured debt can create more freedom in your budget (through lower monthly payments or when the debt is paid off faster) that can still help to decrease your secured debt amount. Making a plan to deal with your unsecured debt is often the first step towards freeing yourself from both types.

Not sure if you would benefit from debt management services? You can take advantage of Consumer Credit Counseling Service’s free online calculators to examine your loan repayment, extra debt payment impact, and whether investments would fare better than debt repayment. You can also examine student loan debt and mortgage debt to see if you would benefit from adjustments in your payment methods in this capacity also. These tools allow you answer some basic questions on your own before making a commitment to speaking with a representative.

Consumer credit counseling reviews also recommend taking advantage of additional classes to help you build a firm and financially stable foundation for the future. If your debt problem seems unmanageable, Consumer Credit Counseling Service claims that its programs “have many times served to prevent bankruptcy.” Taking advantage of these services in advance of bankruptcy can help to minimize the impact that your debt will have on your credit score long term.

Don’t Miss: Simplilearn Reviews – News Report – Financial Literacy

What Does a Good Credit Counseling Agency Do?

Now that we have looked specifically at “What is the Consumer Credit Counseling Service?” we now need to examine what attributes from its company make its credit counseling successful. By examining credit counseling reviews, we can determine exactly which services are helpful, what you should be charged, and how to move forward from drowning in debt.

Top Ten Reviews created a list of credit counseling reviews and assistance for selecting the right company. According to its research, consumer credit counseling consultations should be free, and the counseling services available from Consumer Credit Counseling Service are no different.

Credit Counseling Reviews

Its professional counselors will collect information on your current bills, level of debt, mortgage, and other pertinent information for free budget and credit counseling. Since this company is a nonprofit organization, this service is paid for by grants and donations.

Business Insider’s background information on credit counseling points out that these initial counseling sessions often lead to a debt management plan. These plans are created based on your unique situation with your income and debt history.

In exchange for enrolling in a debt management program, you typically receive reduced interest rates or waived penalty fees from some or all of your creditors. However, according to Business Insider’s credit counseling reviews, you must usually repay all of your principal and interest within five years. Some programs are even shorter, but five years is usually the cap on how long you have to work through your debt.

These debt management programs are created for a fee. Some companies do not charge for the setup while others charge a minimal fee for the time invested in your program. At Consumer Credit Counseling Service, the setup fee is just $25, but the monthly fee can be up to $50 based on 10% of the disbursed funds.

When looking at Consumer Credit Counseling Service reviews, these are definitely not the highest monthly maximum fees or origination fees in the industry nor are they the least expensive. They fall solidly in the middle.

Once you make progress on paying down your debt, it is imperative to learn how to manage your finances to avoid racking up more debt in the future. Consumer credit counseling reviews say that good agencies offer additional education resources for future preparedness. Consumer Credit Counseling Service does offer free or low-cost education programs to its clients to learn how to manage debt, budget wisely, and prevent foreclosure.

Related: What Is a Fico Score? What You Should Know!

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Do the Consumer Credit Counseling Service Reviews Say?

While it seems that the services it offers have the potential to help you dig your way out of debt faster, taking a deeper look at Consumer Credit Counseling Service reviews can help you to determine if it is a good fit for your family.

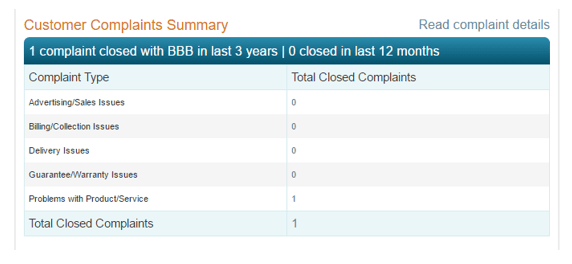

According to the Better Business Bureau credit counseling service reviews, Consumer Credit Counseling Service’s parent company (Family Service Association of Sheboygan, Inc.) has an A+ rating. It has had no complaints lodged against it in the past year and only one closed complaint from its three-year history for a problem with its product or service. Many larger businesses would have several complaints, even with a good history and reputable service to offer.

Consumer Credit Counseling Reviews

Credio’s more detailed consumer credit counseling reviews gave it an overall smart rating of 76. This score was based on its affiliations with nationally accredited agencies, its funding, agency type, debt management program maximum fee, and its pre-discharge debtor education and pre-bankruptcy counseling fee.

Conclusion

Consumer Credit Counseling Service offers a much-needed service for individuals and families who find themselves drowning in debt and dreaming of financial freedom. Consumer credit counseling reviews rate this agency highly for its variety of programs, relatively low-cost fee structure, and its well-recognized accreditation through the National Foundation of Credit Counseling.

Take advantage of its free credit counseling, and consider enrolling in a debt management plan under the guidance of a trained credit counselor during a confidential consultation.

Consider Consumer Credit Counseling Service for your financial needs if you are:

- Struggling to pay off debt, at least a portion of which is unsecured debt or credit card debt

- Facing bankruptcy or in need of bankruptcy counseling

- Facing foreclosure

- In need of financial advocacy services

- Could use assistance with budgeting and managing daily expenses

Residents of Michigan and Wisconsin can benefit from the numerous low-cost services that Consumer Credit Counseling Service offers to its clients to help them increase their financial health. You can contact the company through its 1-800 number to speak with a live person or through its email address to request additional information before making a decision regarding your credit counseling needs or debt management needs.

Popular Article: Best Ways to Improve Your Credit Score Fast

Image sources:

- https://cccsonline.org/about-cccs/

- https://www.bigstockphoto.com/image-3020303/stock-photo-business-woman-handshake

- https://www.bbb.org/us/wi/sheboygan/profile/credit-and-debt-counseling/family-service-association-of-sheboygan-inc-0694-44155803

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.