Intro: CuraDebt Reviews

The 2008 financial crash and recession seems like a long time ago now, but with economic recovery having been spotty at best, millions of Americans continue to find themselves in financial difficulties.

Many are suffering under the burden of high-interest, unsecured debt such as credit cards and personal loans that they cannot repay or that they can only repay very slowly. This puts debtors under a lot of stress as they try to come up with the money to keep on top of the debt with little margin for error. Faced with this situation, many people seek out credit debt help.

While it’s possible for a debtor to deal directly with his or her creditors, many people prefer to use a company like CuraDebt that offers credit consolidation services and other forms of credit debt help.

However, with so many companies offering help with their credit and debt problems, choosing the right one can be very difficult. In this article, we will look at one such company, CuraDebt, to see what it offers people experiencing financial difficulties. We’ll also check out what sort of reviews CuraDebt has received from past customers.

CuraDebt Review: What is CuraDebt?

Image Source: Pixabay.com

CuraDebt is a well-established debt counselling firm based in Hollywood, Florida. CuraDebt has been in business for two decades. CuraDebt was founded in 1996, expanding to serve customers throughout most of the United States in 2000. At present, CuraDebt is able to assist customers in 37 of the 50 states. CuraDebt does not operate in the following states: Colorado, Connecticut, Georgia, Idaho, Illinois, Kansas, North Dakota, New Hampshire, South Carolina, Vermont, Washington, Wisconsin, and West Virginia.

CuraDebt’s focus is on providing debt relief on unsecured debts such as credit card debts, personal and small business loans, and private student loans (if you are a student looking for debt relief reviews that can help with government student loan payments, CuraDebt cannot help you). CuraDebt also offers help for dealing with tax debts.

CuraDebt prides itself on its long history of offering credit debt help to customers in financial difficulties. According to its website, it employs staff with extensive experience in the industry.

See Also: Petplan Reviews – Get all the Facts before Using Petplan Insurance

What Services does CuraDebt Offer?

According to its website, CuraDebt offers the following services:

- Debt relief

- Debt settlement

- Tax debt relief for tax debts owed to both the IRS and state governments

- Debt negotiation

- Credit consolidation services

While CuraDebt will discuss debt relief and credit consolidation services with potential clients, the company’s focus is on offering other forms of credit debt help such as debt settlement and debt negotiation.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to Engage CuraDebt’s Services

CuraDebt’s website offers two methods of initiating contact with the company. Potential customers can either phone the company or they can complete a contact form on the website. Once they are in communication with CuraDebt, customers are offered a free consultation in order to determine which type of help they need with their credit or debt problems. CuraDebt will take some customers with debts as low as $5,000, whereas most of their competitors won’t take work with persons with less than $7,000 in debt.

CuraDebt Fees

CuraDebt doesn’t publish its exact fees on its website. It does state that its fees usually come to less than 21% of the outstanding debts of the customer. This makes the credit consolidation services and debt settlement services offered by CuraDebt very competitive in pricing across the market. CuraDebt also charges a monthly account maintenance fee, which should be taken into account when comparing the cost of its services with those of other companies. CuraDebt’s fees are included in the monthly payments made by customers to the holding accounts in anticipation of a debt settlement. CuraDebt doesn’t take payment until a final settlement of the customer’s account is obtained.

Don’t Miss: Prosper Reviews – All You Need to Know Before Using Prosper.com

CuraDebt Reviews: General

CuraDebt claims to have a high rate of customer satisfaction. On its website, the company offers copies of real debt settlement letters as evidence of its ability to attain attractive settlements for its customers. According to their website, CuraDebt is a member of the following organizations:

- Online Business Bureau

- Netcheck

- HonestE Online

- United States Chamber of Commerce

- American Fair Credit Council, a leading debt relief industry association

Of course, every company tries to portray itself as being effective and honest, so it’s important to check with other sources to see if it lives up to its billing. For this article, we’ve examined three different types of reviews in order to provide a comprehensive review of the quality of credit debt help available from CuraDebt:

- Third-party websites specializing in rating companies offering credit consolidation services and debt settlement services

- Customer feedback for CuraDebt

- Conducting a web search for complaints about CuraDebt or evidence that CuraDebt tries to scam customers.

CuraDebt Reviews: Third-Party Websites

When looking at what third-party reviewers had to say about CuraDebt, our first port of call was TopTenReviews.com. They ranked CuraDebt seventh overall among companies offering credit debt help with a national reach. In this review, CuraDebt scored highly for its accreditation and for making it easy for potential clients to qualify for assistance. CuraDebt lost points for charging an account maintenance fee and for its website, which the reviewer labeled as confusing and difficult to navigate.

We then checked out TheSimpleDollar.com, which showcased CuraDebt as one of three recommended debt settlement companies offering credit debt help. Again, CuraDebt received high marks for offering its services to potential customers with relatively low levels of debt. It was also commended for the length of time it has been in business, and savings it managed to achieve for customers. On the other hand, it was again criticized for the layout of its website (though this reviewer liked the online chat feature). This review also slighted CuraDebt for not belonging to the Better Business Bureau (BBB) and for not operating in all 50 states.

While the first two third-party websites we checked out were broadly positive toward CuraDebt, BestDebtCompanys.com does not recommend doing business with this company. They acknowledge some of the positive points mentioned by the other third-party websites (low qualifying debt, low fees, and accreditation with trade associations), but they mark the company down for a lack of transparency in its operations, including its seemingly small size, and the fact that while it used to be a member of the Better Business Bureau, it no longer is. It must be noted, however, that the customer reviews of CuraDebt on this site are overwhelmingly positive.

Related: Review of E-file Online Tax Software (E-file Reviews)

CuraDebt Reviews – Customer Feedback

The next search we did was for customer reviews of CuraDebt. While BestDebtCompanys.com didn’t have a lot of love for CuraDebt, reviews from CuraDebt customers on that site tell a different story with an average of 9.5/10 over fifty reviews. There was only one negative review of CuraDebt, and the rest scored between 8-10.

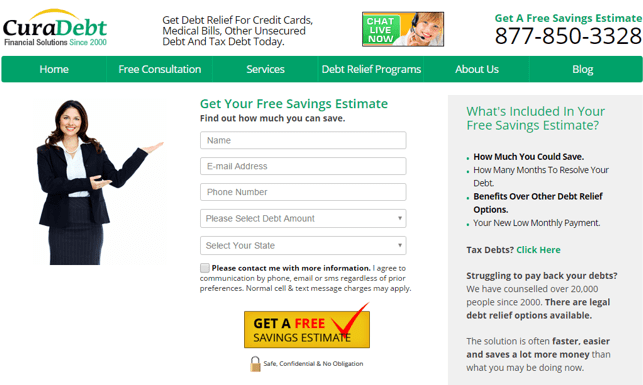

Image Source: CuraDebt

We also looked at CustomerLobby.com. The vast majority of the 675 customer reviews of CuraDebt on that site were rate 5 out of 5 stars. There were some 4 star reviews, and while we didn’t check every review, the worst reviews we found were two 3 star reviews. Even the 3 star reviews of CuraDebt had positive things to say about the customer service offered by the company.

Yelp only offered two CuraDebt reviews – one 5 star review and one 1 star review. The 1 star review of CuraDebt complained of receiving unsolicited calls and text messages after contacting the company.

There are no CuraDebt BBB reviews as the company is not a member of the organization. According to BestDebtCompanys.com, CuraDebt was formerly a member of the BBB and had excellent reviews on it, but has since parted ways with that organization.

Most positive customer reviews of CuraDebt relate to the customer service provided by CuraDebt employees who are described as “kind,” “patient,” and “understanding.” While many reviews also praise the company for obtaining a good result for them, it is the way the company’s employees interact with customers who are dealing with a very stressful situation that wins them the most praise.

CuraDebt Complaints – Google Search Result

Finally we undertook a Google search to try and find negative reviews of CuraDebt. We used the following two search terms:

- CuraDebt complaints

- CuraDebt scam

The first search term we used, “CuraDebt complaints,” brought up very little in the way of complaints about CuraDebt or the credit consolidation services and debt settlement services. One complaint appears to have been made by a disgruntled employee. Whatever the facts behind this complaint, it relates to relations between management and employees, not the quality of service provided to customers.

The two other relevant results to our search for “CuraDebt complaints” both had replies from CuraDebt. They can be seen here and here.

The second search term we used “CuraDebt scam” turned up no relevant results.

No company is perfect, and a Google search will almost always turn up complaints or allegations of bad behavior by disgruntled customers. Complaints about CuraDebt are very rare, and there is no evidence at all that CuraDebt tries to “scam” its customers. Moreover, CuraDebt appears to take a proactive approach responding to and resolving complaints against it.

Popular Article: TurboTax Reviews (Online, Personal, and Business Tax Filing)

Conclusion – CuraDebt Reviews

While we found some CuraDebt complaints and the credit consolidation services and debt settlement services that they offer, online customer reviews of CuraDebt and ratings from third-party websites are overwhelmingly positive. Customer feedback is very complementary of the customer service offered by CuraDebt. Third-party websites tend to note factors such as CuraDebt’s accreditation, its long years in the business, the competitive pricing of its services, and its willingness to accept customers with lower levels of debt than many of its competitors. What criticisms there are do not appear to affect the quality of the credit debt help offered by CuraDebt.

If you find yourself in need of help to deal with unsecured debts, CuraDebt is one option worth examining. If your debts are less than $7,000, CuraDebt becomes an even more compelling choice as most companies that offer credit debt help won’t look at debts below that level. CuraDebt is one of the longest-established companies in the business and has a proven track record of providing good customer service at competitive prices.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.