Overview: Day Trader Definition

You’ve heard that there is great money to be made from investing, but it can be hard to know where to begin. Day trading is an appealing option because it promises the quickest payout — sometimes in just a matter of minutes!

Day trading for a living can be lucrative once you learn day trading basics.

In today’s investment world, day trading is often viewed as a “get rich quick” scheme compared to the more traditional, long-term investments. While plenty of scams exist, learning day trading strategies and tips can help you to begin investing your money wisely.

Image Source: What is Day Trading?

Studies find it hard to estimate the number of people who day trade for a living because so few traders openly share their personal financial gains. In fact, many would argue that studies show most day traders actually lose money, perhaps in part because getting started can be so overwhelming.

To be sure, there’s a lot to learn before jumping in. Tons of questions are floating around out there from “what is day trading?” all the way to “what are the best day trading strategies?” Let’s start by taking a look at what day trading is.

What Is Day Trading?

Day trading, by definition, is the buying and selling of a security all in the same day. By making many trades, possibly in rapid succession of one another, investors aim to make the largest profit possible as quickly as possible.

The aim is to buy securities at the lowest price and to sell them at a higher price within a matter of seconds, minutes, or hours to keep from holding the position overnight. Opening and closing a transaction on a security is often referred to as a round trip.

Of all investment strategies, day trading carries the most risk but also has potential for the greatest gain. One of the best day trading tips is not to invest any money that you aren’t willing to lose if the market doesn’t go your way. It can take time to learn day trading and recognize the patterns within the market. By not investing money that it is crucial for your living expenses, you can make your investments without the additional worry of how you’ll pay for rent.

Day Trader Definition

We can’t ask the question, “What is day trading?” without next asking the question, “Who are day traders?” Are they ordinary people, or do they have a special skillset that most of the population is lacking? What is the best definition of a day trader?

The definition of a day trader is anyone who participates in buying and selling securities within a single day. You don’t have to work for a brokerage or a hedge fund. Anyone can learn day trading basics and utilizing them at home.

The Financial Industry Regulatory Authority (FINRA), which monitors trading activities, has an additional day trader definition for pattern day traders. A pattern day trader is anyone who buys and then sells a security within the same day at least four times over the course of five days.

Anyone has the potential to be successful if they spend a little bit of time learning the day trading basics. Successful traders are people who have a keen eye for detail and don’t mind spending time looking at the history of the securities they may want to purchase and subsequently sell. They have extra money set aside as risk capital and are eager to see if they can transform it into an even larger number.

Above all else, successful day traders are hungry to learn about the stock market or foreign exchange market and to capitalize on the patterns they see emerge. They are typically very patient, well-read, and well-informed on current events. Successful traders, those who are able to day trade for a living, spend much of their time poring over fluctuations in the market to try to predict the market’s next small price change.

Don’t Miss: What Is Debt Consolidation? – Is It Good or Bad? (Ways to Consolidate & Explanation)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Day Trading for a Living

If you’re interested in how to become a day trader, take stock of your own personality to determine how successful you’ll be.

- Are you patient? Learning how to wait until the opportune time to open your position on a security can be a hard skill for some to learn. Wait until your position meets the ideal criteria you set out ahead of time before moving forward, or you may be on the road to ruin.

- Are you willing to take a risk? While you work to learn day trading, the U.S. Securities and Exchange Commission notes that “day traders typically suffer severe financial losses in their first months of trading.” Only trade with money that you do not need for necessary living expenses.

- Do you have the time and flexibility in your schedule? Day trading strategy doesn’t have to be difficult, but it does require a lot of time to keep up on current affairs and monitor the fluctuations of your securities.

If you feel like your personality and life circumstances would be ideal for this type of investing, then it’s time to move forward to figure out the basics of how to become a day trader.

Day Trading Basics

Every new business venture requires certain things for start-up costs. Here are the basics of what you will need to begin to day trading for a living:

1. Investment capital: Under the Financial Industry Regulatory Authority (FINRA), day traders must keep a minimum of $25,000 in their accounts to be pattern day traders on the stock market. Remember, the “pattern day trader” definition is someone who buys and then sells a security within the same day at least four times over the course of five days. Other types of day trading, such as on the foreign exchange market (sometimes called the forex), require less start-up capital, as little as $100.

2. Access to world news: One of the most important day trading strategies is to pay attention to the news from a multitude of sources. Because day trading requires short-term holding, the news can be an important indicator that a security is likely to dip (or skyrocket) in price.

3. Day trading software: While not everyone in the investment world feels that day trading software is necessary, many rely on it to recognize more technical patterns in the way securities fluctuate. Many programs even integrate directly with a brokerage to speed up execution times. The best day trading software programs also show how a certain day trading strategy would have fared historically to help predict future patterns.

4. Online broker: In place of purchasing your own day trading software, you may consider using an online program. Be sure to look for one with low commissions per trade, an easy-to-use interface, and premium day trading strategy features. Some online brokers will even allow you to try their programs commission-free for a period of time in order to earn your loyalty. Below are a few online brokers that you might consider depending on your needs:

Related: What Is Brexit? – Get the Definition & Review (Britain Leaving EU?)

A Note about Day Trading Firms

Plenty of scams abound, promising quick return on investment with minimal risk. Make sure to do your own research on any firm or broker before doing business. They should be able to tell you their success rate of how many of their customers have made profits from day trading with them.

Always make sure that the firm is registered with the U.S. Securities and Exchange Commission before proceeding to do business with them. You can find out if they have a history of problems with regulators well in advance of investing your money with them.

Things to Research

Image Source: Day Trading Basics

As you begin your foray into learning day trading basics, you will want to begin to take note of past performance of the securities you’re interested in purchasing. Find a way to chart their pertinent information that would be easiest for you to read and interpret at a glance. Good information to have handy before opening a position would include:

- Typical patterns for a stock: Does it always sell well after a decline in price over the course of several days? Is the price highest mid-afternoon or in the morning? Sometimes clear patterns begin to emerge as you look at the long-term performance.

- Entry and exit points: Make sure you have a clear expectation for when the best time to enter and exit will be. Vague answers won’t help you to make the best decisions in the heat of the moment. Have a plan based on the historical performance of the stock before entering into any position, and have a clear plan for how to exit to maximize your profit.

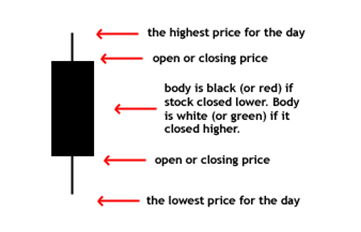

Many investors like to use the candlestick chart as a simple way to denote important information quickly. It shows the highest and lowest price, as well as the opening and closing price, all at a quick glance. Understanding a candlestick chart is a great day trading basic to master for your own record keeping.

Image Source: Candlestick Pattern

The example candlestick pattern above gives you the basic idea of how to read the chart. However, there are many other patterns you can compare and day trading strategies that you can employ based on patterns that emerge from long-term monitoring on the candlestick charts.

Popular Article: What Is a Decent Credit Score? Get All the Facts! (What Is Bad Credit?)

Day Trading Strategies

Now that we can confidently define day trading and what makes a successful day trader, it’s time to start looking at day trading strategy. There are four basic strategies that most day traders employ in order to maximize their profit.

1. Scalping: Scalping is one the most well-known day trading strategies. The aim is to purchase securities at their lowest price and sell them again quickly, even for just a few cents higher than the initial purchase price. It doesn’t always result in a high yield, but it is one of the easiest strategies to employ.

2. Fading: Fading is one of the riskier day trading strategies. It involves purchasing stocks at a lower price and then selling them as the price begins to rise. Those who use fading as a technique try to hold the security for as long as they estimate the rise will be. They wouldn’t want to sell too early and risk losing some of their profit.

3. Range trading: As you learn how to become a day trader, you will be researching the normal prices that securities you’re interested in will sell for. Range trading involves learning the expected lows and highs for a particular stock and always selling within the normal range.

4. News trading: By keeping an eye on the news, you may have a heads up on stories that will have a significant impact on the stock market.

Free Wealth & Finance Software - Get Yours Now ►

A Few Final Thoughts

So, what is day trading, in the end? It can be a lucrative way to earn a living if you can accept the high level of risk involved. By educating yourself on the different start-up necessities, day trading strategies, and general market knowledge, you will build a firm foundation for future success.

Do you have what it takes to become a day trader? Hopefully, learning the day trading basics will help you determine if this type of investing is a good fit for your personality and lifestyle.

Read More: What Is Swing Trading? (Basics, How-to, & Strategies)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.