Overview: What you need to know about CreditReport.com

There’s a good chance you are familiar with the term “credit report” and an equally good chance you’ve browsed your creditreport.com review or used some other agency that provides users with a copy of their credit history.

It seems that, while the general population understands the importance of good credit, only a handful of people actually track their credit score on a consistent basis and take necessary action to improve their score.

We’ve gathered several creditreport.com reviews and spent time accessing the website in order to help those clueless about their FICO score. This will aid those in a quest to better understand this number and how to impact it with the plethora of websites that promise to do just that. So let’s begin, shall we?

See Also: iContact Review – What You Should Know Before Using iContact

What Is a Credit Report?

In layman’s terms, your credit report.com review is a snapshot of your financial history that pertains to credit-related accounts such as a credit card. Seems simple enough, right? Financial institutions that lend you credit (think: banks that lend individuals money for a car loan) report this credit extension to credit bureaus and those credit bureaus then add this account into your credit report.com review. Changes and hard inquiries made to your credit report can have a positive or negative effect on your FICO score.

Your FICO score can range from 300–850, with different categories within this range identifying the number as bad, poor, fair, good or excellent. A breakdown of the standard ranges is below:

- Bad: <599

- Poor 600–640

- Fair: 650–699

- Good: 700–749

- Excellent: 750+

Lenders will use the FICO number located on your creditreport.com review to assist them in making informed decisions before extending credit to any individual. A general assumption is that the lower your credit score, the less likely a creditor will be willing to provide the user with credit (or borrowed money).

CreditReport.com Reviews

After typing “creditreport.com reviews” into your search engine, it doesn’t take long to see that there aren’t a lot of great reviews regarding the program. However, are these credit report.com reviews a result of cynical individuals upset because of their low score, or is this program really not worth the monthly fee? Rather than have you spend time reading through the countless reviews of creditreport.com, we will provide a brief synopsis of the program to help you decide for yourself.

Getting Started

Signing up for your creditreport.com review promises users a copy of each of their credit reports from the three major credit bureaus, Experian, Equifax, and TransUnion, all for the small cost of one dollar. That seems reasonable enough right? After all, haven’t we all wasted a dollar bill on something far more ridiculous than a copy of our credit report?

What you might not see is that by purchasing a copy of these reports with Experian, you are automatically entering into membership with Experian Credit Tracker. If users do not cancel this membership within a seven-day window, they will be billed an additional $24.95 for each month they continue the membership.

From what AdvisoryHQ has found, this complaint seems to be the number one creditreport.com review made from previous users, despite the ease of canceling the account via telephone at any time.

What If My Credit Report Is Wrong?

According to CNN, identity fraud hits a new victim every two seconds, so it comes as no surprise that, from time to time, there will be discrepancies on yours or someone else’s credit report.com review.

Whether the incorrect information has been erroneously logged under your credit history, or whether you are the victim of identity theft or fraud, it is important to continuously monitor your credit report to account for and report any disputes you have with the information that is provided within the report.

Image Source: CreditReport.com Reviews

Although this creditreport.com review led to the discovery that it cannot report discrepancies on your behalf, it does have resources and links to point someone, in this situation, to the right sources that will help to get things resolved.

Don’t Miss: IdentityForce Reviews – What You Should Know Before Using Identity Force

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

That’s It?

Of course, that’s not it! Gaining access to your credit report.com review is just the tip of the iceberg. With creditreport.com, users have access to a host of additional products and offerings designed to help users save money and reach their financial goals. After all, isn’t that part of the purpose of reviewing your credit report? Additional offers include:

- Credit card applications

- Debt consolidation loans

- Auto loans

- Personal loans

- Business loans

Credit Cards

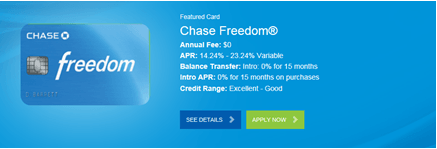

At first glance, this review of creditreport.com discovered that there were more than 31 credit card opportunities for users to sort, view, and compare. It may, initially, seem like an overload, but with the unique ability to sort the credit cards based on your credit risk (bad, poor, fair, good, excellent or even no credit), it makes choosing a credit card a breeze.

Image Source: Chase Freedom

Not to mention, you can apply for these credit cards straight from creditreport.com rather than needing to search for that exact card at the respective banking institution. This alone makes finding the perfect credit card as hassle-free as possible, all the while helping you find the card that works for your specific financial situation.

Debt Consolidation Loans

Let’s face it, multiple loans with multiple interest rates and payment dates can get confusing, and sometimes it just makes sense to consolidate debt into as few loans as possible. The findings of this review of creditreport.com show that you have the ability to apply several filters to your search, such as your monthly income, the state in which you reside, the loan amount you are requesting, and your credit rating (bad, poor, fair, good, excellent or no credit), to which the website will populate the available loan options that are likely the best opportunities for your specific scenario. It’s like having a personal financial advisor right at your fingertips!

Auto Loans

In the market for a new or used car? Or maybe you simply want to refinance your current car to make your monthly payment more affordable? Either way, the creditreport.com review yielded a plethora of auto loans designed to cater to your specific individual needs. As with its other loan options, a review of creditreport.com shows that you can filter the search for loans based on the auto loan type you are in need of (new, used or refinance), your credit rating (bad, poor, fair, good, excellent or no credit), the loan amount you are in need of, and the zip code of your current residence.

After manipulating the tool based on multiple difference circumstances, you can expect roughly 3–8 different loan options to be presented to you based on your own unique filters that are applied. This allows you to make the best informed decision when purchasing a car and can possibly even help prevent loan default in the long run.

Related: Brief Review of Credit Sesame

Personal Loans

Personal loans are another wonderful offering from my creditreport.com review, and, as with its other offerings, users have the opportunity to filter the loans to only show loans that apply directly to their personal circumstances. The filters that can be applied are ranges of net monthly income, state of residence, loan amount, and credit rating (bad, poor, fair, good, excellent or no credit). Some of the different lenders that provide personal loans through creditreport.com are listed below:

- Lending Club

- Discover Personal Loans

- Pioneer Services

- Avant

- Springleaf Financial

Business Loans

Similar to the personal loans page of my review of creditreport.com, the business loans page also provides users the same ability to filter based on personal circumstances to find the business loan that will be best for them and their business. Some of the various lenders that provide business loans are listed below:

- Lending Club

- Prosper

- SoFi

- Discover Personal Loans

Popular Article: Paychex Reviews – Get All of the Facts Before Using Paychex

Free Wealth & Finance Software - Get Yours Now ►

Should You Use Creditreport.com?

There are all sorts of options that exist in order to receive copies of your credit report. Some banks provide their customers with a free copy of their credit report on an annual basis; cellular apps and various websites claim to provide free credit reports as frequently as you want them; and then companies, like creditreport.com, charge you a monthly free to provide you with your detailed credit report.

Regardless of which company you opt to use to monitor your credit report, my review of creditreport.com has shown that it is equally as good as all others who provide these types of analytical reports.

What’s important is making sure that you are consistently checking and monitoring your credit report, reviewing the data for inconsistencies, and setting forth plans and taking action to improve your score in the future. This can save countless hours of stress, headaches, and confusion in the long run!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.