Guide: How to Get the Best Credit Union Credit Cards with Good, Bad, or Average Credit

If you are searching for the right credit card for you, the seemingly endless options can leave you confused.

From credit union credit cards to secured and unsecured credit cards to credit cards offered by your bank, is there really a significant difference?

When it comes to a bank-issued credit card and a credit union credit card, there can be. There are advantages and disadvantages to each, but many of the differences stem from the financial institutions themselves.

Image Source: Pixabay.com

Your choice between a bank and credit union is most likely based on personal preference. While a bank is a for-profit organization in which you are a customer, a credit union is a nonprofit organization you become a member of.

Often, the best credit union credit cards offer some of the most competitive interest rates compared to bank-issued credit cards.

If you are interested in learning how to find some of the best credit union credit cards, like the State Employees Credit Union Credit Card or Nasa Federal Credit Union Credit Card, check out the tips below that cover how to find excellent credit union credit cards for good, average and bad credit.

See Also: Top Best Travel Credit Card Offers | Ranking | Best Credit Cards For Travel (Reviews)

Should You Use Credit Union Credit Cards?

Are credit union credit cards right for you? As with most credit cards, a credit union credit card has its pros and cons.

The best credit union credit cards have unbeatable interest rates compared to those issued by banks. The median annual percentage rate (APR) for a credit union credit card is 17.9 percent, compared to a median of 28.99 percent for bank-issued credit cards. If you carry a consistent balance from month to month, you may find that a credit card from a credit union is a better choice for you to avoid phenomenally high interest.

State Employees Credit Union Credit Card, for example, offers a variable APR of 8% for purchases, balance transfers, and cash advances. Most banks, on the other hand, have higher interest rates for balance transfers and cash advances than purchases, and they are usually significantly higher than an 8% APR.

Image Source: Freeimages.com

Credit unions are also more likely to give their members a chance to have credit because they want to see their members succeed financially. Even if you do not qualify for a traditional line of credit, your credit union may offer you a credit union secured credit card until you prove your creditworthiness.

You also can plead your case to your credit union’s committee to qualify for a credit card you know you can be responsible with. If you have been denied for a federal credit union credit card, you can submit a request for review to the loan review committee for a second chance for approval.

So, those with average or bad credit can still be approved for credit union credit cards even without needing a credit union secured credit card. However, a credit union may require you to attend financial education meetings or classes in exchange for your approval. Credit unions want their members to achieve financial success, but they also want to provide you with the necessary tools and knowledge to do so.

Credit union ATMs with which to use your credit union credit card can be difficult to find, which can be considered an inconvenience to some. Credit unions are part of the Co-Op Network of thousands of banks around the country, but the locations to use your credit card can be difficult to find if you are not familiar with the area you are in.

However, many credit unions offer easy-to-use ATM locators on their websites or mobile apps. Alliant Credit Union, for example, has an ATM and branch locator with more than 80,000 locations on its website so you can quickly locate a place to use your Alliant Credit Union credit card no matter where you travel.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to Find the Best Credit Union Credit Cards

If you decided on using a credit union for your next credit card, how can you find the best credit union credit cards? You should consider conducting your search online, as the Internet gives you quick access to thousands of credit cards from numerous credit unions all over the country.

Many credit unions offer comparisons of their own credit cards on their websites. For example, Navy Federal Credit Union lists all of the Navy Federal Credit Union credit cards available on its website within a handy comparison table. Here, you can view each card’s rates, fees, and benefits compared against each other.

You can also consider using websites like NerdWallet that detail their picks for the best credit union credit cards within specific categories so you can easily find the card that is best for you. The following steps will also help you find the best credit union credit cards based on APR, fees, and other important factors.

1. Become a Member of a Trusted Credit Union

Before you search for credit union credit cards, you should first research some credit unions to find a trustworthy one to join. Some credit unions are restrictive in who can become a member. For example, you can only apply for a Navy Federal Credit Union credit card if you are a member of the credit union, which requires you to be affiliated with the United States military.

Source: Alliant Credit Union

Similarly, before applying for an Alliant Credit Union credit card, you must first become an eligible member of the credit union. Alliant Credit Union requests its members to be a member of a qualifying organization, employee, or retiree of a qualifying company, a family member of a current Alliant Credit Union member or a member of a qualifying community.

Some credit unions are not very restrictive with membership qualifications, but some are. Credit Union One credit card members, for example, only have to live in a qualifying city or town and work with a qualifying organization—and its qualifying cities and organizations are numerous.

The NASA Federal Credit Union credit card, on the other hand, requires members to be affiliated with NASA, the National Space Society, or the Nasa Federal Credit Union.

Check out the membership requirements and consider asking friends and family who are credit union members about their experiences. If you are considering a specific credit union or credit card, search online the name of the credit union and credit card, like Navy Federal Credit Union credit card, to find out more about the credit union and its cards.

Consider reading online reviews of the credit union as well, which can give you a much more personalized view of the credit union from existing customers.

Related: Top Best Credit Cards for Miles | Ranking | Best Miles Credit Card Reviews

2. Check the Credit Union Credit Card Fees and Annual Percentage Rate (APR)

To find the best credit union credit cards, you will want to check its fees and annual percentage rate (APR)—basically, the fine print. These should be transparently outlined on a credit union’s website with their credit card information. If not, you should think twice about applying for that credit union credit card.

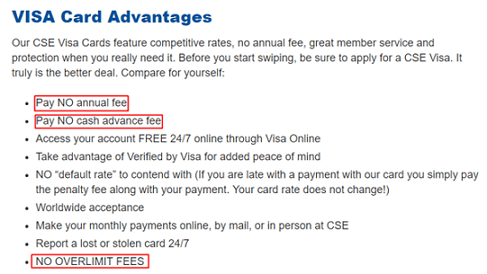

Source: CSE Federal Credit Union

The CSE Federal Credit Union credit card, for example, has no annual fees, balance transfer fees or over limit fees. On its website, you will see these details clearly displayed for prospective customers, so you do not have to search for the fine print.

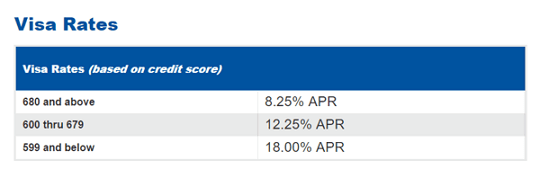

Source: CSE Federal Credit Union

The APR for the CSE Federal Credit Union credit card is also listed on a table on the same webpage for easy reference. Its APR varies according to credit score, with even the lowest credit score eligible for an APR competitive with non-credit union credit cards.

The Credit Union One credit card and Navy Federal Credit Union credit cards are also great picks in terms of transparency with rates and fees and competitive APRs.

3. Consider Credit Unions That Offer Secured Credit Cards

If you currently have bad credit and are searching for a credit card that can help rebuild your credit, consider looking for credit unions that offer secured credit cards. A credit union secured credit card uses a deposit made by you as collateral for your credit line. Your credit line works just like a regular credit line and allows you to learn to use the card responsibly with the chance to switch to an unsecured credit line later.

Navy Federal Credit Union is one of the credit unions that offer secured credit cards. One of the options for Navy Federal Credit Union credit cards is the nRewards Secured Credit Card. This secured card offers no annual fees or balance transfer fees, a possible rate of 9.24%, and a rewards program.

Other credit unions do not offer secured credit cards. For example, there is currently no option for a secured Alliant Credit Union credit card or secured Credit Union One credit card. If rebuilding credit with a credit union secured credit card is important to you, you will want to thoroughly check a credit union’s website first to see if one is offered.

Popular Article: How to Get a Debit Card | Guide on Getting the Best Debit Cards

4. Check Customer Service Availability

Some credit unions rank higher in customer reviews with customer service than others. When searching for the best credit union credit cards, take into consideration a credit union’s customer service and support should you have any issues with your card.

Does the credit union have limited hours, or does it offer a 24/7 customer support hotline? If you need assistance with your Navy Federal Credit Union credit card, for example, the credit union offers a 24/7 hotline to report fraud in addition to various contact methods, including email, social media, and live chat.

Additionally, you can find 24/7 assistance with your State Employees Credit Union credit card through its hotline, or you can send a secure email through your online account. A credit union with various contact methods and a wide range of available contact hours is better suited to meet your needs should you require assistance with your credit union credit card.

5. Find a Credit Union Credit Card with Rewards

Some credit union credit cards come with rewards programs that can help you earn points toward rewards or cash back just for using your card. If you are going to have a credit card, you might as well look for options that provide you with rewards when you use it.

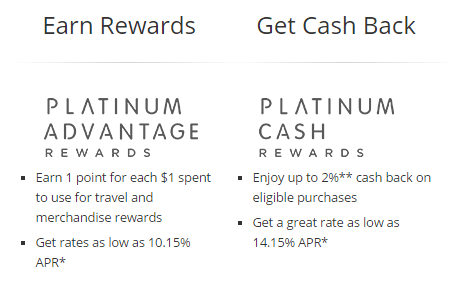

Source: NASA Federal Credit Union

Two options for a NASA Federal Credit Union credit card, for example, offer rewards to their customers: Platinum Advantage rewards and Platinum Cash rewards. With Platinum Advantage, you are eligible for travel and merchandise rewards using your attained points, and Platinum Cash allows you up to 2% cash back on eligible purchases.

The inclusion of a rewards program does not necessarily mean the card is one of the best credit union credit cards, so remember to check the fine print even if the card seems to have an excellent reward system. Its APR and fees could still be high.

6. Research Credit Union Credit Cards Fraud Protection Programs

Finally, when searching for a credit union credit card, you will want to find out its fraud protection policy. Again, this is something that should be clearly outlined on the website, not something you should have to search for.

In case of unauthorized use of your credit union credit card, you should make sure you are protected. Many credit union credit cards offer $0 fraud liability, but if this is not clearly stated, you should not assume a credit card offers it.

NASA Federal Credit Union credit card and Alliant Credit Union credit card are two options that offer $0 fraud liability should your card become lost or stolen and used without your consent. Alliant Credit Union additionally offers a fraud analysis program that continuously monitors your account for potential fraudulent activity.

Conclusion: How to Get The Best Credit Cards From Credit Unions

Credit union credit cards are a good choice for those who wish to become a member of a credit union and enjoy the lower fees and interest rates that usually come with them.

Many credit unions offer around-the-clock customer service should you have an issue with your credit union credit card.

Ensure that you find one that offers exceptional customer care and fraud protection, while also considering reward programs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.